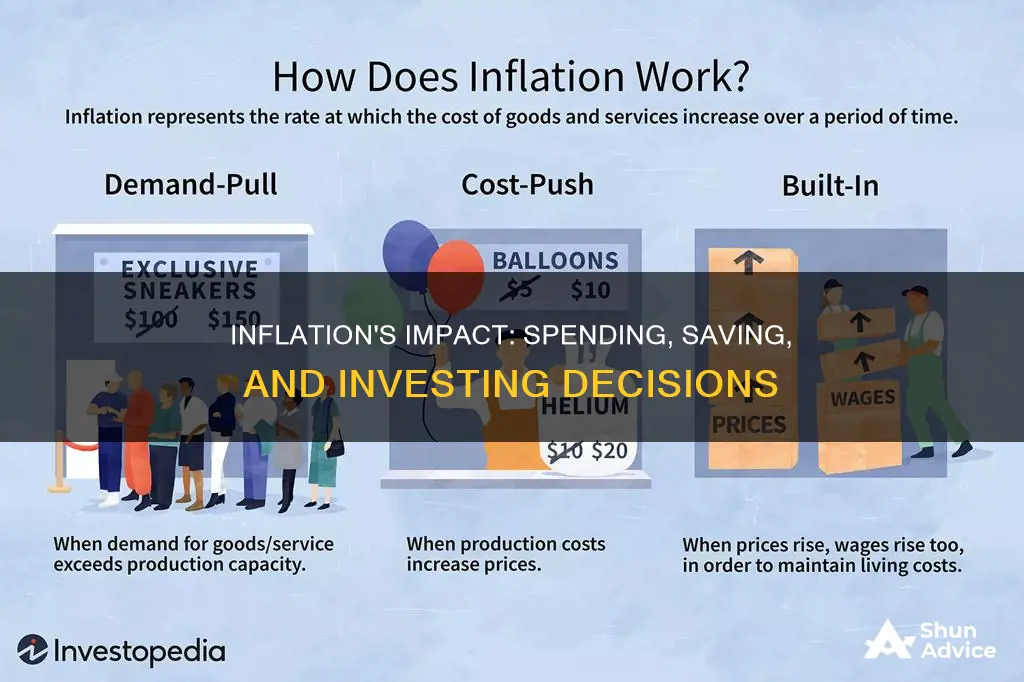

Inflation is a measure of how quickly the purchasing power of money decreases over time. It is a general rise in the price of goods and services, which can be caused by a range of factors, including production costs, labour, demand, and monetary policy. Inflation can have a significant impact on individuals' spending, saving, and investing decisions. When inflation is high, the cost of living increases, and individuals may find that their savings and investments are worth less in real terms. This can affect their spending decisions as they have less purchasing power. It can also influence their saving and investing decisions as they seek to protect their money from the effects of inflation.

What You'll Learn

Inflation erodes the value of savings

For example, if you have $100 in a savings account that pays a 1% interest rate, you will have $101 in your account after a year. However, if the inflation rate is 2%, you would need $102 to maintain the same purchasing power as when you started. While you have gained a dollar, your money doesn't go as far. This is why it is important to monitor your savings against inflation to ensure that your savings grow at the same rate as, or faster than, inflation.

Inflation can significantly impact those living off their savings, such as retired adults. As inflation reduces purchasing power, it becomes harder to maintain the same standard of living. This is particularly true in the US, where medical costs tend to rise faster than many other expenses.

Inflation can also hurt those who are saving for specific goals, such as a college fund or a down payment on a home. The purchasing power of the money saved may decline over time, affecting the ability to reach these goals.

To protect savings from inflation, individuals can invest in Treasury Inflation-Protected Securities (TIPS), government I bonds, stocks, and precious metals. Diversifying one's portfolio with a mix of asset classes and considering inflation risk is crucial when investing for the long term.

Cattle: A Smart Investment

You may want to see also

Inflation impacts investment returns

Secondly, inflation can hurt the performance of investments with set annual returns, such as regular bonds or certificates of deposit. Since the interest payment remains the same each year, inflation can eat into these earnings over time.

Thirdly, inflation can have a mixed impact on stocks. While a strong economy with high inflation may lead to increased sales for companies, it also means higher costs for wages and raw materials, which can hurt their value. The performance of individual stocks depends on the company's ability to manage these competing factors.

Fourthly, certain commodities, such as oil, agricultural goods, and precious metals, tend to do well during periods of high inflation. As the value of the dollar decreases, it costs more dollars to buy the same amount of these products, helping to maintain purchasing power.

Finally, some investments are indexed to inflation and provide returns that adjust for inflationary changes. These include Treasury Inflation-Protected Securities (TIPS) and inflation-indexed bonds, which offer a stable investment option during inflationary periods.

To protect your investment returns, it is important to diversify your portfolio and consider the impact of inflation on different asset classes. Nominal interest rates must keep up with or exceed inflation for an investor to earn a real return, so investments with lower interest rates are more vulnerable to inflation. By investing in assets that appreciate with inflation or generate interest, you can help preserve your purchasing power and maintain your standard of living.

Investments of Passion: Collectibles

You may want to see also

Inflation affects spending power

The impact of inflation on investments depends on the type of investment. For investments with a set annual return, like regular bonds or bank certificates of deposit, inflation can hurt performance. If you receive a payment of $100 per year, for instance, that payment would be worth less each year as inflation reduces its purchasing power. On the other hand, investments in certain commodities, such as oil, agricultural goods, and precious metals, tend to do well during periods of high inflation as their prices rise with the general increase in consumer prices.

Inflation can also affect the spending power of individuals. If your income does not increase at the same rate as inflation, you will not be able to buy as much. For example, if the yearly inflation rate is 10% and a burger costs $2 this year, the same burger will cost $2.20 next year. Therefore, if your income remains the same, you will not be able to buy as many burgers.

To protect against the negative impact of inflation on spending power, individuals can invest in assets that appreciate with inflation, such as stocks, precious metals, or Treasury Inflation-Protected Securities (TIPS). Diversifying your portfolio across asset classes and considering inflation risk is important when investing for the long term. Additionally, individuals can try to find savings accounts or investments that 'beat inflation', meaning the interest or profit is higher than the inflation rate.

The Homeowner's Dilemma: Consumption or Investment?

You may want to see also

Inflation-indexed investments can protect against inflation

Inflation can have a detrimental effect on the value of savings and investments. It can erode the value of savings, particularly those with a fixed payout that may not keep up with rising prices.

However, there are investments that can protect against inflation. Inflation-indexed investments, such as Treasury Inflation-Protected Securities (TIPS), can provide returns that adjust for inflation. TIPS are a type of US Treasury bond that is indexed to inflation to explicitly protect investors from its effects. The principal value of TIPS changes based on the inflation rate, and the rate of return includes the adjusted principal. TIPS can be purchased directly from the US Treasury or through a brokerage account, and they are also held in some mutual funds and exchange-traded funds (ETFs).

Inflation-indexed bonds are tied to the costs of consumer goods as measured by an inflation index, such as the Consumer Price Index (CPI). The outstanding principal of the bond generally rises with inflation, so the face or par value of the bond increases when inflation occurs. This is in contrast to other types of securities, which often decrease in value when inflation rises. The interest paid out by inflation-indexed bonds is also adjusted for inflation, softening the real impact of inflation on bondholders.

Inflation-indexed bonds are considered a popular long-range planning investment vehicle for individuals and institutions because they reduce uncertainty. They are also uncorrelated with the returns of stocks or other fixed-income assets. However, there are certain risks associated with these bonds. Their value tends to fluctuate with interest rates, and they may not offer good protection during deflationary periods when prices decline.

Retirement Readiness: Why Prioritizing Your Golden Years Makes Financial Sense

You may want to see also

Inflation can be mitigated by investing in stocks, precious metals, and real estate

Inflation can be defined as a decrease in the purchasing power of money, reflected in a general increase in the prices of goods and services in an economy. It can be mitigated by investing in stocks, precious metals, and real estate. Here's how:

Stocks

Investing in stocks is one way to protect your savings from inflation. Historically, portfolios with a mix of stocks and bonds have tended to grow even in periods of high inflation. Stocks can provide growth while managing risk. Returns on stock investments generally tend to beat inflation. Investors who want to avoid the volatility associated with individual stocks might opt for mutual funds or exchange-traded funds (ETFs).

Precious Metals

Precious metals like gold and silver are resistant to inflation because their value is derived differently from paper currency. The value of gold, for example, comes from its scarcity and its modern uses, such as jewellery, coins, and industrial applications. During times of economic instability or recession, investors often flock to stable investments like physical gold and silver, boosting their demand and helping to hedge against inflation.

Real Estate

Real estate investments can also serve as a hedge against inflation. While inflation can impact property valuations, financing costs, rental income, and operating expenses, real estate has the potential to appreciate in value over time, safeguarding against the erosion of purchasing power caused by inflation. Rental income can be adjusted periodically to keep up with inflation, and long-term fixed-rate mortgages can shield investors from potential interest rate hikes. Diversifying real estate investments across property types and locations can further mitigate the impact of inflation.

Investment Trust Insights: Strategies for Savvy Buying

You may want to see also

Frequently asked questions

Inflation erodes the value of your savings over time. Even if you have a savings account with an average interest rate, your savings will be affected by inflation. For example, if you have $10,000 in a savings account with a 1% interest rate, and the inflation rate is 2%, you will need $102 to have the same buying power that you started with.

The impact of inflation on investments depends on the type of investment. Inflation can hurt the performance of investments with a set annual return, such as regular bonds or bank certificates of deposit. On the other hand, investments in certain commodities, such as oil, agricultural goods, and precious metals, tend to do well during high inflation.

You can protect your savings and investments from inflation by investing in a variety of assets, including stocks, mutual funds, and inflation-protected securities such as Treasury Inflation-Protected Securities (TIPS). Diversifying your portfolio can help shield your money against inflation. Additionally, consider investing in assets that tend to have a positive relationship with inflation, such as commodities and real estate.