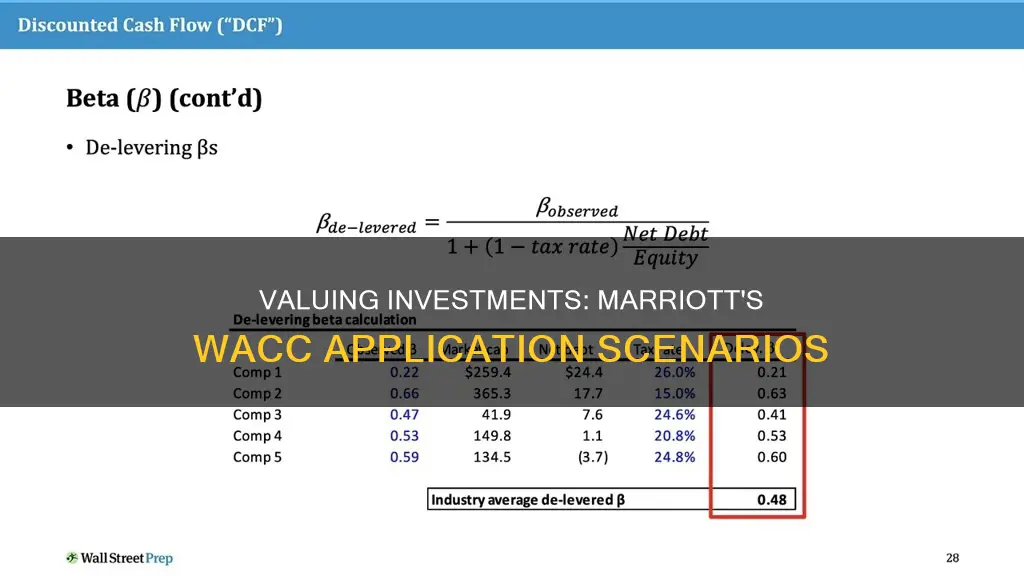

Marriott Corporation's finance division evaluates investments using the Weighted Average Cost of Capital (WACC) as a hurdle rate to discount the cash flows for an investment opportunity. The WACC is calculated from two subgroups: the cost of equity and the cost of debt.

Marriott's WACC can be used to value investments with similar characteristics and divisions to those used to determine the WACC. This means that if an investment opportunity falls within Marriott's three divisions of lodging, contract services, and restaurants, and shares similar qualities to previous investments, then Marriott's WACC is appropriate for evaluating the opportunity.

However, if an investment opportunity has a different amount of risk compared to the typical investment that Marriott undertakes, then the company should calculate a cost of capital that is consistent with the specific opportunity. This could involve looking at comparable companies where the investment would be a typical undertaking.

| Characteristics | Values |

|---|---|

| Investments with similar characteristics and divisions to Marriott Corporation | Valued using Marriott's WACC |

What You'll Learn

Investments with similar characteristics to Marriott's divisions

Marriott's WACC can be used to value investments with similar characteristics to its divisions. These divisions include lodging, contract services, and restaurants.

Marriott's business model is asset-light, meaning it avoids significant capital expenditures associated with acquiring, developing, or maintaining hotel properties. Instead, it generates revenue through franchising and management contracts with independent property owners. This model provides stable and predictable revenue streams that shield Marriott from cyclical downturns in the travel industry.

The company's WACC would be applicable to investments with similar characteristics, such as those in the hospitality industry, including hotels, resorts, and other accommodation providers. These investments would have a comparable focus on branding, customer loyalty, and consistent service delivery across multiple locations.

Additionally, Marriott's WACC could be relevant for investments in companies that operate as franchisees or manage contracts with other businesses. This could include businesses in various sectors, such as food and beverage or restaurants, retail, or even other service industries like fitness or wellness.

It is important to note that the suitability of using Marriott's WACC for valuation purposes depends on the specific characteristics of the investment opportunity and its alignment with Marriott's divisions.

Magic Formula Investing: Does It Work?

You may want to see also

Investments with average risk

Marriott International Inc. is a hospitality company with three main divisions: lodging, contract services, and restaurants. The company uses the Weighted Average Cost of Capital (WACC) to evaluate investments and determine hurdle rates for each division.

When considering what type of investments to value using Marriott's WACC, it is important to assess the risk level of the investments in relation to the company's average investment risk. Marriott's WACC estimates the riskiness of an average investment within the company. Therefore, investments with average risk that closely resemble the typical investments carried out by Marriott can be valued using its WACC.

For example, if Marriott is considering investing in a new hotel property, this investment would likely have similar characteristics to the company's existing lodging division. In this case, using Marriott's WACC would be appropriate as the investment risk is comparable to the average risk of the company's typical investments.

However, it is essential to note that Marriott's WACC may not be suitable for all types of investments. If an investment under consideration has significantly more or less risk than the average investment risk of Marriott's typical investments, using the company's WACC may not accurately reflect the true risk and value of the investment.

In summary, Marriott's WACC can be used to value investments with average risk that align with the company's core business divisions and have similar risk profiles to the company's existing investments. For investments with higher or lower risk profiles, a more tailored approach to valuation may be required to accurately assess their risk and potential returns.

Investments in Jewelry: A Guide to Getting Started

You may want to see also

Investments with more than average risk

Marriott's WACC can be used to value investments with more than average risk, but only if they have similar characteristics to the divisions used to determine the WACC. This is because the WACC estimates the riskiness of an average investment within the company.

If an investment under consideration has more risk than the average investment, the WACC would understate the risk and overstate the value of the investment. Conversely, if an investment has less risk than the average, the WACC would overstate the risk and understate the value.

Therefore, Marriott's WACC is only appropriate for investments that closely resemble the typical investments carried out by Marriott. If an investment has a different amount of risk, the company should calculate a cost of capital that is consistent with the investment in question. This could be done by looking at comparable companies where that particular investment would be typical.

For example, an investment in sports equipment could be evaluated by looking at the cost of capital used by a sports club that uses similar equipment.

Investing Excess Cash: Strategies for Maximizing Your Returns

You may want to see also

Investments with less than average risk

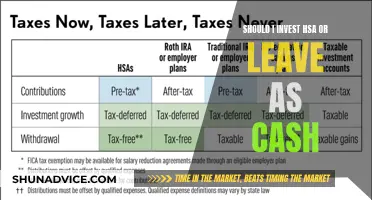

- U.S. Treasury Bills, Notes and Bonds: These securities are backed by the full faith and credit of the U.S. government, which has always paid its debts. Treasury bills have maturities of up to 52 weeks, while notes stretch up to 10 years and bonds mature up to 30 years.

- Series I Savings Bonds: These are a special type of U.S. savings bond with a variable interest rate designed to keep up with inflation, as measured by the consumer price index (CPI). They offer a fixed rate that remains the same for 30 years, plus a variable interest rate that is updated every six months to match inflation.

- Treasury Inflation-Protected Securities (TIPS): Like I bonds, these securities issued by the U.S. Treasury adjust their principal value to keep up with the rate of inflation. They offer maturities of five, 10 or 30 years.

- Fixed Annuities: These are a popular type of annuity contract that guarantees a fixed rate of return over a set period, regardless of market conditions. They are frequently used for retirement planning but can also be useful for medium-term financial goals.

- High-Yield Savings Accounts: These accounts offer a modest return on your money, with the highest-yielding options available online. They are government-insured up to $250,000 per account type per bank.

- Certificates of Deposit (CDs): CDs allow you to invest your money at a set rate for a fixed period. Withdrawing money early will trigger a penalty fee. There are various types, including regular, bump-up, step-up, high-yield, jumbo, no-penalty and IRA CDs.

- Money Market Mutual Funds: These funds invest in various fixed-income securities with short maturities and very low credit risks. They tend to pay modest interest and are considered very safe, but they are not backed by the FDIC.

- Investment-Grade Corporate Bonds: When a public company has a very good credit rating, their bonds are deemed investment grade or high grade, meaning the company is very likely to keep paying interest and return the principal at maturity.

- Preferred Stocks: These combine the characteristics of stocks and bonds, providing investors with dependable income payments and the potential for shares to appreciate over time.

- Dividend Aristocrats: These are public companies that have demonstrated remarkable long-term stability and reliability in their dividend payouts, increasing their annual dividend payments for at least 25 consecutive years.

It's important to note that while these investments are considered lower risk, there is still a sliding scale of risk associated with each of them. Additionally, low-risk investing may not offer high-yield results, as less risk usually means less chance for high growth.

Navigating the Benefits of Investment Advisors

You may want to see also

Investments with similar risk to sports equipment

The weighted average cost of capital (WACC) is a metric used to evaluate the profitability of potential investments. It is calculated using a company's cost of equity and cost of debt, with appropriate weight given to each.

Marriott's WACC can be used to value investments with similar characteristics to the divisions used to determine the WACC. This includes investments in the lodging, contract services, and restaurants industries.

- Investments in sports-related companies: The performance of the sports industry tends to fluctuate seasonally, with the most profitable times being immediately before the major sports seasons begin. Sports-related companies to consider investing in include those in the apparel and footwear, content distributors, equipment, and facilities and warehouses segments. Examples include Nike, Black Diamond, Callaway Golf, and Hibbett Sports.

- Certificates of Deposit (CDs): CDs are time deposit accounts that allow you to invest your money at a set rate for a fixed period. Withdrawing the money before the maturity date will usually trigger an early withdrawal penalty fee. They are considered very low-risk and are insured by the FDIC up to statutory limits.

- Money Market Mutual Funds: Money market mutual funds invest in various fixed-income securities with short maturities and very low credit risks. They are considered very safe, but unlike savings accounts or CDs, they are not backed by the FDIC. They offer plenty of liquidity and modest returns.

- High-Yield Savings Accounts: These accounts offer a modest return on your money while providing unlimited liquidity and the backing of the Federal Deposit Insurance Corp. (FDIC). They are very low-risk as there is no chance of losing money, plus you can withdraw your funds at any time.

- Treasury Inflation-Protected Securities (TIPS): TIPS are issued by the US Treasury and are designed to keep up with inflation. They offer maturities of five, 10, or 30 years. The principal value increases or decreases based on the prevailing rate of inflation, and at maturity, you receive the higher principal value.

- Investment-Grade Corporate Bonds: These are fixed-income securities issued by public companies with very good credit ratings. Credit rating agencies like Moody's, Standard & Poor's, and Fitch assign ratings to companies based on in-depth research on their finances and stability.

These investment options provide a range of opportunities for those seeking to invest in areas with similar risk levels to sports equipment. They offer varying levels of liquidity, returns, and risk, so be sure to consider your investment goals and risk tolerance when making decisions.

Transferring Cash to Invest on Stash: A Step-by-Step Guide

You may want to see also

Frequently asked questions

Marriott's WACC can be used to value investments with similar characteristics to those of the divisions used to determine the WACC. These include the lodging, contract services, and restaurants divisions.

The arithmetic mean is the best predictor of risk premium for the forthcoming time period, whereas the geometric mean is superior at predicting the average risk premium over multiple future time periods.

The cost of equity is the return a company must offer investors to compensate for the risk of investing in its stock. The cost of debt is the interest rate on the company's debt, adjusted for tax benefits.

The cost of equity is calculated using the Capital Asset Pricing Model (CAPM): Risk-Free Rate + Beta x ERP.

The WACC is calculated as the weighted average of a company's cost of equity and cost of debt, adjusted for tax: WACC = Weight of Equity x Cost of Equity + Weight of Debt x Cost of Debt x (1 - Tax Rate).