Saving for retirement in your 20s can feel daunting, but it's one of the most important things you can do for your financial future. The earlier you start, the more time your money has to grow, and even small contributions can make a big difference over time. Here are some tips to get you started on your retirement savings journey:

- Start with a plan: Figure out your short- and long-term goals, create a budget, and make a plan for how much you can save each month.

- Make managing your debt a priority: Focus on paying off any high-interest debt, such as credit card debt, to free up more money for investing.

- Take advantage of employer-sponsored retirement plans: If your employer offers a 401(k) or similar plan, contribute as much as you can, especially if they match your contributions.

- Invest in a Roth IRA: This allows you to invest with after-tax dollars, and your withdrawals in retirement are tax-free.

- Invest in low-cost index funds or ETFs: These are a great way to invest in stocks or bonds without having to pick individual stocks.

- Get help if you need it: Consider working with a financial advisor or using a robo-advisor to help you make investment decisions.

- Incrementally raise your savings rate: Start with what you can afford, and gradually increase your contributions over time, especially when you get a raise.

What You'll Learn

Start saving today

It's easy to put off saving for retirement when you're in your 20s. After all, you're probably more focused on advancing your career and dealing with immediate concerns like student loans and rent. But the truth is, starting to save for retirement in your 20s is one of the smartest financial decisions you can make. Here's why:

Time is on your side

The power of compound interest means that even a small amount saved today can grow into a substantial sum by the time you retire. For example, if you invest $75 a month from age 25 to 65, assuming an 8% return, you'll end up with over $260,000. But if you wait until you're 35 to start saving, you'll need to save more than twice as much each month to reach the same goal.

You may have fewer responsibilities

In your 20s, you might not have a mortgage, family, or other major expenses to worry about yet. This makes it easier to set aside a portion of your income for retirement. And if you're struggling to pay off student loans or cover your rent, remember that you don't have to start with a large sum. Even saving a small amount each month can make a big difference over time.

Take advantage of employer matching

If your employer offers a 401(k) plan or another type of retirement savings account, be sure to sign up. Many employers will match your contributions up to a certain percentage, which is essentially free money for your retirement. For example, if your employer matches your contributions dollar for dollar up to 3% of your salary, contribute at least enough to get the full match. This is a guaranteed return on your investment that you don't want to miss out on.

Reduce your taxable income

Contributing to a 401(k) or a traditional IRA can lower your taxable income for the year. With a 401(k), your contributions are made pre-tax, so you'll pay less tax now. And with a traditional IRA, you can deduct your contributions from your taxable income when you file your taxes. This means you'll pay less tax now and more later when you withdraw the money in retirement.

Get into good financial habits

Starting to save for retirement in your 20s helps you develop good financial habits that will benefit you throughout your life. You'll learn how to budget, set financial goals, and make your money work for you. And if you make saving a habit now, it will be easier to continue as your income grows.

Should You Sell Investments to Pay Off Your Mortgage?

You may want to see also

Sign up for your employer's 401(k)

Signing up for your employer's 401(k) is a great way to start saving for retirement in your 20s. Here are some detailed steps and considerations to help you take advantage of this important benefit:

Understand the Basics of 401(k) Plans

Firstly, it's important to understand what a 401(k) plan is and how it works. A 401(k) is a retirement savings plan offered by employers, which allows employees to contribute a portion of their pre-tax wages to their retirement savings. This means that the money is deducted from your paycheck before taxes, lowering your taxable income for the year. Many employers also offer matching contributions up to a certain percentage of your salary, providing additional "free" money for your retirement.

Sign Up and Choose an Account Type

If your employer offers a 401(k) plan, be sure to sign up and enrol. Starting in 2025, employers will automatically enrol new employees in their workplace plan, with the option to opt out. When signing up, you will need to choose between a traditional 401(k) and a Roth 401(k) option, if available. The main difference is the timing of the tax benefit. With a traditional 401(k), you get the tax break upfront since contributions are made pre-tax. With a Roth 401(k), contributions are made with after-tax dollars, but qualified withdrawals in retirement are tax-free.

Review Investment Choices and Fees

Most 401(k) plans offer a range of mutual fund choices, each holding a diverse array of investments such as stocks, bonds, and cash. Review the available investment options and consider factors such as risk and potential returns. Additionally, pay close attention to investment fees, as these can eat into your returns. Compare the "management fees" or "expense ratios" and avoid any mutual fund with fees higher than 1%.

Contribute Enough to Get the Employer Match

Contributing enough to your 401(k) to get the full employer match is a crucial step. This ensures you maximize the benefits of your employer's contribution. For example, if your employer offers a dollar-for-dollar match up to 3% of your salary, contribute at least 3% to receive the full match. Keep in mind that matching contributions may be subject to a vesting period, which means you need to remain with the company for a certain period to fully receive the matched funds.

Consider Supplementing with an IRA

While a 401(k) is a great starting point, you may also want to consider supplementing your savings with an Individual Retirement Account (IRA). IRAs offer more flexibility and control over investment choices and are a good option if your employer doesn't offer a 401(k) or if you've already maxed out your 401(k) contributions. Traditional IRAs provide tax benefits upfront, while Roth IRAs offer tax-free withdrawals in retirement.

Diamonds: A Risky Investment Gamble

You may want to see also

No 401(k)? Open a Roth IRA

If you don't have access to a 401(k) through your employer, you may want to consider opening a Roth IRA. A Roth IRA is a type of individual retirement plan that you can open on your own through a financial services custodian such as Fidelity, Charles Schwab, Ally Bank, or robo-advisors like Wealthfront and Betterment.

With a Roth IRA, you contribute money that has already been taxed, so your withdrawals can be tax-free. This is different from a traditional 401(k) or IRA, where your contributions are made pre-tax and then taxed upon withdrawal.

Who is eligible for a Roth IRA?

Most people are eligible to contribute to a Roth IRA as long as they have earned income for the year and are below certain income thresholds. For the 2024 tax year in the US, individuals with a modified adjusted gross income (MAGI) below $146,000 and couples with a MAGI below $230,000 can contribute up to the annual limit of $7,000. Above these income limits, the amount you can contribute to a Roth IRA decreases until you are no longer eligible to contribute at all.

One of the biggest advantages of a Roth IRA is the flexibility it offers. You can withdraw your contributions at any time without paying taxes or penalties. This makes it a good option for both retirement savings and short-term savings goals. Additionally, Roth IRAs are not subject to required minimum distributions (RMDs) during your lifetime, so you can let the money grow until you need it or leave it to your beneficiaries.

Another benefit of a Roth IRA is that there are no age limits, so you can open an account for a child of any age. This makes it a great way to start saving for a child's future.

Opening a Roth IRA is a straightforward process and can often be done online. You will need a form of photo identification, your Social Security number or tax identification number, your bank account information, and the name and address of your employer and plan beneficiary. You will also need to fill out Form 5305-R for the Internal Revenue Service (IRS).

Once you have opened your Roth IRA, you will need to decide how to invest the money. You can choose to design your own investment portfolio based on your risk tolerance and time horizon, or you can invest in target-date funds or life-cycle funds, which automatically adjust to safer investments as you approach retirement age. You can also consult a financial advisor to help you pick investments that are appropriate for your goals.

Invest Wisely: Strategies for Success

You may want to see also

Be aggressive with your investments

When it comes to investing for retirement in your 20s, being aggressive with your investments can pay off, but it's important to understand the risks and potential rewards. Here are some detailed tips on how to be aggressive with your investments in your 20s:

Invest a High Percentage in Stocks:

Historically, stocks have been one of the most volatile investment types, but they also offer the potential for high long-term returns. In your 20s, you have a longer investment horizon, so you can afford to ride out the market's ups and downs. Putting a large portion of your portfolio into stocks can help you build significant wealth over time.

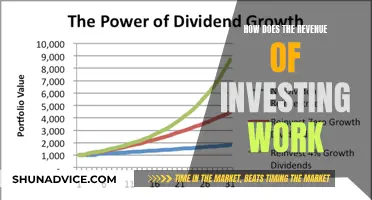

Take Advantage of Compound Interest:

Compound interest is your friend when investing for retirement. The earlier you start, the more time your money has to grow. Even a small amount saved each month can turn into a substantial sum over several decades. For example, investing $75 a month from age 25 to 65 at a moderate 8% return can result in $260,000 or more.

Utilize Employer Matching:

If your employer offers matching contributions to your 401(k) or similar retirement plan, take full advantage of it. This is essentially free money that can boost your retirement savings significantly. Contribute at least enough to get the maximum employer match if possible.

Consider a Roth IRA:

A Roth IRA is a great option, especially if you don't have access to an employer-sponsored retirement plan. While you won't get an immediate tax break on contributions, your investments grow tax-free, and you won't owe any taxes when you withdraw the money in retirement.

Diversify with Mutual Funds or ETFs:

Instead of picking individual stocks, consider investing in mutual funds or exchange-traded funds (ETFs). These funds offer instant diversification by allowing you to invest in a basket of different stocks or bonds. This helps reduce the overall risk of your portfolio while still providing exposure to the stock market.

Understand Your Risk Tolerance:

While being aggressive is a strategy, it's crucial to understand your risk tolerance. Aggressive investing may mean different things to different people. Work with a financial advisor or use online tools to assess your risk profile and determine the right balance of stocks, bonds, and other investments for your portfolio.

Remember, being aggressive with your investments in your 20s can pay off, but it's important to regularly review and adjust your investment strategy as you get older and your financial situation changes.

Pay-for-Performance: Unraveling the Investment Advisor's Fee Structure

You may want to see also

Build an emergency fund

Building an emergency fund is one of the first steps you can take to start saving for retirement. It is a cash reserve that will help you deal with unplanned expenses or financial emergencies, such as car repairs, home repairs, medical bills, or a loss of income. By putting money aside, you can recover quicker and get back on track towards reaching your larger savings goals.

The amount you need to have in your emergency fund depends on your situation. Financial experts typically recommend saving up three to six months' worth of necessary expenses in order to have a healthy, fully-funded emergency account. So, while there's no fixed number, a person in their twenties may need about $5,241 for a three-month emergency fund and $10,482 for a six-month emergency fund, based on an average monthly salary of $2,496 for people aged 20 to 24.

If you're in your late twenties and have a higher salary or live in a more expensive city, your necessary expenses (rent or mortgage, food, utilities, Wi-Fi, transportation, medical costs, etc.) may run you about $2,500 per month. In this case, a three-month emergency fund would be $7,500 and a six-month emergency fund would be $15,000.

To figure out how much you spend each month, you can go through your bank statements or use a budgeting app like Mint, which connects to all your financial accounts and categorizes your transactions. This will help you determine how much to have in your emergency fund.

It's important to note that your emergency fund should grow as you get older. When you're in your 20s, you may not have many expenses beyond rent, utilities, Wi-Fi, food, medications, and monthly debt payments. However, as you get older, you may take on additional obligations like insurance payments, a mortgage, and care for ageing parents, so your monthly expenses will increase. Therefore, the sooner you start building your emergency fund, the easier it will be to keep it growing over time.

Rights: Investing's Golden Ticket

You may want to see also

Frequently asked questions

The earlier you start investing, the more time your money has to grow. In your 20s, you may not have as many financial responsibilities, making it easier to save. Additionally, investing in your 20s allows you to take advantage of compound interest, which can significantly increase your savings over time.

A general rule of thumb is to save 10% to 15% of your income. However, even saving a smaller amount is better than not saving at all. Creating a budget and sticking to it can help you determine how much you can afford to save.

There are several options for retirement accounts, including a 401(k), a Roth IRA, a traditional IRA, and a savings account. A 401(k) is a tax-advantaged retirement account offered by employers, which may include matching contributions. A Roth IRA is funded with after-tax dollars, and withdrawals in retirement are tax-free. A traditional IRA offers tax deductions on contributions, but you will pay taxes on withdrawals. A savings account offers flexibility but may not provide the same tax benefits as other retirement accounts.

It is recommended to invest in a diverse portfolio of stocks, bonds, and mutual funds or exchange-traded funds (ETFs). Stocks tend to provide higher returns but come with higher risk, while bonds are typically lower-risk, lower-return investments. Mutual funds and ETFs allow you to invest in a basket of securities, providing diversification and reducing the need to pick individual stocks.