Navigating the ever-changing landscape of investments can be challenging, especially when planning for the upcoming year. This paragraph introduces the topic of finding new working investments for the following year, emphasizing the importance of strategic research, market analysis, and a proactive approach to financial planning. It sets the stage for a discussion on how to identify and capitalize on potential investment opportunities, ensuring a robust and informed financial strategy.

What You'll Learn

- Market Research: Identify trends, analyze competitors, and assess industry performance

- Risk Assessment: Evaluate potential risks and develop strategies to mitigate them

- Financial Analysis: Study financial statements, cash flow, and profitability to make informed decisions

- Diversification: Spread investments across different asset classes to reduce risk

- Regulatory Compliance: Ensure adherence to legal and ethical standards in investment practices

Market Research: Identify trends, analyze competitors, and assess industry performance

Market research is a critical step in identifying potential investment opportunities for the upcoming year. It involves a systematic approach to gathering and analyzing information about the market, competitors, and industry trends. By conducting thorough market research, investors can make informed decisions and gain a competitive edge. Here's a detailed breakdown of the process:

Identify Market Trends: Begin by researching and understanding the current market dynamics. Look for emerging trends, consumer behavior patterns, and industry shifts. Analyze historical data, market reports, and industry publications to identify patterns and predict future market movements. For example, if you're investing in the technology sector, study the latest innovations, disruptive technologies, and their potential impact on the market. Identifying trends allows investors to anticipate changes and make strategic investment choices.

Competitor Analysis: Conduct an in-depth analysis of your competitors and the companies within your target industry. Study their market share, pricing strategies, product offerings, and unique selling propositions. Identify their strengths and weaknesses to understand their position in the market. Look for gaps in their product lines or services that you can exploit. Analyzing competitors helps investors assess their own strategies and make informed decisions about product development, pricing, and market positioning.

Industry Performance Assessment: Evaluate the overall performance and health of the industry you are interested in. Consider factors such as market growth rate, revenue trends, profitability, and industry-specific challenges. Research and compare industry data with previous years to identify any significant changes or emerging issues. Assess the industry's resilience, regulatory environment, and future prospects. For instance, if you're considering investing in the renewable energy sector, analyze the industry's growth, government policies, and the impact of technological advancements.

To gather this information, investors can employ various research methods. Online surveys, focus groups, and customer interviews can provide qualitative insights. Quantitative data can be collected through sales reports, market research firms, and industry associations. Additionally, social media listening and web scraping techniques can help identify emerging trends and competitor activities.

By following these steps, investors can make well-informed decisions, adapt to market changes, and increase the chances of successful investments. Market research enables investors to stay ahead of the curve, identify untapped opportunities, and make strategic choices to maximize returns. It is an essential process that forms the foundation of a robust investment strategy.

Rich People: Investing Secrets

You may want to see also

Risk Assessment: Evaluate potential risks and develop strategies to mitigate them

When assessing potential investment opportunities for the following year, a comprehensive risk evaluation is crucial to ensure a well-informed decision-making process. Here's a structured approach to identifying and mitigating risks:

Identify Risks: Begin by researching and analyzing various factors that could pose risks to potential investments. This includes market-specific risks, such as economic downturns, industry-specific challenges, and competitive landscapes. For instance, if you're considering an investment in the tech sector, research potential disruptions like technological obsolescence or regulatory changes that could impact the industry. Additionally, consider company-specific risks, such as financial instability, management changes, or legal issues. A thorough analysis of these factors will help you anticipate potential pitfalls.

Risk Categorization: Categorize the identified risks into different groups to gain a comprehensive understanding. For example, you might have categories like financial risks (market volatility, liquidity issues), operational risks (supply chain disruptions, internal process failures), strategic risks (competitive threats, market entry barriers), and external risks (geopolitical events, natural disasters). This categorization will enable you to focus on specific areas and develop tailored mitigation strategies.

Risk Analysis and Impact Assessment: For each risk category, conduct a detailed analysis to understand its potential impact. Evaluate the likelihood of the risk occurring and the severity of its consequences. Assign a probability score and a potential impact score to each risk. This quantitative approach will help prioritize the risks and allocate resources effectively. For instance, a high-probability, high-impact risk might require immediate attention and a comprehensive mitigation plan.

Mitigation Strategies: Develop strategies to minimize the identified risks. Here are some approaches:

- Risk Avoidance: If a risk is highly probable and severe, consider avoiding the investment altogether or seeking alternative opportunities with lower risk profiles.

- Risk Mitigation: Implement measures to reduce the impact of the risk. For instance, diversify your investment portfolio to spread risk, or negotiate favorable terms with the investment entity to include risk-sharing clauses.

- Risk Transfer: Utilize insurance or hedging strategies to transfer the risk to a third party. This could involve purchasing insurance policies that cover potential losses or using financial derivatives to hedge against market risks.

- Risk Monitoring and Control: Establish a system to regularly monitor the investment and its associated risks. This includes setting up key performance indicators (KPIs) and implementing internal controls to ensure the investment aligns with its intended goals.

By following this structured risk assessment process, you can make more informed investment decisions, ensuring that potential pitfalls are identified and addressed proactively. This approach empowers investors to navigate the complexities of the market and make choices that align with their financial objectives.

Salary and Investment: A Correlation

You may want to see also

Financial Analysis: Study financial statements, cash flow, and profitability to make informed decisions

Financial analysis is a critical process that forms the backbone of any investment decision. It involves a comprehensive study of a company's financial health, performance, and potential. By delving into financial statements, cash flow, and profitability, investors can make informed choices, identify trends, and assess the viability of potential investments. This analytical approach is essential for anyone seeking to find new working investments for the following year.

Financial statements are a treasure trove of information, offering a snapshot of a company's financial position at a specific point in time. These statements include the balance sheet, income statement, and cash flow statement. The balance sheet provides a detailed view of a company's assets, liabilities, and equity, helping investors understand the company's financial structure. The income statement reveals the company's revenue, expenses, and net income over a period, offering insights into its profitability and financial performance. Cash flow statements, on the other hand, illustrate the sources and uses of cash, providing a clear picture of the company's liquidity and ability to generate cash.

Analyzing these financial statements requires a keen eye for detail and an understanding of financial ratios and metrics. Investors should calculate and interpret key ratios such as return on equity (ROE), gross margin, net profit margin, and current ratio. These ratios provide valuable insights into a company's efficiency, profitability, and financial stability. For instance, a high ROE indicates efficient use of equity capital, while a low current ratio might suggest potential liquidity issues. By comparing these ratios across different companies and industries, investors can make more informed decisions.

Cash flow analysis is another crucial aspect of financial analysis. It involves assessing the company's ability to generate and manage cash, which is vital for its long-term survival and growth. Investors should examine the sources and uses of cash, including operating activities, investing activities, and financing activities. Positive cash flow from operations indicates a healthy business, while negative cash flow might require further investigation. Additionally, investors should consider the company's debt levels and its ability to service debt, as excessive debt can impact cash flow and financial stability.

Profitability analysis is the final piece of the financial analysis puzzle. It focuses on understanding a company's ability to generate profits and its cost structure. Investors should calculate and compare various profitability metrics, such as gross profit margin, operating profit margin, and net profit margin. These metrics help identify trends, assess cost management, and evaluate the company's competitive advantage. For instance, a consistently high gross profit margin might indicate efficient cost control, while a declining net profit margin could signal potential financial distress.

In summary, financial analysis is a powerful tool for investors seeking to find new working investments. By studying financial statements, cash flow, and profitability, investors can make informed decisions, identify potential risks and opportunities, and assess the financial health of companies. This analytical approach enables investors to navigate the complex world of investments with confidence and a deeper understanding of the market dynamics.

Car Conundrum: Navigating the Buy or Invest Decision

You may want to see also

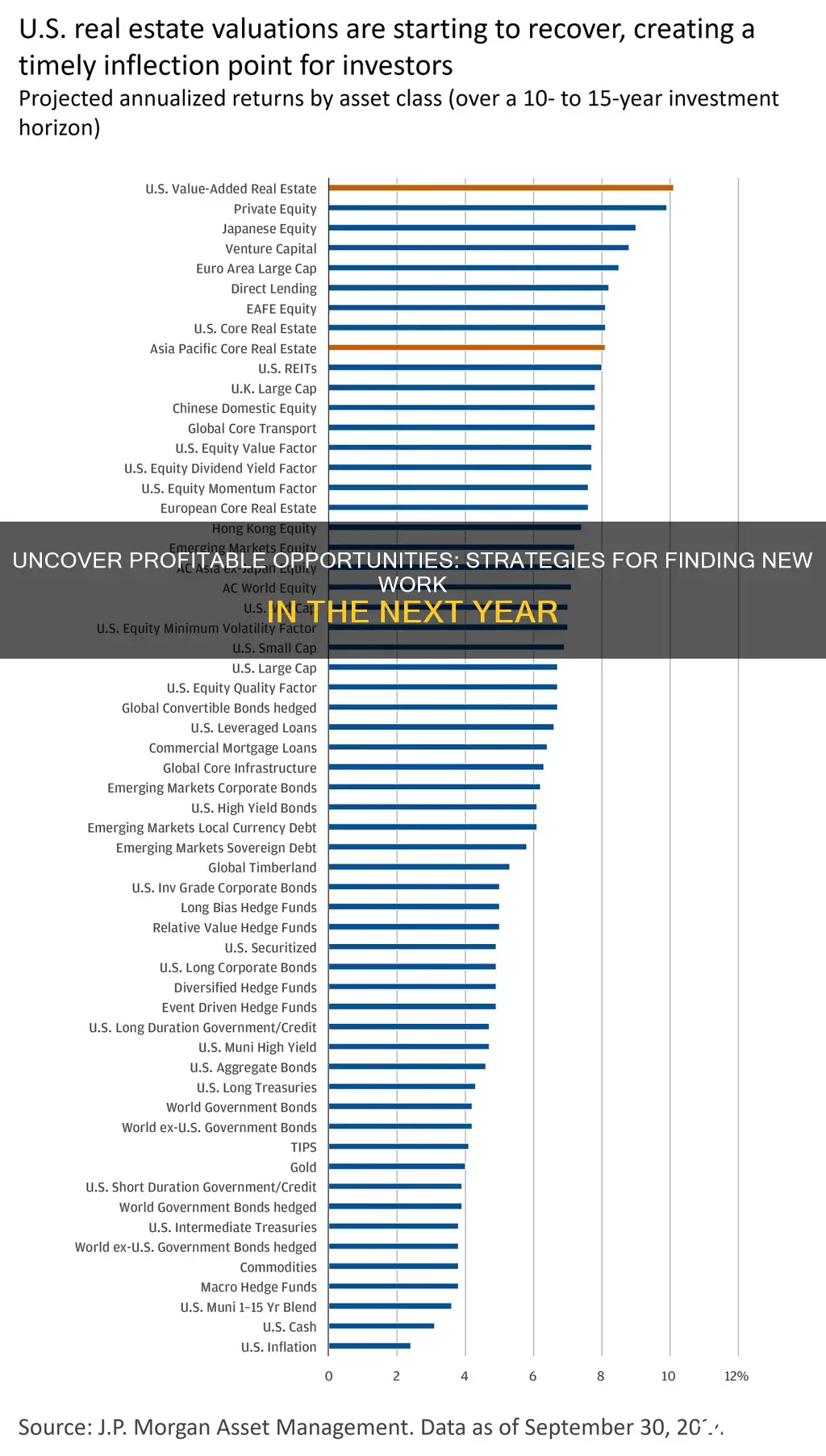

Diversification: Spread investments across different asset classes to reduce risk

Diversification is a fundamental strategy in investing that involves allocating your resources across various asset classes to minimize risk and maximize potential returns. The core principle is simple: by not putting all your eggs in one basket, you can protect your portfolio from the negative impacts of any single investment. This approach is particularly crucial when planning for the future, as it ensures that your investments are well-balanced and resilient.

When considering how to diversify your investments, it's essential to understand the different asset classes available. These typically include stocks, bonds, cash, and various alternative investments like real estate, commodities, and derivatives. Each asset class has its own unique characteristics, risks, and potential rewards. For instance, stocks offer the potential for high returns but come with higher risk, while bonds provide a more stable income stream but with lower potential growth.

The key to successful diversification is to create a portfolio that includes a mix of these asset classes. A common strategy is to allocate a certain percentage of your portfolio to each asset class, ensuring that no single asset class dominates. For example, you might decide to invest 60% in stocks, 30% in bonds, and 10% in cash or alternative investments. This allocation can be tailored to your specific financial goals, risk tolerance, and time horizon.

By diversifying, you're essentially spreading your risk. If one investment underperforms or experiences a market downturn, the positive performance of other investments in your portfolio can offset these losses. This strategy is particularly important for long-term investors, as it helps to smooth out the volatility of individual asset returns over time.

Additionally, diversification allows you to take advantage of the unique characteristics of different asset classes. For instance, stocks can provide growth potential, bonds can offer a steady income stream, and alternative investments might provide a hedge against market fluctuations. This approach ensures that your investment strategy is well-rounded and adaptable to various market conditions.

In summary, diversification is a powerful tool for investors looking to manage risk and optimize their returns. By spreading investments across different asset classes, you can create a robust and balanced portfolio, ensuring that your financial future is as secure and prosperous as possible. It's a key consideration when planning for the year ahead and beyond.

Unraveling Distressed Debt: A Comprehensive Guide to Strategic Investing

You may want to see also

Regulatory Compliance: Ensure adherence to legal and ethical standards in investment practices

In the dynamic world of finance, regulatory compliance is the cornerstone of ethical and sustainable investment practices. As an investor, it is imperative to navigate the legal landscape to ensure that your strategies not only generate returns but also adhere to the highest standards of integrity. Here's a comprehensive guide on how to approach regulatory compliance in the context of finding new investment opportunities for the following year:

Understanding the Regulatory Framework: Begin by immersing yourself in the regulatory environment relevant to your investment activities. This includes studying local and international financial regulations, securities laws, and industry-specific guidelines. For instance, if you're involved in venture capital, familiarize yourself with regulations governing private equity investments, such as the rules set by the Securities and Exchange Commission (SEC) in the United States. Understanding these regulations is the first step towards ensuring compliance.

Due Diligence and Ethical Screening: When identifying potential investment targets, conduct thorough due diligence to assess not only the financial health and growth prospects of the company but also its ethical and legal standing. This involves scrutinizing the company's compliance records, governance practices, and its adherence to environmental, social, and governance (ESG) standards. Ethical screening is a powerful tool to identify investments that not only meet legal requirements but also align with socially responsible practices.

Transparency and Disclosure: Regulatory compliance heavily emphasizes transparency and accurate disclosure of information. Ensure that all investment-related documents, reports, and communications are transparent and comply with legal requirements. This includes providing clear and concise financial statements, investment policies, and any potential risks associated with the investment. Transparency builds trust with investors and regulatory bodies alike.

Regular Monitoring and Reporting: Compliance is an ongoing process. Implement a robust system to monitor your investments regularly, ensuring they continue to meet legal and ethical standards. This may involve setting up compliance committees, conducting internal audits, and staying updated on any regulatory changes that could impact your investment portfolio. Regular reporting to relevant authorities and stakeholders is essential to maintain transparency and accountability.

Stay Informed and Adapt: The regulatory landscape is ever-evolving, with new laws and interpretations emerging frequently. Stay informed about industry developments, attend regulatory workshops, and subscribe to relevant newsletters. Being proactive in understanding regulatory changes allows you to adapt your investment strategies accordingly, ensuring continued compliance.

By embracing these practices, investors can navigate the complex world of regulatory compliance with confidence, ensuring that their investment decisions are not only financially sound but also ethically responsible. This approach fosters a culture of integrity and sustainability, contributing to the long-term success and reputation of investment firms.

Mortgages and Markets: Navigating the Investment Landscape

You may want to see also

Frequently asked questions

Conduct thorough market research and analysis to identify trends, sectors, or industries that are likely to perform well in the upcoming year. Stay updated with economic forecasts, industry reports, and news to make informed decisions. Consider factors like market capitalization, revenue growth, and competitive advantage when evaluating potential investments.

Look for companies or assets that are trading below their intrinsic value or have a strong growth potential. Analyze financial statements, assess the company's management team, and evaluate their competitive position. You can also use technical analysis tools to identify stocks that are undervalued based on historical price patterns and indicators.

Yes, numerous online platforms and financial websites provide investment research and insights. These platforms often offer stock screens, market analysis, and expert recommendations. Some popular resources include financial news websites, brokerage firm platforms, and investment research portals that aggregate data and provide tools for investors to find potential opportunities.

Diversification is crucial to managing risk and maximizing returns. By spreading your investments across different asset classes, sectors, and industries, you reduce the impact of any single investment's performance on your overall portfolio. Diversification ensures that your investments are not overly exposed to specific risks and provides a more stable investment approach.

Timing is essential but can be challenging to predict accurately. While it's beneficial to invest when markets are favorable, it's equally important to be prepared for market downturns. Consider your investment horizon and risk tolerance. Sometimes, waiting for the 'perfect' time to invest might mean missing out on potential gains. A well-diversified portfolio and a long-term investment strategy can help mitigate the impact of timing challenges.