Acorns is a popular micro-investing app that allows users to invest small amounts of money regularly, making it an accessible way to start building wealth. The app rounds up your everyday purchases to the nearest dollar and invests the spare change into a diversified portfolio of stocks, bonds, and ETFs. This recurring investment strategy, known as round-up investing, helps individuals save and invest money effortlessly. By setting up recurring investments with Acorns, you can benefit from dollar-cost averaging, which reduces the impact of market volatility on your investment returns over time. This approach is particularly appealing to those who want to start investing but may not have a large sum to begin with.

What You'll Learn

- Acorns' Investment Model: Acorns rounds up purchases and invests the spare change into a diversified portfolio

- Round-Up Feature: Users can choose their investment amount, with the option to round up or down

- Diversification: Acorns invests in a mix of stocks, bonds, and ETFs to minimize risk

- Fee Structure: Acorns charges a small fee for its services, typically around 0.25% per year

- Tax Benefits: Users may benefit from tax advantages, as Acorns invests in a variety of assets

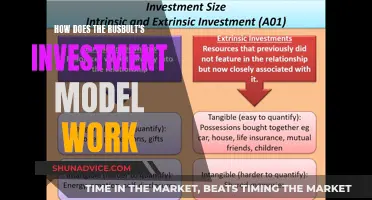

Acorns' Investment Model: Acorns rounds up purchases and invests the spare change into a diversified portfolio

Acorns is a popular micro-investing app that has revolutionized the way many people approach their financial goals, especially those who might not have considered investing before. The core of Acorns' investment model is simple yet innovative: it rounds up your everyday purchases and invests the spare change into a diversified portfolio of stocks, bonds, and ETFs. This approach makes investing accessible and automatic, turning everyday spending into a long-term investment strategy.

When you use Acorns, every time you make a purchase, the app rounds the transaction amount up to the nearest dollar. The difference between the rounded amount and the actual purchase price is then invested. For example, if you buy a coffee for $3.75, Acorns will round it up to $4.00, and the $0.25 difference will be invested into a diversified portfolio. This process is entirely automated, making it easy for users to start investing without any prior financial knowledge or the need to manually transfer money into an investment account.

The investment portfolio is carefully constructed to be diversified, which means it includes a mix of different assets such as stocks, bonds, and exchange-traded funds (ETFs). This diversification is a key strategy to manage risk and potentially earn higher returns over time. By investing in a variety of assets, Acorns aims to provide a balanced and stable investment experience, even for those who are new to the world of investing. The app's algorithm continuously adjusts the portfolio to ensure it remains diversified, making it a hands-off approach to building wealth.

One of the unique features of Acorns is its focus on making investing fun and educational. The app provides users with financial tips and insights, and it also offers a gamified experience where users can earn points and rewards for completing financial tasks. This approach not only encourages users to continue investing but also helps them develop a better understanding of personal finance and the stock market. Over time, the accumulated investments can grow, and users can track their progress, seeing the impact of their everyday spending on their long-term financial goals.

Acorns' investment model is particularly appealing to those who might have been intimidated by the complexity of traditional investing. By automating the process and rounding up purchases, Acorns simplifies the journey into the world of investing. This model has been successful in attracting a large user base, especially among younger generations who are looking for accessible and user-friendly financial tools. As users continue to round up their purchases, the app compounds their investments, potentially leading to significant financial growth over time.

Unlocking Retirement Wealth: A Guide to Investment Strategies

You may want to see also

Round-Up Feature: Users can choose their investment amount, with the option to round up or down

The Round-Up feature is a key aspect of Acorns' recurring investment strategy, allowing users to make small, regular investments with the flexibility to round up or down their contributions. This feature is particularly appealing to those who want to start investing but may not have large sums of money to spare. Here's how it works:

When you set up a recurring investment with Acorns, you have the option to choose a specific amount to invest each time. For example, you might decide to invest $5, $10, or any other amount that suits your financial situation. The beauty of this feature is the ability to round up or down. If you select a $5 investment, you can choose to round up to the nearest dollar, meaning you invest $6 each time, or round down to $4, investing a little less frequently but with a smaller amount each time. This rounding strategy ensures that you can still invest regularly without feeling the financial strain of larger, less frequent contributions.

This feature is especially useful for those who want to build a habit of investing without committing a significant portion of their income. For instance, if you earn a modest income and want to start investing, you can round up your purchases to the nearest dollar and invest the difference. Over time, this can accumulate into a substantial investment. For example, if you spend $45 on groceries and choose to round up to the nearest dollar, you invest $46, with $1 going towards your investment fund. This small amount can add up over time, providing an opportunity to grow your wealth.

The Round-Up feature also offers a sense of control and customization. Users can decide how much they want to invest and how often, making it an accessible and flexible investment tool. This approach is particularly attractive to younger investors or those new to the world of investing, as it provides an easy entry point into the market. Additionally, it encourages a disciplined approach to saving and investing, as users are more likely to stick to a regular investment schedule when they have a say in the amount and frequency.

In summary, the Round-Up feature of Acorns' recurring investment strategy empowers users to take control of their financial future. By allowing users to choose their investment amount and round up or down, Acorns makes investing accessible and adaptable to various financial situations. This feature, combined with Acorns' other investment tools and educational resources, provides a comprehensive approach to building wealth over time.

CPA: A Key to Unlocking Investment Success

You may want to see also

Diversification: Acorns invests in a mix of stocks, bonds, and ETFs to minimize risk

Acorns, a popular micro-investing app, utilizes a strategy called diversification to manage risk and provide a balanced approach to investing. This strategy involves spreading your investments across various asset classes, ensuring that your portfolio is not overly exposed to any single market or security. By diversifying, Acorns aims to minimize the impact of market volatility and potential losses.

The core of Acorns' diversification strategy lies in its investment options, which include a mix of stocks, bonds, and Exchange-Traded Funds (ETFs). Stocks represent ownership in companies and offer the potential for high returns but also carry higher risk. Bonds, on the other hand, are considered less risky as they provide a steady income stream and are often used to balance out stock investments. ETFs are baskets of securities that track a specific index or sector, offering diversification within a particular market or asset class.

When you invest with Acorns, your money is allocated to a combination of these asset classes. For instance, a typical Acorns portfolio might include a certain percentage of stocks, bonds, and ETFs, tailored to your risk tolerance and investment goals. This diversification helps to smooth out the ups and downs of the market. If one investment underperforms, the others may perform well, thus reducing the overall risk of your portfolio.

The app's algorithm plays a crucial role in this process. It continuously monitors the market and adjusts your investments accordingly. For example, if the stock market experiences a downturn, Acorns may rebalance your portfolio by increasing your bond or ETF holdings to maintain the desired level of diversification. This proactive approach ensures that your investments remain well-diversified, even as market conditions change.

By employing this diversification strategy, Acorns aims to provide a more stable and consistent investment experience. It allows users to build a robust financial foundation, even with smaller, recurring investments. This approach is particularly appealing to those who want to start investing but may have concerns about market volatility or lack the knowledge to navigate complex investment decisions. Acorns' user-friendly interface and automated investment strategy make it accessible to a wide range of investors.

The Smart Money Move: Pay Off Debt or Invest?

You may want to see also

Fee Structure: Acorns charges a small fee for its services, typically around 0.25% per year

Acorns, a popular micro-investing app, offers a unique approach to investing by rounding up your everyday purchases and investing the spare change. While this service is free to use, it's important to understand the fee structure that comes into play when you start investing with Acorns.

The fee structure of Acorns is designed to be transparent and straightforward. When you invest through Acorns, a small annual fee is charged, typically around 0.25% of the total amount invested. This fee is a flat rate, meaning it applies to all your investments, regardless of the number of investments or the amount you choose to invest. For example, if you invest $100 over a year, the fee would be $0.25. This fee is a small price to pay for the convenience and accessibility that Acorns provides, especially for those who are new to investing or prefer a low-risk approach.

It's worth noting that this fee is competitive compared to other investment platforms and is often lower than the fees associated with traditional investment accounts. Acorns' fee structure is designed to be fair and consistent, ensuring that users understand the cost of their investments. The company's goal is to provide an affordable and user-friendly investing experience, making it accessible to a wide range of individuals.

Understanding the fee structure is crucial for making informed investment decisions. While the fee is small, it's essential to consider it when evaluating the overall cost of your investments. Acorns provides a clear breakdown of the fee structure, ensuring that users can make decisions based on transparent information. This transparency allows investors to understand the value they receive for their money and make choices that align with their financial goals.

In summary, Acorns' fee structure is a small annual charge, typically 0.25%, applied to all investments. This fee is designed to be competitive and fair, providing users with an affordable way to start investing. By understanding this fee structure, users can make informed decisions and take advantage of Acorns' user-friendly approach to investing.

Stock Market: Why Don't More People Invest?

You may want to see also

Tax Benefits: Users may benefit from tax advantages, as Acorns invests in a variety of assets

Acorns, a popular micro-investing app, offers users a unique way to start building their investment portfolios with recurring investments. One of the key advantages of using Acorns is the potential for tax benefits, which can be particularly appealing to those looking to optimize their financial strategies.

When you invest through Acorns, your money is automatically invested in a diversified portfolio of stocks, bonds, and ETFs. This diversification is a powerful tool in managing risk and maximizing returns over time. As your investments grow, you may be able to take advantage of tax-efficient strategies. For instance, Acorns' investment approach often involves investing in a mix of assets, including both traditional and alternative investments. This variety can help users benefit from different tax treatments.

One of the tax advantages of Acorns' approach is the potential for tax-loss harvesting. When the market experiences a downturn, Acorns can automatically sell losing investments to offset capital gains, thus reducing the user's taxable income. This strategy is particularly useful for those who want to minimize their tax liability while still growing their wealth. Additionally, Acorns' investments in a wide range of assets can provide tax-efficient gains. For example, investments in index funds or ETFs may offer more favorable tax treatment compared to actively managed funds, as they often generate lower capital gains.

Furthermore, Acorns' focus on fractional shares allows users to invest in a variety of companies and industries, potentially spreading the tax benefits across multiple sectors. This diversification can be advantageous, especially for long-term investors, as it may help smooth out the tax impact of market fluctuations. Users can also benefit from the tax-advantaged nature of retirement accounts linked to Acorns, such as IRAs or 401(k)s, which offer tax-deferred growth and tax-free withdrawals in retirement.

In summary, Acorns' recurring investment strategy, combined with its diverse investment options, can provide users with valuable tax benefits. By taking advantage of tax-loss harvesting, investing in a variety of assets, and utilizing tax-efficient retirement accounts, users can potentially minimize their tax burden and maximize their long-term financial gains. Understanding these tax advantages can be a significant factor in users' decision to adopt Acorns as a tool for their financial journey.

Utilities: Invest or Avoid?

You may want to see also

Frequently asked questions

Acorns is a micro-investing app that helps you invest small amounts of money regularly. It rounds up your everyday purchases to the nearest dollar and invests the spare change into a diversified portfolio of stocks, bonds, and ETFs. This approach makes investing accessible and affordable for everyone, even those with limited funds.

Acorns allows you to set up recurring investments, also known as "Round-Ups," where a percentage of your purchases is automatically invested. For example, you can choose to round up to the nearest dollar on every purchase and invest the difference. This feature ensures consistent contributions to your investment portfolio over time.

Yes, Acorns offers various investment options to suit different risk preferences. You can choose from different portfolios, such as Growth, Balanced, or Conservative, each with a unique asset allocation. Additionally, you can adjust your investment settings, including the percentage of purchases to round up and the frequency of investments, to align with your financial goals.

Acorns has a transparent fee structure. The app charges a small fee for its services, which is typically a flat monthly fee. This fee covers the investment management, portfolio diversification, and other features provided. The exact fee amount may vary depending on your account type and the services you utilize. It's recommended to review the fee schedule on the Acorns website for the most up-to-date information.