PNC Investments is a comprehensive financial services platform offered by the PNC Financial Services Group, designed to help individuals and businesses manage their investments and financial goals. It provides a range of investment options, including mutual funds, stocks, bonds, and retirement plans, allowing clients to build and grow their wealth over time. The platform offers personalized investment advice and portfolio management services, catering to different risk tolerances and financial objectives. With an intuitive online interface and mobile app, PNC Investments enables easy access to account information, market insights, and investment tools, making it a convenient and user-friendly choice for those seeking to navigate the world of investing.

What You'll Learn

- Investment Accounts: PNC offers various accounts for investing, including brokerage and retirement accounts

- Investment Products: A range of investment options like stocks, bonds, mutual funds, and ETFs

- Research and Tools: Access to market research, financial calculators, and trading platforms for informed decision-making

- Customer Support: Dedicated advisors and online resources for investment guidance and support

- Fees and Costs: Transparent fee structure for account maintenance, trading, and other investment-related services

Investment Accounts: PNC offers various accounts for investing, including brokerage and retirement accounts

PNC Investments provides a comprehensive range of investment accounts to cater to different financial goals and needs. These accounts are designed to offer individuals a structured way to grow their wealth and achieve their financial objectives. Here's an overview of the investment accounts offered by PNC:

Brokerage Accounts: PNC offers brokerage accounts, which serve as a gateway to the financial markets. These accounts allow investors to buy and sell a wide array of investment products, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). With a brokerage account, you can actively manage your portfolio and make investment decisions based on your financial strategy. PNC provides online trading platforms and tools to facilitate the trading process, ensuring investors can execute their trades efficiently.

Retirement Accounts: PNC understands the importance of retirement planning and offers various retirement account options. These accounts include Traditional and Roth IRAs, as well as 401(k) plans. Traditional IRAs allow investors to contribute pre-tax dollars, reducing their taxable income, while Roth IRAs enable contributions with after-tax dollars, offering tax-free growth. 401(k) plans are employer-sponsored retirement accounts that offer tax advantages and often include employer contributions. PNC provides resources and guidance to help investors navigate retirement savings and make informed decisions about their future.

Investment Management Accounts: For those who prefer a more hands-off approach, PNC offers investment management accounts. These accounts are managed by professional portfolio managers who make investment decisions on your behalf. Investors can choose from various investment strategies and asset allocations based on their risk tolerance and financial objectives. This option is suitable for individuals who lack the time or expertise to actively manage their investments.

PNC's investment accounts are designed to be flexible and adaptable to different investment strategies. Whether you are a seasoned investor or just starting, these accounts provide the tools and resources needed to build and grow a diversified portfolio. With a range of investment options and account types, PNC Investments aims to empower individuals to take control of their financial future and work towards their long-term financial goals.

Understanding Passive Income: Earnings from Work or Investments

You may want to see also

Investment Products: A range of investment options like stocks, bonds, mutual funds, and ETFs

PNC Investments offers a comprehensive suite of investment products to cater to diverse financial goals and risk appetites. These products are designed to provide investors with a range of options to build and grow their wealth over time. Here's an overview of the investment products available:

Stocks: Stocks, also known as equities, represent ownership in a company. When you invest in stocks, you become a shareholder and have the potential to benefit from the company's success. PNC Investments allows investors to purchase individual stocks, which can be a direct way to support companies you believe in and potentially earn capital gains. This investment product offers the opportunity to diversify across various sectors and industries, providing a long-term growth strategy.

Bonds: Bonds are fixed-income securities that represent a loan made by an investor to a borrower, typically a government or corporation. When you buy a bond, you lend money to the issuer, who promises to pay you back with interest over a specified period. PNC Investments offers a range of bond options, including government bonds, corporate bonds, and municipal bonds. Bonds are generally considered less risky than stocks but can provide a steady income stream and capital preservation.

Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. By investing in a mutual fund, you gain instant diversification, as your money is spread across various assets. PNC Investments provides access to a wide array of mutual funds, managed by professional fund managers who make investment decisions on behalf of the fund. This product is suitable for investors seeking a hands-off approach while still benefiting from professional management.

Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They offer a cost-effective way to invest in a basket of assets, providing diversification and the potential for capital appreciation. PNC Investments offers a selection of ETFs covering various markets, sectors, and asset classes. ETFs are known for their low expense ratios and can be a popular choice for investors who want flexibility and the ability to trade throughout the day.

Each of these investment products has its own set of risks and potential rewards, and PNC Investments provides the necessary tools and resources to help investors understand and manage these risks effectively. It is essential to assess your financial goals, risk tolerance, and investment time horizon before deciding on a suitable investment strategy.

Unlocking DZZ's Potential: A Guide to Smart Investing

You may want to see also

Research and Tools: Access to market research, financial calculators, and trading platforms for informed decision-making

PNC Investments offers a comprehensive suite of research and tools to empower investors to make informed decisions. Here's an overview of the resources available:

Market Research: PNC provides access to a wealth of market research materials. This includes in-depth reports on various asset classes, economic indicators, industry trends, and company-specific analysis. Investors can delve into research reports covering stocks, bonds, mutual funds, exchange-traded funds (ETFs), and more. These reports often offer insights into market conditions, potential risks, and opportunities, enabling investors to stay ahead of the curve. The research team at PNC likely employs a combination of fundamental and technical analysis to provide a well-rounded perspective on investments.

Financial Calculators: Calculators are an essential tool for investors to assess the potential performance of their investment portfolios. PNC Investments offers a range of financial calculators that can help investors with tasks such as calculating compound interest, estimating retirement savings, determining the time it takes to double an investment, and evaluating the impact of different investment strategies. These calculators provide valuable insights into the potential growth of investments over time, helping investors make more accurate financial decisions.

Trading Platforms: PNC provides access to user-friendly trading platforms that facilitate the execution of investment strategies. These platforms offer a seamless experience for buying and selling various investment products. Investors can monitor their portfolios in real-time, track performance, and execute trades with just a few clicks. The trading platforms often feature intuitive interfaces, allowing investors to navigate through different asset classes and manage their investments efficiently. Additionally, some platforms may offer automated trading features, enabling investors to set specific criteria for executing trades based on their investment goals and risk tolerance.

By utilizing these research and tool resources, investors can make more informed decisions, develop robust investment strategies, and potentially optimize their returns. PNC Investments' commitment to providing access to market research, financial calculators, and trading platforms demonstrates their dedication to supporting investors throughout their financial journey.

Tata Motors: Invest Now or Miss the Bus?

You may want to see also

Customer Support: Dedicated advisors and online resources for investment guidance and support

PNC Investments offers a comprehensive customer support system to assist investors in navigating their financial journeys. This support structure is designed to provide dedicated advisors and a range of online resources, ensuring investors have the guidance and tools they need to make informed decisions.

Dedicated Advisors:

PNC's network of dedicated investment advisors is a cornerstone of their customer support. These advisors are financial professionals with expertise in various investment areas, including stocks, bonds, mutual funds, and retirement planning. They are available to clients through phone, email, or in-person meetings, offering personalized advice tailored to individual financial goals and risk tolerances. Whether you're a seasoned investor or just starting, these advisors provide valuable insights and strategies to optimize your investment portfolio. They can help with portfolio management, tax-efficient strategies, and providing market analysis to ensure your investments align with your long-term objectives.

Online Resources:

In addition to dedicated advisors, PNC Investments provides a robust online platform that serves as a valuable resource for investors. The online portal offers a wide range of tools and educational materials to empower investors to make informed choices. Here's a breakdown of the key online resources:

- Investment Education: PNC's website features an extensive library of educational content, including articles, videos, and webinars. These resources cover various investment topics, from understanding different asset classes to learning about market trends and economic indicators. Investors can enhance their financial knowledge and make more confident decisions.

- Portfolio Analysis: The online platform allows clients to access real-time portfolio performance data. Investors can track their holdings, review performance history, and receive personalized reports. This feature enables them to monitor their investments actively and make adjustments as needed.

- Market Research: PNC provides market research insights and analysis, helping investors stay informed about economic trends and specific industry developments. This research can guide investment decisions and provide a deeper understanding of the market dynamics.

- Customer Support Portal: The online customer support portal is a centralized hub for investors to access their accounts, view statements, and manage their investments. It offers a user-friendly interface, making it easy for clients to navigate and find the information they require.

PNC Investments' customer support system, combining dedicated advisors and online resources, ensures investors receive personalized guidance and the tools to make informed financial decisions. This comprehensive approach aims to build long-term relationships with clients, fostering their financial success and confidence in their investment journey.

Scams: Why People Fall for Investment Schemes

You may want to see also

Fees and Costs: Transparent fee structure for account maintenance, trading, and other investment-related services

PNC Investments offers a transparent fee structure for various investment-related services, ensuring that clients are well-informed about the costs associated with their accounts. This transparency is a key aspect of their commitment to providing clear and straightforward financial services. Here's an overview of the fees and costs associated with account maintenance, trading, and other investment services:

Account Maintenance Fees:

PNC Investments charges a flat annual fee for account maintenance, which varies depending on the type of account and the level of service required. For example, their standard brokerage accounts typically incur a $39 annual fee, which covers the maintenance and administration of the account. This fee is designed to cover the operational costs associated with managing the account, including record-keeping, statement generation, and regulatory compliance. Clients can also opt for a more comprehensive service package, which may include additional benefits and potentially a higher annual fee.

Trading Fees:

Trading activities are subject to specific fees, which can vary based on the investment strategy and market conditions. PNC Investments employs a per-trade fee structure, where clients are charged a small amount for each transaction executed. The fee is typically a fraction of a percent of the trade value, ensuring that the cost is proportional to the size of the investment. For instance, a typical stock trade might incur a fee of $4.95, while options trades could have a slightly higher fee structure. These trading fees are competitive and designed to provide clients with cost-effective investment opportunities.

Other Investment-Related Services:

In addition to account maintenance and trading fees, PNC Investments offers various other investment-related services with associated costs. These may include portfolio rebalancing, tax-loss harvesting, and research reports. Portfolio rebalancing, for instance, involves adjusting the asset allocation to maintain the desired risk and return profile, and it typically incurs a fee based on the value of the portfolio being rebalanced. Tax-loss harvesting, a strategy to minimize tax liabilities, may also attract a fee, which is charged when PNC Investments executes trades to realize losses and offset gains. Research reports and market insights are provided to clients at no additional cost, ensuring they have access to valuable information for their investment decisions.

The fee structure at PNC Investments is designed to be fair and competitive, allowing clients to make informed choices about their investment needs. By providing transparent fee information, the company ensures that clients can understand the costs associated with their accounts and make decisions aligned with their financial goals. It is always advisable for investors to review the specific fee schedule provided by PNC Investments to gain a comprehensive understanding of the costs involved in their investment journey.

Strategic Synchronization: Unraveling the Art of Equalizing Investment Values

You may want to see also

Frequently asked questions

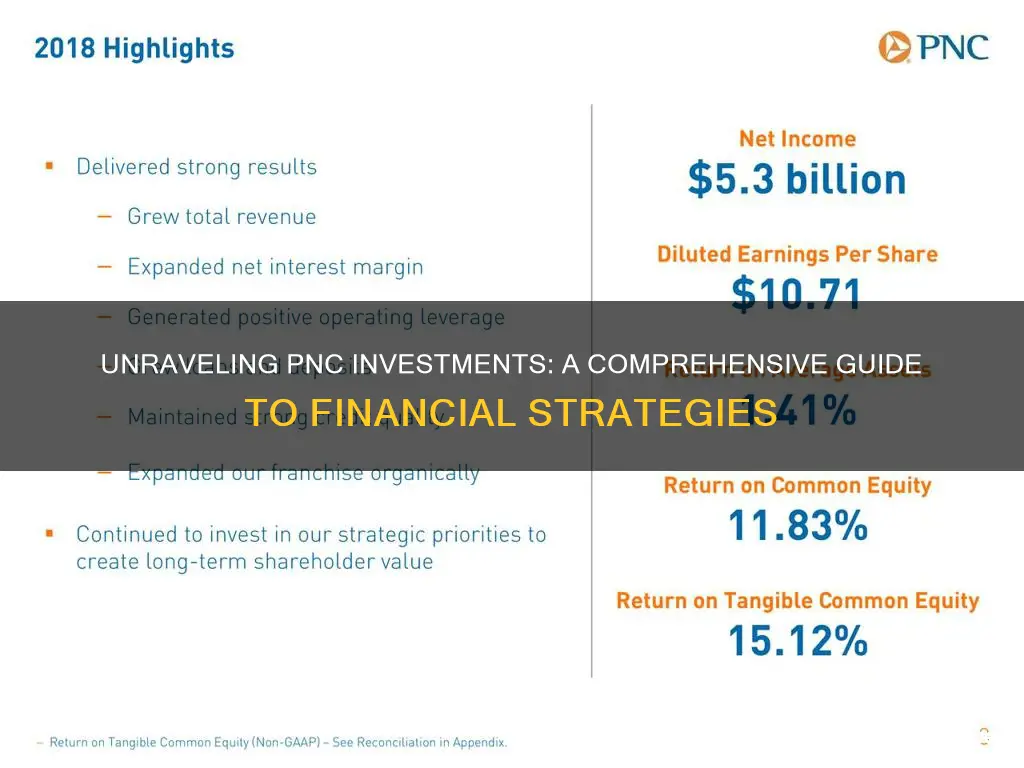

PNC Investments is a wealth management and investment advisory service offered by PNC Financial Services Group, a leading financial services company in the United States. It provides personalized investment strategies and financial planning to help individuals and institutions grow and manage their wealth.

PNC Investments offers a range of services to cater to diverse investment needs. They provide access to a wide array of investment products, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Their team of financial advisors works closely with clients to understand their financial goals, risk tolerance, and time horizons to create tailored investment plans. The service also includes portfolio management, tax-efficient strategies, and regular performance reviews to ensure investors' assets are managed effectively.

PNC Investments differentiates itself by offering a comprehensive approach to wealth management. They combine traditional investment strategies with innovative technologies to provide a seamless and personalized experience. Their digital platform allows clients to access their investment accounts, track performance, and receive real-time updates. Additionally, PNC Investments has a strong focus on client education, providing resources and workshops to help investors make informed decisions and understand market trends.

Yes, there are associated fees with PNC Investments, which are typically based on the services utilized and the assets under management. These fees may include an advisory fee, which is a percentage of the assets invested, and various transaction or account maintenance charges. It is recommended to review the specific fee structure and terms provided by PNC Investments to understand the costs involved in their services.