Understanding how investment in an LLC (Limited Liability Company) works is crucial for anyone looking to diversify their portfolio or start a new business. An LLC is a popular business structure that offers flexibility and protection for investors. When you invest in an LLC, you typically purchase a share of ownership, which can be in the form of membership units or shares, depending on the LLC's structure. This investment can be made directly by the investor or through a third-party platform or fund. The investment process often involves due diligence, where the investor examines the LLC's financial health, management team, business model, and growth prospects. Once the investment is made, the investor becomes a part-owner and may have voting rights and access to the LLC's financial performance. This structure provides investors with a more hands-off approach compared to traditional business ownership, making it an attractive option for those seeking a balance between control and risk mitigation.

What You'll Learn

LLC Structure: Ownership and Management

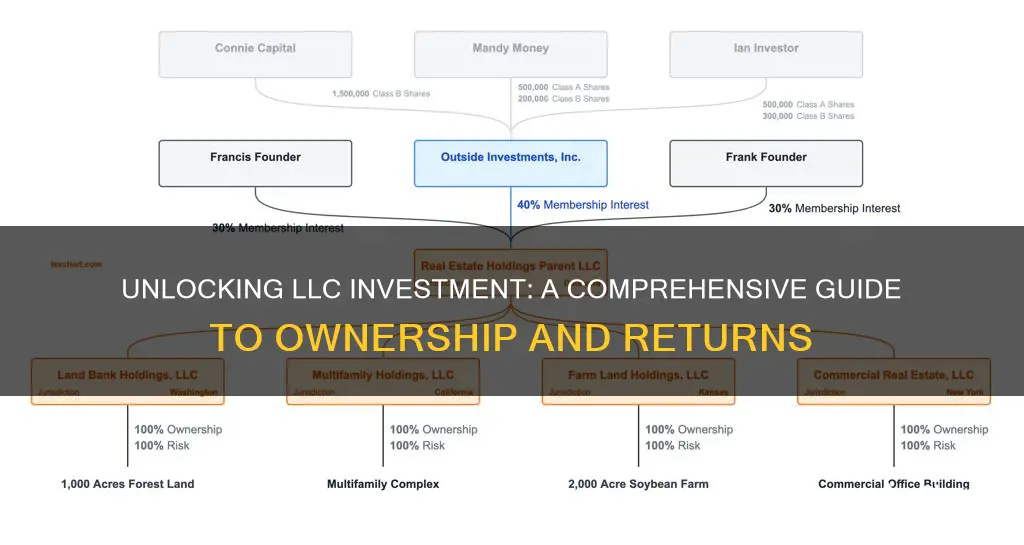

When it comes to investing in an LLC (Limited Liability Company), understanding the structure of ownership and management is crucial for both investors and the LLC itself. LLCs offer a unique blend of personal liability protection and tax advantages, making them an attractive business structure. Here's a detailed breakdown of how ownership and management work in an LLC:

Ownership Structure:

An LLC's ownership is typically defined by an Operating Agreement, a legal document that outlines the rights and responsibilities of each member. This agreement is essential as it specifies the initial ownership percentages, how profits and losses are distributed, and the process for transferring ownership interests. Members can be individuals, other businesses, or even other LLCs. Each member contributes capital in exchange for a share of the LLC's profits and a say in its management. The Operating Agreement can be structured in various ways, such as equal ownership, profit-sharing ratios, or management roles. For instance, an investor might contribute a larger amount of capital and receive a higher ownership percentage, while retaining the right to vote on major decisions.

Management and Decision-Making:

LLCs can be managed in two primary ways: member-managed or manager-managed. In a member-managed LLC, all members actively participate in the day-to-day operations and decision-making. This structure is common in smaller LLCs where members have complementary skills and a shared vision. Each member typically has a voice in management, and decisions are made collectively. On the other hand, a manager-managed LLC has designated managers who oversee the business operations. These managers can be members or third-party professionals, and they make decisions on behalf of the LLC. The Operating Agreement will specify whether management is shared among members or vested in a select group of managers. This distinction is vital for investors, as it determines their level of involvement and control over the LLC's operations.

Investor Rights and Responsibilities:

Investors in an LLC typically have certain rights and responsibilities. These may include the right to inspect financial records, attend member meetings, and vote on significant matters. Investors often contribute capital in exchange for a share of the LLC's profits, which are distributed according to the terms outlined in the Operating Agreement. Additionally, investors may have the right to participate in management decisions, especially if they hold a substantial ownership interest. It is essential for investors to review the LLC's Operating Agreement and understand their rights and obligations before making an investment.

In summary, the LLC structure offers a flexible approach to ownership and management, allowing investors to tailor their involvement to their specific interests and goals. Understanding the legal and operational aspects of LLCs is vital for investors to make informed decisions and ensure a successful investment. This structure provides a balance between the benefits of a corporation and the simplicity of a partnership, making it a popular choice for various business ventures.

The Battle for Beneficiary Rights: Living Trusts vs. Investments

You may want to see also

Capital Contributions: How and When

When investing in a limited liability company (LLC), understanding the concept of capital contributions is crucial. Capital contributions refer to the initial investment made by members or investors in the LLC, which can take various forms, including cash, property, or services. These contributions are essential as they provide the LLC with the necessary funds to operate, grow, and achieve its business objectives.

The process of making capital contributions typically begins with the LLC's operating agreement or articles of organization. This legal document outlines the terms and conditions of the LLC's formation, including the initial capital contributions required from each member. It specifies the amount, type, and nature of the contributions, ensuring transparency and clarity among the investors. Each member's capital contribution is a binding commitment, and it is essential to fulfill these obligations to maintain the LLC's integrity and legal standing.

Investors can make capital contributions in different ways. One common method is through cash contributions, where members provide the LLC with monetary funds. This can be done through bank transfers, wire transfers, or simply depositing the required amount into the LLC's designated bank account. Cash contributions are straightforward and provide the LLC with immediate liquidity to cover operational expenses or invest in business opportunities.

Another way to contribute capital is through the transfer of property or assets. This could include real estate, equipment, intellectual property, or any other valuable assets that hold economic value. When contributing property, the LLC must assess its fair market value and ensure that the contribution is documented properly. This process often involves a third-party valuation and the execution of a contribution agreement, which outlines the terms of the property transfer.

Services can also be considered a form of capital contribution. Members may offer their expertise, skills, or time to the LLC in exchange for a share of profits or distributions. This is particularly common in professional service-based LLCs, where members contribute their professional services to the business. Service contributions should be clearly defined and agreed upon by all members to ensure a fair and transparent arrangement.

The timing of capital contributions is another critical aspect. LLCs typically require members to make their initial contributions upon signing the operating agreement or shortly after. This ensures that the LLC has the necessary capital to commence operations and meet its initial financial obligations. Subsequent contributions may be agreed upon by the members, especially if the LLC plans to raise additional funds or expand its operations.

In summary, capital contributions are a fundamental aspect of investing in an LLC, providing the necessary financial resources for the company's growth and operations. Understanding the legal requirements, contribution methods, and timing ensures that investors fulfill their obligations and contribute to the LLC's success. It is essential to carefully document and manage these contributions to maintain a well-structured and transparent business relationship among the members.

Investing: Timing the Market

You may want to see also

Profits and Losses: Distribution Mechanics

When it comes to investing in a Limited Liability Company (LLC), understanding how profits and losses are distributed is crucial for investors and members alike. The distribution mechanics of an LLC can vary depending on the specific operating agreement and state laws, but there are some general principles to consider.

In an LLC, profits and losses are typically distributed according to the ownership interests of the members. Each member's share of the profits or losses is proportional to their investment or ownership percentage in the company. For example, if an LLC has two members, and Member A owns 60% of the company while Member B owns 40%, Member A will receive 60% of the profits and 60% of the losses, and Member B will receive 40% of each. This distribution method ensures that each member's contribution is reflected in their financial gains or losses.

The operating agreement, a legal document that outlines the LLC's ownership structure, management, and operational procedures, plays a vital role in defining the distribution mechanics. It specifies the rights and obligations of each member, including how profits and losses should be allocated. This agreement can be customized to accommodate various distribution scenarios, such as equal sharing, profit-sharing based on specific criteria, or even loss-sharing arrangements. For instance, an LLC might decide to distribute all profits to the members until a certain debt is paid off, after which the remaining profits are shared in a particular ratio.

State laws also influence the distribution of profits and losses in an LLC. Some states require LLCs to distribute profits in a manner that is consistent with the members' ownership interests, while others may allow for more flexibility in the distribution process. It is essential for LLC members to be aware of the specific laws governing their state to ensure compliance and avoid potential disputes.

Additionally, LLCs can implement various tax strategies to optimize profit distribution. For instance, members can take distributions in the form of tax-deductible expenses, such as management fees or withdrawals, which can help reduce the LLC's taxable income. Proper tax planning can also enable members to receive distributions in a tax-efficient manner, minimizing the tax burden on both the LLC and its members.

In summary, the distribution of profits and losses in an LLC is a critical aspect of investment, as it directly impacts the financial returns and obligations of each member. By understanding the principles of ownership, the role of the operating agreement, and the influence of state laws, investors can make informed decisions and ensure a fair and transparent distribution process.

The Great British Property Myth: Unraveling the Truth About Homeownership and Investments

You may want to see also

Tax Implications: Advantages and Disadvantages

When considering an investment in a Limited Liability Company (LLC), understanding the tax implications is crucial as it can significantly impact your financial decisions. One of the primary advantages of an LLC is the tax flexibility it offers. LLCs are often treated as "pass-through" entities for tax purposes, meaning the company itself doesn't pay taxes; instead, the profits are passed through to the members, who then report them on their personal tax returns. This structure can result in tax savings for investors, as they can claim deductions and credits that might not be available to traditional corporations. For instance, members can deduct their share of the LLC's expenses, such as salaries, rent, and utilities, which can reduce their taxable income.

However, there are potential disadvantages to consider. One significant drawback is the self-employment tax. Since LLC members are considered self-employed, they must pay self-employment tax on their share of the LLC's income. This tax is levied on the net earnings of the business and can be substantial, especially for high-income individuals. Additionally, LLC members may be subject to the Alternative Minimum Tax (AMT), which is designed to ensure that all taxpayers pay at least a minimum amount of tax. The AMT can be triggered by certain tax preferences associated with LLCs, leading to unexpected tax liabilities.

Another tax consideration is the potential for double taxation. While LLCs are pass-through entities, if the LLC distributes profits to its members, those members may be subject to double taxation. First, the LLC pays taxes on its profits, and then, when the profits are distributed, the members pay taxes again on that income. This can be mitigated by taking distributions in the form of loans or capital contributions, which are not subject to self-employment tax. Furthermore, the tax treatment of LLCs can vary depending on the state in which it operates, so investors should be aware of any state-specific tax laws that may affect their investment.

In summary, investing in an LLC offers tax advantages such as pass-through taxation and potential deductions, but it also presents challenges like self-employment tax and the possibility of AMT. Investors should carefully consider these tax implications and consult with tax professionals to ensure they make informed decisions that align with their financial goals and risk tolerance. Understanding these tax dynamics is essential for maximizing the benefits of LLC investments while minimizing potential drawbacks.

Weed and Wait: The Long Game of Marijuana Investments

You may want to see also

Exit Strategies: Selling Your LLC Interest

When it comes to selling your interest in an LLC, there are several exit strategies to consider, each with its own advantages and considerations. Here's an overview of some common approaches:

- Selling to Current Members: One of the most straightforward ways to exit your LLC investment is to sell your interest to existing members. This approach can be advantageous as it often involves a familiar structure and relationships. You can negotiate the terms, including the purchase price, payment structure, and any conditions or warranties. This method is relatively simple and may provide a quicker sale, especially if the LLC has a buy-sell agreement in place, which outlines the process and rights of members in the event of a sale.

- Third-Party Acquisitions: You can attract potential buyers from outside the LLC, such as private equity firms, other businesses, or even individual investors. This strategy may offer a higher potential sale price, especially if your LLC has a unique business model or strong market position. However, it requires a thorough valuation process and may involve complex negotiations. Due diligence is crucial here, as buyers will scrutinize the LLC's financial records, assets, and potential liabilities.

- Management Buyout: In this scenario, the existing members of the LLC can collectively purchase your interest. This approach can be appealing as it allows for a smooth transition and maintains the existing management structure. It often involves a negotiated price and may include incentives or earn-out provisions based on future performance. Management buyouts can be a strategic move if the current members have a clear vision for the LLC's future and want to retain control.

- Liquidation and Asset Sale: If the LLC owns valuable assets, you might consider selling the entire business as an asset sale. This strategy can be attractive if the LLC's assets are highly valued and can generate a substantial sale. However, it may be more complex and time-consuming, requiring the approval of all members and compliance with legal requirements. Liquidation can also impact the LLC's tax status, so seeking professional advice is essential.

Each exit strategy has its own set of benefits and challenges, and the choice depends on various factors, including the LLC's performance, market conditions, and the personal goals of the investors. It is crucial to have a well-defined plan and seek legal and financial advice to ensure a smooth and profitable transition when selling your LLC interest.

MoneyWiz: Your Investment Companion or Competitor?

You may want to see also

Frequently asked questions

An LLC is a popular business structure that offers limited liability to its owners, known as members. It combines the pass-through taxation of a partnership or sole proprietorship with the liability protection of a corporation. LLCs are flexible and can be managed by their members or by appointed managers.

Investors typically invest in an LLC by becoming members and contributing capital in exchange for ownership stakes. This can be done through a capital contribution agreement, where the investor provides funds or assets to the LLC in return for a percentage of ownership and profits.

LLCs are treated as "pass-through entities" for tax purposes, meaning they don't pay taxes at the entity level. Instead, the profits and losses are passed through to the members, who report them on their individual tax returns. This can provide tax advantages, as members can claim deductions and credits.

The management structure can vary. Some LLCs are member-managed, where all members have a say in decision-making. Others may be manager-managed, with designated managers overseeing operations. Investors can participate in management decisions or choose to be passive investors, receiving distributions without direct involvement.

Investing in an LLC offers several advantages, including limited liability, flexibility in management, and tax efficiency. LLCs also have fewer regulatory requirements and can be formed with relatively low costs. Additionally, the pass-through taxation structure can result in tax savings for investors.