Opportunity Zones are a unique investment program designed to stimulate economic growth in designated low-income communities across the United States. This innovative concept allows investors to reinvest their capital gains into these areas, offering a tax incentive to encourage long-term investments. By understanding the mechanics of Opportunity Zone investments, individuals can explore a strategic approach to wealth creation while contributing to the revitalization of underserved neighborhoods. This paragraph sets the stage for a detailed exploration of the investment process, benefits, and potential risks associated with this emerging investment strategy.

What You'll Learn

- Tax Incentives: Reduced capital gains taxes for investments in OZ properties

- Investment Vehicles: OZ funds and real estate investments

- Eligibility Criteria: Specific requirements for businesses and investors

- Economic Development: Strategies to attract businesses and create jobs

- Regulatory Framework: Rules and guidelines for OZ investments

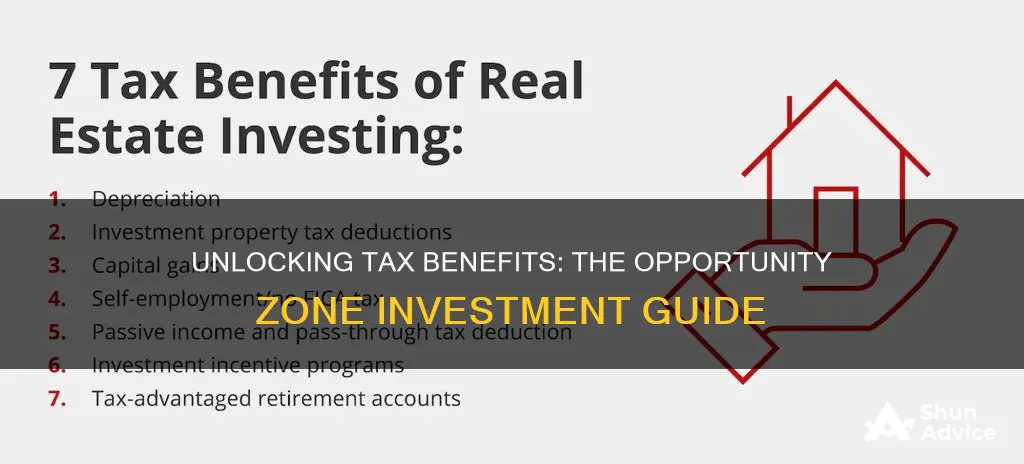

Tax Incentives: Reduced capital gains taxes for investments in OZ properties

Opportunity Zone investments offer a unique tax incentive that can significantly benefit investors looking to optimize their capital gains. When you invest in a property or business located in an Opportunity Zone, you can take advantage of a reduced capital gains tax rate on any future profits. This incentive is designed to encourage long-term investments in these designated areas, which are often economically disadvantaged communities.

Here's how it works: When you sell an asset that was held for at least two years, you typically owe capital gains tax on the profit. However, if you reinvest those gains into an Opportunity Zone property, you can defer paying taxes on the capital gain. This deferral can be a powerful tool for investors, allowing them to reinvest their profits without incurring immediate tax liabilities.

The key to this tax incentive is the long-term hold. To qualify for the reduced tax rate, you must hold the Opportunity Zone investment for at least five years. If you sell the property before this period ends, you may be subject to the full capital gains tax rate, plus an additional 10% tax on any deferred gains. This long-term commitment encourages investors to take a strategic approach, focusing on the potential for long-term value appreciation in these areas.

Additionally, the reduced tax rate on capital gains can be substantial. Typically, long-term capital gains are taxed at 0%, 15%, or 20%, depending on the investor's income. By reinvesting in an Opportunity Zone, investors can potentially avoid these higher rates and keep more of their profits. This tax incentive not only provides a financial benefit but also encourages investors to contribute to the economic development of these targeted communities.

It's important to note that this tax benefit is not limited to individual investors. Opportunity Zone investments can also be made through special funds or real estate investment trusts (REITs), allowing a broader range of investors to participate. These funds often provide diversification and liquidity, making it easier for investors to access this tax incentive without directly managing the properties.

Unleash Compound Interest's Power: Maximizing Portfolio Growth

You may want to see also

Investment Vehicles: OZ funds and real estate investments

Opportunity Zone investments are a relatively new concept in the investment world, offering a unique approach to tax-advantaged investing. These zones are designated areas where investors can channel their capital into specific projects or assets, often with the goal of revitalizing economically distressed communities. The core idea is to encourage long-term investment and economic growth in these areas, providing tax benefits to investors who play a crucial role in this process.

One of the primary investment vehicles for Opportunity Zones is OZ funds, which are special purpose vehicles designed to invest in these designated zones. These funds are structured as limited partnerships, allowing investors to pool their money and invest in a diversified portfolio of assets within the Opportunity Zone. OZ funds can invest in various sectors, including real estate, infrastructure, and small businesses, all while providing tax advantages to investors. By investing in these funds, individuals can gain exposure to a range of assets and contribute to the development of the designated zone.

Real estate investments within Opportunity Zones present an attractive opportunity for investors seeking tangible assets. Investors can acquire or develop properties in these zones, benefiting from the tax incentives associated with Opportunity Zones. This includes the ability to defer capital gains taxes on the sale of other assets and the potential for long-term tax benefits. Real estate investors can focus on acquiring undervalued properties, renovating them, and then selling or renting them out, all while enjoying the tax advantages. This strategy not only provides a potential return on investment but also contributes to the physical development and revitalization of the designated area.

When investing in Opportunity Zones, it's essential to understand the rules and regulations governing these investments. Investors should be aware of the holding period requirements, which typically involve keeping the investment for at least ten years to qualify for the full tax benefits. Additionally, there are specific guidelines for what types of assets can be held within an Opportunity Zone, ensuring that the investments align with the economic development goals of the zone.

In summary, Opportunity Zone investments offer a unique approach to investing, providing tax advantages and the potential for long-term economic growth. OZ funds and real estate investments are key vehicles for participating in this program. By understanding the rules and regulations, investors can strategically channel their capital into these zones, contributing to the development of distressed communities while also potentially generating returns on their investments. This innovative investment strategy has the potential to create a positive impact on both the local economy and the investors themselves.

Strategic Retirement Planning: Maximizing an $850,000 Investment

You may want to see also

Eligibility Criteria: Specific requirements for businesses and investors

Opportunity Zone investments are a unique tax incentive program designed to encourage investment in designated low-income communities, offering significant benefits to both businesses and investors. To qualify for these incentives, specific eligibility criteria must be met, ensuring that the investments contribute to the revitalization and economic growth of these areas. Here are the key requirements for businesses and investors:

Business Eligibility:

- Location: Businesses must be located within an Opportunity Zone, which are specifically designated census tracts that have been identified as low-income areas. These zones are typically in distressed communities, urban or rural, where there is a need for economic development and job creation.

- Investment Type: The business should focus on activities that create new jobs, improve infrastructure, or enhance the local economy. This could include manufacturing, retail, real estate development, or any other industry that contributes to the zone's economic growth.

- Job Creation: One of the primary criteria is the potential for job creation. Businesses must demonstrate a plan to create new jobs, either through expansion or the establishment of new operations within the Opportunity Zone. The number of jobs and the impact on the local community are crucial factors in the eligibility assessment.

- Investment Amount: There are no strict minimum investment requirements, but businesses should be prepared to invest a substantial amount to make a meaningful impact in the zone. The investment should be directed towards assets, equipment, or other eligible expenditures to support the business's operations and growth.

Investor Eligibility:

- Tax Status: Investors can be individuals, corporations, or other entities, but they must be aware of the tax implications. Investors should be prepared to claim the tax benefits associated with Opportunity Zone investments, which include deferring capital gains taxes and potentially reducing income tax liability.

- Investment Timing: Timing is critical for investors. They must invest in eligible businesses or real estate within a specific timeframe to qualify for the tax incentives. This often involves investing in a qualified opportunity fund (QOF) or directly in a business operating within an Opportunity Zone.

- Diversification: Investors are encouraged to diversify their portfolios by investing in multiple Opportunity Zones or businesses. This diversification can provide a more comprehensive impact and potentially increase the chances of meeting the eligibility criteria.

- Long-Term Commitment: Opportunity Zone investments typically require a long-term commitment. Investors should be prepared to hold their investments for at least a decade to benefit fully from the tax incentives and contribute to the zone's development.

Meeting these eligibility criteria is essential for businesses and investors to take advantage of the Opportunity Zone program. It ensures that the investments are directed towards areas of genuine need, fostering economic growth and providing tax benefits to those who participate. Understanding the specific requirements and planning investments accordingly can lead to significant advantages for both parties involved.

Car Conundrum: Unraveling the Economics of Automobile Purchases

You may want to see also

Economic Development: Strategies to attract businesses and create jobs

Economic Development Strategies: Attracting Businesses and Creating Jobs

Attracting businesses and fostering job creation is a cornerstone of economic development, and implementing effective strategies can significantly impact a region's prosperity. Here are some approaches to consider:

Targeted Incentives: Governments can design tailored incentives to attract specific industries or businesses. These incentives may include tax breaks, reduced property taxes, or subsidies for research and development. For instance, offering tax credits for companies investing in renewable energy can encourage green technology adoption. Similarly, providing grants for startups in technology hubs can stimulate innovation and create high-skilled jobs.

Infrastructure Development: Investing in infrastructure is crucial for economic growth. Governments should focus on improving transportation networks, ensuring reliable utilities, and developing modern communication systems. Upgrading roads, bridges, and public transportation can make a region more accessible to businesses and residents alike. Additionally, providing high-speed internet access to rural areas can attract tech companies and remote workers, fostering economic diversification.

Business Incubators and Accelerators: Establishing business incubators and accelerators can nurture entrepreneurship and support local startups. These programs offer mentorship, resources, and networking opportunities to help entrepreneurs launch and grow their ventures. Incubators often provide office space, mentorship, and access to investors, while accelerators offer more intensive support over a shorter period. Such initiatives can create a thriving startup ecosystem, leading to job growth and economic diversification.

Education and Workforce Development: A skilled workforce is essential for attracting businesses. Governments should collaborate with educational institutions to align training programs with industry needs. Offering vocational training, apprenticeships, and industry-specific courses can bridge the skills gap and prepare workers for in-demand jobs. Additionally, providing incentives for higher education and job retraining can ensure a continuous supply of qualified talent.

Community Engagement and Support: Building a strong community is vital for economic development. Local governments should engage with residents, businesses, and community organizations to understand their needs and concerns. Hosting events, workshops, and networking sessions can foster collaboration and attract businesses that align with the community's vision. Providing resources for small businesses, such as business plan competitions and mentorship programs, can encourage local entrepreneurship.

By implementing these strategies, regions can create an attractive business environment, foster innovation, and generate job opportunities. A comprehensive approach, combining incentives, infrastructure development, and community support, is key to driving economic growth and ensuring long-term prosperity.

Saving and Investing: Finding the Right Balance

You may want to see also

Regulatory Framework: Rules and guidelines for OZ investments

The regulatory framework for Opportunity Zone (OZ) investments is designed to provide a structured and transparent environment for investors, ensuring that the program's goals of promoting economic development and job creation are met. This framework is established by the Internal Revenue Service (IRS) and the Treasury Department, with specific rules and guidelines that investors must adhere to.

One of the key rules is the requirement for a qualified opportunity zone. These zones are designated areas that have been identified by state governors and approved by the Treasury Department. They are typically economically distressed communities, and the program aims to encourage investment in these areas to stimulate local economies. Investors must choose an OZ from a list provided by the IRS, ensuring that the investment aligns with the program's objectives.

Investments in OZs are subject to specific tax incentives. Investors can defer capital gains taxes by investing in an OZ fund or property within a specified timeframe. This deferral allows investors to reinvest their gains in the OZ, potentially generating additional returns. However, to qualify for this deferral, investors must hold the OZ investment for at least five years. After this period, investors can choose to recognize the deferred gain or keep it deferred, depending on their investment strategy.

The IRS has outlined specific guidelines for OZ investments. For instance, investors must ensure that the investment is made directly in the OZ, not through a pass-through entity like a partnership or S corporation. This direct investment ensures that the tax benefits are passed through to the investors. Additionally, the IRS requires that the investment be made in a qualified opportunity fund (QOF), which is a type of investment vehicle specifically designed for OZ investments.

Furthermore, there are rules regarding the types of investments that can be made in OZs. These include investments in real estate, tangible personal property, and certain business enterprises located or operated within the OZ. The IRS provides a comprehensive list of eligible investments, ensuring that the program supports a wide range of economic activities. These rules are in place to ensure that OZ investments contribute to the development and revitalization of the designated areas.

In summary, the regulatory framework for OZ investments is a set of rules and guidelines that govern the program's operation. It includes the identification of qualified OZs, tax incentives for investors, and specific investment requirements. By adhering to these rules, investors can take advantage of the tax benefits and contribute to the economic growth of distressed communities. Understanding and following these regulations is essential for investors to maximize the potential of OZ investments while ensuring compliance with the IRS and Treasury Department's standards.

Beanie Babies: A Collectible Craze

You may want to see also

Frequently asked questions

Opportunity Zones are designated areas in the United States that offer significant tax advantages to investors. These zones are designed to encourage long-term investments in low-income communities by providing tax benefits to investors who reinvest their capital gains into eligible properties or businesses within these zones.

Investing in Opportunity Zones typically involves a two-step process. First, you must identify and invest in a Qualified Opportunity Fund (QOF), which is a special type of investment vehicle that pools capital from multiple investors to make investments in Opportunity Zones. These funds are managed by experienced investors who identify and acquire assets in these designated areas. Second, you reinvest your capital gains into the QOF, allowing you to benefit from the tax incentives.

Opportunity Zone investments offer several tax advantages. One of the key benefits is the ability to defer capital gains taxes on eligible investments. Instead of paying taxes on the gains realized from the sale of assets, investors can reinvest those gains into a QOF and defer the taxes until 2026 (or later, if the investment is held for at least 10 years). Additionally, investors can claim a 10% step-up in basis on their original investment cost basis after holding the asset or investment for at least five years in the Opportunity Zone.

Yes, there are certain rules and restrictions to consider. Investors must hold the investment in the Opportunity Zone for at least five years to be eligible for the tax benefits. If the investment is sold or exchanged before this period, the tax advantages may be lost. Additionally, there are specific requirements for the types of assets that can be invested in, such as real estate, businesses, or other tangible property located in the designated Opportunity Zone.