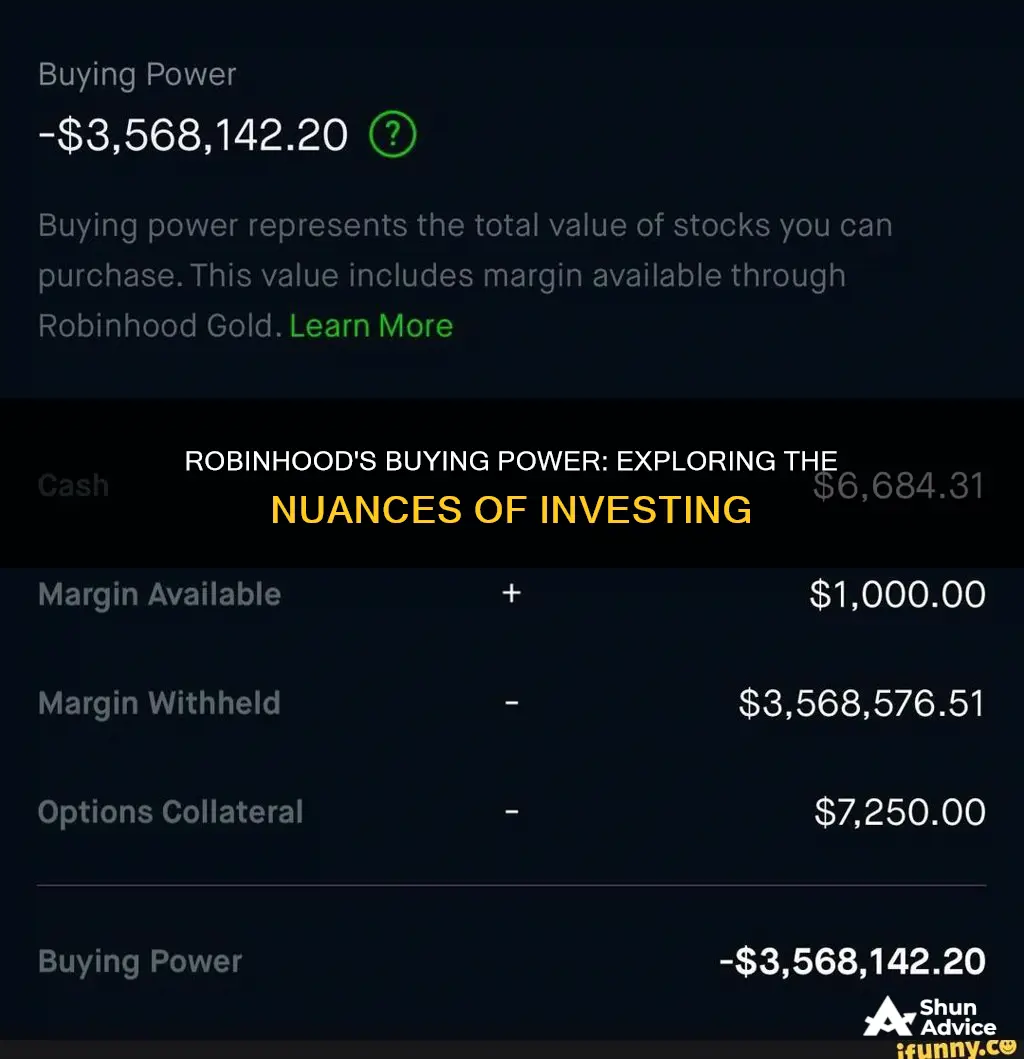

Buying power is the money available to an investor to purchase securities in trading plus the available margin. On the trading platform Robinhood, buying power is the amount of money you can use to purchase stocks, options, or crypto. It is the amount of capital in a user's account after considering any unsettled funds or margin requirements. Robinhood's buying power is determined by the user's cash balance, the amount of money that is currently settled in their account, and any unsettled funds that may be available for trading.

However, buying power is not the same as investing. Investing is the act of putting money into something, such as stocks or crypto, with the expectation of profit. Buying power is simply the amount of money available to do this.

| Characteristics | Values |

|---|---|

| Buying power | The money available to an investor to purchase securities in trading plus the available margin |

| Purchasing power | How much a consumer’s dollar can buy |

| How to increase buying power | Borrowing money to buy stocks, also known as margin investing |

| How to withdraw buying power | Withdrawing fiat cash or cryptocurrency from your account |

What You'll Learn

Buying power and purchasing power are different

Buying power and purchasing power are indeed different concepts. Buying power is the money available to an investor to purchase securities in trading plus the available margin. It is the money sitting in your account, ready to be used to buy stocks, options, and bonds. It is also the amount you can borrow against your account, which is directly related to how much money you have.

Purchasing power, on the other hand, is related to consumer spending and the number of goods or services a person can buy with their money. It is the value of a currency expressed in terms of the number of goods or services that one unit of money can buy. It can weaken over time due to inflation, which causes the dollar to lose value, leading to consumers paying more for fewer goods and services.

For example, if the price of a movie ticket was $5.66 in 2001 and $9.57 in 2021, the purchasing power of $10 is different in these two years. In 2001, $10 may have gotten two people into the cinema, whereas in 2021, it would only get one person in. As the price of goods increases, you can purchase less, and the purchasing power of the dollar is lower.

It is important to note that a decrease in the value of a currency or a person's purchasing power does not necessarily mean a decrease in their buying power. If their income has kept up with inflation, they may still be able to purchase the same amount of goods and services.

Factors that affect purchasing power include economic conditions, inflation, interest rates, exchange rates, income, and government policies. These factors can drive prices up or down, impacting supply and demand, and making credit more expensive.

Understanding the difference between buying power and purchasing power is crucial for making informed investment decisions. While buying power refers to the funds available for trading, purchasing power reflects the value of money in terms of the goods and services it can buy.

Smart Strategies for Investing $100K for Retirement

You may want to see also

Buying power is money available to buy securities

Buying power is the money available to an investor to purchase securities. It is the money sitting in your account, ready to be used to buy stocks, options, and bonds. It is also the amount you can borrow against your account, which is directly related to how much money you have.

On the Robinhood platform, buying power is the amount of money you have available to execute a trade. If the cost of the trade exceeds your buying power, you will be unable to complete the transaction.

Buying power is calculated by adding the total cash in your brokerage account to all available margin. A standard margin account will provide twice the equity in buying power, while a pattern day trading account will provide four times the equity.

It is important to note that money borrowed on margin must be paid back and will likely include interest. Traders take on this risk because they expect the stock price to increase, resulting in profits that will cover the borrowed amount. However, if the stock decreases in value, traders are still responsible for repaying the margin.

Additionally, factors like unsettled trades, pending orders, or trades can impact your buying power on Robinhood. It is crucial to understand your buying power and the associated risks and rewards before placing any orders.

Protecting Retirement: Strategies to Shield Investments from Trade War Fallout

You may want to see also

It's also how much you can borrow against your account

Buying power is the money available to an investor to purchase securities in trading plus the available margin. In other words, it is the money sitting in your account, ready to be used to buy stocks, options, and bonds. It is also the amount of money you can borrow against your account, which is directly related to how much money you have. According to the Federal Reserve, firms can lend traders up to 50% of their buying power to buy securities.

Robinhood offers margin accounts, allowing users to borrow to buy stocks. Robinhood Gold funds these accounts, with a minimum of $2,000 of the investor's own money and a $5 monthly recurring fee. The interest on the margin is determined by the amount of money borrowed. However, margin accounts exclude crypto buying power, meaning that cryptocurrency must be purchased with the client's own money.

When transferring buying power from Robinhood to a bank, specific conditions must be met, and withdrawals are limited to five per day and $50,000 per business day. It is important to note that the time it takes for money to be deposited into a Robinhood account can affect a user's buying power. There is a delay in updating the client's buying power, which was not always the case on the platform. Previously, funds were available immediately when purchasing cryptocurrencies, but now it can take up to five business days for deposited money to settle into the account.

Retirement Redefined: Navigating the Investment Landscape for a Secure Future

You may want to see also

Margin investing and margin calls

Margin investing is a strategy that allows investors to purchase securities, such as stocks, with borrowed money. Margin investing is risky because it involves trading with borrowed money. When an investor borrows money to trade, they are required to keep a certain minimum balance in their margin account as a form of collateral.

A margin call occurs when the percentage of an investor's equity in a margin account falls below the broker's required amount. In other words, it happens when the value of securities in a brokerage account falls below a certain level, known as the maintenance margin. When this happens, the broker will issue a margin call, demanding that the investor deposit additional money or securities into their account to increase its value.

There are a few options for how an investor can respond to a margin call:

- Deposit additional cash into the account

- Transfer additional securities into the account

- Sell securities to make up the shortfall

If the investor doesn't respond to the margin call, the broker may sell some of their securities or even liquidate their entire account to make up the difference. Margin calls can be triggered by various factors, including market volatility, the performance of the securities in the margin account, and changes to the broker's maintenance requirement.

To avoid a margin call, investors can:

- Read the fine print of their margin agreement to understand the terms and conditions

- Monitor their equity and the market regularly

- Diversify their investments to spread out the risk

- Have a backup plan and extra cash on hand to respond to a margin call

Retirement Planning: A Smart Investment Strategy for the Future

You may want to see also

How to increase buying power

Buying power is the money available to an investor to purchase securities in trading plus the available margin. It is the money that is sitting in your account, ready to be used to buy stocks, options, and bonds. On the Robinhood platform, buying power is the amount of money you can use to purchase stocks, options, or crypto.

- Borrow money to buy stocks: Also known as margin investing, this method typically gives twice the equity in buying power. Traders are willing to take on the risk of borrowing money to buy stocks because they count on the rising stock price to make a profit and pay back the borrowed amount. However, if the stock decreases in value, traders are still responsible for paying back the margin with interest.

- Instant deposits: With Robinhood's Instant Deposits, you can get up to $1,000 instantly after initiating a bank deposit into your account. While you may have access to these funds right away, the transfer from your bank to your Robinhood account may take up to five business days.

- Crypto sales: All proceeds from crypto sales are available immediately and can increase your buying power.

- Interest payments: Your buying power may increase due to receiving interest payments on cash.

- Dividends: If one of the stocks you own pays out dividends, your buying power will increase.

- Sweep interest: Your buying power can increase due to receiving sweep interest on cash.

It's important to remember that when transferring buying power from Robinhood to a bank, specific conditions must be met, and there are limits to the number of withdrawals you can make per day and per business day. Additionally, crypto trading requires a separate account, and brokerage cash doesn't have access to instant settlement.

Fear of Investing: Why the Hesitation?

You may want to see also

Frequently asked questions

Buying power is the money available to an investor to purchase securities in a trading context. It is the money sitting in your account, ready to be used to buy stocks, options, and bonds.

Buying power on Robinhood is the amount of money you have available to make purchases in the app. It is the amount of capital in a user's account after considering any unsettled funds or margin requirements.

To get buying power on Robinhood, you need to add money to your account. You can do this by depositing money from your bank account, via a card, or by sending cryptocurrency to your Robinhood account from an external exchange.

To withdraw your buying power from Robinhood, you need to sell any assets and investments you own and wait for the settlement period to end. After this, you can send the money to your bank account or cryptocurrency wallet.