The 1970s was a decade of significant economic shifts and market fluctuations, making it an intriguing period to explore investment strategies. During this time, various assets and sectors demonstrated resilience and growth, offering valuable insights for investors. From the rise of real estate as a stable investment to the performance of stocks in specific industries, understanding the investment landscape of the 1970s can provide a historical perspective on market dynamics and help investors learn from past successes and challenges. This exploration will delve into the key investments that thrived, shedding light on the factors that contributed to their success and the lessons they offer for modern investors.

What You'll Learn

- Oil and Gas: Rising prices fueled investment in exploration and production

- Real Estate: The decade's economic growth boosted property values and demand

- Stocks: Tech and consumer sectors saw strong performance, outpacing other asset classes

- Bonds: Government bonds provided stability, especially in the early 1970s

- Inflation-Protected Securities: Treasury Inflation-Protected Securities (TIPS) gained popularity for their hedging benefits

Oil and Gas: Rising prices fueled investment in exploration and production

The 1970s was a pivotal decade for the oil and gas industry, marked by significant geopolitical events and economic shifts that had a profound impact on global markets. One of the most notable trends during this period was the surge in oil prices, which was primarily driven by the 1973 oil crisis and the 1979 energy crisis. These events led to a dramatic increase in the cost of oil, causing a ripple effect across the global economy. As a result, the oil and gas sector experienced a period of intense investment and exploration, as companies sought to capitalize on the rising prices and secure their position in a market that was becoming increasingly volatile.

The oil crisis of 1973, initiated by the Organization of Arab Petroleum Exporting Countries (OPEC), was a turning point. It resulted in an oil embargo, causing a sharp decline in oil supplies and a subsequent spike in prices. This event not only highlighted the strategic importance of oil but also the potential for significant financial gains in the oil and gas industry. Investors and companies alike recognized the opportunity to profit from the rising prices, leading to a surge in investment in exploration and production. The crisis underscored the need for energy security and the potential for political instability to impact the market, further driving investment in the sector.

In response to the rising prices, many oil companies increased their exploration activities, particularly in regions that were previously considered less accessible or economically unviable. Advanced drilling technologies, such as directional drilling and hydraulic fracturing (fracking), were employed to access oil reserves in deeper and more challenging environments. This period saw a significant shift in the industry's focus, with companies investing heavily in new technologies and infrastructure to enhance their exploration and production capabilities. The development of these technologies not only improved access to reserves but also contributed to the overall efficiency and productivity of the industry.

The investment in oil and gas exploration during the 1970s had a lasting impact on the industry's landscape. It led to the discovery of numerous significant oil fields, some of which became major sources of revenue for the companies involved. For instance, the North Sea oil fields, which were previously considered too expensive to exploit, became a focal point for investment due to the rising oil prices. This period also saw the emergence of new players in the market, as smaller, more agile companies entered the industry, taking advantage of the favorable conditions to establish themselves as significant players in the oil and gas sector.

Furthermore, the 1970s investment boom in oil and gas exploration had long-term effects on the global energy market. It contributed to the diversification of energy sources and the development of alternative energy technologies. As the industry faced the challenges of rising prices and geopolitical tensions, there was a growing emphasis on sustainable practices and the exploration of renewable energy sources. This period, therefore, not only shaped the oil and gas industry but also influenced the broader energy sector, setting the stage for the transition towards more sustainable and diverse energy portfolios in the decades that followed.

Retirement Reinvented: Navigating Post-Career Investment Strategies

You may want to see also

Real Estate: The decade's economic growth boosted property values and demand

The 1970s was a pivotal decade for real estate, marked by significant economic shifts that transformed the property market. As the decade began, the post-war economic boom had started to wane, leading to a period of economic uncertainty. However, this period also brought about a unique opportunity for investors in the real estate sector. The economic growth of the 1970s, driven by technological advancements and the expansion of the service industry, had a profound impact on property values and demand.

One of the key factors that contributed to the success of real estate investments during this time was the rise in disposable income. As more people entered the workforce and benefited from the expanding economy, their purchasing power increased. This led to a surge in demand for housing, as individuals and families sought to secure their own homes. The construction industry responded to this demand by building new residential properties, which in turn increased the overall supply of housing. This dynamic created a competitive market, where buyers had more options and could negotiate better terms, ultimately driving up property values.

The economic growth of the 1970s also led to the development of new commercial properties. With the expansion of the service industry, there was a growing need for office spaces, retail stores, and other commercial real estate. Investors who recognized this shift and invested in commercial properties stood to benefit significantly. As businesses flourished and expanded, they required larger and more specialized spaces, leading to a steady appreciation in commercial real estate values. This trend was particularly prominent in urban areas, where the concentration of economic activities attracted more investment.

Another aspect that favored real estate investments was the government's policies and incentives. In an effort to stimulate the economy, governments often implemented measures that encouraged property development and ownership. These policies could include tax benefits, subsidies, or favorable lending rates, making it more attractive for individuals and institutions to invest in real estate. For instance, the government's focus on affordable housing initiatives during this period provided opportunities for investors to acquire properties at lower prices and then resell them at a profit once the market stabilized.

Furthermore, the 1970s saw the rise of a new generation of investors who were quick to identify emerging trends. These investors kept a close eye on the changing demographics and economic patterns, allowing them to make strategic decisions. For example, the growing popularity of suburban living, driven by the desire for more space and a better quality of life, presented a lucrative opportunity for developers and investors. By building residential complexes and shopping centers in suburban areas, they catered to the changing preferences of buyers and investors alike.

In summary, the 1970s offered a unique investment landscape for real estate, fueled by economic growth, changing demographics, and favorable government policies. The decade's economic shifts boosted property values and demand, creating a competitive market for investors. Whether it was residential or commercial real estate, the 1970s proved to be a golden era for those who recognized the potential and acted accordingly.

GME Investors: Who's In?

You may want to see also

Stocks: Tech and consumer sectors saw strong performance, outpacing other asset classes

The 1970s was a decade of significant economic and political upheaval, but for investors, it presented a unique opportunity to capitalize on certain sectors and asset classes. One of the most prominent investment strategies during this period was the focus on technology and consumer-related stocks, which outperformed many other areas of the market.

The tech sector was in its infancy, and companies like Apple, Intel, and Microsoft were just beginning to make their mark. These early tech giants, along with other innovative firms, experienced rapid growth and became major drivers of the stock market's performance. The rise of personal computing, software development, and the emergence of new technologies like microprocessors fueled investor interest in tech stocks. Many investors recognized the potential for long-term growth in this sector, as these companies were at the forefront of technological advancements, which would shape the future of the global economy.

Consumer-related stocks also thrived during this decade. The consumer sector, encompassing industries such as retail, food, and beverages, benefited from the growing disposable income of the middle class. As the economy expanded, consumers had more spending power, and companies that provided essential goods and services flourished. Retail giants, such as Walmart and Target, expanded their operations and attracted investors seeking stable, dividend-paying stocks. Additionally, consumer product companies, like Procter & Gamble and Coca-Cola, saw strong performance as their brands became household names, benefiting from effective marketing strategies and a growing demand for convenience.

The performance of these sectors can be attributed to several factors. Firstly, the technological advancements and innovations during the 1970s laid the foundation for future growth. The development of new products and services, such as microprocessors, personal computers, and advanced software, created a ripple effect across various industries, leading to increased productivity and efficiency. Secondly, the consumer market's expansion was fueled by the post-war baby boom generation reaching adulthood and entering the workforce, resulting in higher disposable income and a growing demand for goods and services.

Investors who focused on the tech and consumer sectors during the 1970s were able to capitalize on the early stages of these industries, which would later become the backbone of the global economy. The long-term growth potential of these sectors was evident, and many investors recognized the opportunity to build substantial wealth over time. While other asset classes, such as real estate and commodities, also had their moments, the tech and consumer sectors consistently outperformed, making them a key focus for investors seeking strong returns during this decade.

Dogecoin Dilemma: To Buy or To Invest?

You may want to see also

Bonds: Government bonds provided stability, especially in the early 1970s

In the 1970s, government bonds were a reliable and stable investment option, particularly during the early years of the decade. This period was characterized by economic uncertainty and high inflation, making it a challenging time for investors. However, government bonds offered a sense of security and predictability, which was highly valued by investors seeking to protect their capital.

The early 1970s saw a significant rise in inflation, often referred to as 'stagflation', a combination of high inflation and high unemployment. This economic environment made traditional investments, such as stocks, less attractive due to the volatility and uncertainty. In contrast, government bonds, which are typically considered low-risk investments, became a more appealing choice. Governments, needing to finance their operations and projects, issued bonds as a means of borrowing money from investors. These bonds offered a fixed income stream, providing investors with a steady return on their investment, which was crucial during a time of economic uncertainty.

Government bonds are generally considered safer investments because they are backed by the full faith and credit of the issuing government. This means that even if the economy takes a downturn, the risk of default on these bonds is relatively low. During the 1970s, as inflation eroded the purchasing power of money, government bonds provided a hedge against this economic phenomenon. Investors could earn a fixed income that, while not keeping pace with inflation, at least maintained the value of their capital to some extent.

The stability of government bonds was particularly important during the early 1970s when the economy was in a state of flux. As the decade progressed, the investment landscape evolved, and other asset classes, such as real estate and certain commodities, began to gain traction. However, for the first half of the decade, government bonds remained a cornerstone of investment portfolios, offering a safe haven for investors seeking to navigate the turbulent economic waters of the time.

In summary, government bonds were a key investment strategy in the 1970s, especially during the early years, due to their stability and predictability. This investment option provided a sense of security for investors during a period of economic uncertainty and high inflation, making it a valuable asset in any investment portfolio.

Consols: Unlocking the Secrets of Historic Investment Strategies

You may want to see also

Inflation-Protected Securities: Treasury Inflation-Protected Securities (TIPS) gained popularity for their hedging benefits

The 1970s was a decade of significant economic challenges, including high inflation and rising interest rates, which presented investors with a unique set of opportunities and risks. Amidst this turbulent environment, one investment strategy that gained prominence was the utilization of Inflation-Protected Securities, specifically Treasury Inflation-Protected Securities (TIPS). TIPS emerged as a valuable tool for investors seeking to hedge against the adverse effects of inflation and secure the purchasing power of their investments.

TIPS are government-issued securities designed to protect investors from the impact of inflation. They are linked to the Consumer Price Index (CPI), ensuring that the principal value of the security adjusts with inflation. When inflation rises, the principal value of TIPS increases, and when it falls, the principal value decreases, thus maintaining the real value of the investment. This feature made TIPS an attractive option for investors who wanted to safeguard their capital and preserve the value of their money over time.

The popularity of TIPS in the 1970s can be attributed to several factors. Firstly, the decade's economic climate was characterized by double-digit inflation rates, which eroded the purchasing power of traditional fixed-income investments. TIPS provided a solution by offering a fixed income stream that adjusted for inflation, ensuring that investors received a real return on their investments. This was particularly appealing to retirees and individuals seeking stable, long-term savings.

Secondly, TIPS were seen as a safer alternative to other investments during a period of economic uncertainty. With the stock market experiencing significant volatility, investors sought more stable and secure options. TIPS, being backed by the full faith and credit of the U.S. government, offered a lower-risk investment choice, providing a sense of security and stability in a turbulent market.

Furthermore, the hedging benefits of TIPS were particularly attractive to investors with existing portfolios. By incorporating TIPS into their investment mix, they could effectively manage the risk associated with inflation. This strategy allowed investors to protect a portion of their assets while still benefiting from potential gains in other areas of their portfolio. As a result, TIPS became a popular choice for diversifying investment portfolios and mitigating the risks associated with high inflation.

In summary, the 1970s economic landscape, marked by high inflation and uncertainty, provided the impetus for the rise of Inflation-Protected Securities, particularly TIPS. Their ability to hedge against inflation and provide a stable, real return made them an essential tool for investors. TIPS offered a practical solution for individuals and institutions seeking to safeguard their wealth and maintain the purchasing power of their investments during this challenging decade.

The Future of Investing: Navigating the Complex World of 'Will Invest' Tense

You may want to see also

Frequently asked questions

The 1970s was a decade of significant economic challenges, including high inflation and rising interest rates. Despite these hurdles, several investment approaches proved successful. One notable strategy was investing in real estate, as property values often outpaced inflation, providing attractive returns. Additionally, the energy sector was a key beneficiary of the oil price shocks, making energy stocks a popular choice.

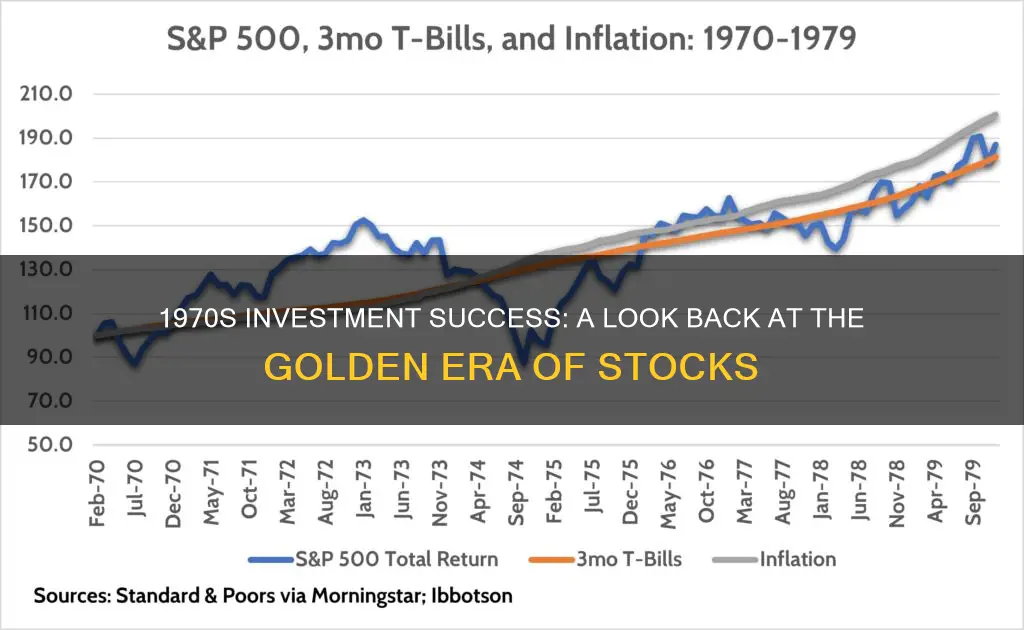

The 1970s stock market experienced a rollercoaster ride. The decade began with a bear market, but the market rebounded strongly in the mid-1970s, driven by the energy sector's performance. The S&P 500 index more than doubled from its 1970 low to its peak in 1973. However, the late 1970s saw a market correction, and the overall trend for the decade was a decline in stock prices, with the market underperforming compared to the previous decade.

Absolutely! The 1970s saw the rise of several prominent mutual funds and investment companies. One notable example is the Fidelity Contrafund, which was launched in 1974 and became one of the most successful mutual funds of all time. It focused on growth stocks and consistently delivered strong returns, attracting investors seeking long-term capital appreciation.

One of the critical mistakes investors should have avoided in the 1970s was over-diversification. With the market's volatility, holding a well-diversified portfolio became crucial. Investors should also be cautious of speculative investments, especially in the early part of the decade, as the market was still recovering from the previous bear market. Additionally, failing to keep up with market trends and economic indicators could lead to poor investment decisions.