An Investment ISA is a tax-efficient way to save and invest your money, offering a range of benefits to help your savings grow. These Individual Savings Accounts (ISAs) allow you to invest in various assets, such as stocks, shares, and bonds, without paying tax on any potential gains or interest earned. Understanding how Investment ISAs work is essential for anyone looking to maximize their savings and investments, as it can help them make informed decisions about their financial future. This guide will provide an overview of the key features and advantages of Investment ISAs, helping you navigate the world of tax-efficient investing.

What You'll Learn

- Tax-Free Growth: Investment ISAs allow compound interest to grow tax-free, unlike standard savings accounts

- Contribution Limits: Annual limits on contributions to ISAs, varying by country and tax year

- Investment Options: ISAs offer a range of investments, including stocks, bonds, and funds, for diversification

- Risk and Returns: Understanding risk profiles and potential returns is crucial for effective ISA management

- Withdrawal and Penalties: Penalties for early withdrawal, and rules for accessing funds without penalties

Tax-Free Growth: Investment ISAs allow compound interest to grow tax-free, unlike standard savings accounts

An Investment ISA, or Individual Savings Account, is a powerful tool for those seeking to grow their savings in a tax-efficient manner. One of its key advantages is the ability to benefit from compound interest, which can significantly boost your savings over time. Compound interest is the interest earned not only on your initial deposit but also on the accumulated interest from previous periods. This means that your money can grow exponentially, providing a substantial return on investment.

Unlike standard savings accounts, where interest is often taxable, Investment ISAs offer a tax-free environment for your savings to flourish. When you place money into an ISA, it is protected from income tax, capital gains tax, and inheritance tax. This tax-free status allows your investments to grow freely, and the compound interest earned is also exempt from tax. As a result, your money can accumulate more rapidly, providing a substantial financial advantage.

The concept of compound interest is particularly beneficial for long-term savings goals. For example, if you invest a fixed amount regularly into an Investment ISA, the compound effect will ensure that your money grows faster than it would in a standard savings account. Over time, this can lead to a substantial nest egg, especially when considering the potential for reinvesting the interest earned.

Furthermore, Investment ISAs often provide access to a wide range of investment options, including stocks, shares, bonds, and funds. This diversity allows investors to tailor their portfolios to their risk tolerance and financial goals. Whether you're a conservative investor or a risk-taker, you can find suitable investment opportunities within an ISA to maximize your tax-free growth potential.

In summary, Investment ISAs offer a unique advantage by allowing compound interest to work its magic tax-free. This feature, combined with the potential for various investment choices, makes ISAs an attractive option for those looking to grow their savings efficiently. By taking advantage of this tax-efficient vehicle, individuals can build a substantial financial future with their hard-earned money working harder for them.

Retirement Nest Egg: Navigating the Investment Maze

You may want to see also

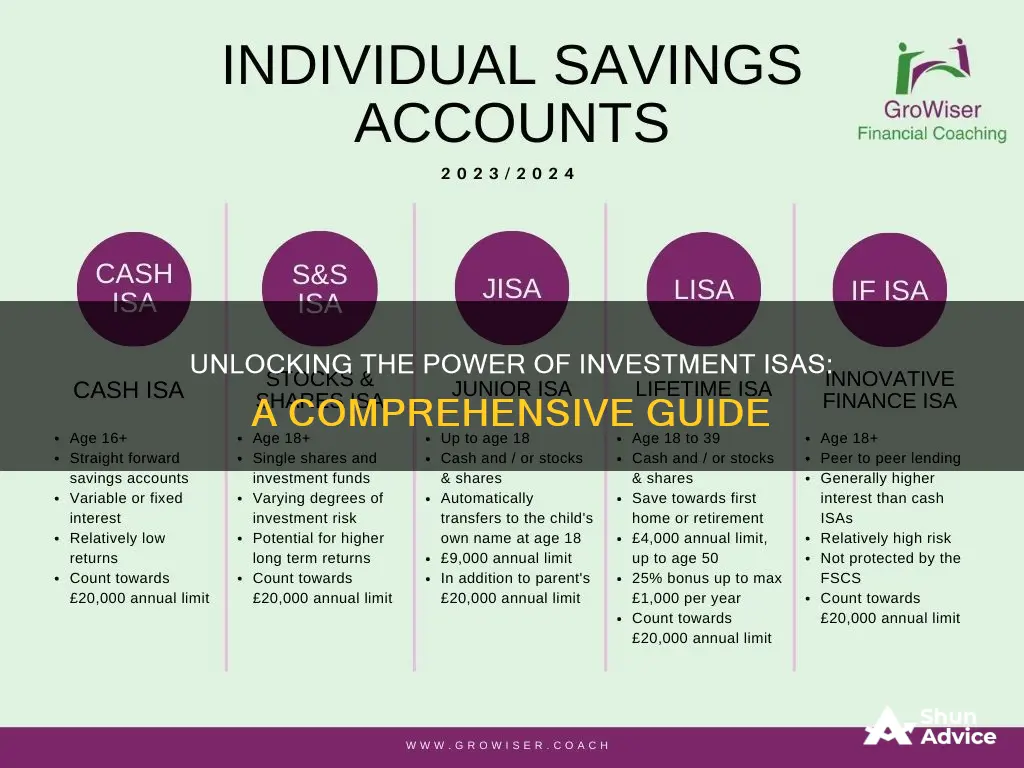

Contribution Limits: Annual limits on contributions to ISAs, varying by country and tax year

When it comes to Individual Savings Accounts (ISAs), understanding the contribution limits is crucial for maximizing the benefits of this tax-efficient savings and investment vehicle. These limits vary depending on the country and the tax year in question. For instance, in the United Kingdom, the annual ISA allowance is set by the government and is adjusted annually. As of the 2023/2024 tax year, UK residents can contribute up to £20,000 per tax year into their ISAs. This limit allows individuals to save a significant amount while enjoying tax advantages. It's important to note that this limit applies to all types of ISAs, including cash ISAs, stocks and shares ISAs, and innovative finance ISAs.

In the United States, the concept of an ISA is not as prevalent, but similar tax-advantaged accounts exist, such as the Roth IRA. The annual contribution limit for a Roth IRA is set by the IRS and is subject to change annually. For the 2023 tax year, the contribution limit for a Roth IRA is $19,500 for individuals under 50 years old. This limit provides a clear framework for American taxpayers to plan their savings and investments effectively.

Other countries may have different approaches to ISA contribution limits. For example, in some European countries, there might be separate limits for different types of ISAs, such as equity-based or property-based ISAs. These variations ensure that individuals can choose the most suitable ISA structure for their financial goals. It's essential for investors to be aware of these differences to make informed decisions regarding their ISA contributions.

Understanding these contribution limits is vital for several reasons. Firstly, it helps individuals plan their savings and investments effectively, ensuring they stay within the legal boundaries. Exceeding the contribution limit can result in penalties and may even disqualify an individual from receiving tax benefits. Secondly, being aware of these limits allows investors to diversify their portfolios across multiple ISAs if permitted by their jurisdiction. This diversification can provide a more balanced approach to wealth accumulation.

Additionally, knowledge of ISA contribution limits can influence an individual's financial decisions throughout the year. For instance, if someone is close to reaching their annual limit, they might consider adjusting their investment strategy or waiting until the next tax year to make significant contributions. This awareness promotes responsible financial management and ensures that individuals can make the most of their ISA opportunities.

The Debt Dilemma: Navigating the Investment vs. Loan Repayment Conundrum

You may want to see also

Investment Options: ISAs offer a range of investments, including stocks, bonds, and funds, for diversification

Investment ISAs, or Individual Savings Accounts, are a popular financial product in the UK that allows individuals to save and invest money tax-efficiently. One of the key advantages of ISAs is the wide range of investment options they offer, providing investors with a diverse and flexible approach to growing their wealth.

When it comes to investment options, ISAs provide access to various asset classes, ensuring that investors can diversify their portfolios. This diversification is a crucial strategy in risk management and long-term wealth creation. Here's a breakdown of the investment options available within an ISA:

Stocks and Shares: ISAs enable investors to buy shares in companies, offering an opportunity to participate in the growth of businesses. This can be done through direct share ownership or by investing in funds that hold a basket of stocks. Stocks provide the potential for capital appreciation and dividend income, making them a popular choice for long-term investors.

Bonds and Fixed-Income Securities: These are debt instruments issued by governments, municipalities, or corporations. Investing in bonds within an ISA provides a steady stream of income through regular interest payments. Bonds are generally considered less risky than stocks but offer lower potential returns. This option is suitable for investors seeking a more conservative approach.

Investment Funds: ISAs allow investors to purchase shares in investment funds, which are managed portfolios of various securities. These funds can be actively managed by fund managers or follow a specific investment strategy, such as index funds or sector-specific funds. Investment funds offer instant diversification, as they pool money from multiple investors to invest in a wide range of assets, reducing risk through diversification.

By offering these investment options, ISAs cater to different risk appetites and financial goals. Diversification is a key principle in investing, and ISAs provide an excellent platform to implement this strategy. Investors can choose to allocate their funds across various asset classes, ensuring that their portfolio is not overly exposed to any single market or security. This approach helps mitigate risk and provides a more stable investment journey.

In summary, Investment ISAs offer a comprehensive suite of investment options, allowing individuals to build a well-diversified portfolio. The ability to invest in stocks, bonds, and funds provides investors with the flexibility to tailor their ISA to their financial objectives, risk tolerance, and investment horizon.

The Workforce Investment Act: Unlocking Tuition Support for Career Seekers

You may want to see also

Risk and Returns: Understanding risk profiles and potential returns is crucial for effective ISA management

Understanding the relationship between risk and returns is fundamental to effective ISA management. Investment ISAs (Individual Savings Accounts) offer a tax-efficient way to save and invest, but the level of risk associated with different ISA investments can vary significantly. This variation in risk directly impacts the potential returns, and thus, investors need to be aware of their risk tolerance to make informed decisions.

Risk profiles are typically categorized as low, medium, or high. Low-risk investments are generally considered safe and stable, offering a steady return with minimal volatility. Examples include government bonds, savings accounts, and some investment trusts. Medium-risk investments offer a balance between safety and growth potential. These might include corporate bonds, shares in established companies, and some property funds. High-risk investments are more volatile and can lead to significant gains or losses. They often include shares in smaller companies, emerging market funds, and some alternative investments like derivatives and venture capital.

The potential returns on an ISA investment are directly linked to the risk level. Higher-risk investments often provide the opportunity for greater returns over the long term. For instance, investing in a diverse portfolio of shares in small, medium, and large companies can offer substantial growth potential. However, this comes with the risk of significant losses if the market takes a downturn. Conversely, low-risk investments provide more predictable returns, often with less volatility, making them suitable for those seeking a steady income or capital preservation.

Assessing your risk profile is a critical step in ISA management. It involves understanding your financial goals, investment time horizon, and personal risk tolerance. Younger investors, for instance, might be more inclined to take on higher risks to benefit from long-term growth potential. In contrast, older investors may prefer lower-risk options to protect their capital and generate a steady income. A financial advisor can help in this process by providing tailored advice based on an individual's circumstances.

In summary, effective ISA management requires a clear understanding of risk and returns. Investors should carefully consider their risk tolerance and match it with the appropriate ISA investment options. This ensures that their ISA portfolio is aligned with their financial goals and provides a balanced approach to saving and growing their wealth. Regular reviews of the ISA portfolio are also recommended to ensure it remains in line with the investor's changing circumstances and objectives.

The Investment Cash Conundrum: Increase or Decrease?

You may want to see also

Withdrawal and Penalties: Penalties for early withdrawal, and rules for accessing funds without penalties

When it comes to withdrawing funds from an Investment ISA (Individual Savings Account), there are specific rules and penalties to be aware of, especially if you make early withdrawals. Here's a breakdown of the key points:

Penalties for Early Withdrawal:

Withdrawing money from your Investment ISA before the end of the tax year (usually April 5th of the following year) can result in penalties. The primary penalty is the loss of the tax-free status of your withdrawals. This means that any interest or growth earned on the withdrawn amount will be subject to income tax. Additionally, you may be charged a penalty by your ISA provider for the early withdrawal. The penalty amount can vary depending on the provider and the terms of your ISA. It's important to carefully review your ISA's terms and conditions to understand the specific penalties associated with early withdrawals.

Rules for Accessing Funds Without Penalties:

To avoid penalties, it's crucial to follow the rules set by the ISA provider and HM Revenue & Customs (HMRC). Here are some key points to remember:

- Tax Year End: You can typically withdraw funds tax-free once per tax year. This means you can make one withdrawal without incurring any penalties or tax implications.

- Age Requirement: If you're a UK resident, you must be at least 18 years old to access your ISA funds without penalties.

- ISA Transfer: If you want to transfer your ISA to a new provider, you can do so without penalties, but you'll need to wait until the end of the tax year to make the transfer.

- Death or Permanent Residence Abroad: In the event of your death or permanent residence abroad, your ISA can be passed on or accessed without penalties.

- Cash ISA vs. Investment ISA: It's important to distinguish between Cash ISAs and Investment ISAs. Cash ISAs allow you to withdraw funds without penalties at any time, while Investment ISAs have the rules mentioned above regarding early withdrawals.

Remember, the rules and penalties can vary depending on your specific ISA provider and the type of ISA you hold. Always consult your ISA provider's documentation or seek professional advice to ensure you understand the withdrawal rules and potential consequences.

Uncovering Bargain Land Deals: A Property Investor's Guide

You may want to see also

Frequently asked questions

An Investment ISA, also known as an Individual Savings Account, is a tax-efficient way to invest in a wide range of assets, including stocks, shares, bonds, and funds. It allows you to save and grow your money without paying tax on the interest, dividends, or capital gains earned within the account.

Opening an Investment ISA is similar to setting up a regular savings account. You can choose from various providers, such as banks, building societies, or investment platforms. You'll typically need to provide personal details, choose your investment options, and decide on the amount you want to invest. Some providers may offer a sign-up bonus or free trades as an incentive.

Investment ISAs offer several advantages. Firstly, they provide a tax-free environment for your investments, allowing your money to grow faster. You can also benefit from a wide range of investment choices, allowing you to diversify your portfolio. Additionally, many providers offer low or no fees, making it an affordable way to invest.

Yes, you can typically withdraw money from your Investment ISA at any time without incurring tax charges. However, it's important to note that any gains or interest earned within the account may be subject to tax if you withdraw before the end of the tax year. Some providers may also charge withdrawal fees, so it's best to check the terms and conditions of your specific ISA.