Dividend stocks can be a great way to boost your investment portfolio's income, especially during times of high inflation and the threat of a recession. Dividend stocks or funds can provide a regular passive income from some of the most robust companies in the economy.

Dividend stocks are shares of companies that make regular distributions to their shareholders, usually in the form of cash payments. Dividend stocks can be a useful source of income, but the best dividend stocks can also be an excellent way to increase your wealth over the long term.

When looking for the best dividend stocks, it's important to consider more than just the highest yield. A high dividend yield could be a trap that covers up erratic payouts, poor performance or minimal growth prospects. Instead, look for stocks with durable dividends and buy them when they're undervalued.

Some examples of dividend stocks with reliable dividends include Comcast Corp Class A, Verizon Communications Inc, Johnson & Johnson, and Exxon Mobil.

What You'll Learn

Dividend stocks vs dividend funds

Dividend stocks and dividend funds are two ways to invest in dividend-paying stocks. Dividend stocks are individual stocks that pay dividends, while dividend funds are funds that invest in a portfolio of dividend-paying stocks. Here are some key differences between the two:

Diversification

Dividend funds provide greater diversification than dividend stocks. By investing in a fund, you gain exposure to a basket of dividend-paying stocks across multiple sectors, reducing the risk associated with investing in a single stock.

Income Consistency

Dividend funds are designed to provide consistent income by investing in stocks with a history of paying dividends. While individual dividend stocks may also pay dividends, their payouts may be less consistent and subject to changes in the company's financial health or broader market conditions.

Expense Ratios

Dividend funds typically have lower expense ratios than actively managed funds and may have lower costs than building a diversified portfolio of individual dividend stocks.

Management

Dividend funds are managed by professional fund managers who make investment decisions on behalf of the investors. With dividend stocks, investors need to make their own investment decisions and conduct thorough research on each company's financial health, dividend history, and market conditions.

Risk

While both dividend funds and dividend stocks carry market risk, dividend funds may be less risky due to their diversification. However, dividend funds are still subject to market fluctuations and can experience declines in value.

Suitability

Dividend funds are suitable for retirees or income-seeking investors who want a reliable and consistent income stream. They are also a good choice for long-term investors who want to reinvest dividends to build wealth over time. On the other hand, dividend stocks may be preferable for DIY investors who want to select their own investments and have a higher risk tolerance.

In summary, the choice between dividend stocks and dividend funds depends on your investment goals, risk tolerance, and preferences. Dividend funds offer diversification and consistent income, while dividend stocks provide the flexibility to choose individual investments but come with higher risk and potentially higher costs.

Tata Steel: Invest Now?

You may want to see also

High-dividend stocks

Dividend stocks can be a great choice for investors looking for passive income. Dividend stocks are shares of companies that regularly pay investors a portion of the company's earnings. Some pay dividends annually, semi-annually, or quarterly, while others are monthly dividend stocks. The average dividend yield of some of the top dividend stocks is 12.69%.

- International Seaways Inc (INSW): This company is one of the top dividend stocks by yield, with a dividend yield of 12.69%.

- Pennymac Mortgage Investment Trust (PMT): PMT is another top dividend stock by yield, but the specific yield percentage is not mentioned.

- Altria Group (MO): Altria is the company behind Marlboro cigarettes, one of the most popular tobacco brands globally. They have stated their intention to pay out most of their earnings as dividends. As of July 12, 2024, their dividend yield was 8.3% and their annual dividend was $3.92.

- Verizon Communications (VZ): Verizon is a leader in communication and technology services, providing mobile phone services to a large portion of the US population. Their dividend yield is 6.4% and their annual dividend is $2.66.

- AT&T Inc.: AT&T is another telecommunications company that generates solid cash flow for shareholders. They recently cut their dividend by almost half as they focus on 5G investments and debt reduction. Their dividend yield is 5.9% and their annual dividend is $1.11.

- Johnson & Johnson (JNJ): Johnson & Johnson is a diversified healthcare company that earns a wide economic moat rating from Morningstar. They have a history of raising their dividends and are considered a dividend aristocrat. Their trailing dividend yield is 3.28%.

- Exxon Mobil (XOM): Exxon Mobil is an oil and gas company that recently acquired Pioneer Natural Resources. They have a history of raising their dividends and are also considered a dividend aristocrat. Their trailing dividend yield is 3.32%.

- Starbucks Corporation (SBUX): Starbucks is a well-known coffee company with over 38,000 stores worldwide. They have consistently raised their dividends since 2010 and currently offer a quarterly dividend of $0.57 per share, resulting in an annual yield of 3.02%.

- Phillips 66 (PSX): Phillips 66 is an energy manufacturing and logistics company that has increased its dividends consecutively since 2012. In April 2024, they raised their quarterly dividend by 10% to $1.15 per share, resulting in an annual dividend of $4.60 and a yield of 3.29%.

- Enterprise Products Partners (EPD): Enterprise Products Partners is a midstream energy company that controls pipeline assets stretching across the US. They recently raised their quarterly dividend to $0.525 per share, resulting in an annual dividend of $2.10 per share and a yield of 7.06%.

It is important to note that a high dividend yield can sometimes be unsustainable or the result of a low stock price. Therefore, it is crucial to carefully research and evaluate dividend stocks before investing.

Raisin in the Sun" Investors Reveale

You may want to see also

Dividend aristocrats

- Johnson & Johnson: A diversified healthcare company with pharmaceuticals, medical devices, and consumer products segments. J&J has increased its dividend for 60 consecutive years and is expected to deliver a 5-year annual return of 12.8%.

- Chevron: One of the world's largest oil and gas companies, with a strong track record of increasing dividends. Chevron has a comfortable dividend payout ratio, providing room for further dividend growth.

- Abbott Laboratories: A global healthcare products provider with a diverse range of nutritional, medical testing, and monitoring products. Abbott has increased its dividend payouts for 52 consecutive years.

- General Dynamics: A provider of aerospace and defence vehicles, as well as AI solutions for defence and cybersecurity. General Dynamics has demonstrated strong financial performance and has increased its dividend for 27 consecutive years.

- Medtronic: The largest manufacturer of biomedical devices and implantable technologies, serving patients and physicians in over 150 countries. Medtronic has raised its dividend for 46 years and is expected to deliver a 5-year annual return of 13.7%.

Lucrative Investment Opportunities: Exploring Avenues with 10 Percent Returns

You may want to see also

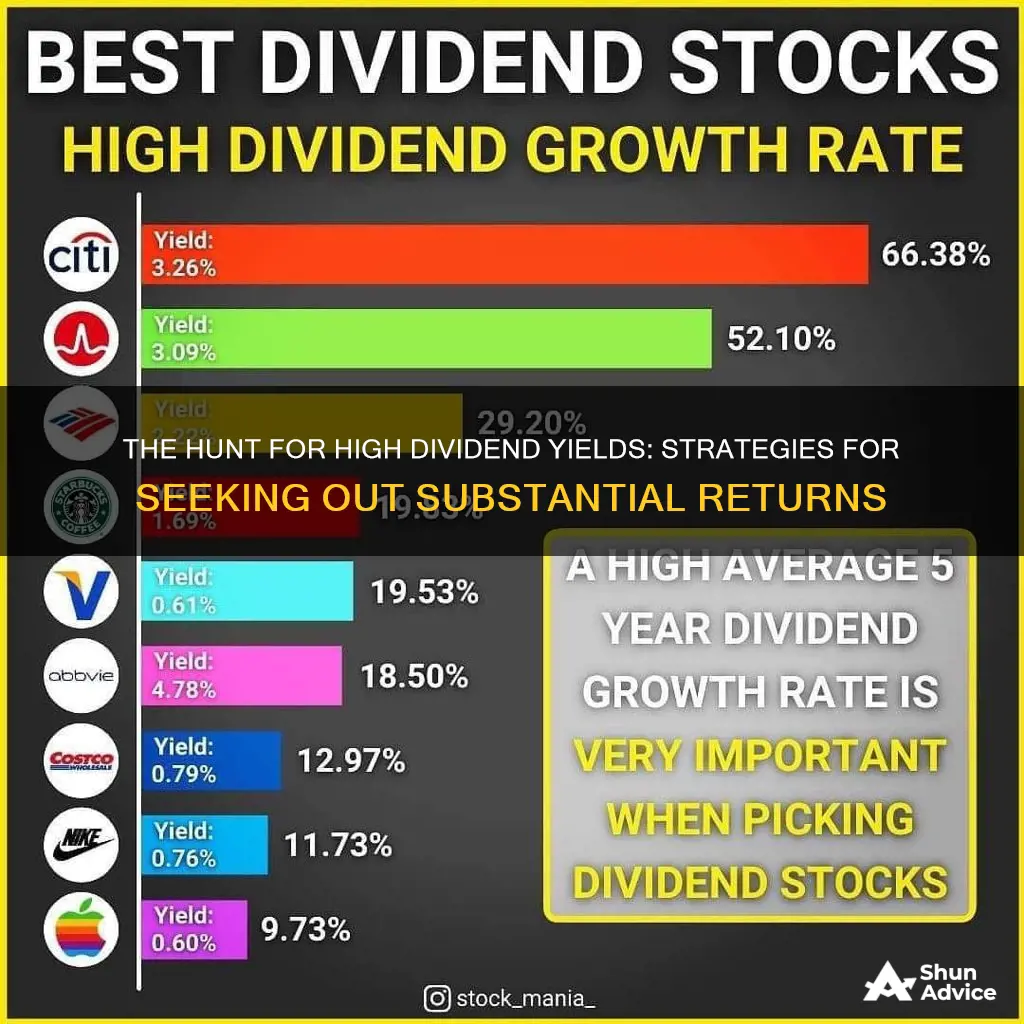

Dividend growth

Dividend-paying stocks can be a lucrative form of passive income, and they also hedge against inflation. Dividend growth stocks can be a great addition to your portfolio, especially in the current environment since rising prices can boost company profits.

Dividends are a Major Source of Long-term Market Returns

Dividends have historically been important to a portfolio's total return. From 1930 through 2017, dividends accounted for about 42% of the S&P 500 Index's total return, and at certain times, such as the 1970s and 2000s, dividends accounted for well over half of the market's returns.

Dividend Growth Stocks Have Outperformed the Stock Market over Time

Companies that consistently pay and grow their dividends have historically outperformed non-dividend stocks. From 1972 through 2017, dividend-paying stocks returned 9.25% per year, beating the equal-weighted S&P 500's annualized return of 7.7% and the 2.6% annualized return of stocks that did not pay dividends.

- Dividend Growth Stocks can Help Ensure a Safe Retirement

- Embracing a Dividend Growth Investor's Mindset can Help You Avoid Market Underperformance

The biggest enemy of long-term market returns is human emotion, specifically the psychological principle of "loss aversion," which states that it hurts twice as much to lose a dollar as it feels good to gain a dollar. Market booms and busts are often caused by investors getting caught up in their emotions. By adopting a dividend growth investor's mindset, you can focus on the long-term health of your portfolio and avoid the temptation to time the market.

Being a Dividend Growth Investor can Help You Earn a Return No Matter What Stock Prices are Doing

By adopting a long-term, value-oriented dividend growth mindset, you can more easily grow your wealth and income over time. Instead of worrying about short-term stock price fluctuations, focus on the dividends your stocks are accruing. Even during market downturns, such as the financial crisis when the S&P 500 dropped over 50%, dividend-paying stocks can still deliver steady income.

Key Considerations for Investing in Dividend Growth Stocks

When investing in dividend growth stocks, it's important to keep the following in mind:

- Focus on business quality and stability: Look for companies with strong cash flows, steady revenue and earnings growth, and durable competitive advantages.

- Evaluate the dividend payout ratio: A reasonably low payout ratio (around 70% or less) indicates that the dividend is sustainable and the company is not putting too much of its income into dividend payments.

- Reinvesting dividends: Reinvesting dividends can significantly enhance your returns over time.

- Diversification: Ensure your portfolio is diversified to manage risk effectively.

- Long-term focus: Dividend stocks typically deliver the best returns when bought and held for the long term.

In conclusion, dividend growth stocks offer a stable, growing income stream that can fund your needs, desires, and retirement. They can be a valuable addition to your investment portfolio, providing both income and wealth accumulation potential.

Investing in Ideas: Backing Brainpower

You may want to see also

Dividend yield vs dividend size

Dividend yield and dividend size are two different metrics that can be used to evaluate a potential stock investment. Dividend yield is expressed as a percentage and represents the ratio of a company's annual dividend compared to its share price. On the other hand, dividend size or dividend rate is expressed as a dollar figure and represents the total amount of dividend payments expected.

Dividend yield is an important metric for investors as it helps them understand the rate of return they can expect from their investment. A higher dividend yield means that the company is offering a greater return to its shareholders relative to its share price. However, it's important to note that a high dividend yield doesn't always indicate an attractive investment opportunity. For example, a company's stock price may have declined, leading to an elevated dividend yield. Additionally, a company with a high dividend yield may be distributing too much of its profits as dividends instead of reinvesting in growth opportunities.

Dividend size, or dividend rate, provides information on the total expected income from an investment. It is expressed as an annualized dollar amount per share and can be calculated by multiplying the dividend yield by the share price. Dividend rates are generally fixed or adjustable and are paid out quarterly, semi-annually, or annually.

When evaluating potential investments, it's important to consider both dividend yield and dividend size, as well as other factors such as the company's financial health, stability, and growth prospects. Additionally, investors should be cautious of companies with distressed stock prices and higher-than-average dividend yields, as there is a risk of dividend reduction or elimination.

In summary, dividend yield and dividend size are both important metrics that provide valuable insights for investors. Dividend yield helps compare the rate of return, while dividend size indicates the total expected income. By considering these metrics together with other financial indicators, investors can make more informed decisions about their investments.

Savings Strategies: Where to Invest

You may want to see also

Frequently asked questions

Dividend stocks are shares of companies that pay investors a portion of the company's earnings. Dividend stocks can be a good choice for investors looking for passive income.

Examples of dividend stocks include Johnson & Johnson, Verizon Communications, Altria, Microsoft, and Starbucks.

You can invest in dividend stocks by setting up a brokerage account and choosing which dividend stocks to invest in. You can also invest in dividend funds, which are funds that hold a basket of dividend stocks.