Net Present Value (NPV) is a financial formula used to evaluate the profitability and feasibility of different projects or investments. It calculates the present value of the future cash flows that a project will generate, minus the initial investment. A positive NPV indicates that the projected cash inflows, discounted to their present value, exceed the initial investment and associated costs, suggesting the project is likely to be profitable. Conversely, a negative NPV suggests that the expected costs outweigh the expected cash inflows, indicating potential financial losses. When choosing between two investments, NPV can be a valuable tool to assess and compare their profitability.

| Characteristics | Values |

|---|---|

| Definition | Net Present Value (NPV) is a capital budgeting technique used to estimate the current value of the future cash flows that a proposed project or investment may generate. |

| Use | NPV is used in investment banking and accounting to determine if an investment, project, or business will be profitable in the long run. |

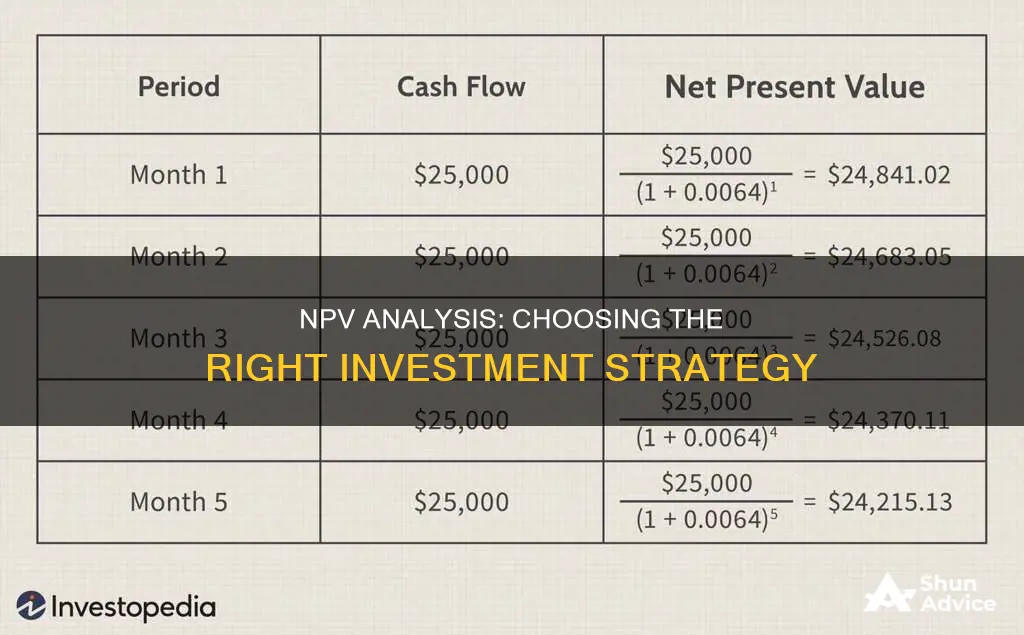

| Formula | NPV = [cash flow / (1+i)^t] - initial investment |

| Variables | Cash flow, cash flow period, discount rate, annual net cash flows, interest rate, time period |

| Calculation | To calculate NPV, you have to start with a discounted cash flow (DCF) valuation because net present value is the end result of a DCF calculation. |

| Interpretation | A positive NPV indicates that the projected earnings from an investment exceed the anticipated costs, representing a profitable venture. A negative NPV suggests that the expected costs outweigh the earnings, signalling potential financial losses. |

What You'll Learn

NPV and the time value of money

Net present value (NPV) is a capital budgeting technique used to estimate the current value of the future cash flows that a proposed project or investment may generate. It is a useful tool for determining whether a project or investment will result in a net profit or a loss.

NPV is calculated by finding the difference between the present value of cash inflows and the present value of cash outflows over a period of time. This calculation is based on the principle of the time value of money (TVM), which states that a sum of money is worth more today than the identical sum in the future. In other words, a dollar today is worth more than a dollar tomorrow. This is because money can be invested and earn interest over time, money is subject to inflation, and there is a risk of not receiving the dollar in the future.

The NPV calculation can be used to value a stream of future payments as a lump sum today, as seen in many lottery payouts. It can also be used to determine the payment on a mortgage or how much interest is being charged on a loan.

To calculate NPV, you need to estimate the timing and amount of future cash flows and choose a discount rate that reflects the minimum acceptable rate of return. The discount rate may be based on a company's cost of capital or the returns available on alternative investments of comparable risk.

NPV can be calculated using the following formula:

NPV = (Cash inflow – Cash outflow) / (1 + i)^t – Initial investment

Where:

- I = Discount rate

- T = Number of time periods

A positive NPV indicates that the projected earnings generated by a project or investment exceed the anticipated costs, suggesting that the project will be profitable. On the other hand, a negative NPV indicates that the expected costs outweigh the expected earnings, signalling potential financial losses.

NPV is a valuable tool for businesses and investors when deciding between different projects or investment opportunities. It helps to determine whether a project or investment will be profitable and provides a quantitative measure of its potential success.

Understanding Net Cash Flow: Does It Include Investments?

You may want to see also

Discount rate and the cost of capital

When deciding between two investments, the net present value (NPV) is a useful tool to estimate the current value of the future cash flows that a proposed investment may generate. To calculate the NPV, you need to estimate the timing and amount of future cash flows and pick a discount rate equal to the minimum acceptable rate of return. The discount rate may reflect your cost of capital or the returns available on alternative investments of comparable risk.

The discount rate, often called the "cost of capital", is the minimum rate of return necessary to invest in a particular project or investment opportunity. It is the interest rate used to calculate the present value of future cash flows from a project or investment. The discount rate is central to the NPV formula. It accounts for the fact that, as long as interest rates are positive, a dollar today is worth more than a dollar in the future. Inflation erodes the value of money over time. The discount rate is simply the baseline rate of return that a project must exceed to be worthwhile.

The discount rate can be calculated using a three-step process:

- First, the value of a future cash flow (FV) is divided by the present value (PV).

- Next, the resulting amount from the previous step is raised to the reciprocal of the number of years (n).

- Finally, one is subtracted from the value to calculate the discount rate.

The discount rate formula divides the future value (FV) of a cash flow by its present value (PV), raises the result to the reciprocal of the number of periods, and subtracts one:

Discount Rate = (Future Value ÷ Present Value) ^ (1 ÷ n) – 1

For example, suppose your investment portfolio has grown from $10,000 to $16,000 over a four-year holding period. The discount rate for this scenario would be approximately 12.5%.

The cost of capital and the discount rate are two related terms that are sometimes confused with each other but have important distinctions. The cost of capital refers to the return required by equity holders and debt holders to make an investment worthwhile. The cost of capital is the company's required return, and it helps establish a benchmark return that the company must achieve to satisfy its debt and equity investors. The cost of capital is calculated using the weighted average cost of capital (WACC) method, which takes into account both the cost of equity and the cost of debt, weighted according to their percentage of the whole.

General Partners: Cash Investment Strategies and Decisions

You may want to see also

NPV vs internal rate of return

Net Present Value (NPV) and Internal Rate of Return (IRR) are two fundamental tools used in finance to assess and compare investment opportunities and make business decisions. They are closely related concepts, but there are some key differences between them.

NPV is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. It is calculated using a discount rate, which can be a company's cost of capital, such as the weighted average cost of capital (WACC). NPV is expressed as a dollar value and can be used to compare the rates of return of different projects or to compare a projected rate of return with the hurdle rate required to approve an investment. A positive NPV indicates that the projected earnings generated by an investment exceed the anticipated costs, while a negative NPV indicates that the investment will result in a net loss.

On the other hand, IRR is a calculation used to estimate the profitability of potential investments and is expressed as a percentage value. It is the discount rate that would make the NPV of an investment zero. In other words, it is the rate of growth an investment is expected to generate. IRR is useful for comparing the anticipated profitability of projects of different time spans on the basis of their projected return rates. However, it may obscure the fact that the rate of return on a shorter-term project is only available for a limited time and may not be matched once capital is reinvested.

Both NPV and IRR have their advantages and disadvantages. IRR is typically more useful when comparing multiple projects or investments or when it is difficult to determine an appropriate discount rate. NPV, on the other hand, is often preferred when cash flows may fluctuate over time or when there are multiple discount rates. NPV also allows for more flexibility in accommodating varying discount rates, enabling users to tailor the analysis to their specific risk profile and return expectations. This makes NPV a more accurate and relevant measure for comparing investment opportunities within capital budgeting decisions.

Exploring Non-Cash Investments: Beyond the Basics

You may want to see also

NPV and project size

When deciding between two investment options, it is important to consider the Net Present Value (NPV) of each project. NPV is a capital budgeting technique used to estimate the current value of the future cash flows that a proposed project or investment may generate. It is calculated by finding the difference between the present value of cash inflows and the present value of cash outflows over a given period.

NPV can be a useful tool for determining whether a project will result in a net profit or loss. A positive NPV indicates that the projected earnings generated by a project or investment exceed the anticipated costs, resulting in a profitable venture. Conversely, a negative NPV suggests that the expected costs outweigh the expected earnings, indicating potential financial losses.

While NPV is a valuable metric, it does have some limitations. One drawback is that it does not consider project size or return on investment (ROI). This can be problematic when comparing projects with substantial hidden costs, as the NPV analysis may not accurately reflect the true costs of the project.

To address this limitation, it is essential to consider additional factors and perform a comprehensive analysis. This may include examining qualitative criteria, conducting sensitivity analyses to understand how changes in input variables impact the NPV, and comparing NPV with other financial metrics such as ROI or internal rate of return (IRR).

By combining NPV with other evaluation methods, you can make more informed decisions when choosing between two investment options and gain a more comprehensive understanding of the potential risks and rewards associated with each project.

Commercial Paper: Investing or Cash Flow?

You may want to see also

NPV and non-financial metrics

Net present value (NPV) is a financial calculation that helps determine the value of an investment or project. It is a useful tool for comparing different investment options and deciding which one to choose. NPV analysis is a form of intrinsic valuation that is widely used in finance and accounting.

NPV is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. A positive NPV indicates that the projected earnings generated by an investment exceed the anticipated costs, suggesting that the investment will be profitable. On the other hand, a negative NPV means that the expected costs outweigh the expected earnings, indicating potential financial losses.

When deciding between two investment options using NPV, it is important to consider the timing of cash flows, as money received sooner is generally more valuable due to inflation and interest rates. Additionally, the discount rate used to calculate NPV should reflect the risk and expected returns of the investment.

However, it is important to note that NPV analysis has some limitations. It relies heavily on assumptions and estimates of future cash flows, discount rates, and other factors. NPV also does not consider non-financial metrics, project size, or hidden costs, which may be relevant to investment decisions. Therefore, it should be used in conjunction with other evaluation methods and criteria to make a well-informed decision.

In summary, NPV is a valuable tool for evaluating and comparing investments, but it should be complemented by other analyses to address its limitations and ensure a comprehensive understanding of the investment options.

Settled Cash for Investment: What's Available and How?

You may want to see also

Frequently asked questions

NPV stands for Net Present Value. It is a capital budgeting technique used to estimate the current value of the future cash flows that a proposed project or investment may generate.

To calculate NPV, you need to estimate the timing and amount of future cash flows and pick a discount rate equal to the minimum acceptable rate of return. The discount rate may reflect your cost of capital or the returns available on alternative investments of comparable risk.

The formula for NPV is: NPV = (Cash flow / (1 + i)^t) - initial investment, where i = discount rate and t = number of time periods.

A positive NPV indicates that the projected earnings generated by an investment exceed the anticipated costs, suggesting the investment will be profitable. Conversely, a negative NPV means the expected costs outweigh the expected earnings, indicating potential financial losses.

When choosing between two mutually exclusive projects, the general rule is to select the project with the highest NPV, as this represents the project that will create the most value for the company.