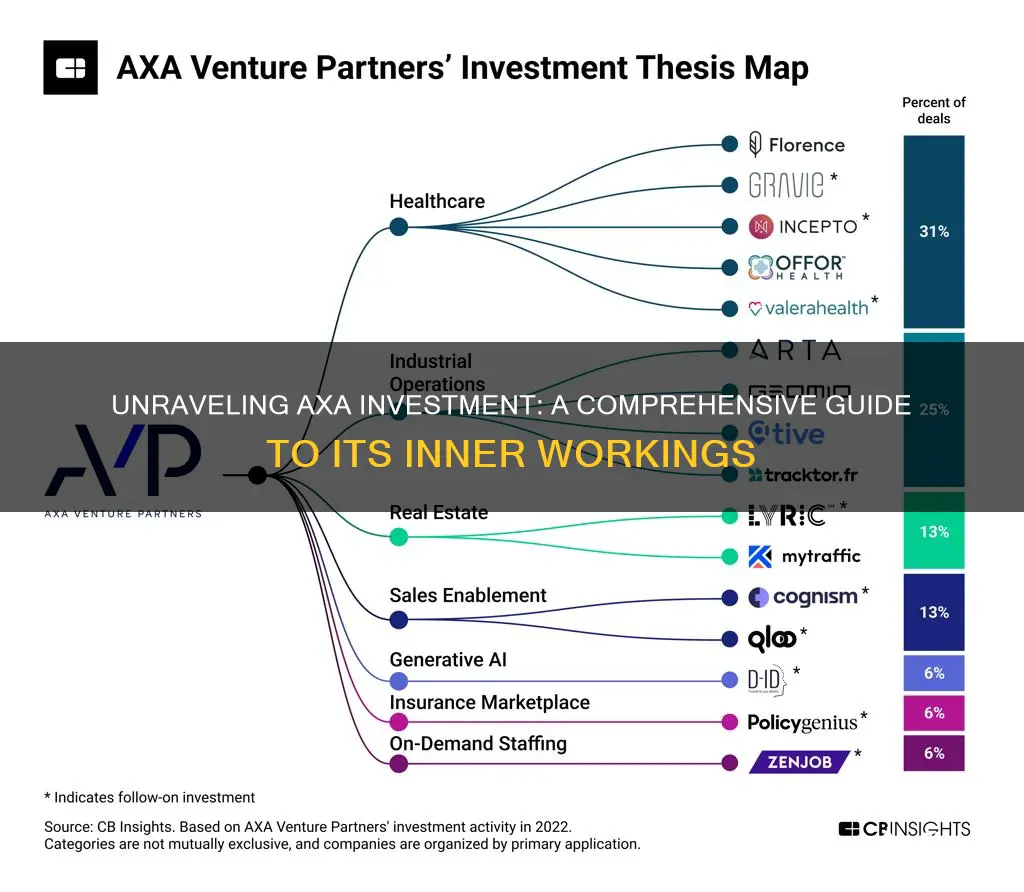

AXA Investment is a comprehensive financial service offered by AXA, a leading global insurance and asset management company. This service is designed to help individuals and institutions manage their investments and wealth effectively. It encompasses a wide range of investment products and strategies, including mutual funds, ETFs, and direct investments in stocks, bonds, and other securities. AXA Investment provides access to a diverse portfolio of assets, allowing clients to build and grow their wealth over time. The service is backed by AXA's extensive experience in the financial industry, ensuring a secure and reliable investment environment. Whether you're a beginner or an experienced investor, AXA Investment offers tailored solutions to meet your financial goals and risk tolerance.

What You'll Learn

- Investment Options: Axa offers various investment products like funds, bonds, and insurance-linked securities

- Risk Management: Axa's risk assessment tools help investors navigate market volatility and protect their portfolios

- Financial Planning: Axa provides personalized financial advice to help clients achieve their investment goals

- Market Insights: Axa's research team offers market analysis and trends to guide investment decisions

- Customer Support: Axa's dedicated support team assists clients with account management and investment queries

Investment Options: Axa offers various investment products like funds, bonds, and insurance-linked securities

Axa, a prominent global insurance and investment management company, offers a diverse range of investment options to cater to various financial goals and risk appetites. These investment products are designed to provide individuals and institutions with opportunities to grow their wealth while managing risk effectively. Here's an overview of the investment options Axa provides:

Funds: Axa offers a comprehensive selection of investment funds, which are a popular choice for investors seeking diversification and professional management. These funds can be categorized into various types, including equity funds, bond funds, mixed funds, and alternative investment funds. Equity funds invest primarily in stocks or shares, aiming to capitalize on the growth potential of companies. Bond funds, on the other hand, focus on fixed-income securities, providing a steady income stream through interest payments. Mixed funds, as the name suggests, invest in a combination of stocks and bonds, offering a balanced approach. Alternative investment funds may include real estate, private equity, or hedge funds, providing access to less traditional investment opportunities. Axa's fund range caters to different risk profiles, with options for conservative, moderate, and aggressive investors.

Bonds: Bond investments are a crucial component of Axa's portfolio, offering a more conservative approach to growing wealth. Bonds are essentially loans made by investors to governments, municipalities, or corporations. Axa provides access to various bond types, including government bonds, corporate bonds, and municipal bonds. Government bonds are considered low-risk, as they are backed by the full faith and credit of a government. Corporate bonds, issued by companies, offer higher yields but may carry more risk. Municipal bonds are issued by local governments or municipalities and often provide tax advantages. Axa's bond offerings allow investors to benefit from the stability of government securities or the potential for higher returns from corporate and municipal bonds.

Insurance-Linked Securities (ILS): Axa's investment arm also provides access to insurance-linked securities, which are a relatively new and innovative investment class. ILS are financial instruments that transfer insurance risk to the capital markets. They are designed to provide investors with exposure to the insurance and reinsurance sectors while offering diversification benefits. These securities are typically structured as bonds or notes and are backed by insurance policies or reinsurance contracts. By investing in ILS, Axa's clients can gain access to a unique and specialized market, allowing them to participate in the insurance industry's risk management and capital allocation processes.

Axa's investment options cater to a wide spectrum of investors, from those seeking stable, long-term growth to those looking for more aggressive, short-term opportunities. The company's diverse product range ensures that clients can build a well-rounded investment portfolio aligned with their financial objectives and risk tolerance. Whether it's through funds, bonds, or insurance-linked securities, Axa provides a comprehensive approach to investing, offering both traditional and alternative investment strategies.

Unraveling the Investment Portfolio: A Comprehensive Guide to Wealth Management

You may want to see also

Risk Management: Axa's risk assessment tools help investors navigate market volatility and protect their portfolios

Axa Investment Managers, a leading global asset manager, offers a comprehensive suite of risk assessment tools designed to empower investors in navigating the complex and often volatile markets. These tools are integral to Axa's investment philosophy, which emphasizes a long-term, risk-conscious approach to portfolio management. By employing advanced analytics and a deep understanding of market dynamics, Axa's risk assessment tools provide investors with valuable insights to make informed decisions.

At the heart of Axa's risk management strategy is a multi-dimensional approach to risk assessment. This involves analyzing various factors that can impact investment performance, including market, credit, liquidity, and operational risks. Axa's tools employ sophisticated algorithms and machine learning techniques to process vast amounts of data, enabling them to identify potential risks and opportunities with precision. For instance, their market risk assessment models consider economic indicators, geopolitical events, and industry-specific trends to gauge the potential impact on investment portfolios.

One of the key benefits of Axa's risk assessment tools is their ability to provide a holistic view of risk. These tools integrate different risk factors and their interrelationships, allowing investors to understand the potential impact of various risks on their portfolios. By doing so, investors can make more strategic decisions, such as adjusting asset allocations or implementing hedging strategies, to mitigate potential losses. For example, Axa's credit risk assessment module evaluates the creditworthiness of issuers, helping investors identify potential defaults and manage their exposure to credit risk effectively.

Axa's risk assessment tools also offer a forward-looking perspective, enabling investors to anticipate and prepare for potential market shifts. These tools can identify emerging risks and trends, allowing investors to proactively adjust their strategies. For instance, Axa's liquidity risk assessment helps investors understand the potential impact of market illiquidity on their holdings, enabling them to take necessary actions to ensure portfolio stability. Furthermore, Axa's risk management solutions are designed to be adaptable, allowing investors to customize their risk assessments based on their specific investment goals and risk tolerance.

In addition to providing risk insights, Axa's risk assessment tools also offer practical recommendations for portfolio optimization. These tools suggest potential adjustments to asset allocations, suggest alternative investments, or propose hedging strategies to manage risk effectively. By combining risk analysis with investment strategy, Axa empowers investors to build resilient portfolios that can withstand market volatility. This comprehensive approach to risk management is a cornerstone of Axa's investment management services, ensuring that investors can navigate the markets with confidence and achieve their long-term financial objectives.

Unraveling Distressed Debt: A Comprehensive Guide to Strategic Investing

You may want to see also

Financial Planning: Axa provides personalized financial advice to help clients achieve their investment goals

Axa, a renowned global insurance and asset management company, offers a comprehensive range of financial planning services to assist clients in reaching their investment objectives. Their approach is centered on providing tailored advice, ensuring that each client's unique financial situation and goals are considered. This personalized strategy is a cornerstone of Axa's financial planning services.

The process begins with an in-depth consultation, where Axa's financial advisors engage with clients to understand their current financial status, risk tolerance, and long-term aspirations. This initial assessment is crucial as it forms the foundation for the entire planning process. By gathering detailed information, Axa can offer advice that is not only relevant but also aligned with the client's needs. For instance, they might consider the client's age, income, existing investments, and any specific financial goals, such as retirement planning or wealth accumulation.

Once the client's profile is established, Axa's advisors employ a variety of tools and methodologies to develop a customized financial plan. This plan is designed to be dynamic, adapting to the ever-changing economic landscape and the client's evolving circumstances. Axa's expertise lies in creating strategies that are both robust and flexible, ensuring that the client's financial goals remain achievable despite market fluctuations. For example, they might suggest a mix of investment options, including stocks, bonds, and alternative investments, to diversify the portfolio and manage risk effectively.

A key aspect of Axa's financial planning is the regular review and adjustment of the investment strategy. Market conditions and personal circumstances can change over time, and Axa's advisors are equipped to provide ongoing support and guidance. They monitor the client's portfolio performance, rebalancing it as necessary to maintain the desired risk-reward profile. This proactive approach ensures that the investment strategy remains on track, helping clients stay focused on their financial objectives.

Moreover, Axa's financial planning services extend beyond investment advice. They offer a comprehensive suite of solutions, including retirement planning, tax efficiency strategies, and insurance products, all designed to work in harmony with the client's financial goals. By providing a holistic approach, Axa ensures that their clients' financial lives are managed efficiently and effectively, offering peace of mind and the confidence to pursue their financial aspirations.

Understanding Zakat on Investments: A Comprehensive Guide

You may want to see also

Market Insights: Axa's research team offers market analysis and trends to guide investment decisions

Axa Investment Managers, a prominent player in the asset management industry, leverages a robust research team to provide valuable insights and guidance to investors. This team plays a pivotal role in shaping investment strategies and decision-making processes. Here's an overview of how their market analysis and trends contribute to the investment landscape:

Market Analysis and Research: The Axa research team employs a comprehensive approach to market analysis, utilizing a wide range of data sources and tools. They delve into various sectors, industries, and global markets to identify emerging trends, potential risks, and investment opportunities. This includes studying economic indicators, company fundamentals, industry reports, and global events that could impact investment portfolios. By gathering and interpreting this data, the team generates in-depth research reports, offering investors a detailed understanding of market dynamics.

Investment Strategy Formulation: Market insights from the Axa research team are instrumental in formulating investment strategies. They analyze historical market performance, identify patterns, and make predictions about future market behavior. This analysis helps investors make informed decisions regarding asset allocation, portfolio diversification, and risk management. For instance, the team might identify sectors with strong growth potential and recommend investments in those areas, providing a strategic edge to investors.

Trend Identification and Forecasting: One of the key strengths of Axa's research team is their ability to identify and forecast market trends. They monitor global economic shifts, technological advancements, and regulatory changes that could impact various industries. By staying ahead of these trends, the team can anticipate market movements and adjust investment strategies accordingly. This proactive approach ensures that investors are well-prepared for potential market fluctuations and can make timely decisions.

Risk Assessment and Mitigation: Market analysis also involves assessing and managing risks. The Axa research team evaluates political, economic, and industry-specific risks that could affect investments. They provide investors with risk assessments and mitigation strategies, helping them navigate volatile markets. This risk management aspect is crucial for long-term investment success and ensures that portfolios are aligned with the investors' risk tolerance.

Investor Education and Communication: Additionally, Axa's research team contributes to investor education by publishing regular market insights and thought leadership pieces. They share their expertise through articles, webinars, and reports, keeping investors informed about market developments. This transparent communication fosters trust and empowers investors to make well-informed choices. By providing market analysis, the team becomes a valuable resource for investors seeking guidance in a complex and ever-changing investment landscape.

In summary, the Axa research team's market analysis and trends play a vital role in the investment process, offering investors a competitive advantage. Their comprehensive research, trend identification, and risk management capabilities contribute to well-informed investment decisions, ultimately helping investors navigate the dynamic world of finance with confidence.

AI's Investment and Research Revolution: The Future Unveiled

You may want to see also

Customer Support: Axa's dedicated support team assists clients with account management and investment queries

Axa Investment, a subsidiary of the renowned Axa Group, offers a comprehensive range of investment products and services tailored to meet the diverse needs of its clients. At the heart of this operation is a dedicated customer support team, which plays a pivotal role in ensuring a seamless and positive experience for investors. This team is the primary point of contact for clients, providing assistance with various aspects of account management and investment-related inquiries.

The support team is equipped with the knowledge and expertise to handle a wide array of issues. They are trained to provide guidance on account setup, ensuring that clients can efficiently open and manage their investment accounts. This includes explaining the different account types, such as individual or joint accounts, and the associated benefits and fees. Additionally, they offer support for account maintenance tasks, such as updating personal details, changing account preferences, and resolving any technical issues related to the online platform.

When it comes to investment queries, the Axa support team is a valuable resource. They assist clients in understanding the various investment products available, including stocks, bonds, mutual funds, and retirement plans. The team provides detailed information on investment strategies, risk assessments, and market trends, enabling clients to make informed decisions. Whether it's helping clients navigate the online investment platform, providing research materials, or offering personalized advice, the support team ensures that investors have the necessary tools and knowledge to manage their portfolios effectively.

Furthermore, the dedicated support team is committed to addressing client concerns promptly. They handle complaints and feedback, ensuring that issues are resolved efficiently. This includes assisting with fund transfers, providing statements and transaction history, and offering guidance on tax-efficient investment strategies. The team's accessibility and responsiveness contribute to building trust and long-term relationships with clients.

In summary, Axa Investment's dedicated customer support team is a vital component of their investment services. By offering comprehensive assistance with account management and investment queries, they empower clients to make the most of their investment opportunities. This level of support not only enhances the overall client experience but also reinforces Axa Investment's reputation as a trusted and reliable investment partner.

Renewable Energy's Return: Does Green Energy Pay Dividends?

You may want to see also

Frequently asked questions

Axa Investment is a financial services company that offers a range of investment products and solutions to individuals and institutions. They provide access to various markets and asset classes, helping clients grow and manage their wealth.

Axa Investment focuses on providing investment management services rather than traditional banking. They offer a more specialized approach, catering to clients seeking wealth creation and portfolio management. Axa Investment also provides access to a wider range of investment options, including stocks, bonds, funds, and alternative investments.

Axa Investment caters to a diverse range of clients, including high-net-worth individuals, institutional investors, pension funds, and retirement planners. They offer tailored solutions for different risk appetites and financial goals, ensuring a personalized investment experience.

Axa Investment utilizes various strategies depending on the client's needs and market conditions. Their approach includes active management, where they actively select investments, and passive management, which involves tracking specific market indices. They also offer thematic investing, focusing on specific sectors or trends, and quantitative investing, utilizing data-driven models for decision-making.

Getting started with Axa Investment involves contacting their team to discuss your financial goals and risk tolerance. They will provide guidance and recommend suitable investment products. You can open an account, choose your investment strategy, and start building your portfolio. Axa Investment also offers educational resources and regular market insights to help clients make informed decisions.