Diversification is a risk management strategy that involves spreading investments across different asset classes, industries, and sectors to reduce the overall risk of an investment portfolio. By holding a variety of investments, the poor performance of one investment can be offset by the better performance of another, leading to a more consistent overall return. This strategy helps to smooth out market volatility and limit exposure to any single asset or risk.

The benefits of diversification include improved potential returns, risk reduction, and increased stability. By owning multiple assets that perform differently, investors can reduce the overall risk of their portfolio, ensuring that no single investment can cause significant harm.

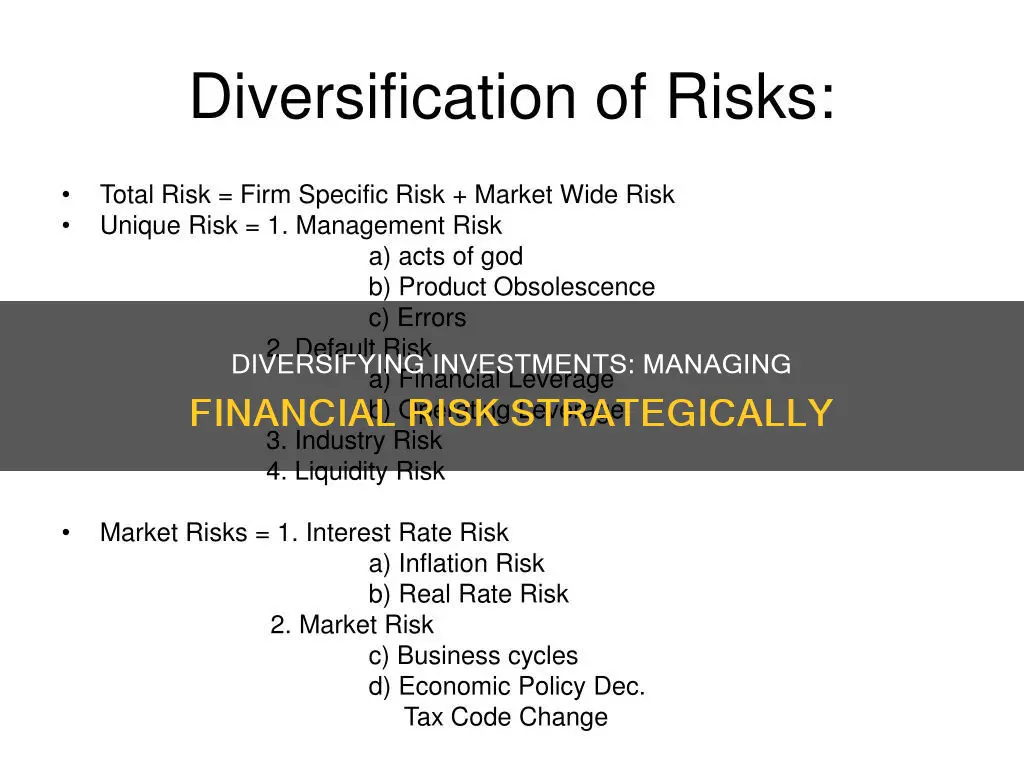

Diversification can be achieved by investing in a range of asset classes such as stocks, bonds, real estate, funds, and cash. It is important to consider different types of risk, such as interest rates, inflation, individual securities, and government policies, when implementing diversification strategies.

While diversification can reduce asset-specific risk, it cannot eliminate market risk. It is important to note that diversification may also lead to lower portfolio-wide returns and can be cumbersome and expensive to manage.

Overall, diversification is a powerful tool for investors to balance risk and reward, smoothen returns, and improve the potential for long-term financial gains.

What You'll Learn

Diversification across asset classes

Diversification is a risk management strategy that mixes a wide variety of investments within a portfolio to reduce financial risk. One of the primary methods of diversification is to invest in different asset classes.

The three main asset classes are stocks, bonds, and cash or cash equivalents. Stocks allow investors to own a piece of a company and offer the highest long-term gains, but they are volatile, especially in a cooling economy. Bonds pay interest to investors who lend money to a company or government and are income generators with modest returns. Cash is low on risk and returns and can buffer volatility or unexpected expenses.

Other asset classes include real estate, commodities, precious metals, and alternative investments such as cryptocurrency. These asset classes usually have a lower correlation to the stock market and can aid in diversification.

Within stocks, investors can diversify by industry, company size, and geography. Industries can be cyclical, with demand growing as the economy strengthens, or defensive, where demand is less impacted by the economic cycle. Larger companies tend to be more stable, while smaller companies have more growth potential.

Within bonds, investors can diversify by creditworthiness or safety, bond issuer, and term length. Longer-term bonds have higher returns but are subject to more interest rate risk. Bonds issued by the US government are considered safer, while those from lower-grade corporations share performance characteristics with stocks.

Benefits of Diversification Across Asset Classes

Drawbacks of Diversification Across Asset Classes

While diversification can reduce asset-specific risk, it cannot eliminate market risk. Diversification may also lead to lower short-term returns, as the goal of diversification is to reduce risk within a portfolio. By reducing risk, an investor is willing to accept lower profits in exchange for the preservation of capital.

Additionally, diversification can be cumbersome and expensive to manage, especially with multiple holdings and investments. Buying and selling investments can affect the bottom line through transaction fees and brokerage charges.

Best Practices for Diversification Across Asset Classes

To achieve effective diversification, investors should blend dissimilar assets so that their portfolio is not overly exposed to one individual asset class or market sector. Stocks from many different sectors should be included, and bonds or other fixed-income securities can protect against a dip in the stock market.

Investors can also diversify their portfolios by investing in both domestic and international markets. International markets can be further classified as developed or emerging. Developed markets tend to have more stability, while emerging markets are more volatile but have higher growth potential.

Tools for Diversification Across Asset Classes

Investors can achieve diversification by purchasing individual securities or through mutual funds, index funds, or exchange-traded funds (ETFs). Mutual funds and ETFs are inexpensive and can be traded at no cost by major brokerages, making it easy to get started with diversification. Robo-advisors are another option, providing automated portfolio rebalancing and exposure to a range of asset classes.

Savings and Investments: Your Guide to Financial Freedom

You may want to see also

Diversification within asset classes

There are five crucial asset categories: derivatives, fixed income, real estate, cash and cash equivalents, and equity. Alternative categories include bitcoins and hedge funds.

Each asset class is unique in terms of related risk, taxation, ownership, exchangeability, revenue, rules, and market instability.

- Stocks: Shares or equity in a publicly traded company

- Bonds: Government and corporate fixed-income debt instruments

- Real estate: Land, buildings, natural resources, agriculture, livestock, and water and mineral deposits

- Exchange-traded funds (ETFs): A marketable basket of securities that follow an index, commodity, or sector

- Commodities: Basic goods necessary for the production of other products or services

- Cash and short-term cash equivalents (CCE): Treasury bills, certificates of deposit (CD), money market vehicles, and other short-term, low-risk investments

The benefits of diversification within asset classes include:

- Reducing overall risk and losses

- Obtaining expected portfolio returns

- Increasing risk-adjusted returns

- Making investing more enjoyable by encouraging the exploration of different unique investments

However, diversification within asset classes may also lead to lower portfolio-wide returns and higher management costs. It is important to consider time horizon and risk tolerance when determining the level of diversification within asset classes.

Saving Plans: The Benefits of a Conservative Financial Strategy

You may want to see also

Diversification across sectors and industries

Diversification is a risk management strategy that mixes a wide variety of investments within a portfolio to reduce the overall risk of an investment portfolio. It is the idea that by holding a variety of investments, the poor performance of any one investment can be offset by the better performance of another, leading to a more consistent overall return.

Additionally, diversification within a sector or industry can also be beneficial. For instance, investing in both airline and railway stocks can help protect against detrimental changes in the airline industry, as passengers may turn to alternative modes of transportation.

When diversifying across sectors and industries, it is important to consider the risks associated with the companies operating within those sectors or industries. For example, anything that affects travel, in general, will hurt both the airline and railway industries. In this case, it would be prudent to also consider investing in sectors or industries that are less affected by travel, such as technology or media companies.

Other Diversification Strategies

In addition to diversifying across sectors and industries, there are several other diversification strategies that investors can employ:

- Diversifying across companies: Investing in multiple companies within the same industry can help reduce company-specific risks related to leadership changes, legislation, acts of nature, or consumer preferences.

- Diversifying across asset classes: Investing in different asset classes such as stocks, bonds, real estate, or cryptocurrencies can help protect against widespread financial risks, as different asset classes respond differently to macroeconomic conditions.

- Diversifying across borders: Investing in companies from different countries can provide exposure to different opportunities and risk levels, as well as help protect against country-specific risks.

- Diversifying across time frames: Considering the time frame of investments can help balance risk and return, as longer-term investments tend to have higher risk but also potentially higher returns.

- Diversifying across alternative asset classes: Investing in alternative asset classes such as real estate, commodities, or cryptocurrencies can provide additional diversification benefits while potentially increasing the portfolio's return.

Understanding the Components of a Successful Investment Portfolio

You may want to see also

Diversification across companies

Diversification is a risk management strategy that involves spreading investments across different companies to reduce the overall risk of an investment portfolio. By holding a variety of investments, the poor performance of any one investment can be offset by the better performance of another, leading to a more consistent overall return.

- Diversification by asset class: The three main asset classes are stocks, bonds, and cash or cash equivalents. Stocks offer the highest long-term gains but are volatile, especially in a cooling economy. Bonds are income generators with modest returns but are usually weaker during an expanding economy. Cash has low risk and low returns.

- Diversification within stocks: Diversification can be achieved by investing in companies across different sectors and industries. This is because each sector and industry is affected differently by the economic cycle. For example, consumer discretionary, financial services, and real estate sectors are considered cyclical, as their performance is closely tied to the economic cycle. In contrast, consumer staples, utilities, and healthcare are considered defensive sectors, as they tend to be less impacted by economic fluctuations.

- Diversification by company size and style: Diversification can also be achieved by investing in companies of varying sizes, known as market capitalization. Larger companies tend to be more stable but have less growth potential, while smaller companies have higher growth potential but carry more risk. Additionally, diversification can be achieved by investing in a mix of growth and value stocks. Growth stocks are expected to experience high growth and are often expensive, while value stocks appear to be undervalued or trading at a discount.

- Geographic diversification: Investing in companies from different geographic locations, including domestic and international markets, can also help reduce risk. International markets can be further categorized into developed and emerging markets. Developed markets tend to have more stability, while emerging markets have higher growth potential but are more volatile.

- Diversification of investment vehicles: Diversification can be achieved by investing in a mix of stocks, bonds, mutual funds, index funds, exchange-traded funds (ETFs), and other investment vehicles. Each of these vehicles has different risk and return profiles, and by combining them, investors can reduce their overall risk.

By diversifying across companies using these strategies, investors can reduce the impact of company-specific risks and improve the overall stability of their investment portfolio.

Investment Management Fees: Are They Deductible by a Trust?

You may want to see also

Diversification across borders

Diversification is a crucial risk management strategy for investors, and one way to achieve this is through diversification across borders.

Diversifying across borders means investing in companies and holdings across different countries and regions. This strategy allows investors to access a broader range of opportunities and benefit from different monetary policies, economic growth, and sector strengths in various parts of the world. For instance, the US market may be negatively impacted by legislative changes to corporate tax rates, while other markets may be less affected. By including international stocks in their portfolio, investors can reduce the risk of losses during an economic downturn in their own country.

Different countries have different correlations to one another, and by investing in a variety of regions, investors can benefit from these varying relationships. For example, the US equity market may be more expensive and offer lower dividend yields compared to other regions. By diversifying into less expensive regions with higher dividend yields, investors can potentially increase their returns.

Additionally, diversifying across borders allows investors to tap into the growth potential of emerging markets. Countries like India, Brazil, and Vietnam are experiencing robust economic growth, driven by factors such as technological advancements and expanding middle classes. This provides fertile ground for investments in sectors such as technology, healthcare, and renewable energy.

However, investing internationally also comes with challenges. Political instability, currency fluctuations, and regulatory differences can impact the value of international investments. To mitigate these risks, investors should consider employing hedging strategies, diversifying across multiple regions and sectors, and conducting thorough due diligence.

Benefits of Diversification

Diversification is a powerful tool for managing financial risk. By spreading investments across various asset classes, industries, and geographical regions, investors can reduce the impact of any single investment's poor performance on their overall portfolio. This strategy aims to lower portfolio volatility and provide more consistent returns over time.

Portfolio Diversification: An Investment Strategy Guide

You may want to see also

Frequently asked questions

Diversifying investments can reduce the overall risk while increasing the potential for overall return. By owning multiple assets that perform differently, investors reduce the overall risk of their portfolio, so that no single investment can hurt them too much. Diversification smooths returns, making them more consistent and stable.

Diversification involves spreading investments across different asset classes, industries, and geographic regions. The idea is that by holding a variety of investments, the poor performance of any one investment can be offset by the better performance of another.

Stocks, bonds, real estate, cryptocurrency, commodities, and cash or cash equivalents.