Quicken Investment is a powerful tool for managing your investments, and understanding how it handles opening balances is crucial for effective financial management. This paragraph will explore the mechanics behind how Quicken Investment calculates and manages the opening balance for your investment accounts, providing insights into the process and its benefits.

What You'll Learn

- Initial Deposit: Quickened investment opens a balance with an initial deposit

- Account Setup: Users set up their investment account with Quicken

- Investment Allocation: Funds are allocated to investment vehicles

- Market Impact: Market conditions affect the opening balance

- Transaction Fees: Fees may apply for opening an investment balance

Initial Deposit: Quickened investment opens a balance with an initial deposit

When you open a new investment account with Quicken, you'll need to make an initial deposit to get started. This initial deposit is the amount of money you put into your account when you first open it. Here's a step-by-step guide to understanding how this process works:

- Funding Your Account: After you've set up your Quicken investment account, the next step is to fund it. You can do this by transferring money from your bank account or by using a check. When you choose to fund your account, Quicken provides a secure and straightforward process. You can link your bank account and authorize Quicken to withdraw the specified amount, or you can manually enter the details of a check you've written. This initial deposit is crucial as it serves as the foundation for your investment journey.

- Account Activation: Once the initial deposit is made, your investment account is officially active. This activation triggers the start of your investment journey, allowing you to begin building your portfolio. It's important to note that the amount you deposit can vary depending on your investment goals and strategies. Some investments might require a minimum initial deposit, while others may not have such restrictions.

- Investment Options: Quicken offers a wide range of investment options, including stocks, bonds, mutual funds, and more. When you make that initial deposit, you gain access to these various investment vehicles. You can then decide how to allocate your funds across different assets based on your financial goals and risk tolerance. Quicken's platform provides tools and resources to help you make informed investment decisions.

- Portfolio Management: After the initial deposit, you can start managing your investment portfolio. Quicken's software allows you to track the performance of your investments, providing real-time updates on market changes. You can also set up automatic contributions to your account, allowing you to build your investments over time. Regularly reviewing and rebalancing your portfolio is essential to ensure it aligns with your financial objectives.

Remember, the initial deposit is just the beginning. Quicken's investment platform is designed to help you grow your wealth over time through strategic investment choices and ongoing management. Understanding the process of opening and funding your investment account is the first step towards achieving your financial goals.

Mutual Funds: Why Invest?

You may want to see also

Account Setup: Users set up their investment account with Quicken

When users first begin setting up their investment account with Quicken, they will need to input some essential details to get started. This process ensures that Quicken can accurately track and manage their investments. Here's a breakdown of the account setup process:

Initial Setup: During the initial setup, users will be prompted to provide their personal information, such as their name, address, and contact details. This is a standard procedure for any financial software to establish a secure and personalized user profile. Additionally, users will need to create a secure login, which is crucial for accessing their investment account and managing their financial data.

Investment Account Details: The next step is to input the specific details of the investment account. Users should provide the account number, which is typically provided by the investment firm or financial institution. This unique identifier ensures that Quicken can accurately link the account to the user's profile. Along with the account number, users will need to enter the type of investment account, such as a retirement account (e.g., IRA), a brokerage account, or a mutual fund account. This classification helps Quicken organize and categorize the investment activities accordingly.

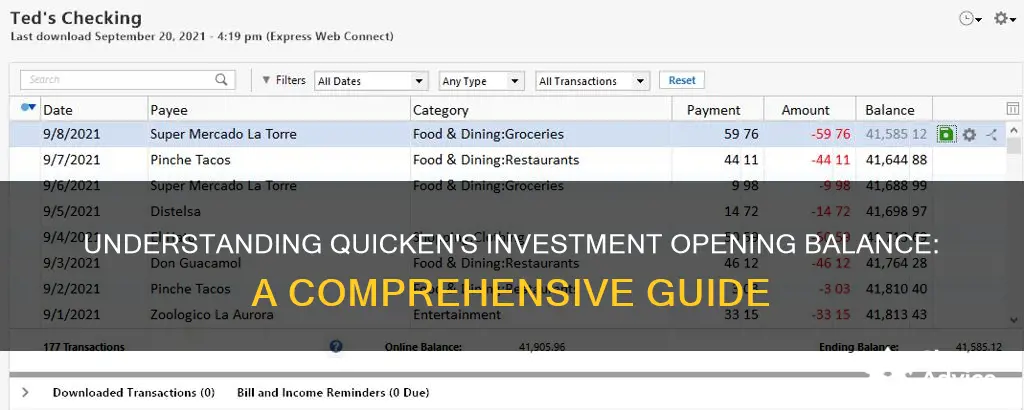

Opening Balance Input: One of the critical aspects of setting up the investment account is entering the opening balance. This balance represents the initial amount of money invested in the account. Users should carefully review their records or statements to determine the exact opening balance. It is essential to provide accurate figures to ensure that Quicken's records are up-to-date and precise. The opening balance serves as a starting point for tracking investment growth and performance.

Additional Information: Depending on the type of investment account, users might be required to provide further details. For example, retirement accounts may need information about contribution limits and tax-deductible amounts. Users should also consider adding any relevant notes or comments to provide context or additional information about the account. This step ensures that Quicken has a comprehensive understanding of the investment, allowing for better organization and management.

By following these steps, users can successfully set up their investment account with Quicken, ensuring that their financial data is accurately represented and easily accessible for future reference and analysis. This process empowers users to take control of their investments and make informed financial decisions.

Doge Coin: Invest Now?

You may want to see also

Investment Allocation: Funds are allocated to investment vehicles

When you open an investment account with Quicken, the first step is to decide how you want to allocate your funds across various investment vehicles. This allocation strategy is crucial as it determines how your money is distributed among different assets, which can significantly impact your investment returns and risk profile. Quicken provides a range of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs), each with its own level of risk and potential for growth.

The allocation process begins with understanding your investment goals and risk tolerance. For instance, if you're a long-term investor seeking capital appreciation, you might allocate a larger portion of your funds to stocks, which historically offer higher returns over extended periods. Conversely, if you prefer a more conservative approach with a focus on capital preservation, you might allocate more to bonds or fixed-income securities. Quicken's investment platform allows you to customize these allocations to align with your financial objectives.

One of the key benefits of Quicken's investment allocation feature is the ability to rebalance your portfolio. Over time, market fluctuations can cause your initial allocation to become imbalanced. For example, if stocks outperform bonds, your portfolio might become overly weighted towards stocks. Quicken's rebalancing tool helps you maintain your desired asset allocation by automatically buying or selling investments to bring your portfolio back to the target distribution. This ensures that your investment strategy remains aligned with your risk tolerance and financial goals.

Additionally, Quicken offers a suite of investment vehicles to choose from, each with its own characteristics. Stocks represent ownership in a company and offer the potential for significant capital gains, but they also carry higher risk. Bonds, on the other hand, provide a steady stream of income and are generally considered less risky than stocks. Mutual funds and ETFs pool money from many investors to invest in a diversified portfolio, offering instant diversification and professional management. Understanding these differences is essential when allocating your funds to maximize returns while managing risk effectively.

In summary, when using Quicken for investment, the allocation of funds to various investment vehicles is a critical step in building a robust investment strategy. It requires a thoughtful approach, considering your financial goals, risk tolerance, and the characteristics of different asset classes. By utilizing Quicken's tools and features, you can create a well-diversified portfolio that aligns with your investment objectives and helps you achieve your financial aspirations.

Velocity Investments: Settling the Storm

You may want to see also

Market Impact: Market conditions affect the opening balance

Understanding how market conditions influence the opening balance in your investment account is crucial for making informed financial decisions. When you open an investment account, the initial balance is often determined by the market value of the assets you've chosen to invest in. This balance can fluctuate based on various market factors, which are essential to consider for long-term investment success.

Market conditions play a significant role in the opening balance of your investment account. For instance, if you invest in stocks, the opening balance will be the sum of the purchase price of the shares you bought. On the day you buy, the market price of the stock determines the value of your investment. If the market is bullish, with rising stock prices, your opening balance will likely be higher. Conversely, in a bearish market, where stock prices are declining, your opening balance may be lower. This immediate impact of market conditions on your investment's value is a critical aspect of understanding how your investment account begins its journey.

The volatility of the market can also affect your opening balance. In highly volatile markets, where prices can fluctuate rapidly, your investment's opening balance may experience more significant changes. For example, if you invest in a sector or asset class that is particularly sensitive to market volatility, your opening balance could be more susceptible to daily price swings. This volatility can lead to a wider range of potential opening balances, making it essential to monitor market trends and adjust your investment strategy accordingly.

Additionally, market conditions can influence the opening balance through the impact of interest rates and economic policies. Central banks' decisions on interest rates can affect the value of investments, especially those tied to fixed-income securities or bonds. Lower interest rates might lead to higher opening balances for bond investors, while higher rates could result in lower initial values. Economic policies, such as quantitative easing or tightening, can also have a similar effect on the market and, consequently, your investment's opening balance.

In summary, market conditions are integral to the opening balance of your investment account. They determine the initial value of your investments and can significantly impact your financial journey. By staying informed about market trends, economic policies, and interest rate changes, investors can make more strategic decisions to manage and grow their investment opening balances effectively.

Volatility: Friend or Foe?

You may want to see also

Transaction Fees: Fees may apply for opening an investment balance

When you open a new investment account with Quicken, it's important to understand the potential fees involved, especially the transaction fees associated with the initial setup. These fees can vary depending on the type of account and the specific Quicken service you're utilizing. Here's a breakdown of what you need to know:

Understanding Transaction Fees:

Transaction fees are charges incurred when you initiate a financial transaction. In the context of opening an investment balance, these fees might be applied when you first deposit funds into your new account. Quicken, as a financial management software, often charges a small fee for this initial setup process. The fee structure can be found in the Quicken service agreement or by contacting their customer support. Typically, these fees are a one-time charge and are designed to cover the costs associated with processing the account opening and ensuring a smooth transition for your investment funds.

Factors Influencing Fees:

The amount of the transaction fee can vary based on several factors. Firstly, the type of investment account you choose might impact the fee structure. For instance, a retirement account might have different fees compared to a regular investment account. Additionally, the Quicken service plan you select can also influence the fee. Some plans offer fee-free account openings, while others may have a standard fee for this service. It's essential to review the Quicken fee schedule or consult their support team to get accurate information tailored to your specific account type and plan.

Transparency and Communication:

Quicken aims to provide transparency regarding their fee structure. They should clearly communicate the potential transaction fees associated with opening an investment balance during the account setup process. This ensures that users are well-informed about the costs involved. It's advisable to carefully review the terms and conditions provided by Quicken to understand any additional fees that might apply beyond the initial transaction charge.

Alternatives and Cost Savings:

To minimize transaction fees, consider exploring Quicken's fee-free account options or negotiating with their customer support team. Some users might also find it beneficial to bundle their investment accounts with other Quicken services, as certain packages could offer reduced or waived fees. Additionally, regularly reviewing Quicken's fee schedule can help you make informed decisions and potentially save on transaction costs over time.

Remember, while transaction fees are a consideration, Quicken's investment opening process is designed to provide a seamless experience for users. Understanding the fee structure allows you to make informed choices and manage your investment funds effectively.

Young Investors: Where to Begin?

You may want to see also

Frequently asked questions

To set up an investment account in Quicken, you'll need to follow these steps: First, log in to your Quicken software and navigate to the "Accounts" section. Click on "Add Account" and select "Investment" as the account type. You'll then be prompted to enter the account details, including the account name, type (e.g., brokerage, mutual fund), and the financial institution or broker associated with it. After providing the necessary information, click "Save" to create the account.

Funding your investment account in Quicken is straightforward. Once the account is set up, you can transfer funds from your checking or savings account. Go to the "Transfer" or "Move Money" option in the software, select the source account, and specify the amount you want to transfer. Choose the investment account as the destination, and complete the transaction. You might need to provide additional details like the account number or the financial institution's routing number.

Managing your investment opening balance is simple. After setting up the account, you can view it in the "Accounts" section of Quicken. Locate the investment account you created and click on it to open the account details. Here, you'll find the current balance, including the opening balance, which represents the initial amount invested. You can also track transactions, view statements, and make adjustments as needed.

Quicken's investment account setup process is designed to be user-friendly and transparent regarding fees. When you set up the account, you'll typically be informed about any associated costs, such as account maintenance fees, transaction fees, or minimum balance requirements. These fees can vary depending on the financial institution or broker you choose. It's essential to review the terms and conditions provided by your chosen financial partner to understand any potential costs.