Vanguard investing is a popular investment strategy that emphasizes low-cost, diversified portfolios. It is based on the principles of index funds, which aim to replicate the performance of a specific market index, such as the S&P 500. By investing in a Vanguard fund, investors can gain exposure to a broad range of companies or assets, reducing risk through diversification. This approach is often associated with legendary investor John C. Bogle, who founded Vanguard and advocated for the benefits of index funds. Vanguard investing works by pooling money from many investors to purchase a large, diverse portfolio of securities, which are then managed by Vanguard's team of professionals. This strategy allows investors to benefit from the overall market's performance without the need for active stock picking, making it an attractive option for long-term investors seeking to build wealth over time.

What You'll Learn

- Vanguard's Index Funds: Passive investing, tracking market indices

- Low Costs: Vanguard's fee structure, cost-effective investing strategy

- Diversification: Building a well-rounded portfolio with various asset classes

- Long-Term Focus: Vanguard's approach to long-term wealth accumulation and growth

- Tax Efficiency: Strategies to minimize tax impact on investments

Vanguard's Index Funds: Passive investing, tracking market indices

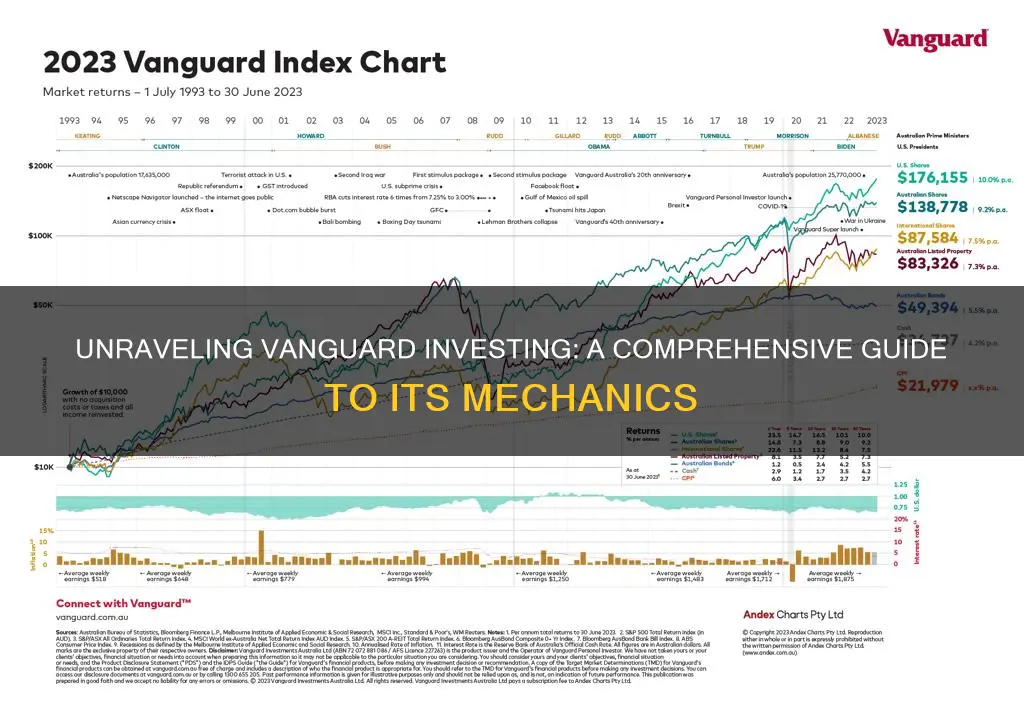

Vanguard Index Funds are a cornerstone of passive investing, offering investors a way to gain broad exposure to the market without the need for active stock selection. These funds are designed to mirror, or 'track', a specific market index, such as the S&P 500 or the FTSE 100. This means that the fund's performance is directly linked to the performance of the index it tracks.

The concept behind index funds is simple: instead of trying to outperform the market, the fund aims to replicate it. This is achieved by holding a portfolio of securities that closely matches the composition of the chosen index. For example, an S&P 500 index fund would own a basket of stocks that make up the S&P 500 index, ensuring that the fund's performance mirrors the overall market. This approach is in contrast to actively managed funds, where professional fund managers make decisions about which stocks to buy and sell.

Vanguard, a leading provider of index funds, offers a wide range of these funds, each tracking a different market index. These funds are known for their low expense ratios, which make them a cost-effective way to invest in the market. By tracking an index, Vanguard's index funds provide diversification across a broad range of companies or sectors, reducing the risk associated with individual stock selection. This is particularly beneficial for long-term investors seeking consistent, market-matching returns.

One of the key advantages of Vanguard Index Funds is their ability to provide broad market exposure at a low cost. Since these funds aim to replicate the market, they don't require the same level of research and analysis as actively managed funds. This passive approach allows Vanguard to keep management fees low, making it an attractive option for investors who want to benefit from the overall market performance without incurring high costs.

Additionally, Vanguard's index funds offer liquidity, as they can be bought and sold on major stock exchanges. This accessibility means investors can easily trade these funds, providing flexibility and convenience. The funds' performance is transparent, as it is directly tied to the index, and investors can track their holdings against the benchmark index. This level of transparency is a significant benefit for investors who prefer a clear understanding of their investment's performance.

Bahamas: Foreign Investment Origins

You may want to see also

Low Costs: Vanguard's fee structure, cost-effective investing strategy

Vanguard is a well-known investment management company that has revolutionized the way people invest by emphasizing low costs and a cost-effective strategy. The company's fee structure is designed to be transparent and straightforward, ensuring that investors can understand and manage their expenses effectively. Vanguard's approach to investing is centered around the belief that active management often comes with higher fees, which can erode long-term returns. By keeping costs low, Vanguard aims to provide investors with a more efficient and cost-efficient way to build wealth over time.

One of the key principles behind Vanguard's low-cost strategy is the concept of index investing. Instead of actively selecting individual stocks or bonds, Vanguard primarily invests in index funds or exchange-traded funds (ETFs) that track a specific market index. These index funds offer broad market exposure and are typically more cost-effective than actively managed funds. By following the market's performance closely, Vanguard can minimize the impact of transaction costs and management fees, allowing investors to benefit from the overall market growth without incurring excessive expenses.

Vanguard's fee structure is simple and transparent, which is a significant advantage for investors. The company charges a small management fee for its funds, which is typically lower than the industry average. These fees are used to cover the operational costs and management expenses associated with running the investment funds. Vanguard also offers a range of expense ratios, which represent the annual cost of investing in a particular fund as a percentage of the fund's assets. Lower expense ratios indicate lower costs for investors, making Vanguard's funds an attractive option for those seeking cost-effective investment solutions.

The cost-effectiveness of Vanguard's strategy is further emphasized by its focus on long-term investing. By investing in a diversified portfolio of index funds, investors can benefit from the power of compounding returns over time. This approach allows investors to build wealth steadily, as the reinvestment of dividends and capital gains contributes to the growth of their investments. As a result, the impact of transaction costs and management fees is significantly reduced, and investors can achieve their financial goals with less friction.

In summary, Vanguard's low-cost investing strategy is built on a foundation of transparency, simplicity, and a commitment to cost-effectiveness. By utilizing index funds and a straightforward fee structure, Vanguard enables investors to build a diversified portfolio with minimal expenses. This approach empowers investors to take control of their financial future, as they can make informed decisions about their investments without being burdened by high costs. Vanguard's cost-efficient strategy has made it a trusted name in the investment industry, attracting investors who seek a long-term, low-cost approach to wealth accumulation.

Young Investors: A Growing Force

You may want to see also

Diversification: Building a well-rounded portfolio with various asset classes

Diversification is a key strategy in Vanguard investing, and it involves spreading your investments across different asset classes to reduce risk and maximize returns. The idea is to create a well-rounded portfolio that can weather market volatility and provide stable, long-term growth. Here's how you can approach building a diversified portfolio:

Asset Allocation: Start by determining the percentage of your portfolio that should be allocated to different asset classes. Vanguard suggests a balanced approach, often recommending a mix of stocks, bonds, and cash equivalents. For example, a typical allocation might be 60% stocks, 30% bonds, and 10% cash. This allocation can be tailored to your risk tolerance and investment goals. Younger investors with a higher risk tolerance might opt for a more aggressive mix, while older investors may prefer a more conservative strategy. The goal is to find a balance that aligns with your financial objectives and can adapt as your circumstances change.

Diversifying Within Asset Classes: Within each asset class, you can further diversify your portfolio. For stocks, consider investing in various sectors and market capitalizations. Large-cap stocks, small-cap stocks, and international equities can all be part of your portfolio. Similarly, for bonds, you can invest in government bonds, corporate bonds, and mortgage-backed securities. Each of these categories has its own level of risk and return potential, so spreading your investments across them can help smooth out volatility.

Geographical Diversification: Expanding your investments geographically is another crucial aspect of diversification. This means investing in companies and securities from different countries and regions. By doing so, you reduce the impact of any single market's performance on your overall portfolio. For instance, you could allocate a portion of your portfolio to US stocks, international developed markets, and emerging markets. This approach ensures that your portfolio is not overly exposed to the risks associated with any one region.

Regular Review and Rebalancing: Diversification is an ongoing process that requires regular review and adjustment. Market conditions and your personal circumstances can change, so it's essential to periodically assess your portfolio's performance and rebalance it if necessary. Rebalancing involves buying or selling assets to restore the original asset allocation percentages. For example, if your stock allocation has grown significantly while your bond allocation has decreased, you would sell some stocks and buy bonds to rebalance the portfolio. This practice helps to maintain your desired risk level and ensures that your investments stay aligned with your investment strategy.

By implementing these diversification techniques, you can create a robust and resilient investment portfolio. Vanguard investing emphasizes the importance of a long-term perspective, and diversification is a powerful tool to help investors stay on track to meet their financial goals. It's a strategy that can provide stability and growth potential, even during turbulent market periods.

Betting on a Bear Market: Navigating Investment Strategies During Economic Downturns

You may want to see also

Long-Term Focus: Vanguard's approach to long-term wealth accumulation and growth

Vanguard investing is a strategy that emphasizes a long-term perspective, aiming to build wealth over time through a disciplined and patient approach. This method is particularly effective for those seeking to accumulate wealth for retirement or other long-term financial goals. The core idea is to focus on long-term wealth creation rather than short-term market fluctuations, which can be volatile and unpredictable.

The Vanguard approach involves investing in a diverse range of assets, typically through index funds or exchange-traded funds (ETFs). These funds track specific market indexes, such as the S&P 500 or the NASDAQ-100, providing broad exposure to various sectors and industries. By diversifying across multiple assets, investors can reduce risk and benefit from the overall growth of the market. This strategy is often referred to as passive investing, as it involves holding a well-diversified portfolio and letting the market work in your favor over the long term.

One of the key principles of Vanguard investing is the belief in the long-term success of the stock market. Historical data shows that, over extended periods, stock markets have tended to rise, providing attractive returns for investors. By maintaining a long-term perspective, investors can avoid the temptation to time the market, which often leads to suboptimal outcomes. Instead, they focus on their investment goals and remain committed to their strategy, allowing their investments to grow over time.

To implement this approach, investors can start by setting clear financial goals and determining their risk tolerance. Vanguard suggests a disciplined investment strategy, including regular contributions to investment accounts, such as through automatic contributions from paychecks or other sources of income. This consistent approach helps to build a substantial investment portfolio over time. Additionally, investors should consider the power of compounding, where returns are reinvested to generate additional returns, further accelerating wealth accumulation.

In summary, Vanguard investing is a long-term wealth-building strategy that emphasizes patience, diversification, and a focus on market trends. By adopting this approach, investors can navigate the complexities of the financial markets and work towards their financial objectives with a higher degree of confidence and success. It is a method that has gained popularity due to its simplicity, effectiveness, and alignment with long-term financial planning.

Is Your Investment Strategy Worth the Cost?

You may want to see also

Tax Efficiency: Strategies to minimize tax impact on investments

When it comes to investing, tax efficiency is a crucial aspect that can significantly impact your overall returns. Vanguard, a leading investment management company, offers various strategies to help investors minimize the tax impact on their investments. Here are some key approaches to consider:

One of the primary strategies is to invest in tax-efficient funds. Vanguard provides a wide range of mutual funds and exchange-traded funds (ETFs) that are designed to be tax-efficient. These funds aim to minimize distributions of taxable capital gains, which can help investors avoid or reduce potential tax liabilities. By holding these funds for the long term, investors can take advantage of tax-advantaged treatment, such as the lower capital gains tax rates for long-term holdings. Additionally, Vanguard's index funds and ETFs often have lower expense ratios, which can further contribute to tax efficiency by reducing the overall cost of investing.

Another important consideration is the timing of investments. Investors can strategically time their purchases and sales to align with tax advantages. For example, buying funds just before the end of the year and selling them early in the new year can help defer taxes on capital gains. Vanguard's tax-efficient exchange-traded funds (ETFs) often provide a cost-effective way to implement this strategy. By carefully monitoring market trends and tax laws, investors can make informed decisions to optimize their tax efficiency.

Diversification is also a key component of tax-efficient investing. Vanguard encourages investors to build a well-diversified portfolio across various asset classes, sectors, and geographic regions. This approach helps spread the tax impact, as different investments may have varying tax treatments. For instance, holding a mix of stocks, bonds, and real estate investments can result in a more balanced tax profile, reducing the overall tax burden.

Furthermore, Vanguard offers tax-managed funds that actively manage the tax implications of their investments. These funds employ strategies to minimize taxable distributions, such as reinvesting dividends or utilizing tax-loss carryforwards. By implementing these tactics, tax-managed funds can provide investors with a more consistent and tax-efficient investment experience.

In summary, Vanguard investing emphasizes the importance of tax efficiency through various strategies. These include investing in tax-efficient funds, timing purchases and sales strategically, diversifying investments, and utilizing tax-managed funds. By adopting these approaches, investors can potentially reduce their tax liabilities and maximize the after-tax returns on their investments. It is essential to stay informed about tax laws and consult with a financial advisor to tailor these strategies to individual investment goals and circumstances.

Understanding Quicken's Investment Opening Balance: A Comprehensive Guide

You may want to see also

Frequently asked questions

Vanguard Investing is a strategy that utilizes the services of Vanguard, a leading investment management company. It involves investing in a diversified portfolio of securities, typically mutual funds or exchange-traded funds (ETFs), to achieve long-term wealth accumulation and growth.

Vanguard is well-known for its indexing strategy, which involves tracking a specific market index, such as the S&P 500. By replicating the index, Vanguard's funds aim to match the performance of the underlying market, providing investors with broad market exposure. This approach offers low costs and diversification, making it an attractive option for long-term investors.

Vanguard Investing offers several advantages. Firstly, it provides access to a wide range of investment options, including mutual funds and ETFs, covering various asset classes and market sectors. Secondly, Vanguard's low-cost structure, known as the "Vanguard Advantage," helps investors keep more of their returns over time. Additionally, their extensive research and expertise in index investing contribute to the strategy's success.

Getting started with Vanguard Investing is relatively straightforward. You can open an investment account with Vanguard, choose the appropriate investment funds or ETFs, and decide on your investment strategy. Vanguard offers a user-friendly platform, allowing investors to build and manage their portfolios online or through their mobile app.

The expense ratio is a critical factor in Vanguard Investing. It represents the annual management fee charged by Vanguard for the services provided. Vanguard is known for its low expense ratios, which are typically lower than industry averages. Lower fees mean more of your investment returns go directly into your portfolio, making it an efficient way to invest and grow your wealth over time.