Schwab's robo-investing platform, known as Schwab Intelligent Portfolio, is an automated investment service designed to help investors build and manage a diversified portfolio with minimal effort. It utilizes advanced algorithms and risk models to create a personalized investment strategy based on an investor's financial goals, risk tolerance, and time horizon. The platform automatically rebalances the portfolio to maintain the desired asset allocation, providing a hands-off approach to investing. With its goal-based approach, investors can set specific objectives, such as retirement planning or saving for a child's education, and the robo-advisor tailors the investment strategy accordingly. This technology-driven investment solution offers a cost-effective way to access professional money management, making it an attractive option for those seeking a simple and efficient way to invest.

What You'll Learn

- Investment Strategy: Automated asset allocation based on risk tolerance and goals

- Portfolio Construction: Uses algorithms to build diversified portfolios

- Rebalancing: Automatically rebalances to maintain target asset allocations

- Tax Efficiency: Optimizes tax-efficient strategies for long-term growth

- Transparency: Provides clear insights into investment performance and fees

Investment Strategy: Automated asset allocation based on risk tolerance and goals

Schwab's robo-investing platform, known as Schwab Intelligent Portfolio, offers an automated investment strategy that is designed to help investors build and manage their portfolios with minimal effort. This approach is particularly appealing to those who prefer a hands-off investment strategy or lack the time and expertise to actively manage their investments. Here's how it works:

The platform begins by assessing an investor's financial goals, risk tolerance, and time horizon. This initial step is crucial as it forms the foundation for the entire investment strategy. Risk tolerance, for instance, determines how much risk an investor is willing to take, which can range from conservative (low risk) to aggressive (high risk). Goals could include retirement planning, saving for a child's education, or a specific financial target. Once these factors are understood, the robo-advisor uses sophisticated algorithms to create a personalized investment plan.

At the heart of Schwab's robo-investing is the concept of automated asset allocation. This strategy involves dynamically adjusting the portfolio's asset mix based on market conditions and the investor's specific needs. The algorithm regularly rebalances the portfolio to maintain the desired risk level and ensure that investments align with the investor's goals. For example, if the market experiences a significant downturn, the algorithm may shift the portfolio towards more conservative assets to reduce risk, while in a bull market, it might allocate more funds to potentially high-growth investments.

One of the key advantages of this automated approach is its ability to adapt to changing market dynamics. The algorithms can quickly respond to market fluctuations, ensuring that the portfolio remains aligned with the investor's risk tolerance and goals. This dynamic asset allocation strategy is designed to provide investors with a sense of control and confidence, knowing that their investments are managed according to a well-defined plan.

Additionally, Schwab's robo-investing platform offers a user-friendly interface, providing investors with regular updates and insights into their portfolio's performance. This transparency allows investors to stay informed about their investments without requiring extensive financial knowledge. The platform's automated nature also means that investors can benefit from professional money management without the associated fees of traditional financial advisors.

Double XP Weekend: Stocking Up for Success

You may want to see also

Portfolio Construction: Uses algorithms to build diversified portfolios

Schwab's robo-investing platform, known as Schwab Intelligent Portfolio, utilizes advanced algorithms to construct and manage investment portfolios for its clients. This automated approach to portfolio construction is designed to provide a diversified and optimized investment strategy tailored to individual risk tolerances and financial goals. Here's an overview of how it works:

The process begins with a comprehensive risk assessment. Investors are asked to provide information about their financial situation, investment objectives, and risk tolerance. This data is then fed into the algorithm, which employs a sophisticated risk model. The model analyzes various factors, including an individual's age, income, savings rate, and investment horizon, to determine an appropriate risk level. This risk assessment is crucial as it forms the foundation for portfolio diversification.

Once the risk profile is established, the algorithm takes over the portfolio construction process. It utilizes a multi-asset class approach, typically including a mix of stocks, bonds, and alternative investments. The algorithm's goal is to create a well-diversified portfolio that aligns with the investor's risk tolerance. It achieves this by dynamically adjusting the asset allocation based on market conditions and individual circumstances. For instance, if market volatility increases, the algorithm may reduce the stock allocation and increase bond holdings to maintain the desired risk level.

One of the key advantages of this algorithm-driven approach is its ability to rebalance the portfolio automatically. Over time, individual asset prices fluctuate, causing the initial asset allocation to deviate from the target. The algorithm continuously monitors these changes and automatically rebalances the portfolio to ensure it remains aligned with the investor's risk preferences. This automated rebalancing feature helps investors stay on track with their investment strategy without constant manual intervention.

Schwab's robo-investing platform also offers a unique feature called "Intelligent Portfolio Rebalancing." This tool provides investors with a clear view of their portfolio's performance and allows them to make adjustments if needed. It provides a detailed breakdown of asset allocations and historical performance, enabling investors to understand the algorithm's decisions and make informed choices. This transparency empowers investors to take control of their portfolio's diversification and risk management.

A Smart Strategy: Investing $400,000 for Retirement

You may want to see also

Rebalancing: Automatically rebalances to maintain target asset allocations

Schwab's robo-investing platform, known as Schwab Intelligent Portfolio, offers an automated rebalancing feature to help investors maintain their desired asset allocations. This rebalancing process is a critical component of the platform's strategy, ensuring that investors' portfolios stay aligned with their risk tolerance and investment goals.

When you set up an investment plan through Schwab robo-investing, you define your target asset allocations, which could include percentages of stocks, bonds, and other asset classes. The platform then automatically adjusts your portfolio to match these allocations. For instance, if your portfolio's stock allocation has grown significantly while your bond allocation has decreased, the robo-advisor will initiate a rebalancing process to restore the original percentages. This process involves selling a portion of the over-allocated asset and using the proceeds to purchase the under-allocated asset, thus maintaining the desired balance.

The rebalancing mechanism is designed to be proactive and timely. It continuously monitors the performance of various asset classes and makes adjustments as needed. This ensures that investors' portfolios are not only diversified but also remain in line with their original risk and return expectations. By automatically rebalancing, investors can avoid the potential pitfalls of market volatility and emotional decision-making, which can often lead to suboptimal investment outcomes.

One of the key advantages of this automated approach is its efficiency. Manual rebalancing can be time-consuming and may lead to missed opportunities or unintended consequences due to market timing. With Schwab's robo-investing, the rebalancing process is executed promptly, ensuring that the portfolio remains optimized according to the investor's specifications. This efficiency also contributes to cost savings, as the platform's low-cost structure allows investors to benefit from cost-effective portfolio management.

In summary, the rebalancing feature of Schwab robo-investing is a powerful tool for investors seeking a hands-off approach to portfolio management. By automatically adjusting asset allocations, the platform ensures that investors stay on track with their financial goals, benefiting from a well-diversified and balanced investment strategy. This level of automation and proactive management can be particularly appealing to those who prefer a more passive investment approach while still aiming for optimal financial outcomes.

Hedging Strategies: Protecting Other's Wealth

You may want to see also

Tax Efficiency: Optimizes tax-efficient strategies for long-term growth

Schwab's robo-investing platform, known as Schwab Intelligent Portfolio, is designed to offer a tax-efficient approach to investing, which is a key aspect of its overall strategy. This feature is particularly important for investors who want to maximize their long-term returns while minimizing the impact of taxes. The platform's algorithm takes into account various factors to optimize tax efficiency, ensuring that investors can benefit from a well-rounded investment strategy.

One of the primary methods employed by Schwab Intelligent Portfolio is tax-loss harvesting. This strategy involves selling investments that have decreased in value to realize losses, which can then be used to offset capital gains and reduce taxable income. By implementing this technique, investors can potentially lower their tax liabilities without sacrificing their long-term investment goals. The platform's algorithm identifies suitable investments for tax-loss harvesting, ensuring that the portfolio remains balanced and aligned with the investor's risk tolerance.

Additionally, the robo-investing platform focuses on tax-efficient fund selection. It offers a wide range of index funds and ETFs, which are known for their low expense ratios and minimal turnover. Lower turnover rates mean that the platform can avoid frequent buying and selling, which often triggers capital gains taxes. By holding a diverse set of tax-efficient funds, investors can benefit from long-term capital appreciation while minimizing the tax impact of short-term market fluctuations.

Schwab's algorithm also considers the timing of investments to optimize tax efficiency. It aims to make contributions and withdrawals in a way that aligns with tax-advantaged accounts, such as 401(k)s and IRAs. By strategically timing investments, the platform can help investors take advantage of tax-deferred growth and potentially reduce the tax burden on their returns. This approach is particularly beneficial for long-term investors who want to build substantial wealth over time while keeping tax implications at a minimum.

Furthermore, the platform provides investors with transparent reporting and tracking of tax-related activities. This includes detailed records of transactions, fund holdings, and tax-efficient strategies employed. By offering this level of transparency, Schwab enables investors to make informed decisions and understand the impact of their investment choices on their tax situation. This feature is valuable for investors who want to take a proactive approach to tax management and ensure that their robo-investing strategy aligns with their overall financial goals.

Thanksgiving Traditions: Do Investment Bankers Work or Get a Break?

You may want to see also

Transparency: Provides clear insights into investment performance and fees

Schwab's robo-investing platform, known as Schwab Intelligent Portfolio, offers a unique approach to investing by providing investors with a high level of transparency regarding their investment performance and associated fees. This transparency is a key feature that sets it apart from traditional investment management services.

When you invest through this platform, you gain access to a comprehensive suite of tools and resources that offer deep insights into your portfolio's performance. The platform provides detailed performance reports, allowing investors to track the growth or decline of their investments over time. These reports are typically presented in an easy-to-understand format, ensuring that investors can quickly grasp the key metrics and trends. For instance, you can see the total return, the return compared to a benchmark index, and the contribution of each asset class to the overall performance.

In addition to performance tracking, the platform also offers transparency in terms of fees. Investors can clearly understand the costs associated with their investments, which is crucial for making informed financial decisions. The fee structure is straightforward and easy to comprehend, with no hidden charges. The platform provides a detailed breakdown of fees, including management fees, transaction costs, and any other applicable expenses. This level of transparency ensures that investors can accurately calculate the true cost of their investments and make comparisons with other investment options.

Schwab's robo-investing platform also offers a unique feature called "Fee Estimator," which further enhances transparency. This tool allows investors to estimate the potential fees they might incur based on their investment goals and portfolio characteristics. By inputting specific details, investors can quickly assess the estimated fees and make adjustments to their investment strategy accordingly. This feature empowers investors to take control of their financial expenses and make informed choices.

Furthermore, the platform provides educational resources and tutorials to help investors understand the various aspects of their investments. These resources cover topics such as investment strategies, risk management, and the impact of fees on long-term returns. By offering such educational content, the platform ensures that investors are well-informed and can make confident decisions about their money. This level of transparency and education is a significant advantage for investors who want to take a proactive approach to managing their portfolios.

Smart Strategies to Invest Half a Million Dollars for Regular Income

You may want to see also

Frequently asked questions

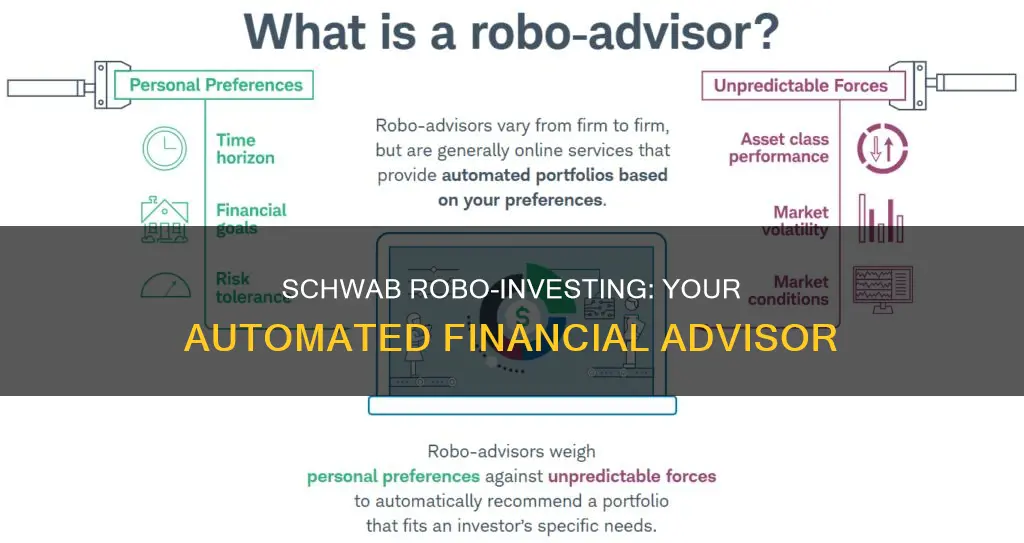

Schwab Robo-Investing is an automated investment service offered by Charles Schwab Corporation. It is designed to help investors build and manage a diversified portfolio with minimal effort. This service uses advanced algorithms and models to make investment decisions on behalf of the investor, taking into account their financial goals, risk tolerance, and time horizon.

The robo-investing algorithm utilizes a risk-based approach, starting with a comprehensive questionnaire to understand an investor's financial situation and goals. It then constructs a portfolio based on the investor's risk tolerance, with a focus on diversification. The algorithm regularly rebalances the portfolio to maintain the desired asset allocation and adjusts it based on market conditions and the investor's changing circumstances.

Yes, customization is a key feature of Schwab Robo-Investing. Investors can choose from various pre-built portfolios tailored to different risk levels and goals, such as growth, income, or balanced. Additionally, investors can make adjustments to their portfolio by rebalancing, tax-loss harvesting, or making additional contributions. The service also provides the option to manually reallocate assets based on market analysis or personal preferences.