Understanding and calculating total net investment losses is a crucial skill for investors and financial analysts. This process involves a comprehensive review of all investment-related expenses and losses incurred over a specific period. It requires a meticulous approach to account for various factors, including transaction costs, interest expenses, and the impact of market fluctuations. By carefully analyzing these elements, investors can gain valuable insights into their investment performance and make informed decisions to mitigate future losses. This guide will provide a step-by-step approach to calculating total net investment losses, ensuring a clear understanding of the financial implications and enabling better investment strategies.

What You'll Learn

- Calculate Total Investment Losses: Sum up all individual investment losses

- Identify Holding Periods: Determine the duration each investment was held

- Apply Tax Implications: Consider tax effects on net losses

- Compare with Gains: Match net losses against net gains

- Track Investment History: Maintain records for accurate loss calculation

Calculate Total Investment Losses: Sum up all individual investment losses

To calculate the total investment losses, you need to sum up all the individual losses incurred from each investment. This process involves a few steps to ensure accuracy and a comprehensive view of your overall investment performance. Here's a detailed guide on how to do this:

Step 1: Identify Investment Positions

Start by making a list of all your current and past investment positions. This includes stocks, bonds, mutual funds, real estate, or any other assets you've invested in. For each position, note the purchase price, the current market value (if applicable), and the date of purchase or acquisition. This initial step is crucial to gather all the necessary data for your calculations.

Step 2: Determine Realized and Unrealized Losses

Investment losses can be categorized into two types: realized and unrealized. Realized losses occur when you sell an asset at a price lower than your purchase price, resulting in a loss. Unrealized losses, on the other hand, are potential losses that exist on paper but have not yet been realized because the assets are still held. You need to distinguish between these two types to calculate the total investment losses accurately.

Step 3: Calculate Realized Losses

For each investment, calculate the realized loss by subtracting the sale price from the purchase price. If you have multiple transactions for the same asset, calculate the loss for each transaction and sum them up. Ensure that you consider any associated fees or commissions for each sale. Realized losses are typically reported on tax forms and are important for tax purposes.

Step 4: Calculate Unrealized Losses

Unrealized losses are a bit more complex. For each investment, compare the current market value to your purchase price. If the market value is lower, you have an unrealized loss. Calculate this loss by subtracting the market value from the purchase price. Again, sum up these losses for all investments to get the total unrealized loss.

Step 5: Sum Up All Individual Losses

Now, add the realized and unrealized losses together to get the total investment losses. This sum represents the cumulative losses from all your individual investments. It provides a clear picture of the financial impact of your investment decisions.

Remember, when dealing with investments, it's essential to keep detailed records and stay organized. This calculation process ensures that you have an accurate assessment of your investment performance, which can be crucial for financial planning and decision-making.

Invest 93: Hurricane or Bust?

You may want to see also

Identify Holding Periods: Determine the duration each investment was held

To accurately calculate total net investment losses, it's crucial to identify the holding periods for each investment. This process involves determining the duration for which an investment was held, which is essential for assessing the performance and potential losses associated with that investment. Here's a step-by-step guide to identifying holding periods:

- Gather Investment Records: Start by collecting all relevant documents and records related to your investments. This includes purchase and sale agreements, transaction histories, statements from brokerage accounts, and any other documentation that provides details about the investments. Make sure to organize these records chronologically to facilitate a clear understanding of the investment timeline.

- Identify Purchase and Sale Dates: For each investment, carefully examine the records to pinpoint the exact purchase date and the date when it was sold or liquidated. These dates are critical as they define the start and end of the holding period. Ensure that you record both dates accurately, including the month and year.

- Calculate Duration: Once you have the purchase and sale dates, you can calculate the holding period duration. Subtract the purchase date from the sale date to determine the number of days the investment was held. For example, if an investment was bought on March 15, 2022, and sold on September 10, 2022, the holding period would be 187 days (from March 15 to September 10).

- Consider Partial Years: In some cases, investments may be held for a portion of a year. For instance, an investment bought in the middle of the year and sold at the end of the following year would have a holding period of less than a full year. Calculate the duration accurately, even for partial years, as this information is vital for loss calculations.

- Document Holding Periods: Create a comprehensive list or spreadsheet with all the investments and their respective holding periods. Ensure that each holding period is clearly defined and documented. This organized approach will make it easier to analyze and compare the performance of different investments when calculating net investment losses.

By meticulously identifying and calculating holding periods, you can ensure that your net investment loss calculations are precise and reflective of the actual investment durations. This level of detail is essential for making informed financial decisions and understanding the overall performance of your investment portfolio.

Unlocking Private Investing: A Beginner's Guide to the World of Deals

You may want to see also

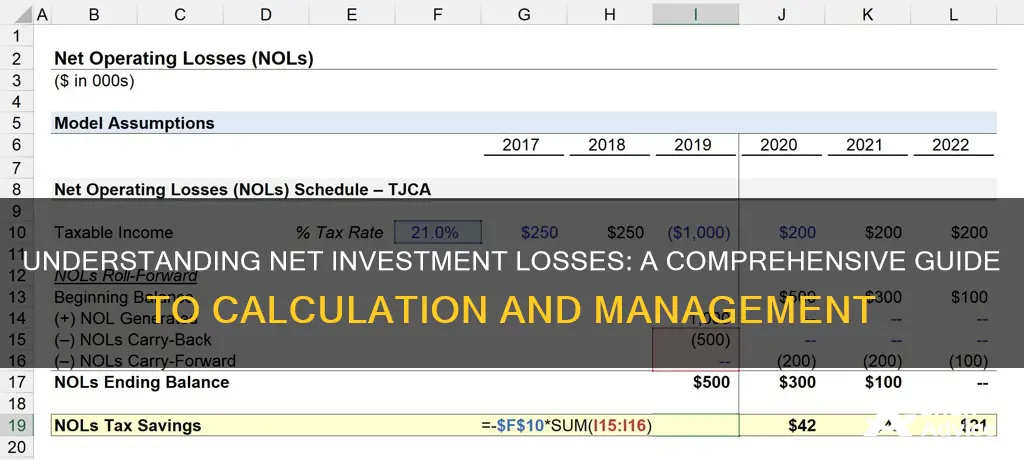

Apply Tax Implications: Consider tax effects on net losses

When calculating total net investment losses, it's crucial to understand the tax implications that can significantly impact your financial situation. Net investment losses occur when the total losses from investments exceed the total gains, resulting in a net loss. This loss can have several tax consequences that investors should be aware of.

One important consideration is the tax treatment of net investment losses. In many jurisdictions, net investment losses can be used to offset other income, which can reduce your taxable income and, consequently, your tax liability. This is particularly beneficial for investors who have experienced significant losses and want to minimize their tax burden. For example, if you have a net investment loss of $10,000, you can use this loss to reduce your taxable income by that amount, potentially lowering your tax bill for the year.

However, there are certain rules and limitations regarding the utilization of net investment losses. Typically, investors can claim a specific amount of net investment loss each year, often limited to a certain percentage of their total income. Any unused portion of the loss can be carried forward to future years, allowing for potential tax savings in subsequent periods. It is essential to review the tax regulations in your country or region to understand the specific rules and limits applicable to your situation.

Additionally, tax authorities may impose restrictions on the types of investments that can generate net losses. For instance, certain types of investments, such as real estate or collectibles, might have different tax treatments or limitations on loss carryovers. Investors should carefully examine their investment portfolios and ensure compliance with tax laws to maximize the benefits of net investment losses.

Understanding the tax implications is vital for effective financial planning. By considering the tax effects, investors can make informed decisions about managing their investments and minimizing potential tax liabilities. Consulting with a tax professional or accountant can provide personalized guidance on how to apply these tax implications to your specific investment scenario.

When Investment Bankers Choose to Retire

You may want to see also

Compare with Gains: Match net losses against net gains

When assessing your investment portfolio's performance, it's crucial to understand the concept of net losses and how they compare to net gains. This comparison provides valuable insights into the overall health and direction of your investments. Here's a step-by-step guide on how to match net losses against net gains:

Start by calculating your net gains for a specific period. Net gains represent the total profit or loss from your investment activities. To find this, you need to subtract the total investment costs and expenses from the total revenue or income generated by your investments. For example, if you sold stocks worth $10,000 and incurred a commission of $50, your net gain would be $9,950.

Next, determine the net losses incurred during the same period. Net losses occur when the total investment costs and expenses exceed the total revenue or income. Calculate this by summing up all the investment-related expenses, including transaction costs, management fees, and any other relevant charges. Then, subtract this total from the initial investment amount or the book value of your investments. For instance, if your initial investment was $5,000 and you incurred $2,000 in losses, your net loss would be $3,000.

Now, it's time to compare these net losses and gains. Analyze the magnitude and frequency of net losses compared to the net gains. Are the losses consistently higher or lower than the gains? Do they occur more frequently? Understanding this relationship can help you identify patterns and make informed decisions about risk management and portfolio optimization.

Consider using a spreadsheet or financial software to organize and visualize your data. This will enable you to easily track and compare net losses and gains over time. You can also set up formulas to automatically calculate these values, ensuring accuracy and efficiency in your analysis.

By comparing net losses against net gains, you gain a comprehensive understanding of your investment performance. This analysis allows you to assess the effectiveness of your investment strategies, identify areas for improvement, and make data-driven decisions to enhance your overall financial well-being. Remember, a thorough comparison of losses and gains is a powerful tool for navigating the complexities of investment management.

Luna: The People's Crypto

You may want to see also

Track Investment History: Maintain records for accurate loss calculation

To accurately calculate your total net investment losses, it's crucial to meticulously track your investment history. This process involves maintaining comprehensive records of all your investment activities, including both gains and losses. Here's a step-by-step guide to help you navigate this task:

- Identify All Investment Vehicles: Begin by making a comprehensive list of all your investment accounts, portfolios, and individual assets. This includes stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate investments, and any other financial instruments you've invested in. Ensure that you account for both traditional and alternative investments.

- Gather Transaction Details: For each investment, collect relevant information such as the date of purchase, purchase price, quantity, and any associated fees or commissions. Similarly, record the date of sale, sale price, and any taxes paid. It's essential to have a clear record of both the cost basis (initial investment) and the proceeds from each transaction.

- Categorize and Organize: Create a structured system to categorize your investments and transactions. You can use spreadsheets, accounting software, or even a simple notebook to record this information. Organize the data by investment type, date, and relevant details. This organization will make it easier to retrieve specific information when calculating losses.

- Calculate Gains and Losses: For each investment, calculate the gain or loss by subtracting the purchase price (or cost basis) from the sale price. If you still hold the investment, use the current market value as the sale price. Ensure that you consider any dividends, interest, or other income generated by the investment.

- Net Investment Losses: Sum up all the individual gains and losses to determine your total net investment losses. This figure represents the cumulative impact of your investment decisions. It's important to note that net investment losses can be significant, especially if you've made multiple investments over time.

- Consider Tax Implications: Remember that investment losses can have tax consequences. In many jurisdictions, you can use net investment losses to offset capital gains, reducing your taxable income. Be aware of any tax regulations and consult with a financial advisor or accountant to understand how to maximize the benefits of your investment losses.

By following these steps, you can ensure that your investment history is accurately documented, enabling you to calculate your total net investment losses with precision. This process is essential for making informed financial decisions and managing your investment portfolio effectively.

Engage and Empower: Strategies to Keep Workers Motivated and Invested

You may want to see also

Frequently asked questions

Net investment loss (NIL) is calculated by subtracting the total investment income from the total investment expenses. The formula is: NIL = Total Investment Income - Total Investment Expenses.

Total investment income includes all earnings from your investments, such as interest, dividends, rental income, and capital gains. It is the sum of all income generated from your investment portfolio.

Investment expenses encompass various costs associated with managing and maintaining your investment portfolio. This includes brokerage fees, management fees, advisory fees, transaction costs, and any other expenses directly related to the investment process.

Yes, in many jurisdictions, investors can carry forward net investment losses to offset future investment gains or even other types of income. This strategy can help reduce the overall tax liability and is a common practice for managing investment losses.

There may be certain limitations or restrictions depending on the tax laws and regulations of your country or region. For example, there might be a cap on the amount of loss that can be carried forward, or specific rules regarding the types of investments that qualify for loss treatment. It's essential to consult tax professionals or advisors to understand the applicable rules in your jurisdiction.