The rate at which your investment grows depends on a variety of factors, including the type of investment, the amount invested, the frequency of contributions, and the rate of return. While it is difficult to predict exactly how long it will take for an investment to grow due to the volatility of stock returns, there are investment calculators available that can provide an estimate. These calculators take into account factors such as the initial investment amount, regular contributions, the length of the investment, the expected rate of return, and the compounding frequency. By inputting these variables, investors can get a better idea of how their money could grow over time. It is important to note that investing carries risks, and there is no guarantee of returns. However, with careful consideration and planning, individuals can work towards achieving their financial goals through investments.

| Characteristics | Values |

|---|---|

| Investment type | Stocks, mutual funds, bonds, exchange-traded funds (ETFs), index funds, real estate, etc. |

| Investment amount | Varies depending on the investment type and individual circumstances |

| Investment frequency | Weekly, bi-weekly, monthly, semi-annually, annually |

| Rate of return | Varies depending on the investment type; historically, the S&P 500 has an average annual total return of about 10% |

| Investment time frame | Long-term investments generally have a higher potential for growth |

| Risk tolerance | Varies depending on individual circumstances; older investors closer to retirement may opt for lower-risk investments |

| Compounding frequency | Daily for stocks, specific for other financial products like savings accounts |

What You'll Learn

Calculating Return on Investment (ROI)

For example, imagine you invest $5,000 and anticipate an annual average return of 5%. To maximise growth, you plan to invest an additional $50 per month over the next 5 years. To calculate your ROI, you would first subtract the initial investment amount ($5,000) from the final value of your investment (let's say, for example, $8,000). This gives you $3,000. Then, divide $3,000 by $5,000, which equals 0.6. Finally, multiply 0.6 by 100, giving you an ROI of 60%.

It is important to note that ROI does not account for the time factor, so depending on your financial goals and time horizon, this may be something to consider when calculating how much money you can earn.

Additionally, it is worth noting that the volatility of stock returns means that the growth of your investment can only be estimated. The actual amount of time it takes to reach your investment goals may vary depending on how your investments perform.

Warren Buffett's Current Investment Strategy

You may want to see also

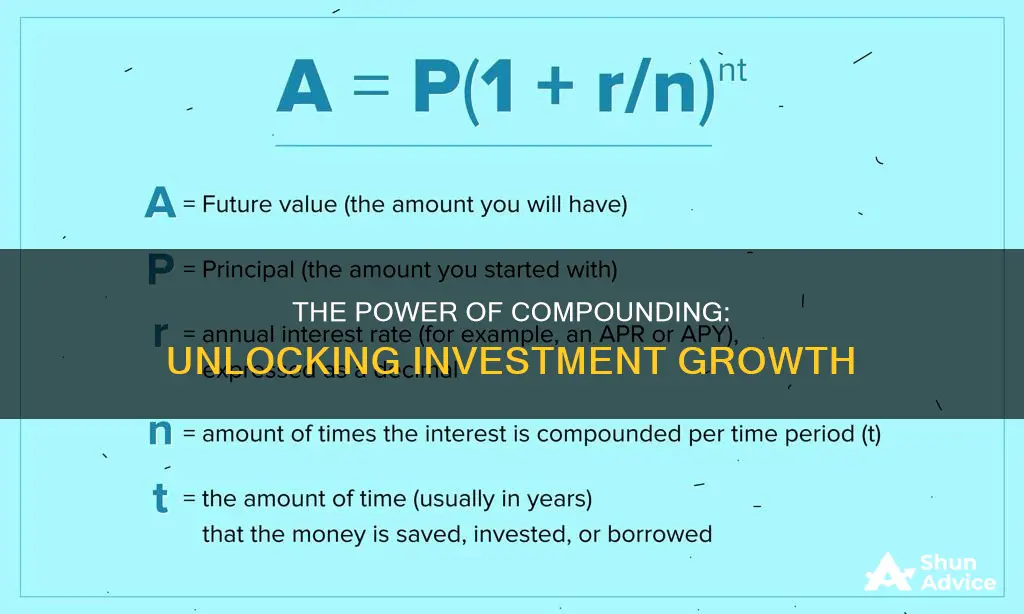

Compound interest

The formula for calculating compound interest is:

= [P (1 + i)n] – P

= P [(1 + i)n – 1]

Where:

- I = annual interest rate

- N = number of compounding periods

- P = principal amount

The Rule of 72 is another way to estimate compound interest. By dividing 72 by your rate of return, you can find out how long it will take for your money to double in value. For example, if you have $100 earning a 4% return, it will grow to $200 in 18 years (72 / 4 = 18).

When it comes to savings and investments, compound interest can help build wealth over the long term. However, when it comes to debt, compound interest can work against you. The amount owed can increase as interest grows on top of both the initial amount borrowed and the accrued interest. It is important to understand how compound interest works to find a balance between paying down debt and investing money.

Retirement Ready: Dave Ramsey's Guide to Investing for Your Future

You may want to see also

Risk and return

The relationship between risk and return is that, generally, the more risk you take with an investment, the higher the potential return. But, taking more risk also means more potential for loss. Factors that influence risk and return include the type, quality, and duration of the investment, market conditions, and the investor's behaviour. For example, if you invest in a company with a strong track record, your risk might be lower, but so might your return. Conversely, if you invest in a new company with an unproven track record, you could make a lot of money if the company succeeds, but you also risk losing your entire investment if the company fails.

There are three broad categories of investments based on risk and return: low-risk and low-return, high-risk and high-return, and moderate-risk and moderate-return. Low-risk, low-return investments include treasury bills, money markets, and bonds. These are considered very low-risk but offer lower returns compared to other investments. High-risk, high-return investments include penny stocks, stocks, and cryptocurrency. These can offer huge returns but carry a higher risk of loss. Moderate-risk, moderate-return investments include mutual funds and index funds. These offer diversification and generally have a lower risk than individual stocks, but they can still offer decent returns.

It's important to note that higher risk doesn't always lead to higher returns, and there are no guarantees. As an investor, you need to decide how much risk you're willing and able to accept for a desired return, considering factors such as age, income, investment goals, liquidity needs, time horizon, and personality.

To manage investing risks, it's crucial to understand the basics of risk, how it is measured, and how to quantify it. Standard deviation is a common metric used to assess risk, providing a measure of the volatility of a value in comparison to its historical average. Diversification is also a key strategy for minimizing risk. A well-diversified portfolio will consist of different types of securities from diverse industries, with varying degrees of risk and correlation. While diversification doesn't guarantee against losses, it helps investors reach their financial goals while reducing risk.

Regression Analysis: Predicting Investment Returns

You may want to see also

Starting balance

The starting balance, also known as the opening balance, is the amount of money you have at the beginning of an investment or accounting period. This could be money you've saved up, a bonus from work, or money received as a gift or inheritance. This sum becomes your investing principal.

Most brokerage firms that offer mutual funds and index funds require a starting balance of a few hundred dollars to $1,000 or more. You can buy individual equities and bonds with less than that.

The starting balance is the first entry in your investment accounts. It can be found on the credit or debit side of the ledger, depending on whether the balance is positive or negative.

If you are transferring your accounts from one accounting system to another, the last entry in the old accounts will become the starting balance in the new accounts.

The starting balance is important in accounting as it is the first entry in a new financial year or when a company is first starting up its accounts. The ending balance of one month or year becomes the starting balance for the next.

Retirement Planning: Your Future, Your Wealth

You may want to see also

Rate of return

The rate of return (RoR) is a metric that shows the net gain or loss of an investment over a specified time period, expressed as a percentage of the initial investment's cost. It is used to measure the profit or loss of an investment over time and can be applied to any investment vehicle, including real estate, bonds, stocks, and fine art.

The formula to calculate the rate of return is:

This simple rate of return is sometimes referred to as the basic growth rate or return on investment (ROI). It does not take into account the effect of inflation over time, which reduces purchasing power. Therefore, it is important to also consider the real rate of return, which is the net amount of discounted cash flows (DCF) received on an investment after adjusting for inflation.

When determining the rate of return, it is also important to consider the time value of money, which is accounted for in the internal rate of return (IRR). The IRR is a discount rate that makes the net present value (NPV) of all cash flows from an investment equal to zero. It measures the annual growth rate of an investment, taking into account the effect of compound interest.

Another metric to consider is the compound annual growth rate (CAGR), which is the mean annual rate of return of an investment over a period longer than one year, factoring in growth over multiple periods.

The rate of return can be influenced by various factors, such as the time horizon of the investment, the frequency of contributions, and the performance of the underlying assets. It is important to note that historical returns do not guarantee future performance, and there is always risk involved in investing.

Pay Off Your Second Mortgage or Invest: Which Comes First?

You may want to see also

Frequently asked questions

The growth of your investment is influenced by the rate of return, contribution amount and frequency, time frame, and the level of risk you are willing to take.

You can use an investment calculator to estimate how your investment will grow. These calculators consider factors such as your initial investment, additional contributions, rate of return, and time period.

Compound interest can significantly impact your investment growth. It allows your earnings to generate additional earnings, accelerating the growth of your investment over time.

Yes, different types of investments have varying growth rates. For example, stocks, mutual funds, exchange-traded funds (ETFs), and bonds offer different potential returns and carry different levels of risk.

It's important to compare your investment growth to relevant benchmarks and assess if it is meeting your financial goals. You can also seek advice from financial advisors or investment professionals to evaluate the performance of your investments.