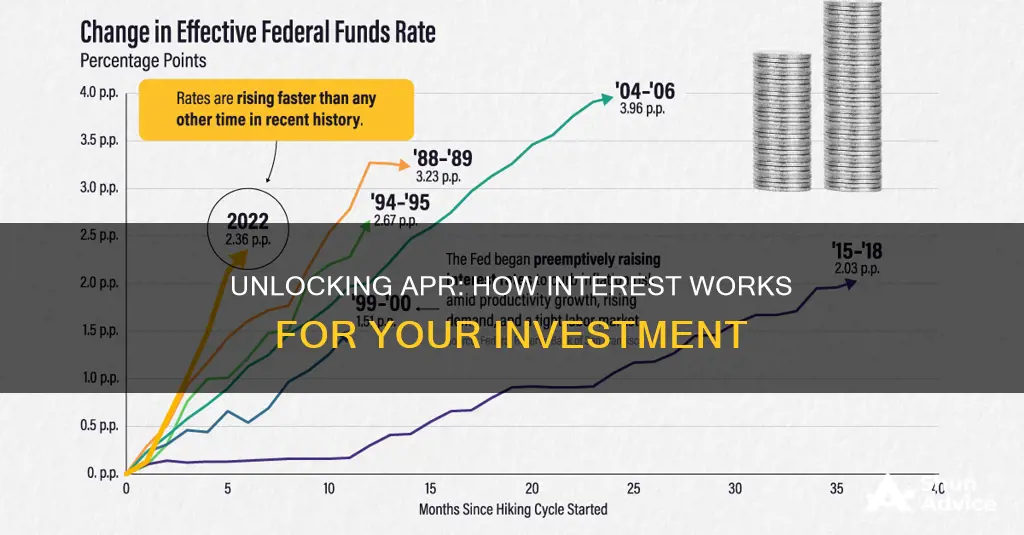

Understanding how APR (Annual Percentage Rate) interest works on investments is crucial for anyone looking to grow their money. APR represents the cost of borrowing or the reward for lending money, expressed as a yearly rate. When applied to investments, it indicates the rate at which your investment grows or compounds over time. This concept is particularly important for savings accounts, loans, and various investment vehicles, as it directly impacts the overall return on your investment. Knowing how APR works can help investors make informed decisions about where and how to invest their money, ensuring they maximize their financial gains.

What You'll Learn

- Interest Calculation: APR determines the yearly interest rate, including compounding

- Loan Repayment: It affects how much you pay back over time

- Investment Growth: Understanding APR helps predict investment returns

- Comparison with Other Rates: APR is compared to APY and nominal rates

- Impact on Creditworthiness: APR influences credit scores and loan eligibility

Interest Calculation: APR determines the yearly interest rate, including compounding

The Annual Percentage Rate (APR) is a crucial concept in understanding the true cost of borrowing or the potential return on an investment. When it comes to interest calculation, APR plays a pivotal role in determining the yearly interest rate, taking into account the effects of compounding.

In simple terms, APR represents the interest rate that is applied to the principal amount over a year. It provides a standardized way to compare different financial products, such as loans, credit cards, and investments, by offering a single rate that reflects the total interest cost or earnings. For example, if you have a savings account with an APR of 5%, it means that your money will grow by 5% in a year, assuming no other fees or charges.

The calculation of interest with APR involves a few key factors. Firstly, you need to know the principal amount, which is the initial sum of money invested or borrowed. Then, you multiply this principal by the APR to find the annual interest. For instance, if you invest $1,000 at an APR of 5%, the interest earned in a year would be $50 (1000 * 0.05).

However, what makes APR unique is its consideration of compounding. Compounding means that interest is calculated on the initial principal and also on the accumulated interest from previous periods. This can significantly impact the overall growth or cost over time. For instance, in a savings account with monthly compounding, the interest is added to the principal each month, and the subsequent interest is calculated on this new total. This results in a higher final amount compared to simple interest calculations.

Understanding the impact of compounding is essential when comparing investment options. It highlights why APR is a more comprehensive measure than the nominal interest rate. By considering the effects of compounding, APR provides a clearer picture of the true interest rate, allowing investors to make more informed decisions about their financial strategies.

Home Sweet Home: Navigating the Safest Investment Path to Buying a House

You may want to see also

Loan Repayment: It affects how much you pay back over time

Loan repayment is a critical aspect of managing debt and understanding how it impacts your overall financial health. When you take out a loan, whether it's for a car, home, or personal reasons, the interest rate, or Annual Percentage Rate (APR), plays a significant role in determining the total cost of the loan. The APR is the interest rate you are charged for borrowing money, and it directly affects the amount you repay over the loan's term.

The repayment process typically involves making regular payments, which include both the principal (the original amount borrowed) and the interest accrued. The interest is calculated based on the outstanding loan balance and the APR. As you make payments, the principal amount decreases, and the interest is calculated on the remaining balance. This is why, in the early stages of a loan, a significant portion of each payment goes towards interest, and only a small amount reduces the principal. Over time, as the principal decreases, more of your payment goes towards the principal, and less towards interest.

The impact of APR on loan repayment is substantial. A higher APR means you'll pay more in interest over the life of the loan, increasing the overall cost. For example, if you borrow $10,000 at a 5% APR, you'll pay $500 in interest annually. If the APR is 10%, the interest cost doubles to $1,000 per year. This difference can add up significantly over the loan's duration. Conversely, a lower APR results in lower interest costs, making the loan more affordable.

Understanding how APR affects loan repayment is essential for making informed financial decisions. When comparing loan offers, consider the APR to determine the true cost of borrowing. A lower APR doesn't always mean better terms; it's the total interest paid that matters. Additionally, if you have multiple loans, the APR can vary, impacting your overall repayment strategy. Managing debt effectively requires a clear understanding of these concepts to ensure you're making the best choices for your financial future.

The Future of Venture Capital: Where the Smart Money Will Flow in Half a Decade

You may want to see also

Investment Growth: Understanding APR helps predict investment returns

Understanding Annual Percentage Rate (APR) is crucial for investors as it provides a clear picture of the potential growth and returns on their investments. APR is a standardized way to express the interest rate on a loan or investment, making it easier for investors to compare different financial products. When it comes to investment growth, APR plays a significant role in predicting the returns an investor can expect over a specific period.

In the context of investments, APR represents the annual cost of borrowing or the rate of return an investor can earn. It is calculated as a percentage of the principal amount and is applied over a year. For example, if an investor borrows $1000 at an APR of 5%, the interest accrued over a year would be $50, resulting in a total repayment of $1050. This simple concept can be applied to various investment vehicles, such as bonds, certificates of deposit (CDs), and even some savings accounts.

The beauty of APR lies in its ability to provide a uniform metric for comparison. When evaluating investment options, investors often juggle different interest rates, compounding periods, and fees. APR simplifies this process by offering a single figure that represents the total cost or gain over a year. This allows investors to quickly assess which investment offers the best return on their money, considering both the interest earned and any associated fees.

Moreover, APR helps investors understand the impact of compounding. Compound interest is the interest calculated on the initial principal and the accumulated interest from previous periods. When applied to investments, it can significantly boost returns over time. For instance, a $10,000 investment at an APR of 5% with monthly compounding will grow to a larger amount compared to the same investment with annual compounding. By understanding APR, investors can estimate how often compounding occurs and predict the potential growth of their investments.

In summary, APR is a powerful tool for investors to gauge the performance and potential returns of their investments. It provides a standardized way to compare interest rates, consider compounding effects, and make informed decisions. By grasping the concept of APR, investors can better navigate the financial markets and optimize their investment strategies for growth. This knowledge empowers investors to choose the right investment vehicles and manage their portfolios effectively.

Green Buildings: Smart Investment, Healthy Future

You may want to see also

Comparison with Other Rates: APR is compared to APY and nominal rates

When evaluating investment options, it's crucial to understand how Annual Percentage Rate (APR) compares to other interest rates, such as Annual Percentage Yield (APY) and nominal rates. These terms are often used interchangeably but represent different concepts, and grasping their distinctions is essential for making informed financial decisions.

APY vs. APR:

APY and APR are both measures of interest rates, but they provide different insights. APY takes into account the effects of compounding, meaning it calculates the total interest earned over a year, including the interest earned on previously accrued interest. This makes APY a more accurate representation of the true cost or benefit of an investment. For example, if you have $1,000 in a savings account with an APY of 5%, you would earn $50 in interest over the year, resulting in a total of $1,050. On the other hand, APR focuses solely on the initial interest rate and does not account for compounding. It is often used for loans and credit cards, where the interest is calculated based on the principal amount borrowed.

Nominal vs. Effective Rate:

Nominal interest rates are the stated or advertised rates before considering the impact of compounding. They are often lower than the effective or real rates because they don't factor in the effects of compounding over time. For instance, a nominal interest rate of 5% might seem attractive, but if it's compounded monthly, the effective rate could be higher due to the increased frequency of interest calculations. This is where APY becomes relevant, as it provides a more accurate representation of the actual interest earned, taking into account the compounding period.

Comparing Investment Options:

When comparing investment products, it's essential to consider both APR and APY. For savings accounts, certificates of deposit (CDs), or other fixed-income investments, APY is a more comprehensive metric. It allows investors to understand the true growth of their money over time. For loans and credit cards, APR is typically used to represent the cost of borrowing. However, it's crucial to note that APR might not fully reflect the total cost due to additional fees and charges. In such cases, understanding the total cost of credit (TCC) or the effective annual rate (EAR) can provide a more accurate comparison.

In summary, while APR is a useful metric for understanding the initial interest rate on loans and credit, APY is the preferred measure for savings and investment products, as it accounts for compounding and provides a clearer picture of the true interest earned or charged. Investors should always consider both APR and APY when evaluating different financial products to make well-informed decisions.

Bitcoin's Promise: Have the Rewards Outweighed the Risks?

You may want to see also

Impact on Creditworthiness: APR influences credit scores and loan eligibility

The Annual Percentage Rate (APR) is a crucial factor that significantly impacts an individual's creditworthiness and their ability to secure loans. When it comes to credit scores and loan eligibility, understanding the relationship between APR and these aspects is essential for making informed financial decisions. Here's an overview of how APR influences creditworthiness:

Credit Score Impact: Credit scores are numerical representations of an individual's creditworthiness, and they play a pivotal role in the lending process. A higher credit score indicates a more responsible borrower, often leading to better loan terms. APR directly affects credit scores because it represents the cost of borrowing, including interest and fees. Lenders use credit scores to assess the risk associated with lending to an individual. A lower APR typically means a more favorable credit profile, as it suggests that the borrower can manage debt effectively. Over time, maintaining a low APR on loans or credit cards can contribute to a positive credit history, resulting in an improved credit score. This is particularly important for individuals seeking large loans, such as mortgages or auto loans, as a higher credit score can lead to more competitive interest rates and better loan terms.

Loan Eligibility and Terms: APR is a critical factor in determining loan eligibility and the terms offered to borrowers. Lenders use APR to evaluate the risk and profitability of lending to a particular individual or entity. A lower APR indicates a reduced risk for the lender, making it more likely for the borrower to be approved for a loan. Additionally, the APR directly influences the interest rate, repayment period, and overall cost of the loan. For instance, a lower APR on a personal loan means lower monthly payments and a reduced total interest cost over the loan's life. This can make borrowing more affordable and manageable, especially for long-term loans. When applying for loans, borrowers with a history of low APRs are more likely to be offered favorable terms, including lower interest rates and more flexible repayment options.

Building a Positive Credit History: Consistently maintaining low APRs on loans and credit accounts can contribute to a positive credit history. This history is crucial for establishing and improving creditworthiness. Over time, a pattern of responsible borrowing and timely repayments at low APRs can lead to a higher credit score. This, in turn, opens doors to better loan opportunities, such as lower interest rates on mortgages or more favorable terms for business loans. Lenders often view a consistent history of low APRs as a sign of financial discipline and stability, making it easier for individuals to access credit when needed.

Long-Term Financial Benefits: The impact of APR on creditworthiness extends beyond individual loans. A strong credit profile, influenced by low APRs, can lead to better overall financial opportunities. For instance, individuals with a history of low APRs may qualify for credit cards with rewards or cashback programs, providing long-term savings. Additionally, a positive credit history can make it easier to secure loans for significant life events, such as purchasing a home or starting a business. The lower the APR, the more financially advantageous it is for the borrower in the long run.

In summary, APR plays a pivotal role in shaping an individual's creditworthiness. It influences credit scores by reflecting the cost of borrowing and the borrower's ability to manage debt. Lower APRs contribute to better loan eligibility and terms, making borrowing more affordable. Over time, maintaining low APRs can lead to a positive credit history, opening doors to various financial opportunities. Understanding the relationship between APR and creditworthiness is essential for borrowers to make informed decisions and build a strong financial profile.

Supply Shock's Impact on Investment and Saving Decisions

You may want to see also

Frequently asked questions

APR is a measure of the cost of credit, expressed as a yearly rate. When it comes to investments, APR is often used to describe the interest rate or return an investor can expect on a particular investment product, such as a bond or a fixed deposit. It represents the annualized rate at which the investment grows or earns interest.

The calculation of APR for investments involves considering the total interest or return earned over a year. It takes into account the initial investment amount, the interest rate or return, and the compounding frequency. For example, if an investment has an annual interest rate of 5% and compounds monthly, the APR would be slightly higher than 5% due to the effect of compounding.

Nominal APR and effective APR are two ways to express the interest rate or return on an investment. Nominal APR is the stated or advertised interest rate without considering the effects of compounding. Effective APR, on the other hand, takes into account the compounding periods and provides a more accurate representation of the actual interest earned over a year. For investments, it's important to understand the effective APR to assess the true growth or return.

APR is a valuable tool for investors to compare the attractiveness of different investment opportunities. By comparing the effective APR of various investments, investors can determine which option offers the highest return or the most favorable interest rate. This helps in making informed decisions, especially when evaluating investments with different compounding periods or interest calculation methods.