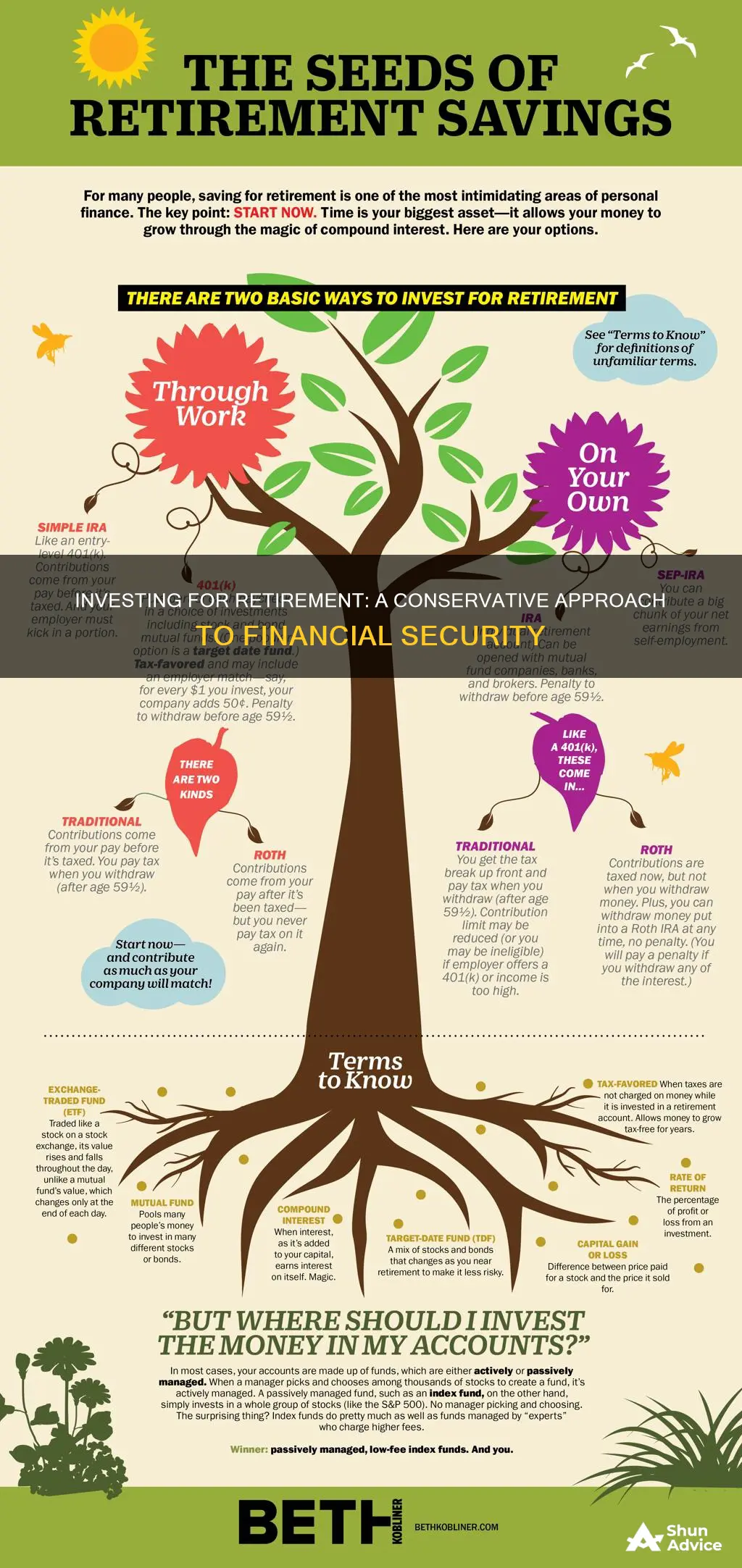

Investing for retirement is a long-term strategy that requires careful planning and consideration. As people approach retirement, they often seek to adopt a more conservative investment strategy to protect their savings and generate a stable income. This involves shifting their portfolio towards lower-risk investments, such as bonds, certificates of deposit (CDs), money market accounts, and guaranteed income funds. These investments typically offer lower returns than riskier options but provide greater financial security and help to minimise exposure to stock market volatility.

Characteristics of Conservative Investment for Retirement

| Characteristics | Values |

|---|---|

| Purpose | Generate income, minimise exposure to stock market volatility, preserve capital |

| Investment Types | Mutual funds, stocks, bonds, money markets, CDs, individual bonds, bond funds, money market accounts, TIPS, annuities, dividend stocks, index funds, exchange-traded funds, corporate bonds, municipal bonds, US Treasury securities, and more |

| Risk | Conservative investments are lower-risk but not entirely risk-free; they may not keep up with inflation |

| Returns | Lower than riskier investments but can still be substantial, e.g. S&P 500 averaged 15% annual total return over 15 years |

| Investor Profile | Investors closer to retirement, or those wanting to protect their retirement funds |

| Professional Advice | Financial advisors can help create a plan for investment needs and goals |

What You'll Learn

Weigh up the weaknesses and strengths of a Certificate of Deposit (CD)

Certificates of Deposit (CDs) are a type of savings account that pays a fixed interest rate on money held for an agreed-upon period of time. They are considered a safe investment option for those seeking to earn more than a standard savings account without taking on more risk. Here is a detailed overview of the weaknesses and strengths of investing in CDs:

Weaknesses of CDs:

- Low liquidity: CDs have a preset maturity date, and early withdrawal typically results in a penalty, such as forfeiting accrued interest or even a portion of the principal. This limited access to cash can be a significant disadvantage if you need to access your money before the maturity date.

- Potential loss of purchasing power due to inflation: Inflation can outpace the interest earned on a CD, resulting in a loss of purchasing power. The fixed interest rate of CDs may not keep up with rising inflation rates, leading to a lower effective return on investment.

- Low returns compared to riskier investments: While CDs offer higher interest rates than standard savings accounts, their returns are modest compared to riskier investments like stocks, mutual funds, and corporate bonds. Over the long term, these riskier investments may provide higher returns, making them more suitable for retirement planning.

- Interest rate risk: CDs lock in the interest rate until maturity. If market interest rates rise significantly during the term, you could be earning less interest income than other investments. Variable-rate CDs or bump-up CDs can mitigate this risk but may have lower starting rates.

Strengths of CDs:

- Safety and principal protection: CDs are considered a safe investment vehicle as they guarantee the return of the original investment after maturity. The Federal Deposit Insurance Corporation (FDIC) insures CDs issued by banks, while the National Credit Union Administration (NCUA) insures CDs from credit unions, up to $250,000 per financial institution.

- Fixed and predictable returns: CDs offer a fixed interest rate, providing investors with income predictability. The interest rate remains constant, even if market interest rates fluctuate, making financial planning more manageable.

- Higher interest rates than savings accounts: CDs typically offer higher interest rates than standard savings or money market accounts. This makes them attractive for those seeking higher returns without taking on the risk associated with stocks or bonds.

- Flexible terms: CDs offer a wide range of terms, from a few weeks to ten years, providing investors with short-term and long-term options. Additionally, investors can choose from various types of CDs, such as liquid CDs, step-up CDs, IRA CDs, and bump-up CDs, to suit their financial goals and needs.

Where to Invest: Personal Preferences

You may want to see also

Understand the benefits of investing in bonds

Bonds are an essential part of everyone's retirement portfolio. Here are some of the benefits they can provide:

Stability and Safety

Bonds are less volatile and less risky than stocks, providing stability to your portfolio. They are less likely to lose money than stocks, so buying bonds can reduce your portfolio's losses during stock market declines. Bonds from the US government (Treasury bonds) are considered the safest investments in the world and are backed by the full faith and credit of the US federal government.

Regular Income

Bonds pay interest regularly, usually twice a year, so they can help generate a steady, predictable stream of income. This makes them ideal for retirees who depend on a consistent income.

Security

US Treasury bonds are one of the safest and most liquid investments globally, next to cash. Short-term bonds can be a good place to park emergency funds or money you'll need soon.

Tax Savings

Certain bonds, like municipal bonds, offer tax advantages with tax-free income. While the income from Treasury bonds is subject to federal income tax, it is often exempt from state and local taxes.

Inflation Protection

Some bonds, like Treasury Inflation-Protected Securities (TIPS) or I bonds, offer a measure of protection against inflation. I bonds, for example, have a variable interest rate that adjusts based on changes in the Consumer Price Index for All Urban Consumers (CPI-U).

Diversification

Bonds bring diversification to your portfolio. While stocks have historically outperformed bonds, having a mix of both reduces your financial risk. As you get older, it's generally recommended to allocate a greater percentage of your portfolio to bonds to lower your risk exposure.

Pfizer: A Smart Investment Move?

You may want to see also

Learn about Treasury Inflation-Protected Securities (TIPS)

Treasury Inflation-Protected Securities (TIPS) are bonds issued by the US Treasury Department. They are designed to protect investors against inflation, with the principal and interest rate payments rising along with inflation. TIPS are sold for a term of 5, 10, or 30 years.

TIPS are considered an ultra-low-risk investment because they are backed by the full faith and credit of the US government. The principal of a TIPS bond can go up or down over its term, depending on the inflation rate. When a TIPS bond matures, investors receive either the inflation-adjusted principal or the original principal, whichever is greater.

TIPS pay a fixed rate of interest every six months until maturity. The interest payment is based on the adjusted principal, so the amount of the interest payment varies. The interest payments are subject to federal income tax, and any increase in the principal value is also taxable at the federal level in the year it occurs. However, TIPS are exempt from state and local income taxes.

TIPS can be purchased directly from the US government through auctions or from online brokerage accounts. They can also be bought and sold in the secondary market. When buying TIPS in the secondary market, it is important to compare the current inflation-adjusted par value to the original par value. Investors are only guaranteed to receive payment up to the original face value of the TIPS.

TIPS are a good option for investors who want to protect their buying power from rising inflation. They are particularly attractive in high-inflation environments, where their performance may exceed that of traditional government bonds. However, TIPS may perform poorly during deflation or low inflation, as their par value and interest payments may decrease.

Additionally, TIPS carry interest rate risk, as their market value may fluctuate with changing interest rates. They also have less liquidity compared to other bonds, as they don't trade as frequently in secondary markets.

Overall, TIPS can be a valuable tool for investors seeking to protect their investments from the effects of inflation. They offer a government-backed guarantee that the principal will keep pace with inflation, ensuring that the purchasing power of the investment is maintained.

Bosnian Investment: Unlocking the Mystery

You may want to see also

Explore the pros and cons of investing in stocks

Stocks are an important part of a retirement portfolio, but they should be approached with caution. While stocks can provide excellent returns, they also come with a higher level of risk compared to other investments.

Pros of Investing in Stocks for Retirement:

- Long-term gains: Historically, stocks have produced long-term gains that outperform other asset classes. Since 1926, large stocks have returned an average of 10% per year, making them appealing for retirement savings.

- Beating inflation: Stocks have the potential to beat inflation over the long term due to their return capabilities.

- Passive income: Dividend stocks can provide a steady stream of passive income during retirement without dipping into your principal savings.

- Income flexibility: Dividend income can be flexible, allowing you to reinvest, save into another asset class, or spend it as needed.

- Value stocks: Dividend stocks are often value stocks, which means they are shares of profitable companies with steady profits and are relatively stable and safe.

- Income and asset growth: Dividend stocks can provide income and also appreciate in value over time, offering the potential for double benefits.

- Hedging inflation: Dividend payments may increase over time, helping your retirement income keep pace with inflation.

- Tax advantages: Dividends may be taxed at lower capital gains rates, resulting in tax savings for retirees.

Cons of Investing in Stocks for Retirement:

- Risk: Stocks are generally riskier than other investments, such as bonds or fixed-income assets. Individual stocks can be particularly risky, even if they are value stocks.

- Cost: Dividend stocks can be more expensive than investments in other companies, as their popularity can drive up the stock price.

- Double taxation: Dividend-paying companies pay taxes on their profits, and investors are taxed on the dividends received, resulting in double taxation.

- Asset allocation complexity: Determining the right mix of dividend-producing investments and hedges against market volatility can be challenging and depends on individual risk tolerance.

- Policy changes: Dividend policies are not guaranteed and can change or be eliminated by the company at any time.

- Sector concentration: Many dividend stocks are concentrated in specific sectors, such as utilities, banks, and old-line industries. A downturn in these sectors can impact your income significantly.

Investments: Where is the Money Going?

You may want to see also

Research the advantages of money market accounts

When considering how to invest for retirement in a conservative fashion, one option to research is a money market account. Money market accounts are interest-accumulating accounts that can be opened at a bank or credit union. They are a type of savings account that often offers higher interest rates than regular savings accounts and can incorporate checking account features, like easy access to cash.

High Annual Percentage Yields (APY)

Money market accounts generally pay higher interest rates than traditional savings accounts. These rates are variable and subject to change based on the market. At the time of writing, some financial institutions offer APYs as high as 4.55%, compared to an average rate of 0.35% for traditional savings accounts.

Easy Access to Funds

Money market accounts offer features of both savings and checking accounts, often coming with debit cards and check-writing abilities. This makes them ideal for those with short-term savings goals, as you can easily access your money whenever you like.

FDIC and NCUA Insurance

Money market accounts are insured by the Federal Deposit Insurance Corporation (FDIC) and the National Credit Union Administration (NCUA) for up to $250,000. This means you can be confident that your money is protected and you won't lose it if the bank fails.

Liquidity

Money market accounts are considered low-risk investments. They are more secure and liquid than other investments, making them a stable option for those seeking conservative retirement investment strategies.

Check-Writing Privileges

Retirement money market accounts often come with check-writing privileges, allowing retirees to easily withdraw funds as needed.

While money market accounts offer these advantages, it's important to consider potential drawbacks as well, such as monthly fees, minimum balance requirements, and withdrawal limits. Additionally, the returns on these accounts may be lower than riskier investments, and they may not always outpace inflation.

Mortgage Lenders: Your Investment Papers, Please!

You may want to see also

Frequently asked questions

Investing conservatively for retirement can help you generate income and minimise your exposure to stock market volatility. Conservative investments tend to be lower-risk and can provide insulation against losses during a market downturn.

Conservative investments include US Treasury securities, money market funds, dividend stocks, index funds, certificates of deposit (CDs), and bonds.

The right conservative investments depend on your individual goals and risk tolerance. It's important to consider your time horizon for investing and your overall risk tolerance. You may want to consult a financial advisor to help you create a financial plan that suits your needs and goals.