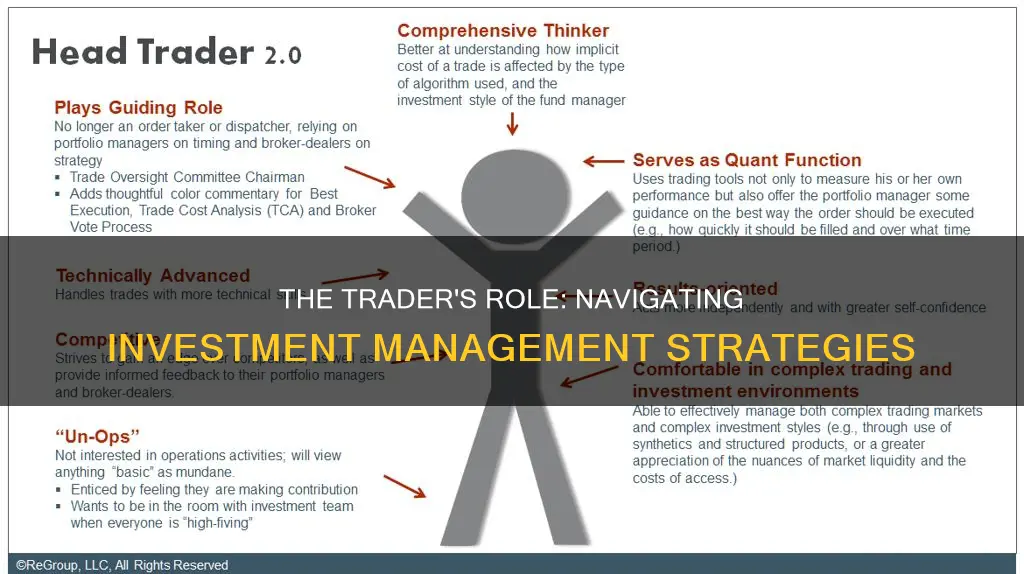

The role of a trader in investment management is a dynamic and critical function within the financial industry. Traders are responsible for executing investment strategies by buying and selling financial instruments such as stocks, bonds, derivatives, and currencies. They work closely with portfolio managers and analysts to identify investment opportunities, manage risk, and optimize returns. Traders employ various strategies, including market making, where they provide liquidity to the market by quoting both buy and sell prices, and algorithmic trading, which involves using computer programs to execute trades at high speeds. Their expertise lies in understanding market dynamics, analyzing financial data, and making timely decisions to navigate the complex world of investment management.

What You'll Learn

- Trader Selection: Identifying and hiring skilled traders for specific investment strategies

- Market Analysis: Utilizing data and research to make informed trading decisions

- Risk Management: Implementing strategies to minimize potential losses and protect assets

- Execution Strategies: Employing various methods to buy and sell assets efficiently

- Performance Evaluation: Regularly assessing trader performance and adjusting strategies accordingly

Trader Selection: Identifying and hiring skilled traders for specific investment strategies

Trader selection is a critical process in investment management, as it directly impacts the performance and success of investment strategies. The goal is to identify and hire traders who possess the skills, expertise, and mindset to excel in their respective roles and contribute to the overall investment objectives. Here are some key considerations and steps for effective trader selection:

Defining the Role and Strategy: Begin by clearly defining the trader's role and the specific investment strategy they will be responsible for. Different investment strategies, such as equity trading, fixed-income trading, or algorithmic trading, require distinct skill sets and expertise. For example, equity traders focus on buying and selling stocks, while fixed-income traders manage bond portfolios. Understanding the nuances of each strategy is essential to attract the right candidates.

Job Description and Requirements: Create a comprehensive job description outlining the responsibilities, qualifications, and desired experience of the trader position. This should include technical skills, such as proficiency in trading platforms, data analysis tools, and programming languages relevant to the strategy. Soft skills are also crucial; look for individuals with strong analytical abilities, decision-making prowess, risk management skills, and a results-driven mindset. Highlight any specific certifications or industry recognition that are advantageous for the role.

Screening and Assessment: Develop a rigorous screening process to evaluate candidates' suitability. This may involve reviewing resumes, cover letters, and references to identify individuals with the required technical and soft skills. Consider using assessment tools like trading simulations or case studies to evaluate candidates' problem-solving abilities and decision-making under pressure. For more senior positions, consider conducting in-depth interviews to assess their trading strategies, risk management approaches, and industry knowledge.

Experience and Market Knowledge: Prioritize candidates with relevant industry experience and a proven track record of success in similar roles. Look for traders who have successfully navigated the specific investment strategy you are targeting. Market knowledge and understanding of industry trends, regulatory changes, and economic factors are essential. Consider candidates who have worked in various market conditions, demonstrating adaptability and resilience.

Cultural Fit and Team Dynamics: Assess candidates' alignment with the firm's culture and values. A strong cultural fit ensures better collaboration and communication within the investment team. Evaluate their ability to work in a team, as trading often involves close collaboration with other professionals like portfolio managers, analysts, and risk officers. Consider candidates who can contribute to a positive and productive team dynamic.

Continuous Evaluation and Training: Trader selection is an ongoing process, as the investment landscape is ever-evolving. Regularly assess traders' performance and provide opportunities for professional development. Offer training programs to enhance their skills and keep them updated on industry advancements. This ensures that the trading team remains adaptable and capable of executing the investment strategy effectively.

Toys to Spark a Lifetime of Learning: Investing in Play for Your Four-Year-Old Boy

You may want to see also

Market Analysis: Utilizing data and research to make informed trading decisions

Market analysis is a critical component of the trader's role in investment management, as it involves the systematic examination and interpretation of data to guide trading strategies and decisions. Traders rely on comprehensive market analysis to identify trends, assess risks, and make informed choices that can lead to profitable outcomes. This process is both an art and a science, requiring a blend of technical skills, analytical prowess, and a deep understanding of market dynamics.

The primary goal of market analysis is to gather and interpret relevant data points that can influence investment decisions. This includes historical price data, financial statements, economic indicators, industry trends, and news events. Traders employ various tools and techniques to collect and organize this information, such as charting software, financial databases, and market research reports. By analyzing these data sources, traders can identify patterns, correlations, and potential opportunities or risks associated with different investments.

One key aspect of market analysis is technical analysis, which involves studying historical price and volume data to identify patterns and trends. Traders use technical indicators such as moving averages, relative strength index (RSI), and moving average convergence divergence (MACD) to generate trading signals. These indicators help traders make objective decisions by removing emotional biases and providing a quantitative basis for entry and exit points. For example, a trader might use a moving average crossover strategy, where the purchase of a security is triggered when a short-term moving average crosses above a long-term moving average.

Fundamental analysis is another essential part of the market analysis toolkit. This approach focuses on evaluating the intrinsic value of an investment by examining its financial health, competitive position, and industry trends. Traders analyze financial statements, assess management quality, and consider macroeconomic factors to determine the long-term viability of an investment. For instance, a trader might study a company's revenue growth, profit margins, and debt levels to gauge its financial strength and make informed investment decisions.

Additionally, market analysis involves staying abreast of industry news and global events that can impact markets. Traders monitor economic calendars, company announcements, and geopolitical developments to anticipate market movements. This proactive approach allows traders to adapt their strategies and make timely adjustments to their portfolios. By combining technical and fundamental analysis, traders can make more accurate predictions and execute trades with a higher probability of success.

In summary, market analysis is a multifaceted discipline that empowers traders to make informed decisions in investment management. It involves a systematic approach to data collection, interpretation, and application. By utilizing technical and fundamental analysis, traders can identify market trends, assess risks, and make strategic choices that align with their investment objectives. Effective market analysis is a cornerstone of successful trading, enabling traders to navigate the complexities of financial markets with confidence and precision.

Investing for Retirement: A Decade-Long Strategy

You may want to see also

Risk Management: Implementing strategies to minimize potential losses and protect assets

Risk management is a critical aspect of the trader's role in investment management, as it involves implementing strategies to minimize potential losses and protect the firm's assets. Traders are responsible for identifying, assessing, and mitigating various types of risks that can impact investment portfolios. Here's an overview of how risk management strategies are put into practice:

Risk Identification: Traders start by recognizing different risk factors that could affect their investments. This includes market risk, which is the potential for losses due to fluctuations in asset prices. For instance, a trader might identify the risk associated with a particular stock's volatility or the impact of economic indicators on the overall market. Additionally, credit risk, liquidity risk, and operational risk are also considered. Each investment decision should be accompanied by a thorough analysis of these risks.

Risk Assessment: Once risks are identified, traders must assess their potential impact and likelihood. This involves quantitative and qualitative analysis. Quantitative methods involve statistical models and historical data to estimate the probability and potential magnitude of losses. For example, value-at-risk (VaR) models are commonly used to measure the maximum expected loss within a given confidence interval. Qualitative assessments consider factors like industry trends, geopolitical events, and company-specific issues that might influence risk.

Risk Mitigation and Management: Effective risk management strategies are then employed to minimize potential losses. Traders can use various techniques such as diversification, where investments are spread across different asset classes, sectors, or geographic regions to reduce concentration risk. They may also employ hedging, which involves taking offsetting positions to protect against potential losses. For instance, a trader might buy put options to hedge against potential declines in a stock's price. Additionally, risk limits and stop-loss orders can be set to automatically trigger actions when certain risk thresholds are reached.

Regular Monitoring and Review: Risk management is an ongoing process. Traders should regularly monitor the performance of their investments and the overall market to identify any emerging risks. This includes staying updated on news and events that could impact the portfolio. Regular risk assessments and reviews ensure that the strategies remain effective and relevant, especially in dynamic market conditions.

By implementing these risk management practices, traders can make informed investment decisions, protect the firm's capital, and contribute to the overall success of the investment management process. It is a crucial responsibility that ensures the sustainability and growth of the investment portfolio over the long term.

Gamestop Investors: Who's In?

You may want to see also

Execution Strategies: Employing various methods to buy and sell assets efficiently

When it comes to the role of a trader in investment management, execution strategies are a critical component of their daily activities. These strategies involve a set of techniques and methods that traders employ to buy and sell assets efficiently, ensuring optimal outcomes for their clients. The goal is to minimize transaction costs, maximize returns, and maintain a competitive edge in the market. Here's an overview of some key execution strategies:

Market Making: This strategy involves traders taking on the role of market makers, which means they are actively providing liquidity to the market by quoting both buy and sell prices for a particular asset. By doing so, they facilitate trading for other market participants. Market makers typically use advanced algorithms and high-frequency trading techniques to execute orders at lightning speeds, ensuring they can capitalize on small price differentials. This approach is common in highly liquid markets like forex and equity derivatives.

Algorithmic Trading: Traders utilize algorithms to automate the execution of trades based on predefined rules and criteria. These algorithms can analyze vast amounts of market data, identify trading opportunities, and execute orders with minimal human intervention. Algorithmic trading strategies include trend-following, statistical arbitrage, and news-based trading. For instance, a trend-following algorithm buys assets when the market is rising and sells when it's falling, aiming to capitalize on the momentum. This method requires sophisticated programming and a deep understanding of market dynamics.

Limit Orders and Stop-Loss Orders: These are simple yet effective strategies for managing risk and executing trades at desired price levels. A limit order allows traders to specify the maximum price they are willing to pay for a buy order or the minimum price for a sell order. If the market reaches this price, the trade is executed automatically. Stop-loss orders, on the other hand, are used to limit potential losses by automatically selling an asset when it reaches a certain price. This strategy helps traders manage risk and protect their capital.

Arbitrage Opportunities: Traders often look for arbitrage situations where they can simultaneously buy an asset in one market and sell it in another, taking advantage of price discrepancies. This strategy requires real-time market data and the ability to execute trades across multiple exchanges or platforms. Arbitrage trading can be highly profitable but also carries risks, especially in illiquid markets. Traders must act quickly to capitalize on these opportunities while managing potential slippage and transaction costs.

In investment management, execution strategies are designed to navigate the complex world of financial markets, ensuring that trades are executed efficiently and effectively. Traders must stay updated on market trends, employ advanced technologies, and make quick decisions to gain a competitive advantage. These strategies contribute to the overall success of investment firms and the satisfaction of their clients.

The Debt-Investment Dilemma: Navigating the Path to Financial Freedom

You may want to see also

Performance Evaluation: Regularly assessing trader performance and adjusting strategies accordingly

Performance evaluation is a critical aspect of the trader's role in investment management, as it directly impacts the success and profitability of trading strategies. Regular assessment of trader performance is essential to ensure that investment objectives are met and that the trading process remains efficient and effective. This process involves a systematic review of various performance metrics and indicators to gauge the trader's effectiveness and make informed decisions about strategy adjustments.

The evaluation process typically begins with setting clear performance targets and establishing a benchmark for comparison. This includes defining key performance indicators (KPIs) such as return on investment (ROI), risk-adjusted returns, trading volume, and win rate. These metrics provide a quantitative measure of the trader's performance and allow for a comprehensive analysis of their trading activities. By setting these targets, investment managers can assess whether the trader is consistently meeting or exceeding the desired performance levels.

During the evaluation, traders' historical trading records are scrutinized, examining factors such as trade execution, risk management, and decision-making processes. This involves analyzing trade entries and exits, position sizing, and the overall strategy employed. For instance, evaluating the success rate of trades, the average holding period, and the impact of market conditions on performance can provide valuable insights. Additionally, comparing the trader's performance against industry benchmarks and peer groups can help identify areas of strength and weakness.

One crucial aspect of performance evaluation is the identification of areas for improvement. This may include refining risk management techniques, optimizing trading strategies, or enhancing market analysis skills. By addressing these areas, traders can enhance their decision-making abilities and potentially improve overall performance. Regular performance reviews also facilitate open communication between traders and their managers, allowing for constructive feedback and the implementation of necessary changes.

Furthermore, performance evaluation enables investment managers to make strategic adjustments. If a trader consistently underperforms, alternative strategies or traders may be considered to optimize portfolio performance. This process ensures that the investment management firm remains agile and responsive to market dynamics, allowing for quick adaptations to changing market conditions. Ultimately, performance evaluation is a powerful tool for maintaining a high standard of trading excellence and fostering a culture of continuous improvement.

FTX: Celebrity Investors

You may want to see also

Frequently asked questions

Traders are responsible for executing buy and sell orders on behalf of clients or the firm's own accounts. They analyze market trends, assess risk, and make investment decisions to maximize returns while managing potential losses.

Traders play a crucial role in implementing investment strategies by identifying and executing trades based on research and analysis. They monitor market conditions, execute orders, and provide real-time market data to support investment decisions.

Successful traders often possess strong analytical skills, a deep understanding of financial markets, and the ability to make quick, informed decisions. They typically have a finance or economics background, advanced degrees, and relevant certifications such as the Chartered Financial Analyst (CFA) designation.

Risk management is a critical aspect of a trader's role. They employ various strategies such as setting stop-loss orders, diversifying portfolios, and using derivatives to hedge against potential losses. Traders also stay updated on market news and trends to anticipate and mitigate risks effectively.