Internal financing and foreign investment are two distinct approaches to funding business operations and growth. Internal financing involves utilizing a company's own resources, such as retained earnings, to fund projects and investments. This method allows businesses to maintain control over their operations and financial decisions. In contrast, foreign investment refers to the process of investing in a company or project located in a different country. It involves bringing capital and expertise from one country to another, often to support economic development and expansion. The key difference lies in the source of funds and the scope of investment, with internal financing being a domestic strategy and foreign investment involving international elements.

What You'll Learn

- Sources: Internal financing relies on domestic funds, while foreign investment brings capital from abroad

- Control: Domestic control is maintained with internal financing, but foreign investment offers external ownership

- Risk: Internal financing may have less risk, whereas foreign investment can carry higher risks

- Access: Domestic markets are accessible with internal financing, but foreign investment provides global market access

- Impact: Internal financing can shape local economy, while foreign investment influences the global economy

Sources: Internal financing relies on domestic funds, while foreign investment brings capital from abroad

Internal financing and foreign investment are two distinct approaches to acquiring capital for business operations and growth, each with its own unique sources and implications.

Internal financing, as the name suggests, involves utilizing funds generated within the company or country. This can be achieved through various means, such as reinvesting profits, reducing operational costs, or optimizing cash flow. For instance, a company might decide to retain a portion of its earnings instead of distributing them as dividends, allowing it to invest in research and development, expand its infrastructure, or acquire new assets. Internal financing is a strategic move that strengthens the company's financial position and reduces reliance on external sources. It provides a sense of financial autonomy and control, especially for businesses aiming to maintain a stable and predictable cash flow.

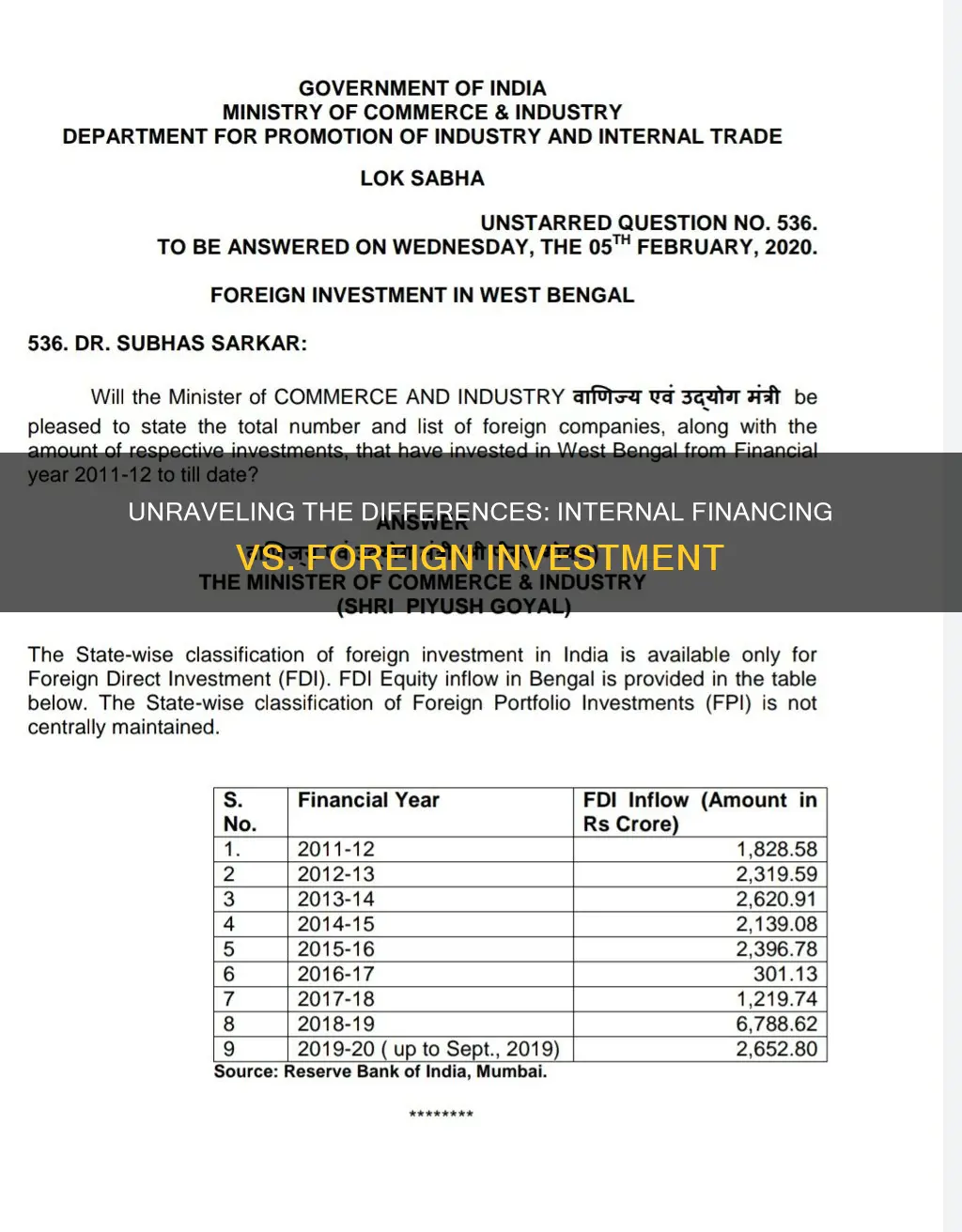

In contrast, foreign investment involves attracting capital from international markets. This can be done through direct investment, where a foreign entity acquires a significant stake in a domestic company, or through portfolio investment, where foreign investors buy and sell securities listed on the local stock exchange. Foreign investment often brings much-needed capital to developing economies, fostering economic growth and providing access to international markets. For instance, a multinational corporation might invest in a local startup, bringing not only financial resources but also expertise, technology, and global connections. This type of investment can lead to knowledge transfer, job creation, and the establishment of new industries.

The key difference lies in the origin of the capital. Internal financing is a domestic affair, focusing on optimizing existing resources and managing cash flow efficiently. It is a strategic decision made by the company's management to ensure financial stability and growth. On the other hand, foreign investment is an international process, bringing capital and expertise from abroad, which can have a significant impact on the local economy and business landscape.

Both methods have their advantages and are often used in conjunction to achieve a company's financial goals. While internal financing provides a sense of control and stability, foreign investment can offer much-needed capital, new opportunities, and a global perspective. Understanding these differences is crucial for businesses and investors alike, as it influences decision-making regarding capital allocation, market expansion, and overall financial strategy.

Switzerland's Foreign Investment Magnetism: Unlocking Global Capital

You may want to see also

Control: Domestic control is maintained with internal financing, but foreign investment offers external ownership

The concept of control is a critical aspect when comparing internal financing and foreign investment, as it highlights the different ways in which ownership and decision-making power are structured. Internal financing, as the name suggests, involves a company's financial resources being utilized from within its own operations. This approach allows the company to maintain a higher degree of control over its financial decisions and strategic direction. By using internal funds, the company can ensure that its financial activities align with its long-term goals and objectives without external interference. This level of control is particularly important for companies that value autonomy and want to preserve their unique corporate culture and identity.

In contrast, foreign investment introduces a different dynamic, as it involves the influx of capital and ownership from external sources, often international investors. When a company attracts foreign investment, it grants a degree of control to external stakeholders, who may have different interests and priorities compared to the company's existing management. This external ownership can bring in new perspectives, expertise, and resources, potentially enhancing the company's capabilities and market position. However, it also means that the company's decision-making power is shared with these foreign investors, which may lead to a dilution of control for the original management team.

The key difference lies in the level of autonomy and decision-making authority retained by the company. With internal financing, the company's management retains full control over financial strategies, ensuring that the company's operations remain aligned with its internal vision and goals. This approach fosters a sense of ownership and commitment within the organization. On the other hand, foreign investment can provide access to capital and international markets, but it may also lead to a more complex governance structure, requiring careful negotiation and management to maintain the company's desired level of control.

In summary, while internal financing allows a company to maintain domestic control and autonomy, foreign investment introduces external ownership and potential collaboration. The choice between these two options depends on the company's strategic goals, risk tolerance, and the desire to balance control with the benefits of external investment. Understanding these differences is crucial for businesses navigating the complex landscape of financial decisions and ownership structures.

Liquid Cash Investment: Where to Place Your Money Wisely

You may want to see also

Risk: Internal financing may have less risk, whereas foreign investment can carry higher risks

Internal financing and foreign investment are two distinct approaches to funding a business, each with its own set of advantages and potential risks. When it comes to risk assessment, internal financing often presents a lower-risk option compared to foreign investment. Here's a detailed explanation:

Internal financing refers to the process of generating funds from within the company, such as using retained earnings, issuing stocks, or reducing expenses. This method allows businesses to maintain control over their operations and decision-making processes. By utilizing internal resources, companies can avoid the potential risks associated with external stakeholders. For instance, when a company decides to issue stocks, it involves sharing ownership and potentially diluting control. However, this risk is often mitigated by the company's ability to carefully manage its finances and maintain a strong financial position. Internal financing provides stability and ensures that the business's operations remain aligned with its long-term goals.

On the other hand, foreign investment involves attracting capital from international sources, which can be a more complex and risky endeavor. When a company engages in foreign investment, it opens itself up to various risks, including political, economic, and cultural factors. Political instability in the host country can lead to unforeseen challenges, such as changes in regulations or even nationalization of assets. Economic risks include fluctuations in exchange rates, which can impact the company's profitability and cash flow. Additionally, cultural differences may pose challenges in understanding local business practices and building successful partnerships. These risks can be significant, especially for companies entering new markets for the first time.

The key difference lies in the level of control and the associated risks. Internal financing provides a more secure and controlled environment, allowing businesses to maintain their autonomy and make decisions based on their specific needs. In contrast, foreign investment requires careful consideration of external factors, and companies must navigate potential risks to ensure successful operations in a foreign market. While internal financing may have its own challenges, such as limited funds or potential conflicts with shareholders, the risks are generally more manageable and predictable compared to the uncertainties and complexities of foreign investment.

In summary, internal financing offers a relatively safer and more controlled approach to funding, allowing businesses to maintain stability and focus on their core operations. Foreign investment, while potentially lucrative, carries higher risks due to external factors that are beyond the company's immediate control. Understanding these differences is crucial for businesses to make informed decisions regarding their funding strategies and risk management.

Securities Trading: Part of Investing Cash Flow?

You may want to see also

Access: Domestic markets are accessible with internal financing, but foreign investment provides global market access

Internal financing and foreign investment are two distinct approaches to accessing markets, each with its own advantages and implications. When it comes to accessing domestic markets, internal financing is the primary method. This involves utilizing the financial resources available within a country, such as local banks, capital markets, and government funds. By tapping into these sources, businesses can secure the necessary capital to fund their operations, expand their infrastructure, and develop their products or services to meet the demands of the domestic market. This process allows companies to establish a strong presence within their home country, build relationships with local suppliers and customers, and gain a deeper understanding of the local market dynamics.

However, internal financing has its limitations, especially when it comes to accessing global markets. Domestic financial systems may not always provide the scale or diversity of funding required for international expansion. This is where foreign investment comes into play as a powerful alternative. Foreign investment involves attracting capital and expertise from other countries, often through strategic partnerships, mergers, or acquisitions. By welcoming foreign investment, a country opens its markets to international investors, bringing with them not only financial resources but also access to global networks and markets.

Foreign investment provides a gateway to global market access, which is a significant advantage. International investors bring a wealth of experience and connections, enabling companies to expand their reach beyond domestic borders. This can lead to the establishment of international supply chains, access to new customer bases, and the ability to leverage global market trends. For instance, a foreign investor might provide the necessary capital to develop a new manufacturing facility in a foreign country, allowing the company to produce goods for both domestic and international markets. This not only facilitates market access but also fosters economic growth and development in the host country.

Furthermore, foreign investment can bring technological advancements and knowledge transfer, which are crucial for a country's long-term growth. International investors often introduce innovative practices, management techniques, and industry-specific expertise, contributing to the overall development of the host country's economy. This aspect of foreign investment is particularly valuable for countries seeking to modernize their industries and stay competitive in the global marketplace.

In summary, while internal financing is essential for accessing domestic markets, foreign investment plays a pivotal role in providing global market access. It enables companies to expand their reach, leverage international networks, and benefit from foreign expertise. By embracing foreign investment, countries can foster economic growth, attract international partners, and establish themselves as key players in the global economy. This strategic approach to market access highlights the importance of understanding the differences and potential of internal financing and foreign investment.

Best Places to Invest Your Cash Today

You may want to see also

Impact: Internal financing can shape local economy, while foreign investment influences the global economy

Internal financing and foreign investment are two distinct mechanisms that play crucial roles in the economic landscape, each with its own unique impact on the economy. Internal financing, primarily sourced from within a country, involves the allocation of financial resources to support domestic projects, businesses, and infrastructure. This process is driven by the country's own needs and goals, aiming to stimulate economic growth and development from within. When a country utilizes internal financing, it can have a profound effect on its local economy. It allows for the funding of various initiatives, such as building new roads, improving public services, or supporting small and medium-sized enterprises (SMEs). This, in turn, creates jobs, boosts local industries, and enhances the overall standard of living for residents. For instance, a government's investment in renewable energy projects through internal financing can lead to the creation of green jobs, foster technological advancements, and contribute to a more sustainable economy.

On the other hand, foreign investment refers to the influx of capital and resources from international sources, often involving multinational corporations or investors from other countries. This type of investment carries significant global implications. When foreign investment enters a country, it can bring substantial financial resources, advanced technologies, and new business practices, thereby contributing to the country's economic growth. Foreign investors may establish new businesses, expand existing ones, or acquire local companies, leading to increased productivity and efficiency. Moreover, foreign investment can attract additional capital and expertise, fostering innovation and knowledge transfer. For example, a foreign tech company setting up a research and development center in a developing country can not only create high-skilled jobs but also transfer cutting-edge technology, thereby enhancing the country's innovation capabilities.

The impact of internal financing and foreign investment on the economy is quite different. Internal financing is more localized, focusing on the specific needs and goals of a country, and its effects are often felt within the domestic market. It helps to build a robust and self-sustaining economy, ensuring that the country's resources are utilized efficiently to meet its own objectives. In contrast, foreign investment has a more global reach, as it involves the integration of international markets and the exchange of capital, goods, and services across borders. This type of investment can lead to increased international trade, improved infrastructure, and the adoption of best practices from around the world. However, it also brings potential challenges, such as the risk of exploitation of local resources or the displacement of local industries, which need to be carefully managed to ensure sustainable development.

In summary, internal financing and foreign investment are powerful tools for economic development, but they operate on different scales and have distinct implications. Internal financing is instrumental in shaping the local economy, fostering job creation, and meeting the specific needs of a country. Foreign investment, on the other hand, has a global impact, driving economic growth, attracting foreign expertise, and facilitating international trade. Understanding these differences is essential for policymakers and investors alike, as it enables them to make informed decisions that promote sustainable and inclusive economic development.

Investing Platforms: Beginner's Guide to Choosing the Right One

You may want to see also

Frequently asked questions

Internal financing refers to the use of a company's own funds, such as profits, reserves, or shareholder equity, to finance its operations, investments, or expansion. It involves utilizing the company's resources without seeking external capital. On the other hand, foreign investment involves the injection of capital from foreign sources, often from international investors or entities, to support a company's financial needs.

Internal financing is sourced from within the company, typically through retained earnings, depreciation, or other internal cash flows. It is a self-sustaining process where the company generates funds without relying on external investors. In contrast, foreign investment is obtained from external sources, such as foreign governments, international organizations, or individual investors from other countries.

Yes, tax considerations can differ. Internal financing may be subject to corporate income tax on the profits used for financing, depending on the jurisdiction. Foreign investment, especially from international investors, might be subject to different tax regulations, including potential double taxation agreements or tax incentives provided by the host country.

With internal financing, the company retains full control over its financial decisions and operations, as it is not dependent on external stakeholders. The company's management has complete autonomy in allocating resources. Conversely, foreign investment can lead to a dilution of control as external investors gain a stake in the company, potentially influencing decision-making processes and strategic directions.

Internal financing allows for better control and flexibility, as the company can adapt quickly without external approval. It also avoids the need to share profits with investors. However, it may limit growth opportunities if internal funds are insufficient. Foreign investment can bring in much-needed capital, expertise, and market access, but it may also introduce cultural and operational challenges, and the company might face increased scrutiny from multiple stakeholders.