Understanding how to calculate the percent interest on a total investment is crucial for assessing the profitability of financial decisions. This guide will provide a step-by-step approach to determining the percentage return on an investment, offering valuable insights for investors and financial planners alike. By following these instructions, you can easily calculate the interest earned and make informed choices about your financial strategies.

What You'll Learn

- Understanding Interest Rates: Learn how interest rates are calculated and their impact on investment returns

- Compounding Frequency: Explore how often interest is compounded and its effect on total growth

- Interest Calculation Formula: Discover the formula to calculate interest and its components

- Investment Term: Understand the duration of an investment and its relation to interest

- Real-World Examples: Examine real-life scenarios to grasp how interest accrues over time

Understanding Interest Rates: Learn how interest rates are calculated and their impact on investment returns

Interest rates are a fundamental concept in finance, representing the cost of borrowing money or the reward for lending it. Understanding how interest rates are calculated and their impact on investment returns is crucial for anyone looking to make informed financial decisions. When you invest, the interest rate plays a pivotal role in determining the growth of your money over time.

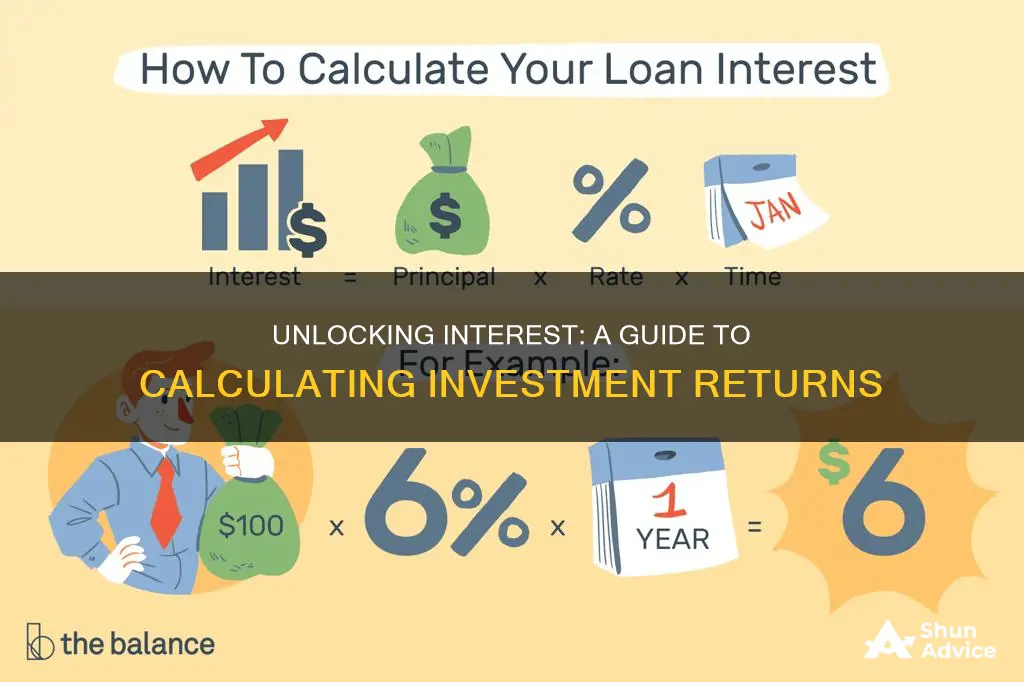

The calculation of interest rates involves a simple formula: Interest = Principal × Rate × Time. Here, the principal is the initial amount of money invested, the rate is the interest rate expressed as a decimal, and time is the duration for which the money is invested. For example, if you invest $1000 at an annual interest rate of 5% for one year, the interest earned would be $50, resulting in a total return of $1050. This basic understanding forms the foundation for more complex financial calculations.

Interest rates can be expressed in various ways, including annual percentage rates (APRs) and nominal rates. APRs consider the effects of compounding, where interest is earned on the accumulated interest, leading to exponential growth. Nominal rates, on the other hand, represent the simple interest earned without compounding. For instance, a 5% APR means that for every $100 invested, you earn $5 in interest annually, but the actual return may be higher due to compounding over time.

The impact of interest rates on investment returns is significant. Higher interest rates generally lead to increased investment returns, especially for long-term investments. This is because higher rates mean a greater return on the initial investment and any accumulated interest. Conversely, lower interest rates may result in slower growth or even reduced returns, particularly for fixed-income investments like bonds. Understanding these dynamics is essential for investors to make strategic choices, especially when comparing different investment options.

Moreover, interest rates can influence market behavior and economic trends. Central banks often adjust interest rates to control inflation and stimulate economic growth. During periods of high interest rates, borrowing becomes more expensive, potentially slowing down economic activity. Conversely, low-interest rates encourage borrowing and investment, which can boost economic growth. Investors should stay informed about these rate changes and their potential impact on their portfolios.

Unleash the Power of Compound Interest: Your Guide to Smart Investing

You may want to see also

Compounding Frequency: Explore how often interest is compounded and its effect on total growth

The concept of compounding frequency is a crucial aspect of understanding how interest works and how it can significantly impact your investments over time. When you invest money, the interest you earn can be compounded, meaning it is added to the principal amount, and then interest is calculated on the new, larger amount. This process repeats over time, with the interest earned in each period being added to the principal, and then interest is calculated on this new total. The frequency at which this compounding occurs is what we refer to as the compounding frequency.

There are several ways to express the compounding frequency, including annually, semi-annually, quarterly, monthly, and even daily. Each of these frequencies will have a different impact on the growth of your investment. For instance, if you compound interest annually, the growth rate will be slightly higher than if you compound it semi-annually because the interest is calculated and added to the principal once a year, allowing for a bit more growth in the next period.

To understand the effect of compounding frequency, let's consider an example. Suppose you invest $1,000 at an annual interest rate of 5%. If the interest is compounded annually, after one year, your investment will grow to $1,050. However, if the interest is compounded semi-annually, the interest is calculated and added to the principal twice a year. This results in a slightly higher final amount. After one year, your investment would grow to $1,052.50, which is more than the annual compounding amount.

The difference in growth between these compounding frequencies can be substantial over time. The more frequent the compounding, the more significant the impact on your investment's growth. This is because the interest earned in each period is added to the principal, and then interest is calculated on this new, larger amount. As a result, your money can grow exponentially faster with more frequent compounding.

Understanding the impact of compounding frequency is essential for making informed investment decisions. It allows you to compare different investment options and see how often interest is compounded. By choosing an investment with a higher compounding frequency, you can potentially earn more significant returns over the long term. This knowledge empowers investors to make strategic choices, ensuring their money works harder for them and grows according to their financial goals.

Interest Rate Hikes: Navigating the Impact on Your Investment Portfolio

You may want to see also

Interest Calculation Formula: Discover the formula to calculate interest and its components

To calculate the interest on an investment, you can use the following formula:

Interest Calculation Formula

The formula to calculate interest is:

Interest = P x R x T

Where:

- P = Principal amount (the initial amount of money)

- R = Annual interest rate (as a decimal)

- T = Time the money is invested for, in years

This formula is a simple way to calculate the interest earned on a single investment. It takes into account the principal amount, the interest rate, and the time period.

Breaking Down the Formula

Let's break down each component:

- Principal (P): This is the initial amount of money you invest. For example, if you invest $1000, then P = $1000.

- Annual Interest Rate (R): This is the percentage of interest you expect to earn in a year, expressed as a decimal. For instance, if the interest rate is 5%, then R = 0.05.

- Time (T): This represents the duration of the investment in years. If you invest for 2 years, then T = 2.

Example Calculation

Let's say you invest $5000 at a 4% annual interest rate for 3 years. Using the formula:

Interest = $5000 x 0.04 x 3 = $600

So, the interest earned would be $600.

Additional Components

The formula above calculates simple interest. In real-world scenarios, you might encounter compound interest, where interest is calculated on the initial principal and also on the accumulated interest from previous periods. The compound interest formula is more complex and involves the concept of compounding periods.

Remember, understanding how interest is calculated is crucial for making informed financial decisions, especially when considering investments and loans.

Understanding Taxability of Investment Interest Expenses: A Comprehensive Guide

You may want to see also

Investment Term: Understand the duration of an investment and its relation to interest

The concept of investment duration is crucial in finance, as it directly impacts the overall return on an investment. When considering an investment, understanding its term is essential, as it determines how long your money will be tied up and the potential for earning interest. Investment duration refers to the period during which an investment is held, and it plays a significant role in calculating the total interest earned.

In simple terms, the longer an investment is held, the more time it has to accumulate interest. Interest is the earnings generated from an investment, typically expressed as a percentage of the principal amount (the initial investment). The interest rate and the duration of the investment are key factors in determining the total interest earned. For instance, if you invest a certain amount at a fixed interest rate for a specific period, the interest earned will be a percentage of the initial investment, calculated over the entire duration.

To calculate the percent interest for a total investment, you need to consider both the interest rate and the investment term. The interest rate represents the cost or reward for lending or borrowing money for a certain period. It is typically expressed as an annual rate. When you invest for a longer duration, the interest earned compounds over time, meaning the interest is calculated on the initial principal and any accumulated interest from previous periods. This compounding effect can significantly increase the total interest earned.

For example, let's say you invest $10,000 at an annual interest rate of 5% for 3 years. The interest earned in the first year would be $500 (5% of $10,000). In the second year, the interest is calculated on the new total, which includes the initial $10,000 and the $500 interest from the previous year, resulting in $525 of interest. This process continues for the full term of the investment. By understanding the investment duration, you can estimate the total interest earned and make more informed financial decisions.

In summary, the investment term is a critical factor in determining the interest earned on an investment. Longer investment durations provide more time for interest to accumulate, potentially resulting in higher total returns. When evaluating investment opportunities, consider the interest rate, investment term, and the compounding effect to calculate the percent interest for your total investment and make choices that align with your financial goals.

Robinhood's Interest Game: Unveiling the Truth Behind Investment Fees

You may want to see also

Real-World Examples: Examine real-life scenarios to grasp how interest accrues over time

Let's explore some real-world examples to understand how interest compounds over time and impacts your investment.

Example 1: Savings Account

Imagine you deposit $1,000 into a savings account with an annual interest rate of 5%. At the end of the first year, you'll earn $50 in interest, bringing your total to $1,050. In the second year, interest is calculated based on the new balance of $1,050. You'll earn $52.50 in interest, making your total $1,102.50. This illustrates compound interest, where interest is added to the principal, and then interest is earned on that new total.

Example 2: Loan Repayment

Now, consider taking out a $10,000 loan with a 6% annual interest rate. You'll make monthly payments. In the first month, you'll pay interest on the entire $10,000. In subsequent months, a portion of each payment goes towards the principal, and the rest towards interest. Over time, the interest accrued will decrease as the principal is paid down. This example shows how interest can accumulate if payments are delayed, leading to higher overall costs.

Example 3: Investment Growth

Suppose you invest $5,000 in a stock that appreciates by 8% annually for five years. At the end of the first year, your investment is worth $5,400. In the second year, it grows by 8% of $5,400, resulting in a higher gain. This demonstrates how compound growth can significantly increase your investment over time.

Example 4: Bond Investment

Bonds pay interest in the form of coupon payments. If you buy a $1,000 bond paying 4% interest annually, you'll receive $40 in interest each year. If you hold the bond to maturity, you'll receive the principal back plus the accumulated interest. This example highlights how regular interest payments can contribute to your overall investment return.

These examples illustrate the power of compound interest and how it can work for or against you depending on the context. Understanding these scenarios helps you make informed decisions about saving, investing, and managing debt.

Overnight Rate Hike: Impact on Investment Strategies

You may want to see also

Frequently asked questions

To find the percent interest, you need to divide the interest earned by the total investment and then multiply by 100. The formula is: (Interest / Total Investment) * 100.

Sure, let's say you invest $1000 and earn $150 in interest over a year. The calculation would be: (150 / 1000) * 100 = 15%. So, the percent interest is 15%.

In that case, you need to calculate the future value of the investment first, and then find the interest earned. The formula for compound interest is: Future Value = P(1 + r/n)^(nt), where P is the principal amount, r is the annual interest rate, n is the number of times interest is compounded per year, and t is the time in years. After finding the future value, you can calculate the percent interest as mentioned in the first answer.

To find the annual interest rate, rearrange the formula from the first A: r = (Interest / Total Investment) * 100 / t, where r is the annual interest rate, and t is the time in years.

Absolutely! There are numerous financial calculators and online tools available that can assist with interest calculations. These tools often provide quick and accurate results, especially for complex interest scenarios involving compounding and different investment periods.