DST investments, or Digital Securities Tokenization, is a revolutionary concept that leverages blockchain technology to tokenize traditional financial assets like real estate, commodities, and intellectual property. This process involves converting these assets into digital tokens, which can be bought, sold, and traded on decentralized platforms. By doing so, DST investments democratize access to high-value assets, allowing investors from around the world to participate in markets that were previously restricted to institutional investors. This innovative approach not only enhances liquidity and transparency but also reduces the complexity and cost associated with traditional investment vehicles, making it an attractive option for both individual and institutional investors seeking to diversify their portfolios and gain exposure to a wide range of assets.

What You'll Learn

- Investment Vehicles: Dst investments include stocks, bonds, ETFs, and derivatives

- Risk and Reward: Dst investments offer potential high returns but also carry significant risks

- Market Timing: Dst strategies often involve buying and selling assets at specific market points

- Data-Driven Decisions: Dst relies on advanced analytics and data to make investment choices

- Regulatory Considerations: Dst investments are subject to various regulations and compliance requirements

Investment Vehicles: Dst investments include stocks, bonds, ETFs, and derivatives

DST investments, or Delayed or Distributed Solar Time investments, are a strategy that utilizes various financial instruments to potentially generate returns while also providing a unique approach to managing time-sensitive assets. These investments are particularly relevant in the context of renewable energy projects and the transition to a low-carbon economy. Here's an overview of the investment vehicles that fall under the DST investment category:

Stocks: Investing in stocks of companies involved in renewable energy, such as solar panel manufacturers, wind turbine producers, or energy storage solutions providers, can be a direct way to support the DST concept. By purchasing shares in these companies, investors become partial owners and benefit from their growth and profitability. Stocks offer the potential for capital appreciation and dividend income, making them an attractive option for long-term investors. For instance, investing in a renewable energy ETF (Exchange-Traded Fund) that holds a basket of these stocks can provide diversification and exposure to the entire sector.

Bonds: Bond investments in the context of DST can be made in companies or projects that align with the renewable energy and sustainability goals. These bonds often carry a social or environmental impact focus, allowing investors to support projects that contribute to a greener economy. Bondholders receive regular interest payments and the return of principal upon maturity. This investment vehicle is particularly appealing to risk-averse investors seeking a steady income stream while contributing to sustainable initiatives.

ETFs (Exchange-Traded Funds): ETFs are a popular choice for DST investments as they offer instant diversification and liquidity. These funds typically track an index or a specific sector, such as renewable energy or sustainable infrastructure. By investing in an ETF, investors gain exposure to multiple companies or projects within the DST theme. ETFs also provide the advantage of low costs and the ability to trade them throughout the day, similar to stocks. This makes them accessible and flexible investment options for various investors.

Derivatives: Derivatives, such as options, futures, and swaps, can be utilized to gain exposure to the DST market without directly investing in the underlying assets. These financial instruments allow investors to speculate on the future performance of renewable energy projects or related securities. Derivatives can be used for hedging purposes, providing protection against potential losses, or for speculative trading, aiming to profit from price movements. However, derivatives are complex and carry a higher risk, requiring advanced knowledge and a well-defined strategy.

In summary, DST investments offer a range of options for investors interested in supporting renewable energy and sustainability initiatives. Stocks, bonds, ETFs, and derivatives provide different levels of exposure, risk, and potential returns, catering to various investor preferences and strategies. Understanding the underlying principles of DST and carefully selecting investment vehicles can help investors contribute to a more sustainable future while also pursuing financial gains.

Forever Stamps: A Smart Investment?

You may want to see also

Risk and Reward: Dst investments offer potential high returns but also carry significant risks

DST investments, or Digital Securities Tokens, represent a novel approach to investing in financial assets, offering both the potential for high returns and significant risks. These tokens are digital representations of traditional financial instruments, such as stocks, bonds, or derivatives, and are built on blockchain technology. This innovative structure allows for increased transparency, efficiency, and accessibility in the investment process.

The potential for high returns is a significant attraction of DST investments. By leveraging blockchain technology, investors can gain exposure to a diverse range of assets, including those that might have been previously inaccessible or illiquid. For instance, fractional ownership of real estate or private company equity can now be achieved through DSTs, providing investors with opportunities to diversify their portfolios and potentially earn substantial returns. The ability to trade these tokens on secondary markets also means that investors can buy and sell their positions quickly, taking advantage of market fluctuations and potentially generating capital gains.

However, the risks associated with DST investments are equally important to consider. The very nature of these investments, being relatively new and untested, means that there are inherent uncertainties and potential pitfalls. One of the primary concerns is the regulatory environment, which is still evolving and varies significantly across different jurisdictions. Investors must navigate complex legal and compliance issues, ensuring that their DST investments comply with local regulations and avoiding potential legal consequences.

Market volatility is another significant risk factor. The secondary market for DSTs can be highly speculative, with prices fluctuating rapidly based on various factors, including market sentiment, news events, and regulatory changes. This volatility can lead to substantial losses for investors, especially those who are less experienced or who have not adequately diversified their portfolios. Additionally, the lack of a robust and standardized valuation system for DSTs can make it challenging to assess the true value of an investment, further increasing the risk.

Lastly, the technology underlying DSTs is still maturing, and there are potential technical risks associated with smart contracts and blockchain platforms. While these technologies offer enhanced security and transparency, they are not immune to bugs, glitches, or security breaches. Investors must carefully consider the technology providers and the security measures in place to protect their investments.

In summary, DST investments present an exciting opportunity for investors to access a wide range of assets and potentially achieve high returns. However, they also carry significant risks, including regulatory, market, and technological challenges. Prospective investors should conduct thorough research, seek professional advice, and carefully assess their risk tolerance before engaging in DST investments. Understanding the potential rewards and pitfalls is essential to making informed and prudent investment decisions in this emerging market.

Blockchain's Institutional Investing Revolution: Unlocking a New Era of Opportunities

You may want to see also

Market Timing: Dst strategies often involve buying and selling assets at specific market points

Market timing is a critical aspect of DST (Distressed Securities Trading) strategies, where investors aim to capitalize on market opportunities by buying and selling assets at strategic points. This approach requires a deep understanding of market dynamics and the ability to identify favorable conditions for transactions. Here's an overview of how market timing fits into the broader context of DST investments:

In the world of DST, investors often focus on distressed companies or assets that are temporarily out of favor but possess long-term value. The goal is to buy these assets at a discount when the market is pessimistic, and then sell them when market sentiment improves, resulting in a profit. Market timing is the art of recognizing these turning points and making informed decisions. It involves analyzing various factors such as economic indicators, company-specific news, and industry trends to predict market shifts. For instance, an investor might identify a distressed real estate company with a strong balance sheet and a highly skilled management team. By understanding the market's cyclical nature and recognizing the potential for a recovery, they can decide to buy the company's stock or assets when prices are low.

The key to successful market timing is a combination of technical analysis and fundamental research. Technical analysts study historical price data, trading volumes, and market trends to identify patterns and potential turning points. They use tools like moving averages, relative strength indicators, and chart patterns to make buy and sell decisions. On the other hand, fundamental analysts delve into financial statements, industry reports, and market news to assess the intrinsic value of an asset. By combining these approaches, investors can make more informed choices, especially in the volatile world of distressed securities.

A well-executed market timing strategy requires discipline and a long-term perspective. Investors must be prepared to act quickly when opportunities arise, as market conditions can change rapidly. It also involves managing risk effectively, as buying at the wrong time can lead to significant losses. For instance, if an investor buys a distressed stock just before a major negative event, they might incur substantial losses. Therefore, a comprehensive understanding of market dynamics and the ability to make timely decisions are essential.

In summary, market timing is a sophisticated strategy within the DST investment framework. It involves a careful analysis of market conditions, technical indicators, and fundamental factors to identify the optimal moments to buy and sell assets. By mastering this skill, investors can navigate the complexities of distressed markets and potentially generate substantial returns. This approach requires a keen eye for market trends, a disciplined mindset, and a willingness to adapt to changing market conditions.

Unraveling the Mystery: Navigating the Path to Purchasing an Investment Property

You may want to see also

Data-Driven Decisions: Dst relies on advanced analytics and data to make investment choices

Data-Driven Decisions: Dst Investments and Advanced Analytics

In the world of finance, Data-Driven Strategies (Dst) investments are a relatively new approach that has gained significant traction. Dst relies on a powerful concept: using advanced analytics and data to make informed investment choices. This method is a stark contrast to traditional investment strategies, which often depend heavily on intuition, market trends, and sometimes, even gut feelings. By embracing data-driven decision-making, Dst aims to provide a more systematic, objective, and evidence-based approach to investing.

The core idea behind Dst is to leverage vast amounts of data, including historical market data, financial statements, news articles, social media sentiment, and more. This data is then processed and analyzed using sophisticated algorithms and machine learning techniques. These tools enable Dst investors to identify patterns, correlations, and trends that might not be immediately apparent through traditional methods. For instance, natural language processing can be used to analyze news articles and social media posts to gauge market sentiment, while predictive analytics can forecast future market movements based on historical data.

One of the key advantages of this approach is the ability to make more accurate predictions and informed decisions. By relying on data, Dst investors can reduce the influence of emotional biases and subjective judgments, which are common in traditional investing. This leads to more consistent and potentially higher returns, as the investment process becomes more systematic and less dependent on individual intuition. Moreover, the use of advanced analytics allows Dst to adapt quickly to changing market conditions, making it easier to capitalize on emerging opportunities.

Dst investments also benefit from the ability to back-test strategies. By analyzing historical data, investors can evaluate the performance of different investment approaches and make adjustments as needed. This iterative process helps refine strategies over time, leading to improved decision-making. Additionally, the use of data enables Dst to identify and manage risks more effectively. By analyzing large datasets, investors can identify potential pitfalls and make proactive decisions to mitigate these risks.

In summary, Dst investments represent a paradigm shift in the financial industry, emphasizing the power of data and advanced analytics. By making investment choices based on evidence and systematic analysis, Dst investors can make more informed decisions, adapt to market changes, and potentially achieve better results. As technology continues to advance, the role of data in investment strategies is likely to become even more prominent, shaping the future of finance.

Dividends Dilemma: Unraveling the Equity Method Mystery

You may want to see also

Regulatory Considerations: Dst investments are subject to various regulations and compliance requirements

DST investments, or Delayed Sales Transactions, are a structured approach to investing in private equity, real estate, and other alternative assets. These investments are designed to provide investors with a way to gain exposure to high-value assets while mitigating certain risks associated with direct ownership. However, this innovative investment strategy is subject to a complex web of regulatory considerations that investors must navigate carefully.

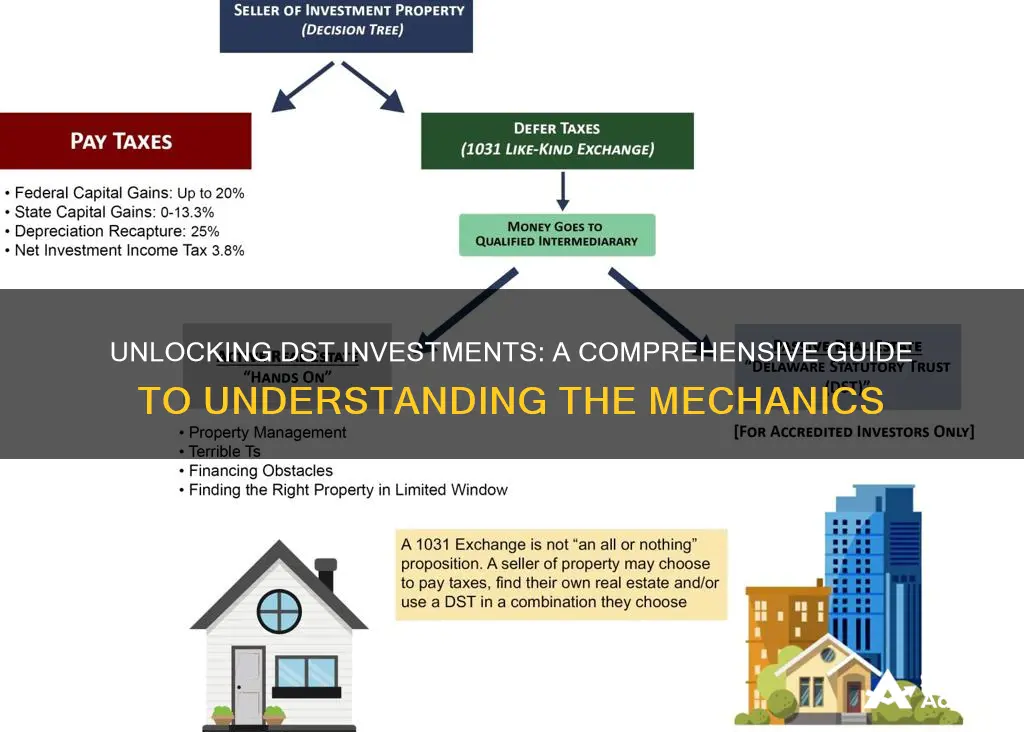

One of the primary regulatory aspects of DST investments is the need for compliance with securities laws and regulations. In many jurisdictions, DSTs are considered securities, which means they are subject to the same regulations as traditional securities offerings. This includes the requirement to register the offering with the relevant regulatory authorities, such as the Securities and Exchange Commission (SEC) in the United States. The registration process involves disclosing detailed information about the investment, the underlying assets, and the structure of the DST to potential investors. This transparency is crucial to ensuring that investors have the necessary information to make informed decisions and to protect themselves from potential fraud or misrepresentation.

Additionally, DST investments often involve complex structures and multiple parties, which can introduce regulatory challenges. For instance, in a DST, investors may be dealing with a general partner or manager who oversees the investment and a limited partnership structure. This arrangement is subject to specific regulations governing the roles and responsibilities of each party, including the management of investor funds, the allocation of profits, and the provision of transparency and reporting. Investors must ensure that these structures comply with applicable laws to avoid legal and regulatory consequences.

Furthermore, tax regulations play a significant role in the DST investment landscape. These investments often have tax implications that can vary depending on the jurisdiction and the specific structure of the DST. Investors should be aware of the tax treatment of their investments, including any potential tax benefits or liabilities associated with the DST structure. Proper tax planning and compliance are essential to ensure that investors maximize their returns while adhering to tax laws.

In summary, DST investments offer an attractive way to access alternative assets, but they come with a set of regulatory considerations that investors must carefully navigate. Compliance with securities laws, understanding complex structures, and staying informed about tax regulations are essential aspects of successfully investing in DSTs. Investors should seek professional advice to ensure they meet all legal and regulatory requirements, thereby protecting their interests and the integrity of the investment process.

Investing: Separating Fact from Fiction

You may want to see also

Frequently asked questions

DST stands for "Deed of Trust," which is a legal document used in real estate transactions. DST investments involve pooling money from multiple investors to purchase a property, which is then held in a trust. This allows investors to own a fractional interest in the property, providing an opportunity to invest in real estate without the need for a large upfront investment.

Returns in DST investments are primarily derived from the rental income generated by the property. The trust manages the rental process, and investors receive a share of the rental income based on their fractional ownership. Additionally, potential capital appreciation can be realized when the property is sold, providing investors with a return on their initial investment.

DST investments offer several advantages. Firstly, they provide diversification by allowing investors to own a piece of various properties without the complexity of direct real estate ownership. Secondly, DSTs often have lower entry requirements, making it accessible to a wider range of investors. Moreover, the professional management of the trust can simplify the investment process, providing a hands-off approach to real estate investing.

While DST investments can be lucrative, they also carry certain risks. The value of the property can fluctuate, impacting the overall return on investment. Additionally, there may be delays in receiving rental income or potential capital gains if the trust encounters financial or legal issues. It is essential for investors to conduct thorough research and due diligence before investing in DSTs to minimize these risks.