Risk is an inherent part of investing, and it's important to evaluate it because it's connected to your return. Generally, the higher the risk, the higher the potential return. However, this also means that investing returns are not guaranteed, and your investment could go up or down in value. It's important to understand your comfort with risk and your capacity to handle it. This includes your ability and willingness to accept an investment outcome, even if it doesn't produce the expected results. There are several types of risk in investing, including market risk, inflation risk, concentration risk, and liquidity risk.

| Characteristics | Values |

|---|---|

| Risk is connected to return | Generally, the higher the risk of an investment, the higher the potential return |

| Risk is always present | Every investment involves some degree of risk |

| Risk tolerance | Your level of risk tolerance can affect your potential returns |

| Types of risk | Market risk, inflation risk, concentration risk, liquidity risk |

| Risk management | The process of identifying the potential downsides as well as the potential rewards of an investment |

What You'll Learn

- Risk and return are connected: the higher the risk, the higher the potential return

- Risk tolerance: understanding your comfort with risk and the types of risk involved

- Liquidity risk: the risk of being unable to sell your investment at a fair price

- Inflation risk: the risk of a loss in purchasing power due to the value of your investments

- Market risk: the risk of investments declining in value due to economic developments or events

Risk and return are connected: the higher the risk, the higher the potential return

Investing involves buying securities or other assets with the hope that they will increase in value and produce a return. However, it's important to remember that investing returns are not guaranteed. The value of your investments can go up or down, and sometimes this can happen on the same day.

When evaluating risk, it's essential to consider your level of risk tolerance. This includes understanding your comfort with different types of risk, such as market risk, inflation risk, concentration risk, and liquidity risk. Your risk tolerance will impact your potential returns. If you focus solely on achieving the highest possible return without considering the associated risks, you may find yourself taking on more risk than you are comfortable with.

It's also important to understand your capacity to handle risk. This involves assessing your ability and willingness to accept an investment outcome, even if it doesn't meet your expectations. Different investments carry different levels of risk, and it's essential to discuss your risk tolerance with a trusted advisor. They can help you evaluate the risks and returns based on your goals, resources, and time horizon.

By evaluating risk and return together, you can make more informed investment decisions. While a higher level of risk can lead to higher potential returns, it's crucial to balance the two and ensure that you are comfortable with the level of risk you are taking.

Betterment Investing: Understanding the Risk Factors

You may want to see also

Risk tolerance: understanding your comfort with risk and the types of risk involved

Risk tolerance is an important consideration when investing. It's about understanding your comfort with risk and the types of risk involved.

Risk is always part of investing, and it's connected to your return. The higher the risk, the higher the potential return. However, this also means that investing returns are not guaranteed, and your investment could go up or down in value. It's important to pay attention to both the risk and the potential return of an investment. If you focus only on achieving the highest possible return, you may not recognise the risk you are taking.

There are several types of risk to consider when investing, including market risk, inflation risk, concentration risk, and liquidity risk. Market risk refers to the possibility of investments declining in value due to economic developments or other events. Inflation risk is the possibility of losing purchasing power because the value of your investments doesn't keep up with the rising cost of living. Concentration risk occurs when your money is concentrated in one investment or type of investment, and liquidity risk is the risk of being unable to sell your investment at a fair price.

It's important to understand your capacity to handle risk, including your ability and willingness to accept an investment outcome, even if it doesn't produce the expected results. This involves discussing your goals, resources, and risk tolerance with a trusted advisor. By evaluating risk and understanding your risk tolerance, you can make more informed investment decisions that align with your financial goals and comfort level.

Understanding Pips: Portfolio Investment Strategy Basics

You may want to see also

Liquidity risk: the risk of being unable to sell your investment at a fair price

Risk is an inherent part of investing. When you invest, you are buying securities or other assets in the hopes that they will increase in value and produce a return on your investment. However, investing returns are not guaranteed, and the value of your investments can go up or down.

Liquidity risk is the risk of being unable to sell your investment at a fair price. This is one of several types of risk that investors face, including market risk, inflation risk, and concentration risk. It's important to understand your comfort with risk and your capacity to handle it. This includes your ability and willingness to accept an investment outcome, even if it doesn't produce the expected results.

The level of risk you are willing to assume should be discussed with a trusted advisor and based on your goals, resources, and timeline. Risk and return are connected, so a higher level of risk often means a higher potential return. However, focusing only on achieving the highest possible return may cause you to overlook the risks you are taking.

To manage liquidity risk, investors should consider strategies such as avoidance, retention, sharing, transferring, and loss prevention and reduction. One method of measuring risk is by determining standard deviation, a statistical measure of dispersion around a central tendency.

Investing in US IPOs: A Guide for Indians

You may want to see also

Inflation risk: the risk of a loss in purchasing power due to the value of your investments

Risk is always part of investing, and it's important to evaluate it because it's connected to your return. Generally, the higher the risk of an investment, the higher the potential return. However, this also means that investing returns are not guaranteed, and it's possible for an investment to go up or down in value, even on the same day.

One type of risk is inflation risk: the risk of a loss in purchasing power due to the value of your investments. This is one of several types of risk, including market risk, concentration risk, and liquidity risk. It's important to understand your comfort with risk and your capacity to handle it. This includes your ability and willingness to accept an investment outcome, even if it doesn't produce the expected results.

Inflation risk is the possibility that the value of your investments will not keep up with the rate of inflation, resulting in a loss of purchasing power. For example, if you invest in a stock that pays a dividend, and the dividend stays the same while inflation increases, the purchasing power of that dividend will decrease over time. This means that you will be able to buy less with the dividend than you could before, resulting in a loss of value.

To manage inflation risk, investors can consider investments that are expected to keep up with or exceed the rate of inflation. This might include stocks, which have historically outpaced inflation, or investments in companies that are expected to benefit from inflationary pressures, such as those in the energy or materials sectors. Additionally, investors can diversify their portfolios to include a mix of assets that are expected to perform well in different economic environments, helping to offset the impact of inflation on any one investment.

It's important to note that while managing inflation risk is crucial, it should be done in the context of an overall risk management strategy. This involves considering all types of risk and understanding how they interact with each other and with potential returns. By evaluating and managing risk effectively, investors can make more informed decisions and better protect their portfolios.

Crafting a Winning Investment Pitch: Strategies for Success

You may want to see also

Market risk: the risk of investments declining in value due to economic developments or events

Risk is an inherent part of investing. The higher the risk, the higher the potential return, but this also means that investing returns are not guaranteed. It's important to understand your comfort with risk and your capacity to handle it. This includes your ability and willingness to accept an investment outcome, even if it doesn't produce the expected results.

Market risk is the risk of investments declining in value due to economic developments or events. This type of risk is connected to your return on investment and can be influenced by factors such as inflation, concentration, and liquidity. For example, inflation risk refers to the possibility of losing purchasing power because the value of your investments does not keep up with the rising cost of living. Concentration risk, on the other hand, involves the potential loss of having all your money tied up in one investment or type of investment. Liquidity risk is the chance that you won't be able to sell your investment at a fair price when you need to.

When considering market risk, it's essential to evaluate the potential impact of economic developments and events on your investments. This includes assessing the overall health of the economy, as well as specific industry or sector trends that may affect your investments. Diversifying your investments across different sectors and asset classes can help mitigate market risk by reducing the impact of any single economic event.

Additionally, staying informed about current events and market trends can help you anticipate potential risks and make more timely investment decisions. Regularly reviewing and rebalancing your investment portfolio can also ensure that you maintain an appropriate level of risk exposure over time.

By understanding and actively managing market risk, investors can better protect their investments and potentially improve their long-term returns. This involves carefully considering the types of investments made, the timing of those investments, and the overall diversification of their portfolio.

Equity Method Investment: Understanding Goodwill's Role

You may want to see also

Frequently asked questions

Risk and return are connected, so it's important to evaluate both. If you focus only on achieving the highest possible return, you may not recognise the risk you are taking.

Generally, the higher the risk of an investment, the higher the potential return. However, this also means that investing returns are not guaranteed.

There are several types of risk, including market risk, inflation risk, concentration risk, and liquidity risk.

It's important to understand your capacity to handle risk, including your ability and willingness to accept an investment outcome, even if it doesn't produce the expected results. You should discuss this with a trusted advisor based on your goals, resources, and timeline.

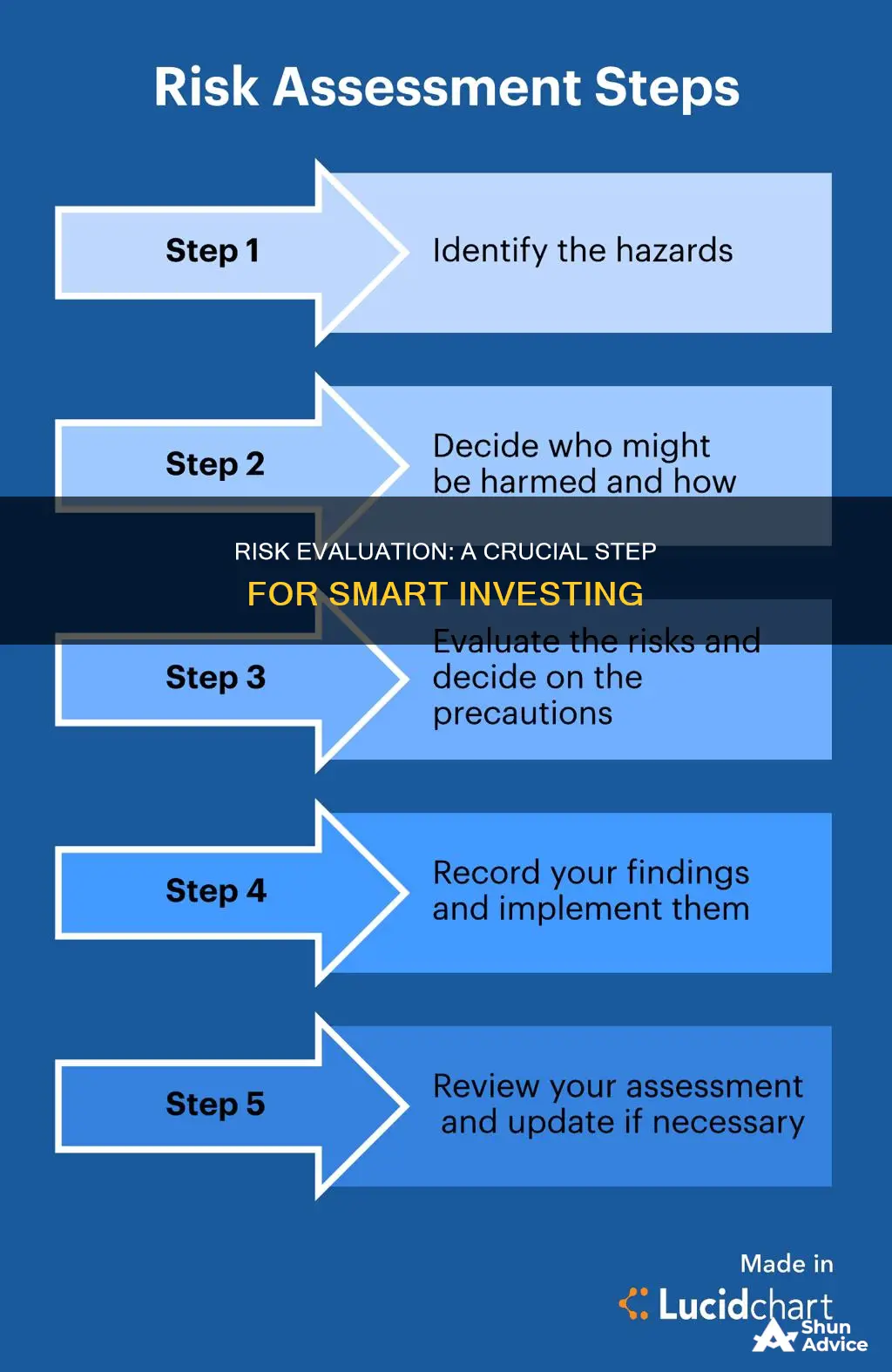

Risk management is the process of identifying the potential downsides as well as the potential rewards of an investment. Strategies include avoidance, retention, sharing, transferring, and loss prevention and reduction.