Unit trust investments are a popular and accessible way for individuals to invest in a diversified portfolio of assets. This paragraph introduces the concept: Unit trusts are investment funds that pool money from multiple investors to invest in a variety of assets such as stocks, bonds, or real estate. Each investor owns 'units' in the fund, which represent their share of the portfolio's value. The fund is managed by a professional investment manager who makes decisions about where and how to invest the pooled money. Investors benefit from the diversification and professional management, making unit trusts a convenient and potentially lucrative way to invest, especially for those who prefer a hands-off approach or lack the time and expertise to manage their own investments.

What You'll Learn

- Structure: Unit trusts are managed funds that pool money from investors to invest in a diversified portfolio

- Management: Professional fund managers make investment decisions on behalf of the trust

- Pricing: Units are priced at the end of each trading day based on the fund's net asset value

- Distribution: Investors receive a share of the fund's profits in the form of dividends or capital gains

- Risk and Return: Unit trusts offer varying levels of risk and potential returns depending on the fund's strategy

Structure: Unit trusts are managed funds that pool money from investors to invest in a diversified portfolio

Unit trusts are a type of investment vehicle that offers investors a way to access a diversified portfolio of assets without having to assemble and manage the portfolio themselves. This structure is particularly appealing to those who prefer a more hands-off approach to investing or who lack the time and expertise to research and select individual securities.

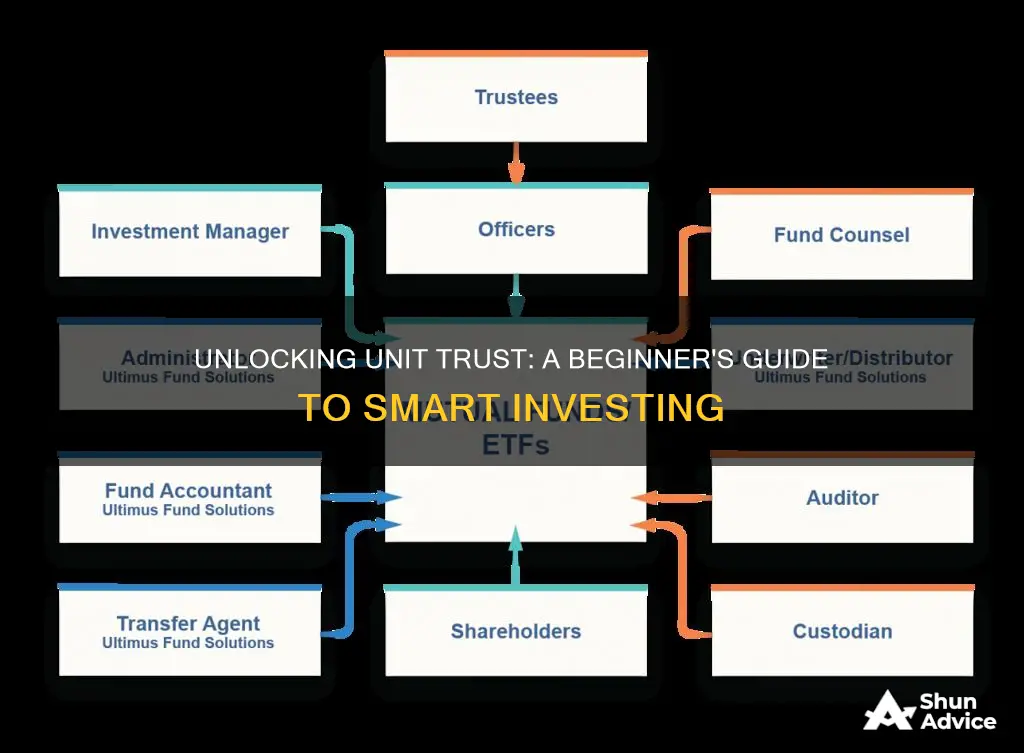

The concept of a unit trust is relatively simple. Investors purchase 'units' in the trust, which represents a fraction of the total fund's assets. The trust is managed by a fund manager or investment company, who is responsible for making investment decisions on behalf of the investors. This manager typically has a team of professionals, including analysts, traders, and researchers, who work together to build and manage the investment portfolio.

When investors buy units in a unit trust, they are essentially pooling their money with other investors' contributions. This pooled capital is then invested in a diverse range of assets, such as stocks, bonds, commodities, or other financial instruments. The fund manager's role is crucial here; they decide how much of the fund's assets should be allocated to each type of investment, aiming to achieve the trust's stated investment objective. This objective could be as specific as targeting a particular sector or industry or as broad as aiming for capital growth or income generation.

The beauty of unit trusts lies in their diversification. By investing in a portfolio of various assets, the risk is spread across multiple investments. This diversification helps to reduce the impact of any single investment's poor performance on the overall fund, potentially providing more stable returns over time. Additionally, unit trusts often have lower entry and management costs compared to individually managing a portfolio, making them an attractive option for long-term investors.

In summary, unit trusts provide investors with a convenient and cost-effective way to invest in a diversified portfolio. The structure allows for professional management, reducing the burden of investment decision-making and potentially offering more stable returns. This makes unit trusts a popular choice for those seeking a balanced approach to investing, combining the benefits of professional management with the diversification of a well-constructed portfolio.

Smart Ways to Invest $10,000

You may want to see also

Management: Professional fund managers make investment decisions on behalf of the trust

Unit trust investments are a popular way for individuals to invest in a diversified portfolio of assets without having to manage the investments themselves. At its core, a unit trust is a type of investment fund that pools money from many investors to invest in a variety of assets such as stocks, bonds, and other securities. The key concept here is that professional fund managers, rather than individual investors, make the investment decisions on behalf of the trust.

When you invest in a unit trust, you essentially buy a portion of the fund, known as a 'unit'. The price of each unit is determined by the value of the underlying assets in the fund, which is calculated at the end of each trading day. This means that the value of your investment can fluctuate based on the performance of the assets in the fund.

Professional fund managers are responsible for selecting the specific assets that the unit trust will invest in. These managers typically have extensive knowledge and experience in financial markets and use their expertise to make informed decisions about where to allocate the trust's capital. They may also employ various investment strategies, such as value investing, growth investing, or a mix of both, to achieve the trust's investment objectives.

One of the main advantages of unit trust investments is the diversification they offer. By investing in a unit trust, you gain exposure to a wide range of assets, which can help reduce the risk associated with individual stock or bond investments. This diversification is particularly beneficial for investors who may not have the time, expertise, or resources to build and manage a diversified portfolio on their own.

Additionally, unit trust investments provide investors with a level of liquidity. Investors can typically buy or sell units in the trust at the end of each trading day, allowing them to access their funds relatively quickly. This flexibility is another attractive feature for investors who may need to access their money for various reasons.

In summary, unit trust investments are a structured way to invest in a diversified portfolio managed by professional fund managers. This approach offers investors the benefits of professional management, diversification, and liquidity, making it an appealing choice for those seeking a more hands-off investment strategy.

The Battle for Beneficiary: Will vs. Investments

You may want to see also

Pricing: Units are priced at the end of each trading day based on the fund's net asset value

Unit trust investments are a popular way for individuals to invest in a diversified portfolio of assets, offering a simple and accessible approach to investing. The pricing mechanism of unit trusts is a critical aspect that investors should understand. At the end of each trading day, the price of each unit in the trust is calculated based on the Net Asset Value (NAV) of the fund. This NAV represents the total value of the fund's assets minus its liabilities, providing a clear picture of the fund's overall worth.

The NAV is determined by dividing the total value of the fund's holdings by the number of units outstanding. This calculation ensures that the price of each unit reflects the underlying value of the investments held within the trust. For instance, if a fund holds a diverse range of stocks, bonds, and other securities, the NAV would be the sum of the market value of these assets divided by the total number of units. This daily pricing mechanism ensures that investors can accurately assess the value of their holdings and make informed decisions.

This pricing structure is designed to provide transparency and fairness to investors. By pricing units at the end of each trading day, investors are given a clear snapshot of the fund's performance and value. This daily valuation allows investors to track the growth or decline of their investment over time and make adjustments as needed. It also ensures that the price of units is not influenced by market volatility during the day, providing a more stable and predictable pricing model.

The NAV-based pricing system is a key advantage of unit trusts, as it simplifies the investment process and reduces the complexity often associated with other investment vehicles. Investors can buy or sell units at the end-of-day price, which is based on the fund's actual performance and asset value. This approach ensures that investors are not exposed to the risks of short-term market fluctuations, making unit trusts an attractive option for those seeking long-term investment growth.

In summary, the pricing of unit trust investments is a critical component that ensures investors receive a fair and transparent representation of their holdings. By calculating the price at the end of each trading day based on the NAV, investors can make informed decisions and manage their investments effectively. This pricing mechanism is a fundamental aspect of unit trust investments, providing a stable and accessible way for individuals to participate in the financial markets.

The Homeowner's Dilemma: Consumption or Investment?

You may want to see also

Distribution: Investors receive a share of the fund's profits in the form of dividends or capital gains

When you invest in a unit trust, you essentially become a part-owner of the fund, and your investment is pooled together with other investors' money. This collective fund is then managed by a professional fund manager who makes investment decisions on behalf of all the unit holders. The beauty of this arrangement is that it allows individual investors to access a diversified portfolio of assets, which might otherwise be too costly or complex to manage on their own.

Now, regarding distribution, investors in a unit trust receive a share of the fund's profits. This distribution can occur in two main ways: through dividends or capital gains. Dividends are essentially a portion of the fund's profits that are paid out to investors. These dividends are typically calculated as a percentage of the net asset value (NAV) of each unit held by the investor. For instance, if an investor holds 100 units of a fund with a NAV of $10 each, and the fund declares a dividend of 5 cents per unit, the investor would receive $5 in dividends.

Capital gains, on the other hand, are realized when the fund sells an asset for more than it originally paid for it. In this scenario, the excess amount over the original cost is considered a capital gain. These gains are also distributed to the investors, and they can be significant, especially in funds that have performed well over time. It's important to note that capital gains are often treated differently in terms of taxation compared to dividends, so investors should be aware of these tax implications.

The distribution process is typically managed by the fund's administrators, who ensure that investors receive their rightful share of the fund's profits. This can be done through regular dividend payments or, in some cases, through the reinvestment of capital gains back into the fund, allowing investors to compound their returns over time. Additionally, some unit trusts may offer a combination of dividends and capital gains distributions, providing investors with a flexible way to receive their returns.

Understanding how unit trust investments distribute profits is crucial for investors as it directly impacts their overall returns. By grasping the concepts of dividends and capital gains, investors can make more informed decisions about their investment strategies, risk tolerance, and expected returns. This knowledge also empowers investors to plan for their financial goals, whether it's for retirement, education, or other long-term objectives.

Diversification Strategies: Exploring the Impact of Call Option Buying

You may want to see also

Risk and Return: Unit trusts offer varying levels of risk and potential returns depending on the fund's strategy

Unit trusts are a type of investment vehicle that allows investors to pool their money together and invest in a diversified portfolio of assets, such as stocks, bonds, or other securities. One of the key advantages of unit trusts is that they offer investors a way to access a broad range of investments without having to individually select and manage each asset. This makes them an attractive option for those who want to invest in a diversified portfolio but may not have the time or expertise to do so on their own.

The risk and return profile of a unit trust depend on the underlying assets it holds and the investment strategy employed by the fund manager. Unit trusts can be categorized into different risk levels, typically ranging from low to high. Low-risk unit trusts often focus on more stable and secure investments, such as government bonds or high-quality corporate bonds. These funds aim to provide a steady income and capital preservation, making them suitable for risk-averse investors. On the other hand, high-risk unit trusts may invest in more volatile assets like stocks or emerging market securities, which can offer higher potential returns but also come with greater risks.

The investment strategy is a critical factor in determining the risk and return of a unit trust. Fund managers use various strategies to manage the portfolio, such as growth, income, or value strategies. Growth-oriented funds aim to capitalize on the potential for long-term capital appreciation by investing in companies with strong growth prospects. Income funds focus on generating regular income through dividends or interest payments. Value funds seek to identify undervalued assets and aim to provide capital appreciation over time. Each strategy carries its own level of risk and potential return, allowing investors to choose an option that aligns with their financial goals and risk tolerance.

Investors should carefully consider the risk and return characteristics of a unit trust before making an investment decision. It is essential to understand the fund's investment objectives, the types of assets it holds, and the historical performance of the fund. Risk tolerance is a crucial factor, as it determines the level of risk an investor is willing to take. Younger investors with a longer investment horizon may be more inclined to take on higher risks for potentially higher returns, while older investors approaching retirement may prefer lower-risk options to preserve capital.

In summary, unit trusts offer investors a convenient way to access a diversified portfolio of investments. The risk and return potential of these funds vary depending on the underlying assets and the investment strategy employed. By understanding the different risk levels and strategies, investors can make informed decisions and choose unit trusts that align with their financial objectives and risk preferences. This approach enables investors to build a well-rounded investment portfolio and potentially achieve their long-term financial goals.

Unlocking the Secrets to Buying Land as a Smart Investment Strategy

You may want to see also

Frequently asked questions

A unit trust is a type of investment fund that pools money from many investors to invest in a diversified portfolio of assets such as stocks, bonds, or other securities. Each investor owns 'units' in the trust, representing their share of the fund's assets.

Unit trusts generate returns by investing in various financial instruments. The fund manager makes investment decisions on behalf of the investors, aiming to grow the capital and provide income. Returns are distributed to unit holders based on the number of units they own.

Unit trusts offer several benefits. They provide instant diversification, reducing risk by spreading investments across multiple assets. They are also professionally managed, allowing investors to benefit from expert analysis and decision-making. Additionally, unit trusts are typically more accessible to individual investors with lower minimum investment requirements compared to direct stock market investments.

Investors can buy or sell units in a unit trust through financial advisors or online platforms. The process involves placing an order with the fund manager or authorized dealer, who then executes the transaction on the investor's behalf. The price of units is typically calculated at the end of each trading day and may fluctuate based on the performance of the underlying assets.

Unit trusts can be a suitable investment option for various investors, but it depends on individual financial goals, risk tolerance, and investment time horizons. They are generally considered a long-term investment strategy. Investors should carefully consider their risk profile and consult with a financial advisor to determine if unit trusts align with their investment needs.