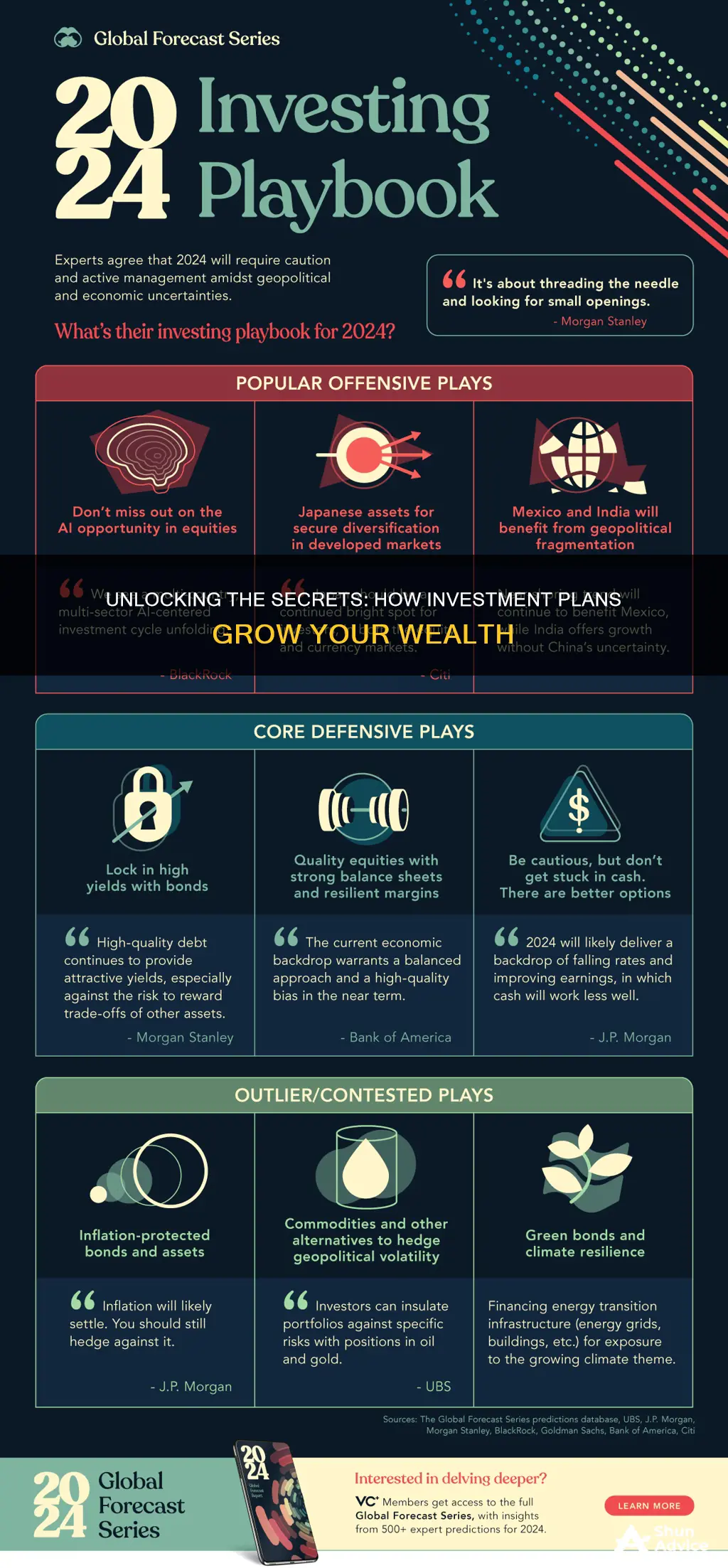

Investment plans are a structured approach to growing your wealth over time. They involve a series of steps and strategies designed to help you reach your financial goals, whether it's saving for retirement, a house deposit, or simply building a financial cushion. These plans typically involve a combination of different investment products, such as stocks, bonds, mutual funds, and real estate, each with its own level of risk and potential return. Understanding how investment plans work is crucial for anyone looking to make informed decisions about their financial future.

What You'll Learn

- Investment Vehicles: Understanding stocks, bonds, mutual funds, and ETFs

- Risk and Return: How risk tolerance impacts investment choices

- Time Horizons: Long-term vs. short-term investment strategies

- Tax Implications: Tax-efficient strategies for different investment types

- Diversification: Spreading investments to manage risk and maximize returns

Investment Vehicles: Understanding stocks, bonds, mutual funds, and ETFs

When it comes to investing, there are various vehicles that individuals can utilize to grow their wealth. Understanding these investment vehicles is crucial for anyone looking to navigate the financial markets effectively. Here's an overview of four common investment options: stocks, bonds, mutual funds, and Exchange-Traded Funds (ETFs).

Stocks, also known as shares or equities, represent ownership in a company. When you buy a stock, you become a shareholder and have a claim on a portion of the company's assets and profits. Stocks are typically traded on stock exchanges, and their prices fluctuate based on market conditions and the company's performance. Investors can buy individual stocks of specific companies or diversify their portfolios by investing in stock market indexes, which track a basket of stocks. This diversification helps mitigate risk as it's not tied to the performance of a single company.

Bonds are essentially loans made by investors to governments or corporations. When you buy a bond, you are lending money to the issuer in exchange for a promise to repay the principal amount (face value) plus interest at a specified date in the future. Bonds are considered less risky than stocks but generally offer lower returns. They are often used as a source of stable income through regular interest payments. Government bonds are typically seen as a safer investment, while corporate bonds may offer higher yields but carry more risk.

Mutual funds are a type of investment fund that pools money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities. By investing in a mutual fund, you indirectly own a portion of each security held by the fund. Mutual funds are managed by professional fund managers who decide how to allocate the fund's assets. This allows investors to benefit from the expertise of professionals and diversify their investments across various assets, reducing risk.

ETFs, or Exchange-Traded Funds, are similar to mutual funds in that they also hold a basket of securities, but they trade on stock exchanges like individual stocks. ETFs can track indexes, sectors, commodities, or even specific investment strategies. One of the key advantages of ETFs is their flexibility; they can be bought and sold throughout the trading day, just like stocks. ETFs often have lower expense ratios compared to mutual funds, making them an attractive option for cost-conscious investors.

Each of these investment vehicles has its own characteristics, risks, and potential rewards. Stocks offer ownership in companies and the potential for high returns but come with higher risk. Bonds provide a steady income stream and are considered less volatile. Mutual funds and ETFs offer diversification and professional management, making them suitable for long-term investors. Understanding the differences and choosing the right investment vehicle depends on an individual's financial goals, risk tolerance, and investment horizon.

Oil Investment 101: A Guide to Buying Oil as an Asset

You may want to see also

Risk and Return: How risk tolerance impacts investment choices

Understanding risk tolerance is crucial when navigating the world of investments. It's the concept of how much risk an investor is willing to take on in pursuit of their financial goals. This tolerance varies from person to person and is influenced by factors like age, financial situation, investment time horizon, and personal preferences. For instance, a young, high-income earner with a long-term investment horizon might be more inclined to take on higher risks for potentially higher returns, while a retiree with a shorter time frame might prefer more conservative investments to preserve capital.

Risk tolerance is often categorized into three main types: low, moderate, and high. Low-risk tolerance investors typically seek stable, secure investments with minimal volatility, such as bonds or savings accounts. Moderate risk tolerance investors are open to a mix of stocks and bonds, aiming for a balance between growth and stability. High-risk tolerance investors are more aggressive, often favoring stocks and other high-risk, high-reward investments to achieve significant long-term gains.

The relationship between risk and return is a fundamental principle in investing. Generally, the higher the risk, the higher the potential return. This is because investments with higher risk often offer the potential for greater growth, but they also come with a higher likelihood of loss. For example, stocks are known for their higher risk and potential for substantial returns over the long term, while government bonds are generally considered low-risk and offer more stable, albeit lower, returns.

When assessing your risk tolerance, it's essential to consider your financial goals, time horizon, and emotional comfort with risk. A comprehensive investment plan should align with your risk tolerance to ensure that your portfolio is structured to meet your objectives. For instance, if you're saving for retirement, a balanced approach that includes a mix of stocks and bonds might be appropriate, allowing for growth while also preserving capital.

In summary, risk tolerance plays a pivotal role in shaping investment choices. It dictates the types of investments an individual is willing to consider, and it's a key factor in determining the overall success of an investment strategy. By understanding and managing risk tolerance, investors can make informed decisions that align with their financial goals and comfort levels with risk.

Betting on a Bear Market: Navigating Investment Strategies During Economic Downturns

You may want to see also

Time Horizons: Long-term vs. short-term investment strategies

When it comes to investment plans, understanding the concept of time horizons is crucial. Time horizons refer to the length of time an investor is willing to commit their money to an investment strategy. This decision significantly impacts the types of investments chosen and the overall approach to building wealth. The two primary time horizons in investing are long-term and short-term.

Long-term investment strategies are characterized by a patient and consistent approach. Investors adopting this strategy typically aim to hold their investments for an extended period, often years or even decades. The idea is to ride out short-term market fluctuations and benefit from the long-term growth potential of the market. Long-term investors often focus on a diversified portfolio of stocks, bonds, and other assets, allowing their investments to grow over time. This approach is particularly attractive to those who can afford to wait out temporary market dips and are confident in the market's ability to deliver positive returns over the long haul.

On the other hand, short-term investment strategies are more reactive and focused on quick gains. Short-term investors often aim to capitalize on market trends and price movements within a relatively brief period. This strategy may involve frequent buying and selling of assets, taking advantage of short-term market inefficiencies or news-driven events. Short-term investors might use technical analysis, charting tools, and market indicators to make quick decisions. While this approach can be profitable in the short run, it often requires a higher level of market monitoring and may not be suitable for those who prefer a more passive investment style.

The choice between long-term and short-term investment strategies depends on an individual's financial goals, risk tolerance, and time availability. Long-term investors often benefit from compound interest, allowing their investments to grow exponentially over time. This strategy is particularly effective for retirement planning, education funds, or any long-term financial objective. Short-term investors, on the other hand, may be more suitable for those seeking to generate quick returns or those who prefer a more active role in managing their investments.

In summary, understanding your time horizon is essential when designing an investment plan. Long-term investors embrace market volatility and focus on the big picture, while short-term investors aim to capitalize on quick market movements. Both strategies have their merits and can be effective tools in an investor's arsenal, but the key is to align the investment approach with your financial goals and risk tolerance.

Smart Investment Strategies: Unlocking the Power of a $50K Investment

You may want to see also

Tax Implications: Tax-efficient strategies for different investment types

Understanding the tax implications of your investment choices is crucial for optimizing your financial strategy and ensuring you're making the most of your money. Different investment vehicles come with varying tax treatments, and being aware of these can significantly impact your overall returns. Here's a breakdown of tax-efficient strategies for various investment types:

Stocks and Mutual Funds:

- Capital Gains Taxes: When you sell stocks or mutual funds, you may be subject to capital gains tax. The rate depends on your income and the holding period. Generally, short-term capital gains (held for less than a year) are taxed as ordinary income, while long-term gains (held for more than a year) often qualify for a lower rate.

- Tax-Loss Harvesting: This strategy involves selling investments that have decreased in value to offset capital gains from other investments. By strategically selling losing positions, you can reduce your taxable income and potentially defer taxes until a more favorable tax bracket.

Bonds and Fixed-Income Securities:

- Interest Income Taxation: Bondholders receive interest payments, which are typically taxable as ordinary income. The tax rate on bond interest depends on your overall income.

- Municipal Bonds: These bonds are issued by local governments and often exempt from federal and state income tax. However, they may still be subject to state and local taxes.

Real Estate:

- Capital Gains and Property Taxes: Selling a property can trigger a capital gains tax. The tax rate varies based on your holding period and income. Additionally, property taxes must be paid annually, and the amount can vary depending on the location and property value.

- 1031 Exchange: This tax-deferral strategy allows you to exchange one property for another of equal or greater value, deferring capital gains taxes. This is beneficial for real estate investors looking to diversify their portfolio without incurring immediate tax liabilities.

Retirement Accounts:

- Tax Advantages: Traditional retirement accounts like 401(k)s and IRAs offer tax benefits. Contributions are often tax-deductible, and earnings grow tax-deferred until withdrawal.

- Roth Accounts: Roth IRAs and 401(k)s allow tax-free growth and withdrawals in retirement. Contributions are made with after-tax dollars, but qualified withdrawals are tax-free.

Cryptocurrencies and Other Digital Assets:

- Capital Gains and Tax Rates: Cryptocurrency transactions are often treated as property transactions for tax purposes. This means short-term gains are taxed as ordinary income, while long-term gains qualify for a lower rate.

- Tax Reporting: The IRS requires detailed reporting of cryptocurrency transactions. It's essential to keep accurate records of buys, sells, and holdings for tax purposes.

General Tips for Tax Efficiency:

- Diversification: Diversifying your investment portfolio can help spread tax liability across different asset classes and tax treatments.

- Long-Term Holding: Holding investments for the long term often results in lower tax rates on capital gains.

- Consult a Tax Professional: Tax laws are complex and constantly evolving. Consulting a qualified tax advisor can help you navigate the intricacies and make informed investment decisions.

Couch Potato Investing: Unlocking the Power of Lazy Money

You may want to see also

Diversification: Spreading investments to manage risk and maximize returns

Diversification is a fundamental strategy in investment planning, aiming to reduce risk and optimize returns by allocating investments across various asset classes, sectors, and geographic regions. This approach is based on the principle that different investments perform differently over time, and by diversifying, investors can smooth out the volatility of their portfolio. Here's a detailed breakdown of how diversification works and its benefits:

Understanding Risk and Return: Investment risk refers to the potential for losses in the value of an investment. This can be categorized into various types, including market risk (fluctuations in the overall market), credit risk (default by borrowers), and liquidity risk (difficulty in buying or selling an asset). Diversification targets multiple risks by spreading investments, ensuring that a potential downturn in one area is potentially offset by gains in another. For instance, investing solely in stocks could lead to significant losses during a market downturn, but diversifying into bonds, real estate, or commodities might provide a more stable return profile.

Asset Allocation: This is the process of deciding how much of your investment portfolio should be allocated to different asset classes. Common asset classes include stocks, bonds, cash equivalents, real estate, and commodities. A well-diversified portfolio typically holds a mix of these assets. For example, a 60/40 stock/bond allocation is a common starting point for many investors, aiming to balance risk and return. Over time, investors may adjust this allocation based on their risk tolerance, investment goals, and market conditions.

Sector and Geographic Diversification: Within each asset class, further diversification can be achieved by investing in different sectors and geographic regions. For instance, within stocks, one might invest in technology, healthcare, consumer goods, and energy sectors. This approach ensures that the portfolio is not overly exposed to the risks associated with a single industry. Similarly, investing globally across various countries can reduce country-specific risks and provide access to diverse market opportunities.

Benefits of Diversification: Diversification offers several advantages. Firstly, it reduces the impact of individual security or market performance on the overall portfolio. By holding a variety of investments, the potential for significant losses is minimized. Secondly, it can lead to higher long-term returns. Historical data suggests that diversified portfolios tend to outperform non-diversified ones over extended periods. Lastly, diversification allows investors to align their portfolio with their risk tolerance and financial goals, providing a more personalized investment strategy.

Implementing Diversification: Diversification can be achieved through various means, including mutual funds, exchange-traded funds (ETFs), and index funds, which offer instant access to a diversified portfolio. Individual investors can also build a diversified portfolio by hand-picking stocks, bonds, and other securities. The key is to maintain a consistent allocation strategy and regularly review and rebalance the portfolio to ensure it remains aligned with the investor's goals and risk profile.

Blockchain Bets: Exploring Investment Opportunities Beyond Cryptocurrencies

You may want to see also

Frequently asked questions

An investment plan is a strategy designed to help individuals grow their wealth over time by allocating their money into various financial instruments. It involves making regular contributions to a designated account, which can be a retirement account, a mutual fund, or a brokerage account. The goal is to benefit from the power of compounding, where the earnings from your investments generate additional returns, leading to potential long-term growth.

Investment plans typically involve investing in assets such as stocks, bonds, mutual funds, or exchange-traded funds (ETFs). These assets can appreciate in value over time, providing capital gains. Additionally, many investments offer regular income through dividends or interest payments. The returns generated depend on market performance, the specific assets chosen, and the time horizon of the investment strategy. Diversification across different asset classes is a common approach to manage risk and maximize potential gains.

Investment plans offer several advantages. Firstly, they provide a structured approach to saving and investing, making it easier for individuals to build wealth consistently. By automating contributions, investors can take advantage of dollar-cost averaging, which reduces the impact of market volatility. Over time, this can lead to a higher overall return. Investment plans also encourage long-term financial discipline, helping individuals stay focused on their goals. Moreover, with proper diversification, these plans can offer a balance between risk and reward, potentially providing financial security for the future.