Whether to buy a car or invest depends on several factors. Firstly, one must consider the difference between an asset and an investment. While a car can be considered an asset as it can be sold for a large sum, it is not an investment as it depreciates over time and does not generate income. On the other hand, investments like stocks or real estate can grow in value and pay dividends. Thus, if one is considering buying a car, it is important to understand that it is a large, necessary purchase that should be carefully researched, especially in terms of maintenance and insurance costs. Additionally, it is recommended that individuals spend no more than 10% of their gross annual income on a car to avoid exceeding their budget and missing out on investment opportunities.

| Characteristics | Values |

|---|---|

| Initial cost | Cars are the second-most expensive purchase after homes |

| Running costs | Cars have high running costs, including fuel, parking fees, toll fees, maintenance, insurance, and annual licensing fees |

| Return on investment | Cars are depreciating assets, losing value over time, whereas investments should make you money |

| Opportunity cost | Buying a car means missing out on investing in assets that can grow and pay dividends, such as real estate or stocks |

| Stress | Spending a large proportion of your income on a car can increase stress and guilt |

What You'll Learn

Cars are depreciating assets, not investments

While a car may be a necessity for some, it is important to understand that it is not an investment. An investment is an asset that generates an income for you during its ownership. A car, on the other hand, is a depreciating asset, meaning it loses value over time.

When you buy a car, you are making a large and often necessary purchase. However, it is important to realise that you will not recover all the money you spend on it. In the first year alone, most cars depreciate in value by at least $1,500, with an average decrease of about $2,500. Over the first five years of ownership, a new car will depreciate in value by between $6,000 and $10,000. This depreciation is the biggest in the first three years of ownership, which is why you don't lose as much money when you buy a used car.

In addition to the depreciation, there are also maintenance costs, fuel costs, parking fees, toll fees, insurance, and annual licensing fees associated with owning a car. These costs can add up and eat into your savings. Therefore, it is crucial to carefully consider all your options when buying a car and to choose a vehicle that fits within your budget. Experts suggest spending between 10% and 50% of your annual gross income on your car.

If you are thinking about buying a car, ask yourself if you truly need one. Consider your daily commute and the alternatives available to you, such as public transportation, taxis, or ride-sharing services. If you live in an urban area, these alternatives may be more convenient and cost-effective than owning a car. However, if you live in a rural area with limited transportation options, buying a car may make more sense.

In conclusion, while a car can be a necessary purchase, it is important to recognise that it is a depreciating asset and not an investment. By understanding this, you can make more informed decisions about your car purchases and ensure that you are not spending beyond your means.

Investment Calls: Why You?

You may want to see also

Investments make you money

Investments are a great way to make your money work for you. While you might earn a steady paycheck from working, investing can put your hard-earned money to work for you. A wisely crafted investment portfolio can build tremendous wealth over time that you can use for your retirement, to send your kids to college, or for any of your other financial goals.

There are several ways to invest, including stocks, ETFs, mutual funds, bonds, CDs, real estate, and more. The best approach for you depends on your risk tolerance, the amount of money you have to invest, and your time horizon, among other factors.

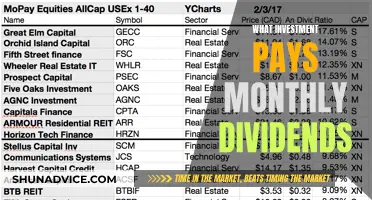

Stocks

When you buy a company's stock, you own a small slice of that company and become a shareholder. Stocks have consistently proven to be the best way for the average person to build wealth over the long term. As a stockholder, you own a business, and as that business grows and becomes more profitable, you own a more valuable business.

Stocks can increase in value over time, and companies may also share a percentage of their profits with shareholders by paying out dividends. The value of a share of stock reflects how much investors think the company is worth. For example, if a company is estimated to be worth $10 million and there are 1 million shares, each share would be worth $10.

Bonds

When you buy a bond, you are loaning money to a company or government over a fixed period. They promise to pay you back after that time, along with regular interest payments. That's why bonds are called "fixed-income" securities.

Bonds can also increase in value, and you earn money from the interest payments. For example, a $100 bond with 3% interest over 10 years would earn you $3 a year, totalling $30 in interest by the end of the term.

Mutual Funds and ETFs

Mutual funds and exchange-traded funds (ETFs) are similar in that they pool investors' money to buy a portfolio of stocks or other investments. The main difference is that ETFs trade on major stock exchanges, and you can buy and sell shares whenever the stock market is open. Mutual funds, on the other hand, price their shares only once a day and are not as liquid.

Both mutual funds and ETFs can be a great way to invest in a diverse range of securities, reducing the risk associated with investing in a single security. They can also pay dividends, and ETFs typically have low fees, making them a good option for long-term wealth building.

Real Estate

Owning real estate can be a wonderful way to build wealth. You can buy a rental property, which can create an income stream, or invest passively through real estate investment trusts (REITs). REITs are excellent investments for income since they don't pay corporate taxes as long as they pay out at least 90% of taxable income in dividends.

Other Investments

Other types of investments include high-yield savings accounts, certificates of deposit (CDs), and cryptocurrencies.

In summary, investments can make you money by increasing in value over time or by providing income through interest or dividend payments. By investing wisely and for the long term, you can build wealth and achieve your financial goals.

Gun Control: The Investment Angle

You may want to see also

Cars are large, necessary purchases

Firstly, it is worth noting that a car is not an investment. An investment is defined as an asset that generates an income for you during its ownership. While a car may be considered an asset because you can sell it for a large amount of money, it depreciates over time and does not appreciate in value. In fact, in the first year, most cars depreciate in value by at least $1,500, and over the first five years of ownership, a new car will depreciate between $6,000 and $10,000. Therefore, you should be aware that you will not recover all of the money that you spend on a car.

When deciding whether to buy a car, it is important to consider your current financial situation. If you are carrying consumer debt or have large student loans, it is recommended that you are more conservative when purchasing a car. A car payment will tie up a percentage of your income and make it more difficult for you to do other things, such as pay off your debt or handle emergencies. Experts suggest that you only spend between 10 and 50% of your annual gross income on a car. Additionally, it is worth considering the cost of maintaining a car, including fuel, parking fees, toll fees, maintenance, insurance, and annual licensing fees.

If you are thinking about buying a car, it is worth considering whether you need a car or just mobility. If you live in an urban area with well-developed public and private transport, you may find that a car is not necessary. However, if you live in a rural area with no public or private transport, a car may be a necessary purchase.

In conclusion, while a car is a large and often necessary purchase, it is important to carefully consider your options and financial situation before buying one. A car is not an investment, and you should be aware that you will not recover all of the money you spend on it.

Invest Now: Where to Put Your Money

You may want to see also

Consider the opportunity cost of buying a car

When deciding whether to buy a car or invest, it is essential to consider the opportunity cost of buying a car. This refers to the potential benefits or returns you could have gained by investing your money instead of purchasing a car.

Firstly, it is important to understand that a car is typically not considered an investment. While it may be an asset due to its high price tag and resale value, a car generally depreciates over time and does not generate income or provide returns on your investment. On the other hand, investments such as stocks or real estate have the potential to grow in value and pay dividends.

By purchasing a car, you may be forgoing the opportunity to invest your money in assets that can offer long-term growth and financial gains. The money spent on a car could potentially be invested in the stock market or used to buy income-generating properties, which could provide greater financial returns over time.

Additionally, it is crucial to consider the ongoing costs associated with car ownership. Maintenance, insurance, fuel, and parking fees can add up quickly and eat into your savings or investment budget. These costs can impact your financial flexibility and ability to invest in other opportunities.

Furthermore, buying a car can impact your stress levels and overall financial health. Spending a significant portion of your income on a car may increase your stress and worry about additional costs or potential damage to the vehicle. It can also affect your ability to pay off debt, handle emergencies, or invest in other areas, such as retirement or education.

When considering the opportunity cost of buying a car, it is essential to evaluate your financial goals and priorities. If investing and growing your wealth is a priority, then allocating your funds towards investments may be a more prudent decision. However, if a car is a necessity for your daily commute or business, then purchasing a car that fits within your budget and minimises opportunity costs may be the right choice.

LetGo: Why Venture Capitalist Investments?

You may want to see also

Cars come with many hidden costs

Additionally, there are registration and licensing fees, which vary by state, and car insurance premiums, which depend on factors such as the car owner's driving record, age, marital status, and area of residence. The type of car also matters—more expensive and performance-oriented vehicles tend to have higher insurance premiums. Maintenance and repair costs can also add up, especially for older, used cars.

Depreciation is another significant hidden cost of car ownership. Most cars depreciate in value over time, with some losing thousands of dollars in value within the first few years of ownership. This is an important consideration when deciding to sell the vehicle, as it will impact the resale value.

It's essential to carefully consider all these hidden costs when deciding to buy a car, as they can significantly impact your finances.

Heavy Price Tag, Heavy Considerations

You may want to see also

Frequently asked questions

A car can be useful for commuting to work or school, especially if you live in a rural area with no public or private transport solutions. It can also be a tool of the trade if you work in agriculture, mining, or other land-based production activities.

A car is a depreciating asset and is not an investment. It comes with additional costs such as fuel, parking fees, toll fees, maintenance, insurance, and annual licensing fees.

Investing allows you to grow your wealth and generate income. It is essential to attain happiness and success in life, providing returns not just financially but also in terms of living a healthy life.