Investing in oil and gas can be a tricky business, but it is an essential industry for the global economy. The market is divided into three sectors: upstream (exploration and extraction), midstream (transportation and storage), and downstream (refining and marketing). Each sector plays a critical role in transforming crude oil into usable products. Investing in oil and gas requires an understanding of the various factors that affect market prices and profitability, such as global supply and demand dynamics, geopolitical tensions, and technological advancements. There are several investment options within the oil and gas sector, including purchasing company stocks, ETFs, and mutual funds, trading oil futures, and direct investments like mineral rights ownership and Direct Participation Programs (DPPs). These investments come with their own set of risks and potential returns, and it's important for investors to carefully consider these before entering this volatile market.

| Characteristics | Values |

|---|---|

| Investment type | Direct investments, purchasing company stocks, ETFs, mutual funds, trading oil futures, mineral rights ownership, Direct Participation Programs (DPPs) |

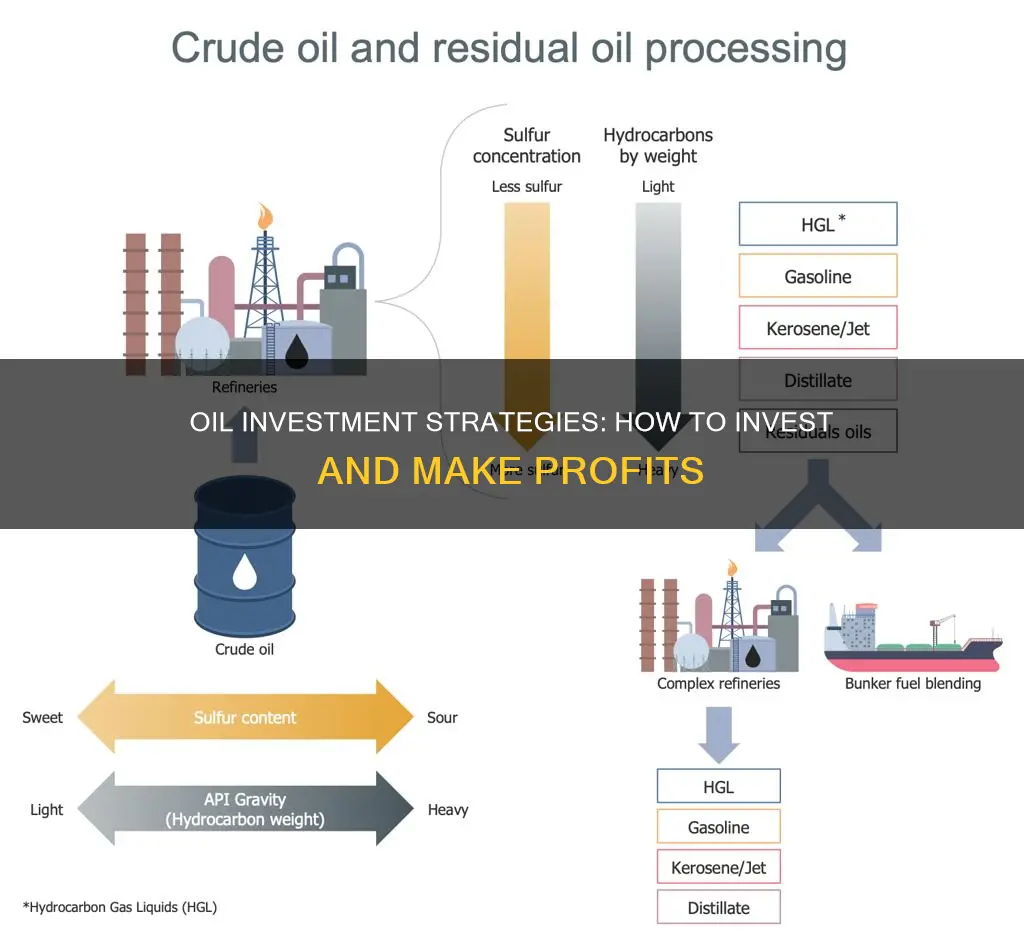

| Industry sectors | Upstream (exploration and extraction), midstream (transportation and storage), downstream (refining and marketing) |

| Market price factors | Global supply and demand, geopolitical tensions, technological advancements |

| Risks | High, speculative, volatile |

| Returns | Varying, some investors report 20%+ returns, others report average or inconsistent returns |

| Tax implications | Unique tax benefits and implications, active income losses can be offset against other income types, 15% depletion allowance, 1990 Tax Act exemptions |

What You'll Learn

Oil and gas sector volatility

The oil and gas industry has always been volatile, with unpredictable commodity price fluctuations, uncertainty about the future of fossil fuels, and complex global trade negotiations. These factors have disrupted the traditional supply and demand fundamentals, creating new challenges for oil and gas executives.

The exploration and production (E&P) division of the oil and gas sector is highly speculative, with rising costs and falling prices discouraging investment in drilling. The unpredictable nature of the industry is further exacerbated by the impact of global events, such as the COVID-19 pandemic, which caused a slowdown in the global economy and volatile prices in the oil and gas market.

The revenue and cost structure of oil and gas firms can fluctuate dramatically, leading to frequent risk events. Even slight changes in the price of oil or natural gas can result in significant financial losses or gains for companies. This volatility is influenced by various factors, including the country's oil production levels, with firms in high-producing countries being more sensitive to global uncertainty and price shocks.

To navigate this volatile landscape, oil and gas executives must pay close attention to strategic and tactical facets. They need to create a strategic identity based on their inherent capabilities and vision for the future. This involves re-evaluating their traditional business lines, divesting non-core assets, and realigning portfolios to focus on strengths and new growth areas.

Additionally, investors in the oil and gas sector should be aware of the risks and work with expert advisors to make informed decisions. Due diligence is crucial when evaluating operators and specific deals, as the industry has its share of scammers. Diversification of the asset base can also help mitigate the variability of cash inflows.

Understanding Broker Fees: What You Need to Know

You may want to see also

Exploration and production

There are several ways to invest in exploration and production. One option is through Direct Participation Programs (DPPs), where investors contribute capital for working interest ownership stakes or shares. These programs are often structured as limited partnerships or companies with limited liability. Another way to invest is through mineral rights ownership, which is considered lower-risk compared to other investment options in the oil and gas sector.

It is important for investors to be aware of the unique tax benefits and implications of investing in oil and gas. The U.S. tax code offers provisions that allow investors to partially shield their earnings from taxes. For example, a working interest in an oil and gas well is considered an active, rather than passive, activity, allowing net losses to be offset against other forms of income. Additionally, the IRS provides a 15% depletion allowance, and the 1990 Tax Act exempts certain entities from 15% of their gross income from federal taxes to support smaller oil companies and direct investors.

When considering investing in exploration and production, it is crucial to work with trusted operators and networks. Due diligence is essential to navigate the potential risks, such as scammers and unreliable operators. It is also important to have a good understanding of the industry, including crucial investment determinants, to make informed decisions.

Young Investors: Why the Apathy?

You may want to see also

Tax benefits and implications

Oil and gas investments are well-known for their tax advantages, which are offered by the US government to stimulate production and drive economic growth. These tax breaks are available to investors regardless of their income or net worth, as long as they limit their ownership to 1,000 barrels of oil per day.

One of the most popular tax advantage strategies is through the use of master limited partnerships (MLPs). MLPs are publicly traded partnerships that distribute income directly to investors while avoiding corporate income tax. MLPs typically own assets such as pipelines or storage facilities and generate income from fees charged to other companies for using those assets.

There are several types of partnerships available for oil and gas investments, including direct participation programs (DPPs), limited partnerships, and general partnerships. DPPs allow investors to pool their money with others to purchase ownership shares in a company or an oil and gas well, while still taking advantage of tax benefits. Limited partnerships are the most common structure, as they limit the liability of the entire producing project to the amount of the partner's investment. General partnerships may yield tax benefits in the first one or two years, through the passing down of intangible drilling costs (IDCs).

Intangible drilling costs include everything but the actual drilling equipment, such as labour, chemicals, and other miscellaneous items. These expenses typically constitute 60-80% of the total cost of drilling a well and are 100% deductible in the year incurred. Tangible drilling costs, on the other hand, refer to the direct cost of drilling equipment and are typically around 25% of the cost of drilling a well. These costs can be depreciated over seven years.

Other tax benefits available to oil and gas investors include the qualified business income deduction, depletion deductions, and loss deductions. Individuals may qualify to deduct up to 20% of their income from a working interest in an oil or gas asset under Section 199A. Depletion deductions account for the use of natural resources and are still available even after the cost basis has been fully recovered. A royalty interest in an oil and gas asset is considered passive income, while a working interest is considered active income. Loss deductions can be used to offset other forms of income, such as wages, interest, and capital gains.

Retirement Planning: The Optimal Investment Percentage at 45

You may want to see also

Risks and returns

Oil and gas investments carry significant risks and potential for strong returns. The main risk is price volatility, with oil prices sensitive to supply and demand and prone to fluctuating due to geopolitical events and economic factors. For example, during the COVID-19 pandemic, oil prices dropped substantially, impacting oil company stocks. Oil stocks tend to be more volatile than the broader market, and investments in this sector are speculative and sensitive to market conditions.

The discovery of large oil fields can lead to steep rises in oil company stock prices, and oil fields can be profitable within a year of exploration. Technological advancements have also lowered the risk of investing by improving drilling techniques. Oil and gas companies often pay dividends, making regular income an attractive prospect for investors.

However, there is a risk that dividend payments may be cut if a company's revenue decreases, which is intertwined with low commodity prices. Oil companies are also exposed to legal and regulatory risks, as well as the possibility of accidents, such as oil spills, which can lead to huge investor losses. The exploration phase carries the uncertainty of what lies beneath the ground, which can lead to lower-than-expected yields.

The oil sector is susceptible to scams and fraudulent activity, and investors should be vigilant and conduct thorough due diligence to avoid such incidents. Political instability and changes in government policies can also impact projects, especially when companies operate in unstable territories or countries with a history of sudden nationalization.

Despite the risks, the demand for oil and natural gas remains high, and investments in this sector can offer diversification and potential for good returns. Investors should be aware of the market conditions and implement risk management strategies to effectively manage the risks associated with investing in oil.

Retirement and Beyond: Exploring the Benefits of Investing Outside Your Nest Egg

You may want to see also

Technological advancements

Digitalization and Automation: The integration of digitalization and automation has revolutionized the industry. Digitalization enables real-time monitoring and analysis of production data through advanced analytics platforms and remote monitoring technology. This allows for proactive maintenance, optimization of operations, and enhanced decision-making. Automated drilling systems, including robotic drilling rigs and autonomous drilling control systems, have transformed drilling operations, improving efficiency and reducing costs.

Advanced Exploration Techniques: High-resolution 3D seismic imaging, combined with artificial intelligence algorithms, has enhanced the precision of imaging subsurface structures. This reduces exploration risks and increases the success rate of drilling operations, optimizing resource allocation and maximizing the recovery of oil and gas reserves.

Enhanced Oil Recovery (EOR) Techniques: Innovations such as polymer flooding, steam injection, and microbial-enhanced oil recovery are increasing production rates and extending the economic life of mature reservoirs. EOR techniques not only enhance overall yield but also present lucrative commercial opportunities, maximizing the value of existing investments.

Renewable Energy Integration: The oil and gas industry is witnessing a significant transformation with the integration of renewable energy sources. Companies are investing in solar power, wind energy, and geothermal energy to reduce carbon emissions and improve sustainability. Renewable energy systems power operations in remote fields, reducing reliance on fossil fuel-powered generators. This not only lowers greenhouse gas emissions but also leads to long-term cost reductions.

Safety Enhancements: Technology plays a crucial role in enhancing the safety of workers in the oil and gas industry. This is particularly important for deepwater drilling, as seen with the BP oil spill in the Gulf of Mexico. Improved instruments, sensors, and diagnostics are being developed to enhance safety measures and prevent accidents in challenging environments.

Carbon Capture and Storage (CCS): CCS technology is expected to play a pivotal role in mitigating carbon emissions in the oil and gas industry. By compressing and storing carbon dioxide underground, CCS can aid in enhanced oil recovery while simultaneously addressing environmental concerns.

The oil and gas industry continues to embrace technological advancements to address challenges, improve operational efficiency, and contribute to global energy security. These advancements drive commercial advancements, enhance sustainability efforts, and unlock new opportunities for growth and value creation.

Mortgage Debt vs Retirement Savings: Navigating the Financial Tightrope

You may want to see also

Frequently asked questions

Oil and gas are essential to the global economy, and the demand for energy is strong. There are also several major tax benefits available for investors in the oil and gas industry, including the ability to offset net losses against other forms of income.

The oil and gas industry is highly volatile due to factors such as geopolitical tensions, technological advancements, and the transition to clean energy. It is also a speculative investment, and there is a risk of scams and fraudulent operators.

There are various investment options within the oil and gas sector, including purchasing company stocks, ETFs, and mutual funds, trading oil futures, and direct investment opportunities like mineral rights ownership and Direct Participation Programs (DPPs).

The U.S. tax code offers specific provisions that allow investors to partially shield their earnings from taxes. For example, a working interest in an oil and gas well is considered an active, not passive, activity, allowing net losses to be offset against other forms of income.

It is important to have a sophisticated understanding of the industry and its complexity. Factors such as global supply and demand dynamics, geopolitical tensions, and technological advancements can affect market prices and profitability. It is also crucial to consider the inherent risks and potential returns of investing in this sector.