Understanding how investments work at Northwestern Mutual can be a game-changer for anyone looking to build wealth and secure their financial future. Northwestern Mutual offers a comprehensive range of investment options tailored to individual needs, whether you're a seasoned investor or just starting. Their approach involves creating personalized financial plans that align with your goals, risk tolerance, and time horizon. This includes a variety of investment products such as mutual funds, stocks, bonds, and annuities, each with its own level of risk and potential return. By working with a Northwestern Mutual financial advisor, you can navigate the complexities of the financial markets and make informed decisions to grow your wealth over time. This personalized guidance is a key differentiator, ensuring that your investments are not just a collection of assets but a strategic plan to achieve your financial aspirations.

What You'll Learn

- Investment Accounts: Understand the different types of accounts offered by Northwestern Mutual

- Investment Strategies: Learn about various investment approaches and their potential benefits

- Risk Management: Explore methods to mitigate risks associated with investments

- Financial Planning: Discover how investments fit into a comprehensive financial plan

- Tax Implications: Examine the tax effects of different investment choices

Investment Accounts: Understand the different types of accounts offered by Northwestern Mutual

Northwestern Mutual offers a range of investment accounts to cater to various financial goals and risk tolerances. Understanding the different types of accounts available is essential for investors to make informed decisions about their money. Here's a breakdown of the investment accounts provided by Northwestern Mutual:

- Individual Retirement Accounts (IRAs): These accounts are designed to help individuals save for retirement while offering tax advantages. Northwestern Mutual provides traditional and Roth IRA options. With a traditional IRA, contributions may be tax-deductible, and earnings can grow tax-deferred until withdrawal. Roth IRAs, on the other hand, allow tax-free growth and withdrawals in retirement. Investors can choose from various investment options within these accounts, including mutual funds, stocks, bonds, and more.

- Annuity Accounts: Annuities are insurance products that provide a steady income stream during retirement. Northwestern Mutual offers fixed and variable annuity options. Fixed annuities guarantee a fixed rate of return, offering stability and predictability. Variable annuities, however, allow for potential higher returns but also come with more investment risk. These accounts are suitable for those seeking a guaranteed income stream or those who want to manage risk through a mix of fixed and variable investments.

- Mutual Funds and Variable Universal Life (VUL) Accounts: Northwestern Mutual offers a selection of mutual funds, which are professionally managed investment portfolios. These funds invest in a diversified range of assets, such as stocks, bonds, and other securities. VUL accounts combine life insurance with investment options, providing both death benefit protection and potential investment growth. Investors can allocate their funds across various investment choices within these accounts, allowing for customization based on their risk preferences.

- Investment Accounts for Non-Retirement Purposes: Northwestern Mutual also caters to investors looking to build wealth for other objectives. They offer non-qualified investment accounts, where individuals can invest for short-term goals or build a portfolio for various reasons. These accounts provide flexibility in terms of investment choices and tax treatment, allowing investors to tailor their strategy according to their specific needs.

When considering investment accounts with Northwestern Mutual, it's crucial to evaluate your financial objectives, risk tolerance, and time horizon. Each account type offers unique advantages and considerations, and a financial advisor can provide personalized guidance to help you choose the most suitable investment strategy. Remember, investing involves risk, and it's essential to understand the potential risks and rewards associated with each account type before making any investment decisions.

Helium Havens: Navigating the Investment Landscape

You may want to see also

Investment Strategies: Learn about various investment approaches and their potential benefits

When it comes to investing, Northwestern Mutual offers a range of strategies to suit different financial goals and risk tolerances. Understanding these strategies is key to making informed decisions about your investments. Here's an overview of some common investment approaches and their potential advantages:

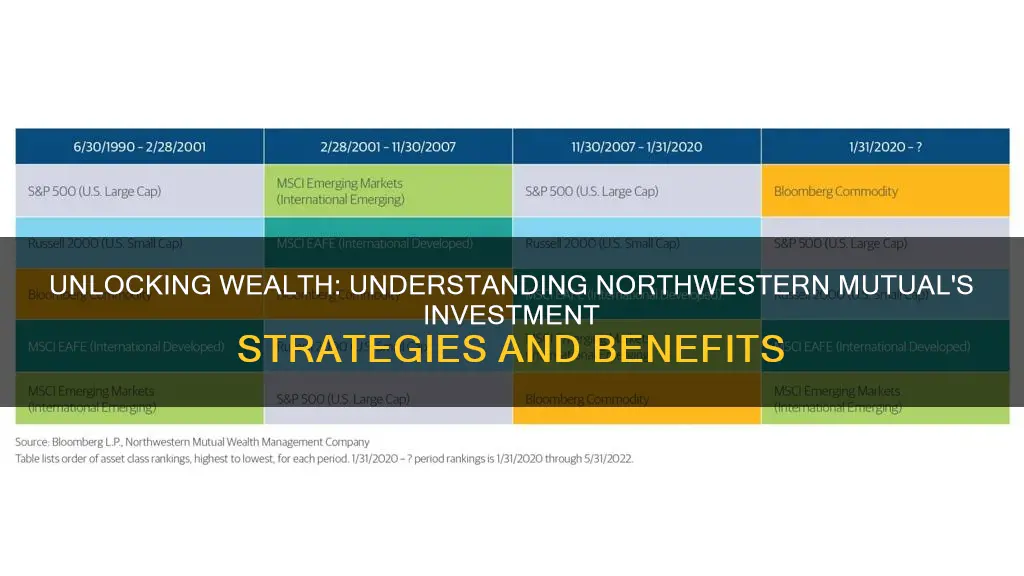

- Asset Allocation: This strategy involves dividing your investment portfolio across various asset classes such as stocks, bonds, cash, and real estate. The goal is to create a balanced mix that aligns with your risk profile and financial objectives. For instance, a conservative investor might allocate more funds to bonds and less to stocks, while a more aggressive investor might favor a higher stock allocation. Asset allocation helps manage risk and can provide a more stable investment journey over time.

- Growth Investing: This approach focuses on capital appreciation, aiming to maximize returns by investing in companies with strong growth potential. Growth investors typically seek out businesses with innovative products, solid management teams, and a competitive edge in their industry. While this strategy can lead to substantial gains, it often involves higher risk due to the volatile nature of growth stocks. Diversification is crucial to mitigate this risk.

- Value Investing: Value investors seek undervalued assets, believing that the market has overlooked certain companies with strong fundamentals. They analyze financial metrics and look for stocks trading at a discount to their intrinsic value. This strategy requires thorough research and a long-term perspective. Value investing can offer attractive returns when the market recognizes the true worth of these companies.

- Income Investing: This strategy is geared towards generating regular income through dividends, interest, or rental payments. Income investors often focus on stable, established companies that provide consistent cash flow. This approach is particularly appealing to those seeking a steady stream of income, especially during retirement. However, it may come with lower potential capital appreciation compared to growth-oriented strategies.

- Index Investing: Index funds or exchange-traded funds (ETFs) track a specific market index, such as the S&P 500. This strategy provides broad market exposure and is often considered a low-cost, diversified approach. Index investors aim to replicate the performance of the index, which can be an effective way to capture market returns over the long term. This method is particularly suitable for investors who prefer a hands-off approach and want to mirror the overall market.

Each investment strategy carries its own set of risks and rewards. It's essential to assess your financial goals, risk tolerance, and time horizon before deciding on an investment approach. Northwestern Mutual's financial advisors can provide personalized guidance, helping you navigate these strategies and build a portfolio tailored to your unique needs.

Retirement Readiness: Smart Investing in Your 20s

You may want to see also

Risk Management: Explore methods to mitigate risks associated with investments

When it comes to managing investments, risk mitigation is a critical aspect of ensuring long-term success and financial security. Here are some methods to consider for effectively managing risks associated with your investments:

Diversification: One of the fundamental principles of risk management is diversification. This strategy involves spreading your investments across various asset classes, sectors, and geographic regions. By diversifying, you reduce the impact of any single investment's performance on your overall portfolio. For example, if you invest in a mix of stocks, bonds, real estate, and alternative investments, a decline in one area may be offset by gains in another. Northwestern Mutual emphasizes the importance of diversification to create a balanced and resilient investment portfolio.

Risk Assessment and Analysis: Conducting thorough risk assessments is essential to identify potential pitfalls. This process involves evaluating the historical performance, volatility, and potential risks associated with different investment options. Northwestern Mutual's financial advisors can assist in creating a comprehensive risk analysis report, which includes assessing your risk tolerance, understanding market trends, and identifying specific risks related to your chosen investments. This analysis will help you make informed decisions and adjust your portfolio accordingly.

Asset Allocation: Proper asset allocation is a key risk management technique. It involves dividing your investment portfolio into different asset categories based on your risk tolerance and financial goals. For instance, a more conservative approach might allocate a larger portion of your portfolio to bonds and fixed-income securities, while a more aggressive strategy could focus on stocks and growth-oriented investments. Regular reviews of asset allocation ensure that your portfolio remains aligned with your risk profile and objectives.

Regular Portfolio Reviews: It is crucial to monitor and review your investment portfolio periodically. Market conditions and personal circumstances can change, impacting the risk associated with your investments. Northwestern Mutual recommends setting up regular portfolio reviews to assess performance, rebalance your holdings if necessary, and make adjustments to your investment strategy. This proactive approach allows you to stay on track and make informed decisions to manage risk effectively.

Risk Mitigation Strategies: There are various risk mitigation techniques to consider, such as stop-loss orders, which automatically sell an investment if it reaches a predetermined price, limiting potential losses. Additionally, hedging strategies can be employed to protect against downside risk. Northwestern Mutual's financial experts can provide tailored advice on implementing these strategies based on your investment goals and risk tolerance.

By implementing these risk management methods, you can navigate the investment landscape with greater confidence and potentially safeguard your financial well-being. Remember, effective risk management is an ongoing process that requires regular attention and adaptation to changing market conditions.

AI's Investment Research Revolution: Transforming the Future of Finance

You may want to see also

Financial Planning: Discover how investments fit into a comprehensive financial plan

When considering financial planning, investments play a crucial role in helping individuals achieve their long-term financial goals. At Northwestern Mutual, investments are an integral part of a comprehensive financial strategy, offering a means to grow wealth, secure the future, and meet various financial objectives. Here's how investments fit into the broader context of financial planning:

Defining Investment Objectives: Financial planning begins with understanding an individual's unique goals. These objectives could include retirement planning, saving for a child's education, purchasing a home, or building an emergency fund. Investments are tailored to align with these specific goals. For instance, if an individual aims to retire early, a financial advisor might suggest a mix of stocks and bonds to potentially generate higher returns over time.

Risk Management and Asset Allocation: A key aspect of financial planning is managing risk. Investments are carefully selected and allocated based on an individual's risk tolerance and time horizon. Northwestern Mutual's financial advisors employ asset allocation strategies to diversify portfolios, ensuring that investments are spread across different asset classes like stocks, bonds, real estate, and alternative investments. This diversification helps minimize risk and provides a more stable investment journey.

Long-Term Wealth Creation: Investments are a powerful tool for wealth accumulation. By investing in a variety of assets, individuals can benefit from the potential for long-term growth. For example, investing in mutual funds or exchange-traded funds (ETFs) can provide instant diversification, allowing investors to own a small piece of various companies. Over time, this can lead to substantial wealth creation, which is a cornerstone of successful financial planning.

Regular Review and Adjustment: Financial planning is an ongoing process, and investments require regular monitoring and adjustments. Northwestern Mutual's advisors provide periodic reviews of investment portfolios to ensure they remain aligned with the client's goals and risk tolerance. Market conditions and life events may necessitate rebalancing the portfolio, buying or selling assets, or making strategic changes to the investment strategy. This proactive approach ensures that investments remain a vital component of a dynamic financial plan.

In summary, investments are a critical element of financial planning at Northwestern Mutual, enabling individuals to achieve their financial aspirations. By understanding investment objectives, managing risk, and regularly reviewing portfolios, individuals can make informed decisions that contribute to a secure and prosperous financial future. It is through this comprehensive approach that Northwestern Mutual assists clients in navigating the complexities of investing and financial planning.

Student Debt Strategies: Investing to Reduce the Burden

You may want to see also

Tax Implications: Examine the tax effects of different investment choices

When considering investment options, understanding the tax implications is crucial as it can significantly impact your overall returns. At Northwestern Mutual, they offer a range of investment products, each with its own tax characteristics. Here's an overview of the tax effects associated with different investment choices:

Tax-Deferred Accounts: One of the most common investment vehicles is a tax-deferred account, such as a 401(k) or a traditional IRA. Contributions to these accounts are typically made with pre-tax dollars, reducing your taxable income for the year. This means you don't pay taxes on the money you invest initially. The earnings and growth within these accounts also grow tax-deferred, allowing your investments to compound over time. However, withdrawals from these accounts in retirement are generally taxed as ordinary income, and early withdrawals may incur penalties.

Tax-Advantaged Accounts: Roth IRA and Roth 401(k) plans offer tax advantages. With a Roth IRA, you contribute after-tax dollars, meaning you've already paid income tax on the money. This allows qualified distributions, including earnings, to be tax-free and penalty-free in retirement. Similarly, a Roth 401(k) provides tax-free growth and withdrawals in retirement. While contributions are not tax-deductible, the earnings can grow tax-free, providing a significant long-term benefit.

Taxable Accounts: Traditional brokerage accounts are subject to taxation. Any capital gains realized from selling investments held for more than a year are taxed at a favorable long-term capital gains rate. Short-term capital gains are taxed as ordinary income. Dividends from stocks held for less than a year are also taxed as ordinary income. Additionally, interest earned on bonds and other fixed-income securities is generally taxable as ordinary income.

Real Estate and Business Investments: Investing in real estate or starting a business can have complex tax implications. Depreciation is a key consideration, allowing investors to claim a loss on the property's value each year, which can offset other income. Business investments may provide tax credits, deductions, and tax-free distributions under certain conditions. However, these investments often require careful planning and may have stricter eligibility criteria.

Alternative Investments: Alternative investments like hedge funds, private equity, and collectibles can offer unique tax treatments. Some may provide tax-efficient strategies, while others might have complex tax structures. It's essential to understand the specific tax rules associated with each alternative investment to make informed decisions.

Understanding the tax implications is a critical aspect of investment planning. Northwestern Mutual's financial advisors can provide personalized guidance, helping you navigate these complexities and make investment choices aligned with your financial goals and tax situation.

Clara Robert's Role at EasyWay Investments: Unveiling the Facts

You may want to see also

Frequently asked questions

At Northwestern Mutual, we offer a comprehensive investment advisory service tailored to meet your financial goals and risk tolerance. Our process begins with a thorough understanding of your financial situation, goals, and preferences. We then create a customized investment plan, which may include a mix of mutual funds, stocks, bonds, and other investment vehicles. Our team of financial advisors provides ongoing guidance and regular reviews to ensure your investments stay on track and align with your evolving needs.

Choosing the right investment options is a critical step in building your financial future. Our advisors will assess your risk tolerance, time horizon, and financial objectives to recommend suitable investment choices. We offer a wide range of investment products, including mutual funds, index funds, and fixed-income securities. Our goal is to provide diversification and potential for growth while managing risk effectively. We also provide educational resources and regular performance updates to help you make informed decisions.

Northwestern Mutual is a trusted financial services company with a strong commitment to its clients' financial well-being. Here are some key benefits:

- Personalized Service: Our advisors take the time to understand your unique needs and provide tailored investment strategies.

- Comprehensive Approach: We offer a holistic view of your finances, helping you manage your investments alongside other financial aspects like insurance and retirement planning.

- Long-Term Focus: We believe in building a solid financial foundation for the long term, ensuring your investments are aligned with your retirement goals.

- Financial Security: Northwestern Mutual's strong financial position provides stability and peace of mind for your investments.

We provide various tools and resources to help you stay informed and actively manage your investments. Our online platform offers real-time account access, where you can view your investment performance, track progress, and make adjustments as needed. Additionally, our advisors will provide regular updates, performance reports, and recommendations to ensure you are actively engaged in your investment journey. We also offer educational resources to enhance your understanding of the market and investment strategies.