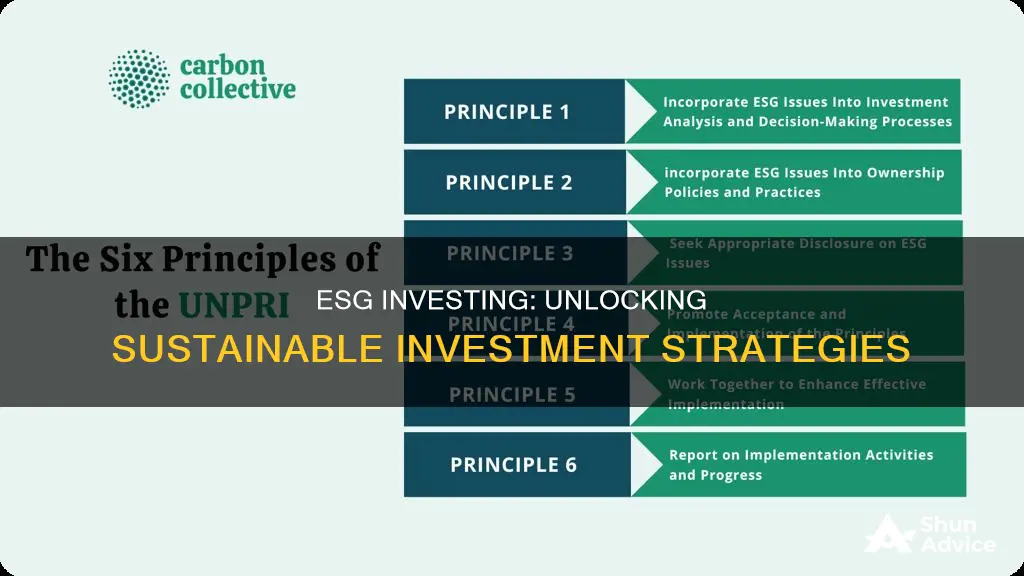

ESG investing, or Environmental, Social, and Governance investing, is a growing trend in the financial world, where investors focus on companies that demonstrate a commitment to sustainability and ethical practices. This approach goes beyond traditional financial metrics, considering factors like a company's environmental impact, its treatment of employees, and its governance structures. By integrating these criteria, investors aim to create long-term value while contributing to positive societal and environmental changes. This method is becoming increasingly popular as investors seek to align their portfolios with their values and contribute to a more sustainable future.

What You'll Learn

- ESG Criteria: Companies are evaluated based on environmental, social, and governance factors

- Impact Measurement: Investors assess the tangible impact of ESG factors on financial performance

- Integration: ESG factors are integrated into investment analysis alongside traditional financial metrics

- Risk Management: ESG data helps identify and mitigate risks, enhancing portfolio resilience

- Sustainability Reporting: Companies disclose ESG data to meet regulatory requirements and investor expectations

ESG Criteria: Companies are evaluated based on environmental, social, and governance factors

ESG investing, or Environmental, Social, and Governance investing, is a powerful approach to investing that goes beyond traditional financial metrics. It involves assessing and selecting companies based on their performance and commitment to environmental, social, and governance (ESG) factors. These factors are crucial in understanding a company's long-term sustainability and its impact on society and the environment.

Environmental criteria focus on a company's impact on the natural world. This includes its carbon footprint, energy efficiency, waste management, and resource consumption. Investors look for companies that demonstrate a commitment to reducing environmental harm, such as those implementing renewable energy sources, adopting circular economy practices, or actively working towards carbon neutrality. For instance, a company might be evaluated on its water usage, with a positive score awarded for implementing water recycling systems or reducing water consumption.

Social factors encompass a wide range of issues, including labor practices, human rights, customer satisfaction, and community engagement. Investors assess companies' treatment of employees, suppliers, and customers, as well as their impact on local communities. A company might be praised for its commitment to fair wages, diverse hiring practices, and ethical supply chain management. Social criteria also include a company's approach to product safety, data privacy, and customer data protection.

Governance is about the internal processes and structures that guide a company's decision-making. This includes board diversity, executive compensation, shareholder rights, and transparency in financial reporting. Investors seek companies with strong corporate governance, which often leads to better long-term performance and reduced risk of fraud or mismanagement. A well-governed company is likely to have a more stable and ethical business model.

The evaluation of these ESG criteria is a complex process, often involving specialized research and data from various sources. Investors use ESG ratings and reports to compare companies and make informed investment decisions. These ratings consider a company's performance across multiple ESG factors, providing a comprehensive overview. For example, a company might receive high scores for its environmental initiatives but lower scores for its social impact on local communities. This detailed assessment allows investors to align their portfolios with their values and contribute to positive change.

Biden's Retirement Investment Rule: A Game-Changer for Americans' Golden Years

You may want to see also

Impact Measurement: Investors assess the tangible impact of ESG factors on financial performance

ESG investing, or Environmental, Social, and Governance investing, is a strategy that integrates these factors into investment decisions, aiming to create long-term value while addressing societal and environmental concerns. Impact measurement is a critical aspect of this approach, as it allows investors to assess the tangible outcomes of their ESG-focused investments. This process involves evaluating the direct and indirect effects of ESG factors on financial performance, which is essential for making informed investment choices.

Investors employ various methods to measure the impact of ESG factors. One common approach is to analyze the correlation between a company's ESG performance and its financial metrics. This can be done by comparing companies with strong ESG practices to those with weaker practices within the same industry. For instance, a study might reveal that companies with higher ESG ratings tend to have better financial stability, as indicated by lower debt-to-equity ratios and higher credit ratings. This correlation provides a quantitative measure of the impact of ESG factors on financial health.

Another impact measurement technique is to track the long-term financial performance of companies with strong ESG practices. Investors can study historical data to determine if companies that prioritize ESG factors tend to outperform their peers over time. This analysis can be further refined by controlling for other factors that might influence financial performance, such as industry trends or macroeconomic conditions. By isolating the impact of ESG factors, investors can gain insights into the potential for sustainable value creation.

Additionally, investors often use ESG ratings and assessments provided by independent agencies. These ratings consider various ESG factors and assign scores or grades, which can be used to benchmark companies' performance. Investors can then compare these ratings across different companies to identify those with superior ESG practices. This approach provides a standardized way to measure and communicate the impact of ESG factors, making it easier for investors to make informed decisions.

In summary, impact measurement in ESG investing involves a systematic evaluation of the relationship between ESG factors and financial performance. By employing statistical analysis, historical data comparison, and standardized ratings, investors can assess the tangible impact of ESG considerations. This process enables investors to make more sustainable investment choices, aligning financial gains with environmental, social, and governance responsibilities. It also encourages companies to adopt better practices, fostering a more sustainable and responsible business environment.

The Evolution of Will Restaurant Investment Group: A Culinary Journey

You may want to see also

Integration: ESG factors are integrated into investment analysis alongside traditional financial metrics

ESG investing, which stands for Environmental, Social, and Governance investing, is a growing trend in the financial world, where investors consider factors beyond just financial performance when making investment decisions. The integration of ESG factors into investment analysis is a key aspect of this approach, allowing investors to make more informed and sustainable choices. This process involves incorporating environmental, social, and governance criteria alongside traditional financial metrics to evaluate and select investments.

When integrating ESG factors, investors analyze a company's performance and potential risks through a more holistic lens. Environmental factors consider the company's impact on the environment, such as its carbon footprint, resource efficiency, and adherence to sustainability standards. Social factors examine the company's relationships with its employees, customers, and the communities it operates in, including labor practices, human rights, and diversity and inclusion policies. Governance factors assess the quality of a company's leadership, executive compensation, board structure, and accountability measures.

By integrating these factors, investors can identify companies that not only have strong financial prospects but also demonstrate a commitment to sustainable and ethical practices. For example, an investor might consider a company's renewable energy initiatives, its impact on local communities, and its board's diversity when making investment decisions. This approach allows for a more comprehensive evaluation, ensuring that investments are aligned with the investor's values and long-term goals.

The integration process often involves specialized tools and methodologies. Investors may use ESG ratings and scores provided by independent agencies, which assign companies a rating based on their performance in various ESG categories. These ratings can be integrated into financial models and analysis frameworks, enabling investors to compare companies across sectors and identify those that excel in sustainability and governance. Additionally, some investment firms have developed proprietary models that weight and analyze ESG factors alongside financial data, providing a comprehensive view of a company's potential.

This integration of ESG factors into investment analysis is a powerful tool for investors who want to contribute to positive change while also seeking financial returns. It encourages companies to adopt more sustainable practices and fosters a market that rewards responsible behavior. As the global focus on sustainability and corporate responsibility grows, the integration of ESG factors will likely become even more prevalent, shaping the future of investment strategies and market dynamics.

Young Investors: Where to Begin?

You may want to see also

Risk Management: ESG data helps identify and mitigate risks, enhancing portfolio resilience

ESG investing, which stands for Environmental, Social, and Governance investing, is a powerful approach to risk management in the financial world. It involves integrating ESG factors into investment decisions, allowing investors to build more resilient portfolios. Here's how ESG data plays a crucial role in this process:

Identifying Risks: ESG data provides a comprehensive view of a company's operations, enabling investors to identify potential risks that might not be apparent through traditional financial analysis. For instance, environmental data can reveal a company's exposure to climate-related risks, such as the impact of extreme weather events on its operations or the potential for regulatory changes affecting its industry. Social factors, such as labor practices and human rights issues, can also be assessed to gauge the company's ability to manage risks associated with its supply chain or workforce. Governance metrics, including board diversity and executive compensation, offer insights into a company's internal controls and decision-making processes, which are vital for risk assessment.

Risk Mitigation and Portfolio Resilience: By analyzing ESG data, investors can make informed decisions to mitigate risks and enhance portfolio resilience. For example, if a company has a poor environmental record, investors might choose to divest from it or negotiate for improved sustainability practices. In the social sphere, investors can identify companies with strong labor relations and diverse, inclusive workplace cultures, reducing the risk of reputational damage or legal issues. Governance-related risks, such as a lack of transparency or high executive turnover, can be addressed by selecting companies with robust governance structures and ethical leadership. This proactive approach to risk management allows investors to build portfolios that are not only financially robust but also aligned with sustainable and responsible investment principles.

ESG data empowers investors to make strategic choices, ensuring that their investments are not only profitable but also contribute to positive environmental and social outcomes. It encourages a long-term perspective, where companies with strong ESG practices are more likely to navigate challenges and maintain their competitive edge. As a result, investors can better manage risks and build portfolios that are resilient and aligned with their values.

In summary, ESG investing is a comprehensive risk management strategy that utilizes ESG data to identify and address various risks. This approach enables investors to make informed decisions, ensuring their portfolios are not only financially sound but also environmentally and socially responsible, thus fostering a more sustainable and resilient investment landscape.

Unveiling Cisco Investments: How It Works and What It Offers

You may want to see also

Sustainability Reporting: Companies disclose ESG data to meet regulatory requirements and investor expectations

Sustainability reporting is a critical practice in the modern business landscape, where companies are increasingly aware of the importance of environmental, social, and governance (ESG) factors in their operations. This process involves the disclosure of ESG data, which provides a comprehensive overview of a company's sustainability performance and its impact on various stakeholders. The primary purpose of sustainability reporting is to meet both regulatory obligations and the expectations of investors, who are increasingly interested in the long-term viability and ethical practices of the companies they support.

Regulatory bodies around the world have introduced various standards and guidelines to ensure that companies provide transparent and accurate ESG information. These standards often mandate the disclosure of specific data points, such as greenhouse gas emissions, energy consumption, waste management practices, labor standards, and board diversity. For instance, the European Union's Non-Financial Reporting Directive (NFRD) requires large companies to disclose non-financial information, including ESG data, to ensure a level of transparency that allows stakeholders to assess the company's sustainability performance. Similarly, the SEC in the United States has proposed rules that would require public companies to disclose climate-related risks and emissions data, aligning with global efforts to combat climate change.

Investors, including institutional investors, asset managers, and individual investors, are increasingly integrating ESG factors into their investment decisions. They recognize that ESG performance can significantly impact a company's long-term value and risk profile. By reviewing sustainability reports, investors can identify companies that demonstrate strong ESG practices, such as effective environmental management, ethical labor practices, and transparent governance. This information helps investors make more informed choices, ensuring their investments align with their values and risk preferences. For example, investors may prefer companies with robust sustainability reporting as they are more likely to have better risk management practices, attract and retain top talent, and maintain a positive brand image, all of which contribute to long-term financial success.

The process of sustainability reporting involves a systematic collection and analysis of data related to various ESG factors. Companies typically engage in a thorough review of their operations, identifying key performance indicators and metrics that are relevant to their industry and sustainability goals. This may include data on carbon emissions, water usage, waste reduction, employee diversity, customer satisfaction, and board composition. Once the data is gathered, companies must ensure its accuracy and completeness, often engaging external auditors to verify the information. The reported data is then presented in a structured and transparent manner, making it accessible to investors, regulators, and the public.

In summary, sustainability reporting is a vital mechanism for companies to demonstrate their commitment to ESG principles and meet the demands of a rapidly changing business environment. By disclosing relevant data, companies can ensure compliance with regulatory requirements, attract environmentally and socially conscious investors, and build a positive reputation. As the global focus on sustainability continues to grow, effective sustainability reporting will become even more crucial for companies aiming to thrive in the long term while contributing to a more sustainable and responsible economy.

The Great Debate: Paying Off Loans vs. Investing During Residency

You may want to see also

Frequently asked questions

ESG investing, or Environmental, Social, and Governance investing, is an investment approach that considers factors beyond traditional financial metrics. It focuses on companies that demonstrate strong performance and commitment to environmental sustainability, social responsibility, and ethical governance practices.

ESG investing offers several advantages. Firstly, it allows investors to align their portfolios with their values and beliefs, promoting positive change. Secondly, companies with strong ESG practices often exhibit better risk management, leading to more stable and resilient performance over time. Additionally, ESG factors can provide insights into a company's long-term sustainability and potential for growth.

Yes, ESG investing can have a positive impact on financial returns. Studies suggest that companies with higher ESG ratings tend to have better risk-adjusted returns and are less likely to face significant financial downturns. Investors increasingly recognize that integrating ESG factors can lead to more informed investment decisions and potentially enhance overall portfolio performance.

Investors can utilize various tools and resources to identify ESG-aligned companies. This includes ESG rating agencies that provide comprehensive assessments of companies' performance in these areas. Additionally, investors can review company reports, sustainability disclosures, and industry rankings to make informed decisions. Due diligence and research are key to finding companies that align with ESG principles.

While ESG investing offers benefits, it is not without risks. Some critics argue that the data and methodologies used in ESG assessments may not always be consistent or reliable. Additionally, certain industries or sectors might have limited ESG data, making it challenging to make accurate comparisons. Investors should carefully consider the potential risks and ensure a thorough understanding of the companies in their portfolios.