Betterment Investing is a popular online investment platform that offers a user-friendly approach to investing. It provides a simple and accessible way for individuals to build and grow their wealth over time. The platform utilizes a robo-advisor model, where it automatically manages your investments based on your financial goals and risk tolerance. With Betterment, you can invest in a diversified portfolio of stocks, bonds, and other assets, allowing you to benefit from long-term market growth while minimizing the risk associated with individual stock picking. This automated investing strategy is designed to be cost-effective and efficient, making it an attractive option for those who want to start investing but may not have the time or expertise to manage their own portfolios.

What You'll Learn

- Investment Accounts: Betterment offers various accounts for different investment goals and tax advantages

- Automated Investing: Algorithmic strategies manage your portfolio, rebalancing and optimizing asset allocation

- Diversification: Betterment's platform provides access to a wide range of investment options for portfolio diversification

- Fee Structure: Transparent fees are charged, with no hidden costs or commissions

- Performance Tracking: Real-time performance metrics and analytics help investors monitor their investment growth

Investment Accounts: Betterment offers various accounts for different investment goals and tax advantages

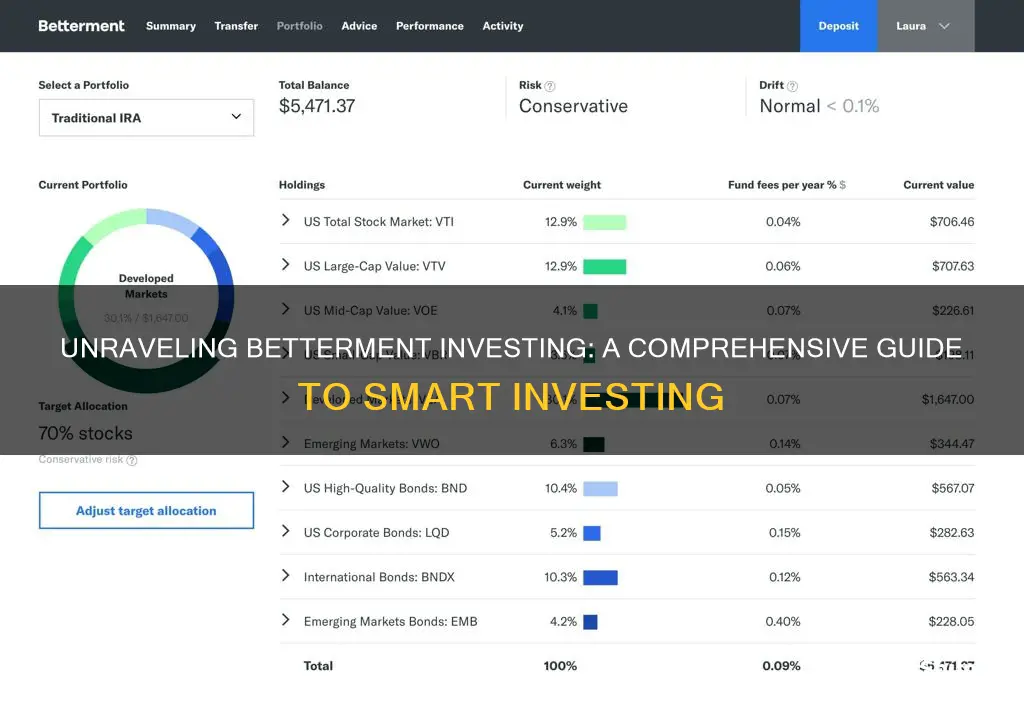

Betterment is an online investment platform that provides a range of investment accounts tailored to meet diverse financial objectives. These accounts are designed to offer a combination of investment strategies, tax efficiency, and flexibility, catering to various investor needs. Here's an overview of the investment accounts offered by Betterment:

Retirement Accounts: Betterment offers two primary retirement account options: Traditional and Roth IRAs. Traditional IRAs allow investors to contribute pre-tax dollars, providing tax deductions in the contribution year, which can be beneficial for those who expect to be in a lower tax bracket during retirement. On the other hand, Roth IRAs enable contributions with after-tax dollars, offering tax-free growth and withdrawals in retirement. This flexibility allows investors to choose the account type that best aligns with their future tax situation and retirement goals.

Tax-Advantaged Accounts: Betterment also provides tax-efficient investment accounts, such as Health Savings Accounts (HSAs) and 529 Plans. HSAs allow individuals to save for qualified medical expenses tax-free, providing a triple tax advantage—contributions are tax-deductible, earnings grow tax-free, and withdrawals are tax-free for eligible expenses. 529 Plans, designed for education savings, offer tax-free growth and withdrawals for qualified education expenses, making them an excellent choice for parents and guardians looking to save for their child's future education.

Diverse Investment Options: Each Betterment account offers a carefully curated portfolio of investments, including stocks, bonds, and exchange-traded funds (ETFs). These portfolios are diversified to manage risk and provide potential for growth. Investors can choose from various risk levels, such as conservative, moderate, or aggressive, depending on their risk tolerance and investment goals. The platform's automated rebalancing feature ensures that the portfolio remains aligned with the investor's chosen strategy, making it a convenient and efficient way to manage investments.

Fee Structure: Betterment's investment accounts typically come with low management fees, which are competitive compared to traditional investment advisors. These fees are designed to be transparent and straightforward, ensuring that investors can understand the costs associated with their accounts. Additionally, Betterment offers a fee-free account called the Betterment Cash Account, allowing users to hold their funds in a savings-like account with no management fees, providing a safe and accessible way to keep their money liquid while earning interest.

By offering these various investment accounts, Betterment caters to a wide range of investors, from those planning for retirement to individuals seeking tax-efficient savings options. The platform's user-friendly interface and automated investment strategies make it accessible to both novice and experienced investors, providing a comprehensive solution for managing and growing their wealth.

Retirement Investing: Knowing When to Play it Safe

You may want to see also

Automated Investing: Algorithmic strategies manage your portfolio, rebalancing and optimizing asset allocation

Automated investing, often referred to as algorithmic investing or robo-investing, is a method of managing your investment portfolio using computer algorithms and automated processes. This approach offers a more hands-off, systematic way to invest, which can be particularly appealing to those who prefer a less active role in the investment process or lack the time and expertise to manage investments manually. Here's how it works and the benefits it offers:

Portfolio Management: At its core, automated investing involves the use of algorithms to build and manage a diversified portfolio. These algorithms are designed to analyze vast amounts of financial data, including market trends, economic indicators, and individual stock or fund performance. By employing sophisticated mathematical models, the algorithms can make data-driven decisions on asset allocation, ensuring that the portfolio is well-balanced and aligned with the investor's financial goals and risk tolerance. This automated approach eliminates the emotional biases that can often cloud human decision-making, leading to more consistent and disciplined investment strategies.

Rebalancing: One of the critical aspects of successful investing is maintaining an optimal asset allocation. Over time, market fluctuations can cause a portfolio to deviate from its intended allocation. Automated investing platforms regularly rebalance the portfolio to ensure it stays on track. For example, if the stock market has outperformed the bond market, the algorithm will automatically sell a portion of the stocks and buy more bonds to restore the desired allocation. This rebalancing process helps investors stay committed to their long-term investment strategy and reduces the risk of making impulsive decisions based on short-term market movements.

Asset Allocation Optimization: Algorithmic investing platforms often utilize advanced optimization techniques to maximize the potential returns of a portfolio while managing risk. These strategies involve dynamically adjusting the weightings of different asset classes based on market conditions and the investor's objectives. For instance, during periods of economic uncertainty, the algorithm might suggest a more conservative approach by increasing the allocation to bonds or cash equivalents. Conversely, when the market is expected to perform well, the algorithm may recommend a higher exposure to stocks or growth-oriented funds. This automated optimization process ensures that the portfolio is tailored to the investor's needs and market circumstances.

Benefits of Automated Investing: This method of investing offers several advantages. Firstly, it provides access to professional-level portfolio management without the need for extensive financial knowledge. The algorithms are designed to make informed decisions based on historical data and market trends, reducing the risk of costly mistakes. Secondly, automated investing platforms often have lower fees compared to traditional investment advisors, making it a cost-effective option for long-term investors. Additionally, the automated nature of these platforms allows for frequent rebalancing and reallocation, ensuring that the portfolio remains aligned with the investor's risk profile and goals.

In summary, automated investing through algorithmic strategies offers a sophisticated and disciplined approach to portfolio management. By utilizing data-driven decision-making, rebalancing, and optimization techniques, investors can benefit from a well-managed, diversified portfolio that adapts to changing market conditions. This method of investing is particularly suitable for those seeking a more passive, systematic approach to building wealth over the long term.

Oil Investment Options: A Guide to Getting Started

You may want to see also

Diversification: Betterment's platform provides access to a wide range of investment options for portfolio diversification

The Betterment platform is designed to offer investors a comprehensive suite of investment options, enabling them to build diversified portfolios tailored to their financial goals and risk tolerance. Diversification is a key strategy in investing, as it helps spread risk across various asset classes, sectors, and geographic regions, thus reducing the potential impact of any single investment's performance on the overall portfolio.

Betterment's platform provides access to a wide array of investment options, including stocks, bonds, and mutual funds, as well as alternative investments like real estate investment trusts (REITs) and exchange-traded funds (ETFs). This diverse range of assets allows investors to construct well-rounded portfolios that can potentially provide stable returns over the long term. For instance, stocks offer the potential for high growth but come with higher risk, while bonds provide a more stable, income-oriented investment. By allocating a portion of their portfolio to each of these asset classes, investors can balance risk and reward.

The platform's algorithm-driven approach also plays a crucial role in diversification. Betterment's algorithm analyzes the investor's risk tolerance, financial goals, and time horizon to suggest an optimal asset allocation. This automated process ensures that the portfolio is not only diversified but also aligned with the investor's specific needs and preferences. Over time, the algorithm can rebalance the portfolio to maintain the desired asset allocation, automatically buying or selling assets as needed.

In addition to traditional asset classes, Betterment also offers access to alternative investments. These include REITs, which allow investors to invest in real estate without directly purchasing property, and ETFs, which provide exposure to a basket of securities or assets. ETFs are particularly attractive due to their low cost and ability to track a specific index or sector, offering investors a way to diversify their portfolios across multiple assets with a single purchase.

By providing access to a wide range of investment options, Betterment empowers investors to take control of their financial future. Diversification is a critical component of a successful investment strategy, and the platform's comprehensive approach to investing makes it a valuable tool for those seeking to build a robust and resilient portfolio.

Merrill Lynch's Guide to Retirement Investing: Strategies for a Secure Future

You may want to see also

Fee Structure: Transparent fees are charged, with no hidden costs or commissions

Betterment Investing is a popular online investment platform that offers a unique approach to investing, focusing on transparency and accessibility. One of its key strengths is its fee structure, which is designed to be straightforward and clear, ensuring investors know exactly what they are paying for.

When it comes to fees, Betterment takes a simple and transparent approach. They charge a small annual fee, which is typically a percentage of the assets under management. This fee is clearly stated and easily accessible to all users. The platform ensures that there are no hidden costs or commissions, providing investors with a clear understanding of their expenses. This transparency is a significant advantage, as it allows investors to make informed decisions and manage their finances effectively.

The fee structure is designed to be competitive and fair. Betterment offers different account types, such as taxable brokerage accounts and retirement accounts, each with its own fee structure. For example, their taxable brokerage accounts may have a fee of 0.25% per year, while retirement accounts could have a slightly lower rate. These fees are competitive compared to traditional investment advisors and often lower than what one might pay for in-person financial advice.

What sets Betterment apart is its commitment to educating investors about fees. They provide detailed explanations of their fee structure on their website and within the platform. Investors can easily access this information, ensuring they are well-informed about the costs associated with their investment choices. This level of transparency is crucial for building trust and ensuring investors can make decisions aligned with their financial goals.

In summary, Betterment Investing's fee structure is a key feature that attracts many investors. By charging transparent and competitive fees, they provide an accessible and cost-effective way to invest. This approach empowers investors to take control of their financial future, offering a refreshing change from traditional investment methods. With no hidden costs, investors can make informed decisions and build their portfolios with confidence.

Why People Invest: Unlocking Motivations

You may want to see also

Performance Tracking: Real-time performance metrics and analytics help investors monitor their investment growth

Performance tracking is a critical aspect of Betterment Investing, offering investors a comprehensive view of their investment performance in real-time. This feature empowers investors to make informed decisions and take proactive measures to optimize their portfolios. Here's how it works:

Real-time Metrics: Betterment provides investors with a suite of real-time performance metrics. These metrics include asset allocation percentages, portfolio value changes over time, and individual investment returns. For instance, an investor can instantly see how much their portfolio has grown or shrunk in the last day, week, or month. This immediate feedback allows for quick adjustments to strategies.

Analytics and Insights: The platform goes beyond basic metrics by offering advanced analytics. Investors can access detailed reports and visualizations that break down their investments' performance. These analytics might include historical performance comparisons, risk-adjusted returns, and sector-specific performance. By presenting data in an understandable format, Betterment helps investors identify trends, strengths, and weaknesses in their portfolios.

Goal Tracking: One of the key benefits of performance tracking is the ability to set and monitor investment goals. Investors can define short-term and long-term financial objectives, such as saving for a house or retirement. The platform then provides regular updates on how the portfolio is performing relative to these goals. This feature encourages investors to stay focused and motivated, making it easier to make necessary adjustments to reach their financial milestones.

Risk Management: Real-time performance tracking is also essential for risk management. Investors can quickly identify potential risks or opportunities by monitoring their investments' performance. For example, if a particular asset class is underperforming, investors can decide whether to rebalance their portfolio or explore alternative investments. This proactive approach helps in maintaining a balanced and diversified investment strategy.

Personalized Reports: Betterment Investing offers personalized performance reports tailored to each investor's needs. These reports can be customized to highlight specific areas of interest, such as tax-efficient strategies or sustainable investing. By providing tailored insights, the platform ensures that investors receive relevant and actionable information to make the most of their investment journey.

In summary, performance tracking in Betterment Investing is a powerful tool that provides investors with the necessary insights to make informed decisions. By offering real-time metrics, advanced analytics, and goal-tracking features, investors can actively manage their portfolios, adapt to market changes, and work towards their financial aspirations. This level of transparency and control is a significant advantage for investors seeking a modern and efficient approach to wealth management.

Invest in IoT's Future Today

You may want to see also

Frequently asked questions

Betterment Investing is an automated investment platform that helps individuals build wealth by offering a range of investment options, including stocks, bonds, and ETFs. It uses a robo-advisor approach, providing personalized investment advice and portfolio management based on an individual's financial goals, risk tolerance, and time horizon.

Betterment's algorithm is designed to optimize investment strategies for its users. It utilizes a risk-based approach, starting with a comprehensive assessment of an investor's financial situation and goals. The algorithm then constructs a portfolio tailored to the individual's risk profile, regularly rebalancing it to maintain the desired asset allocation. This automated process aims to provide diversification and potentially higher returns over the long term.

Yes, Betterment offers a degree of customization to cater to different investment preferences. Users can adjust their portfolio's asset allocation by rebalancing their investments manually or setting specific target allocations for different asset classes. Additionally, Betterment provides various investment options, allowing users to choose from a range of ETFs, mutual funds, and individual stocks to build a portfolio that aligns with their investment strategy and goals.