Magic formula investing is a popular strategy that aims to identify undervalued stocks by applying a set of quantitative rules. This approach, often associated with the work of Joel Greenblatt, promises to uncover hidden gems in the market by focusing on companies that meet specific financial criteria. The concept is simple: by using a combination of financial ratios and metrics, investors can potentially identify stocks that are trading at a discount relative to their intrinsic value. However, the effectiveness of this strategy is a subject of debate among investors and financial experts. Some argue that it is a reliable method for generating consistent returns, while others question its long-term viability and the assumption that such a systematic approach can consistently outperform the market. This paragraph introduces the topic by highlighting the intriguing nature of magic formula investing and the ongoing discussion about its performance and potential benefits for investors.

What You'll Learn

- Historical Performance: Magic Formula's track record and long-term success

- Backtesting: Robustness of the strategy across different market conditions

- Risk Management: Techniques to mitigate potential downsides of the approach

- Implementation: Practical steps to apply Magic Formula in real-world portfolios

- Criticisms and Limitations: Common criticisms and potential drawbacks

Historical Performance: Magic Formula's track record and long-term success

The Magic Formula, a stock-picking strategy developed by Joel Greenblatt, has gained significant attention in the investment world for its promise of outperforming the market. This formula is designed to identify undervalued stocks by combining two financial ratios: the return on capital (ROC) and the equity multiplier (EM). The idea is that companies with high ROC and EM are likely to be undervalued and have the potential for above-average returns.

To assess the historical performance of the Magic Formula, it's essential to examine its track record over an extended period. While the strategy has been around for several decades, its widespread adoption and popularity are more recent phenomena. Backtesting the Magic Formula on historical data reveals a compelling story. Studies show that during the 1980s and 1990s, the Magic Formula consistently generated impressive returns, often outperforming the S&P 500 index. This historical success has fueled the belief that the formula is a powerful tool for investors seeking market-beating strategies.

However, it's crucial to consider that past performance is not a guaranteed indicator of future results. The Magic Formula's success in the 1980s and 1990s might have been influenced by specific market conditions and economic environments that no longer exist. For instance, the high-interest rate environment of the 1980s favored companies with high ROC, which might not be the case in today's low-interest-rate environment. Therefore, while the Magic Formula's historical performance is impressive, it's essential to remain cautious and consider the potential impact of changing market dynamics.

Long-term success stories associated with the Magic Formula are indeed present. Many investors and fund managers have reported substantial gains by implementing this strategy. For example, the Magic Formula Investing website showcases numerous success stories, including one where a small-cap stock identified by the formula yielded a 100% return in just a few months. These success stories contribute to the growing belief that the Magic Formula is a valuable addition to an investor's toolkit.

In conclusion, the Magic Formula's historical performance and long-term success stories provide compelling evidence of its effectiveness. However, investors should approach this strategy with a critical mindset, understanding that past performance does not guarantee future results. The Magic Formula can be a valuable tool, but it should be used in conjunction with other investment principles and risk management techniques to make informed and well-rounded investment decisions.

Pay Off the House or Invest: The Barefoot Investor's Guide to Financial Freedom

You may want to see also

Backtesting: Robustness of the strategy across different market conditions

Backtesting is a critical step in evaluating the effectiveness and robustness of any investment strategy, including the Magic Formula Investing approach. This process involves simulating the strategy's performance over a historical period, allowing investors to assess its potential under various market conditions. The primary goal is to determine whether the strategy's success is consistent and reliable, or if it is highly dependent on specific market scenarios.

When backtesting the Magic Formula Investing strategy, one should focus on a diverse range of market conditions to ensure its robustness. This includes analyzing the strategy's performance during different market cycles, such as bull markets, bear markets, and periods of market stability. By examining these diverse scenarios, investors can gain insights into how the strategy adapts and performs under varying market pressures. For instance, during a bull market, the strategy might emphasize growth stocks, while in a bear market, it could shift towards more defensive, value-oriented stocks.

The backtesting process should also consider different time frames to evaluate the strategy's long-term and short-term performance. This involves running simulations for extended periods, such as 10-year or 20-year backtests, to assess the strategy's consistency over time. Additionally, shorter-term backtests can provide insights into the strategy's responsiveness to market fluctuations and its ability to generate quick profits. By analyzing these time-bound results, investors can make informed decisions about the strategy's suitability for their investment goals.

Another crucial aspect of backtesting is stress testing the Magic Formula Investing strategy under extreme market conditions. This includes scenarios like financial crises, rapid market declines, or significant economic shocks. By simulating these extreme events, investors can assess the strategy's resilience and its ability to withstand adverse market conditions. Stress testing helps identify potential weaknesses or vulnerabilities in the strategy and allows for the implementation of necessary adjustments to enhance its robustness.

Furthermore, backtesting should be conducted using multiple data sources and historical market data to ensure accuracy and reliability. This involves utilizing various financial databases, market indices, and stock price histories to replicate the trading environment as closely as possible. By employing a comprehensive dataset, investors can make more informed conclusions about the strategy's performance and its potential for success in different market scenarios.

In summary, backtesting is a powerful tool for evaluating the Magic Formula Investing strategy's robustness across various market conditions. By analyzing different market cycles, time frames, and extreme scenarios, investors can gain valuable insights into the strategy's performance and its potential for long-term success. This process enables investors to make well-informed decisions, ensuring that the strategy aligns with their risk tolerance and investment objectives.

Jesus Invested in People Through Love and Sacrifice

You may want to see also

Risk Management: Techniques to mitigate potential downsides of the approach

When considering the Magic Formula Investing strategy, it's important to acknowledge that no investment approach is entirely risk-free. This method, which combines value and momentum investing, aims to identify stocks with strong growth potential, but it still carries certain risks that investors should be aware of. Effective risk management is crucial to ensure that the strategy's benefits outweigh its potential drawbacks. Here are some techniques to mitigate these risks:

- Diversification: One of the fundamental principles of risk management is diversification. By spreading your investments across various sectors, industries, and company sizes, you can reduce the impact of any single stock's performance. In Magic Formula Investing, this could mean investing in a wide range of companies, ensuring that your portfolio is not overly exposed to any one sector or market segment. Diversification helps to balance risk and provides a more stable investment experience.

- Regular Review and Rebalancing: Market conditions and individual stock performances can change rapidly. Therefore, it is essential to regularly review your Magic Formula Investing portfolio. Set up a schedule to periodically assess the performance of each stock and the overall portfolio. This review process allows you to identify underperforming stocks or those that no longer align with your investment criteria. Rebalance your portfolio by buying or selling stocks to maintain your desired asset allocation, ensuring that your risk exposure remains consistent with your investment strategy.

- Risk Assessment and Thresholds: Develop a comprehensive risk assessment framework to identify and quantify the potential risks associated with Magic Formula Investing. This could include market risk, company-specific risk, and implementation risk. Set clear risk thresholds for each category, and if a stock or sector exceeds these thresholds, consider adjusting your position or even excluding it from your portfolio. Regularly monitoring these risks will help you make informed decisions to manage potential downsides.

- Stop-Loss Orders: Implementing stop-loss orders is a practical risk management technique. A stop-loss order is an instruction to sell a stock if it reaches a certain price point. This strategy limits potential losses by automatically selling a stock when it falls to a predefined level. For Magic Formula Investing, you can set stop-loss orders for each stock, ensuring that you don't hold onto underperforming investments that could further decline. This technique provides a safety net and helps control risk.

- Research and Due Diligence: Thorough research and due diligence are essential to mitigate risks associated with Magic Formula Investing. Study the companies you are considering for investment, analyzing their financial health, competitive advantage, and growth prospects. Understand the factors that could impact their performance and how they align with the Magic Formula criteria. By conducting in-depth research, you can make more informed decisions and potentially avoid investments that may not meet the expected standards.

By implementing these risk management techniques, investors can navigate the potential challenges of Magic Formula Investing more effectively. It is a proactive approach to ensure that the strategy's benefits are maximized while minimizing the impact of market volatility and individual stock risks. Remember, successful investing often involves a combination of strategic decision-making, disciplined risk management, and a long-term perspective.

Mortgage Applicants: Lying About Investment Properties

You may want to see also

Implementation: Practical steps to apply Magic Formula in real-world portfolios

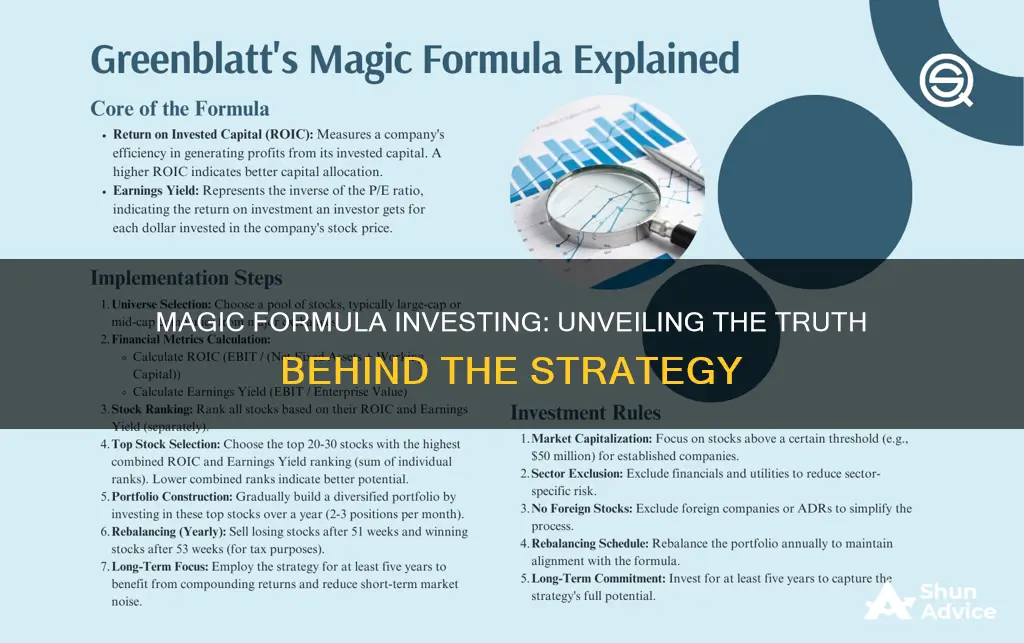

The Magic Formula Investing strategy, as popularized by Joel Greenblatt, is a systematic approach to identifying undervalued stocks with the potential for above-average returns. It involves a set of criteria that investors can use to screen for companies that meet specific financial characteristics. While the concept is straightforward, its successful implementation requires careful consideration and a structured process. Here are the practical steps to apply the Magic Formula in real-world portfolios:

- Understand the Criteria: Begin by thoroughly understanding the Magic Formula criteria. The formula typically involves a combination of financial ratios and metrics. The core components often include a high return on invested capital (ROIC), a low price-to-book ratio (P/B), and a high earnings yield (EBIT/Enterprise Value). These ratios are designed to identify companies with strong business fundamentals and potential for growth. Research and study the original sources, such as Greenblatt's book "The Little Book That Beats the Market," to grasp the exact calculations and thresholds.

- Gather Financial Data: Collect financial data for the companies you intend to screen. You can use various sources, including financial websites, company annual reports, and third-party financial data providers. Ensure that the data is up-to-date and covers a sufficient period to make meaningful assessments. The data should include historical financial statements, such as income statements, balance sheets, and cash flow statements, to calculate the required ratios.

- Calculate the Magic Formula Ratios: Apply the Magic Formula criteria to the financial data. Calculate the return on invested capital (ROIC), price-to-book ratio (P/B), and earnings yield (EBIT/Enterprise Value) for each company. You can use financial modeling software or spreadsheets to automate these calculations, ensuring accuracy and consistency. The goal is to identify companies that meet or exceed the defined thresholds for these ratios.

- Screen and Rank Companies: Create a ranked list of companies based on their Magic Formula scores. Assign a score or rank to each company based on how well they meet the criteria. Companies with higher scores or ranks are more likely to be undervalued and have the potential for outperformance. This step helps in narrowing down the list of potential investment candidates.

- Perform Further Analysis: While the Magic Formula provides a quantitative approach, it is essential to conduct additional research and analysis. Evaluate the quality of the company's management, industry trends, competitive landscape, and growth prospects. Consider factors like market share, product innovation, and financial stability. This qualitative assessment complements the quantitative Magic Formula screening and helps in making informed investment decisions.

- Portfolio Construction: Incorporate the identified Magic Formula stocks into your investment portfolio. Diversify your portfolio by selecting companies across different sectors and industries. Consider the risk-reward profile of each investment and ensure that the overall portfolio aligns with your investment goals and risk tolerance. Regularly review and rebalance your portfolio to maintain the desired asset allocation.

- Monitor and Evaluate: Implement a monitoring system to track the performance of your Magic Formula investments. Regularly review the financial data and news related to these companies. Stay updated on any changes in their business operations, financial health, or industry dynamics. Evaluate the performance of your portfolio against the Magic Formula criteria and make adjustments as necessary. This ongoing evaluation ensures that your investments remain aligned with the strategy's objectives.

By following these practical steps, investors can effectively apply the Magic Formula Investing strategy to build a robust and potentially profitable portfolio. It is important to remember that while the Magic Formula provides a structured approach, market conditions and individual company factors can influence investment outcomes. Therefore, a comprehensive understanding of the criteria, thorough research, and ongoing monitoring are key to successful implementation.

Home Loan vs. Investing: Where Should Your Money Go?

You may want to see also

Criticisms and Limitations: Common criticisms and potential drawbacks

The Magic Formula Investing strategy, which combines fundamental analysis with a quantitative approach, has gained popularity among investors seeking a systematic method to identify undervalued stocks. However, it is not without its criticisms and limitations, which investors should be aware of before adopting this strategy.

One common criticism is the assumption that the strategy's quantitative models can consistently identify undervalued stocks across all market conditions. The Magic Formula Investing approach relies on a set of rules and ratios, such as the Price-to-Book (P/B) ratio and the Return on Equity (ROE) ratio. While these metrics can be powerful indicators, they may not always capture the complexities of a company's financial health. For instance, a company with a high P/B ratio might be considered undervalued, but it could also indicate that the market has not yet recognized the company's potential for growth. Conversely, a low P/B ratio might suggest an overvalued stock, but it could also mean that the company is facing temporary challenges. Critics argue that these quantitative models may not account for qualitative factors, such as management quality, industry trends, and competitive advantages, which are crucial for long-term investment success.

Additionally, the strategy's reliance on historical data and ratios may become a limitation during periods of rapid market change or economic shifts. The Magic Formula Investing approach assumes that past performance and ratios will continue to predict future performance accurately. However, this assumption may not hold true during market bubbles or crashes, where traditional valuation metrics can become unreliable. For example, during the 2008 financial crisis, many companies with strong financial ratios still experienced significant declines in stock price, highlighting the limitations of this strategy in extreme market conditions.

Another criticism is the potential for overfitting and the need for frequent model adjustments. The strategy's success often depends on the ability to fine-tune the quantitative models to specific market conditions or time periods. This process can lead to overfitting, where the models perform exceptionally well on historical data but fail to generalize to new, unseen data. As market conditions evolve, investors may need to constantly update and adjust the models, requiring significant time and resources. Critics argue that this iterative process can become cumbersome and may not guarantee consistent results over the long term.

Furthermore, the Magic Formula Investing strategy may not adequately address the issue of concentration risk. By focusing on a limited set of stocks that meet specific criteria, investors might be exposed to significant risks if these stocks underperform. A diversified portfolio is a cornerstone of risk management, and critics suggest that the strategy's emphasis on a narrow set of criteria could lead to an overly concentrated investment, potentially increasing overall portfolio risk.

In summary, while Magic Formula Investing offers a structured approach to stock selection, it is not without its criticisms and limitations. Investors should carefully consider the assumptions and potential drawbacks of this strategy, ensuring that it aligns with their investment goals, risk tolerance, and the overall market environment. As with any investment strategy, a comprehensive understanding of its strengths and weaknesses is essential for making informed decisions.

Whiskey: The New Investment Liquid

You may want to see also

Frequently asked questions

Magic Formula Investing is a stock-picking strategy developed by Joel Greenblatt, a renowned value investor. It combines two financial ratios, the Return on Capital (ROC) and the Equity Multiples (EM), to identify undervalued companies with strong growth potential.

The Magic Formula is based on the idea that a company's ability to generate returns on its capital and its efficiency in using equity are key indicators of its financial health and future success. By screening for companies that meet specific criteria in these ratios, investors can potentially uncover hidden gems that are undervalued by the market.

While Magic Formula Investing has gained popularity and some success stories, it is not without its critics. The strategy relies on historical data and assumptions, and there is no guarantee that it will consistently identify top-performing stocks. Market conditions and individual company factors can influence the effectiveness of this approach.

This investing style offers a systematic approach to stock selection, which can help investors avoid emotional decision-making. It focuses on fundamental analysis and seeks to identify companies with a competitive advantage and strong financial metrics. By following the formula, investors might find opportunities that align with their investment goals and risk tolerance.