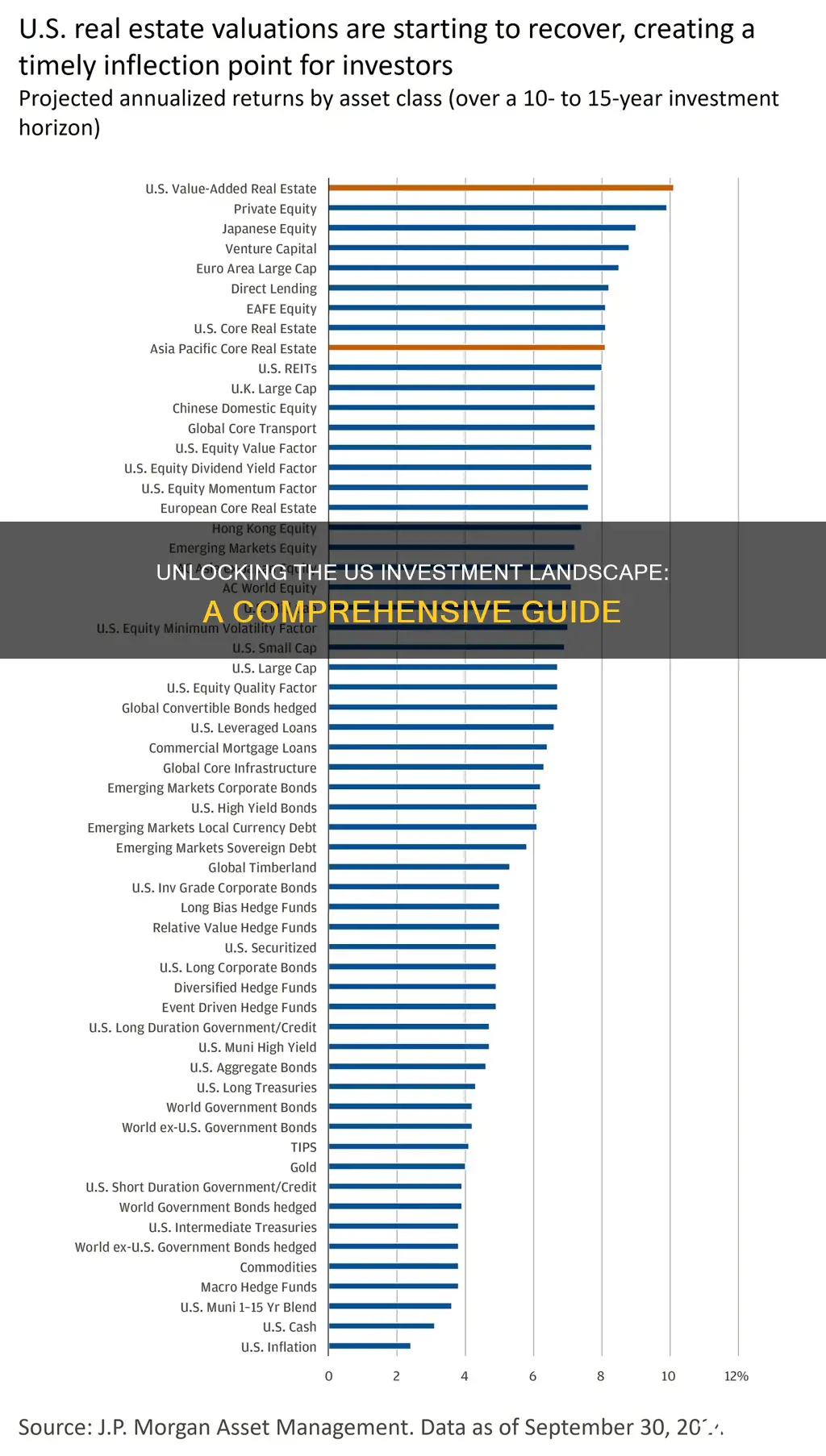

Investment in the United States is a multifaceted process that plays a crucial role in the country's economic growth and development. It involves allocating financial resources to various assets, such as stocks, bonds, real estate, and other securities, with the expectation of generating returns over time. Understanding how investment works in the US is essential for individuals and institutions seeking to grow their wealth, support businesses, and contribute to the nation's economic prosperity. This process typically begins with an investor's decision to purchase an asset, which can be done through various financial intermediaries like brokers, investment banks, or online platforms. The investor's capital is then utilized by the underlying company or entity to fund operations, expand, or pursue new projects. Over time, the value of these investments can appreciate, providing returns through capital gains or dividends, and investors can choose to reinvest these gains or withdraw them, depending on their financial goals and strategies.

What You'll Learn

- Investment Vehicles: Stocks, bonds, mutual funds, ETFs, and real estate

- Market Timing: Strategies for buying and selling investments at optimal times

- Risk Management: Diversification, stop-loss orders, and insurance to protect investments

- Tax Implications: Capital gains, dividends, and tax-efficient investment strategies

- Investment Research: Analyzing companies, industries, and market trends for informed decisions

Investment Vehicles: Stocks, bonds, mutual funds, ETFs, and real estate

When it comes to investing in the United States, there are various vehicles and options available to individuals seeking to grow their wealth. Understanding these investment vehicles is crucial for anyone looking to navigate the complex world of finance. Here's an overview of some common investment options:

Stocks: Investing in stocks means purchasing shares of ownership in a company. When you buy stock, you become a shareholder and have a claim on a portion of the company's assets and earnings. Stocks are typically traded on stock exchanges, such as the New York Stock Exchange (NYSE) or NASDAQ. Investors can buy individual stocks of well-known companies or diversify their portfolios by investing in exchange-traded funds (ETFs) that hold multiple stocks. The value of stocks can fluctuate based on market conditions, company performance, and investor sentiment.

Bonds: Bonds are essentially loans made to governments or corporations. When you invest in a bond, you are lending money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity. Bonds are generally considered less risky than stocks but offer lower potential returns. The price of bonds can be influenced by interest rate changes, with prices tending to fall when interest rates rise. Government bonds, corporate bonds, and municipal bonds are some of the types available.

Mutual Funds: Mutual funds pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities. A professional fund manager makes investment decisions on behalf of the group. Mutual funds offer instant diversification, reducing risk compared to buying individual stocks. They are available in various forms, including equity funds, bond funds, and balanced funds, each with different investment strategies and risk profiles. Investors can choose from a wide range of mutual funds to align with their financial goals and risk tolerance.

Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They hold a basket of assets, such as stocks, bonds, or commodities, and their value fluctuates throughout the trading day. ETFs offer diversification and are often used to track specific market indexes or sectors. Investors can buy and sell ETFs during regular stock market hours, providing flexibility and potential tax advantages over mutual funds. ETFs have become increasingly popular due to their low costs and ease of trading.

Real Estate: Investing in real estate involves purchasing property, such as residential or commercial buildings, land, or real estate investment trusts (REITs). Real estate can be a tangible investment, providing income through rent and potential capital appreciation over time. REITs, on the other hand, are companies that own and operate income-generating real estate. Investors can buy shares in REITs, allowing them to indirectly invest in real estate without directly owning property. This option offers diversification and the potential for steady income, but it also carries risks associated with market fluctuations and property management.

Each of these investment vehicles has its own set of advantages, risks, and strategies. Diversification is a key principle in investing, and combining different types of investments can help manage risk and maximize returns. It is essential to conduct thorough research, understand your risk tolerance, and consider consulting a financial advisor before making any investment decisions.

GME Investors: Who's In?

You may want to see also

Market Timing: Strategies for buying and selling investments at optimal times

Market timing is a strategy that involves attempting to predict the best time to buy or sell an investment, aiming to maximize returns and minimize losses. It is a complex and challenging task, as financial markets are influenced by numerous factors, and timing the market perfectly is extremely difficult. However, successful market timing can significantly impact investment outcomes. Here are some strategies to consider:

- Trend Analysis: One approach is to identify and follow market trends. Investors can analyze historical price data to determine if a market is in an uptrend or downtrend. Buying when the market is rising and selling when it's falling is a common strategy. For example, if you observe a consistent upward price movement in a particular stock, it might indicate a strong market trend, and buying at the right time could lead to substantial gains.

- Technical Indicators: Technical analysis involves using various indicators and charts to identify patterns and signals. Moving averages, relative strength index (RSI), and exponential moving averages are tools that can help investors determine entry and exit points. These indicators provide insights into market momentum, potential reversals, and overbought or oversold conditions, allowing for more informed decision-making.

- Fundamental Analysis: This strategy focuses on evaluating the intrinsic value of an investment by analyzing financial statements, economic factors, and industry trends. Investors can identify undervalued assets by comparing a company's financial health, growth prospects, and competitive advantage to its current market price. Buying when the market price is below the perceived intrinsic value is the goal, as it often leads to better long-term returns.

- Market Sentiment and News: Keeping an eye on market sentiment and news is crucial. Positive or negative news, earnings reports, and geopolitical events can significantly impact market behavior. Investors can use this information to anticipate market movements and make timely decisions. For instance, a company's positive earnings surprise might trigger a rapid price increase, prompting investors to buy or sell accordingly.

- Risk Management and Diversification: While market timing can be profitable, it is essential to manage risk effectively. Diversifying your investment portfolio across different asset classes, sectors, and regions can help mitigate the impact of any single market timing decision. Additionally, setting stop-loss orders and regularly reviewing and rebalancing your portfolio can limit potential losses during market downturns.

It's important to note that market timing is a high-risk strategy, and past performance is not indicative of future results. Many investors find it challenging to consistently time the market successfully. Therefore, a combination of market timing strategies, along with a well-diversified portfolio and a long-term investment horizon, can help balance the risks and rewards.

Bill Gates' Current Investment Focus

You may want to see also

Risk Management: Diversification, stop-loss orders, and insurance to protect investments

When it comes to investing in the United States, risk management is a critical aspect of safeguarding your financial assets. Effective risk management strategies can help investors mitigate potential losses and protect their investments. Here are some key techniques to consider:

Diversification: One of the fundamental principles of risk management is diversification. This strategy involves spreading your investments across various asset classes, sectors, and geographic regions. By diversifying your portfolio, you reduce the impact of any single investment's performance on your overall returns. For example, if you invest in a mix of stocks, bonds, real estate, and commodities, a decline in one area may be offset by gains in another. Diversification helps to smooth out the volatility of your investment returns, providing a more stable and consistent outcome over time.

Stop-Loss Orders: Another valuable tool for risk management is the use of stop-loss orders. A stop-loss order is an instruction to sell an asset when it reaches a certain price, which is typically set below the current market price. This order helps to limit potential losses by automatically triggering a sale when the investment drops to a predetermined level. For instance, if you own a stock and set a stop-loss order at $50, the sale will be executed if the stock price falls to $50 or lower. This strategy is particularly useful for investors who want to protect their capital and manage risk proactively.

Insurance for Investments: Insurance can also play a role in risk management for investors. Investment insurance policies can provide protection against various risks, such as market volatility, liquidity issues, or even fraud. These policies may offer coverage for a portion of the investment's value or provide compensation in the event of specific adverse events. For instance, some insurance companies offer investment protection plans that safeguard against market downturns, ensuring that investors recover a certain percentage of their initial investment even if the overall market performs poorly.

Implementing these risk management techniques can significantly contribute to the long-term success of your investment strategy. Diversification ensures a balanced approach, stop-loss orders provide a safety net, and insurance offers additional protection against unforeseen circumstances. It is essential to regularly review and adjust your risk management strategies as your investment portfolio evolves to ensure it aligns with your financial goals and risk tolerance.

Final Countdown: Strategic Investments for the Retirement Rush

You may want to see also

Tax Implications: Capital gains, dividends, and tax-efficient investment strategies

Understanding the tax implications of investments is crucial for US investors, as it can significantly impact their overall financial well-being. When it comes to investing, US investors must consider the tax treatment of capital gains and dividends, which can vary depending on the type of investment and the investor's tax bracket.

Capital gains are the profits realized from the sale of a capital asset, such as stocks, bonds, or real estate. In the US, capital gains are taxed at different rates depending on the holding period and the investor's income level. Short-term capital gains, which are profits from assets held for less than a year, are typically taxed as ordinary income. This means that the tax rate on short-term capital gains can vary widely, ranging from 10% to 37%, depending on the investor's taxable income. On the other hand, long-term capital gains, which are profits from assets held for more than a year, are generally taxed at a lower rate, which can be as low as 0% for some investors, especially those in lower tax brackets.

Dividends, another important aspect of investment taxation, are payments made by companies to their shareholders. Dividends are typically considered taxable income and are subject to federal income tax. The tax rate on dividends can also vary, and it is often lower than the tax rate on ordinary income. For example, qualified dividends, which meet certain criteria, are taxed at long-term capital gains rates, which can be more favorable for investors. However, not all dividends qualify for these lower rates, and some may be taxed as ordinary income.

To minimize the tax impact of investments, investors can employ various tax-efficient strategies. One common approach is to take advantage of tax-deferred or tax-free investment accounts. For instance, contributions to traditional Individual Retirement Accounts (IRAs) are typically tax-deductible, allowing investors to defer taxes on their contributions and potential earnings until retirement. Similarly, investments in certain tax-free municipal bonds can provide tax-free income, as the interest earned is exempt from federal and state income taxes.

Additionally, investors can consider the timing of their investments and withdrawals. By strategically selling investments that have generated capital gains in lower tax brackets, investors can minimize their tax liability. This strategy is often referred to as tax-loss harvesting, where investors sell losing investments to offset capital gains and reduce their taxable income. Another approach is to reinvest dividends and capital gains back into the portfolio, allowing for potential tax-free growth over time.

In summary, understanding the tax implications of capital gains and dividends is essential for US investors to optimize their investment strategies. By considering the tax rates, holding periods, and various tax-efficient investment vehicles, investors can make informed decisions to minimize their tax burden and maximize their after-tax returns. It is always advisable to consult with a tax professional or financial advisor to tailor investment strategies to individual circumstances and take full advantage of the tax benefits available.

Home "Investments": Why Buying a House is Not an Actual Investment

You may want to see also

Investment Research: Analyzing companies, industries, and market trends for informed decisions

Investment research is a critical process that forms the backbone of informed decision-making in the US financial markets. It involves a comprehensive analysis of various factors, including companies, industries, and market trends, to assess the potential risks and rewards associated with an investment. This research is essential for investors, whether they are individuals, institutions, or financial advisors, as it helps them make strategic choices that align with their financial goals and risk tolerance.

When conducting investment research, analysts delve into a multitude of aspects. Firstly, they examine individual companies by studying their financial statements, management teams, business models, and competitive advantages. This includes assessing revenue growth, profitability, debt levels, and cash flow. For instance, an investor might analyze a company's historical financial data to identify trends, such as consistent revenue increases or a strong balance sheet, which could indicate a sound investment opportunity. Additionally, industry analysis is crucial, as it provides context for a company's performance. Researchers evaluate industry dynamics, market share distribution, regulatory environment, and emerging trends to understand the overall health and prospects of the sector.

Market trend analysis is another vital component of investment research. This involves studying historical price movements, economic indicators, and global events that impact the markets. Investors use this information to predict future price movements and make strategic decisions. For example, understanding the relationship between interest rates and stock market performance can help investors anticipate potential shifts in the market. Furthermore, keeping abreast of macroeconomic factors, such as GDP growth, inflation rates, and employment data, is essential for making well-informed investment choices.

The process of investment research also includes risk assessment and management. Analysts identify potential risks associated with specific companies or industries, such as competitive threats, regulatory changes, or economic downturns. By understanding these risks, investors can develop strategies to mitigate them. This might involve diversifying portfolios across different sectors or asset classes to reduce the impact of any single investment.

In summary, investment research is a meticulous and multifaceted process that empowers investors to make prudent decisions. It requires a deep understanding of companies, industries, and market dynamics, coupled with the ability to identify and manage risks. By employing rigorous research methods, investors can navigate the complex US financial landscape with confidence, ensuring their portfolios are well-positioned for long-term success. This research-driven approach is fundamental to the US investment culture, promoting a more informed and disciplined investment strategy.

The Hunt for High Dividend Yields: Strategies for Seeking Out Substantial Returns

You may want to see also

Frequently asked questions

Investment in the United States can take various forms, and it plays a crucial role in the country's economy. Here's a simplified breakdown:

- Equity Investments: This involves buying shares or stocks of companies, which means you become a partial owner of the company. When you invest in the stock market, you purchase shares of publicly traded companies, and your returns come from the company's profits and the appreciation of your share value.

- Debt Investments (Bonds): Bond investments are essentially loans made to governments or corporations. When you buy a bond, you're lending money to the issuer, and in return, they pay you interest over a specified period. Bonds are considered less risky than stocks but generally offer lower returns.

- Mutual Funds and Exchange-Traded Funds (ETFs): These are investment vehicles that pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities. Mutual funds are managed by professionals and offer an easy way to invest in a wide range of assets. ETFs, on the other hand, trade on stock exchanges like individual stocks.

- Real Estate: Investing in real estate can be done through purchasing properties directly or by investing in Real Estate Investment Trusts (REITs), which are companies that own or finance income-producing real estate.

- Retirement Accounts: The US offers retirement savings plans like 401(k)s and IRAs, which provide tax advantages and help individuals save for the long term. These accounts often include investment options, allowing investors to choose how to allocate their funds.

The Federal Reserve, often referred to as the Fed, is the central banking system of the United States. It has several key roles related to investment:

- Monetary Policy: The Fed manages monetary policy, which influences interest rates and the money supply. Lower interest rates can encourage investment by making borrowing cheaper, while higher rates might discourage new investments.

- Regulation: The Fed regulates and supervises financial institutions, ensuring the stability and safety of the investment market.

- Open Market Operations: The Fed buys and sells government securities in the open market to control the money supply and influence interest rates, which can impact investment decisions.

Starting an investment journey in the US can be straightforward, and here are some steps:

- Educate Yourself: Understand the basics of investing, including different asset classes, market dynamics, and risk management.

- Determine Your Investment Goals: Are you saving for retirement, a house, or a specific financial goal? This will help you decide on the type of investments and strategies.

- Choose an Investment Account: Open a brokerage account or a retirement account (like a 401(k) or IRA) to start investing.

- Select Investment Vehicles: Decide on the type of investments you want to make, such as stocks, bonds, mutual funds, or ETFs.

- Diversify Your Portfolio: Diversification is a key strategy to manage risk. Spread your investments across different asset classes and sectors.

- Monitor and Review: Regularly review your investments, stay informed about market trends, and adjust your portfolio as needed.

Investing in the US comes with certain tax considerations:

- Capital Gains Taxes: When you sell an investment for a profit, you may be subject to capital gains tax. The tax rate depends on your income and the holding period of the investment.

- Dividend Taxes: Dividends from stocks are typically taxable income. The tax rate can vary depending on the investor's tax bracket.

- Interest Income: Interest earned from bonds or savings accounts is generally taxable.

- Retirement Accounts: Contributions to traditional retirement accounts (like 401(k)s) may be tax-deductible, and withdrawals in retirement are taxed differently. Roth accounts offer tax-free growth and withdrawals.

- Tax-Efficient Investing: Consider tax-efficient investment strategies, such as tax-loss harvesting, to optimize your after-tax returns.