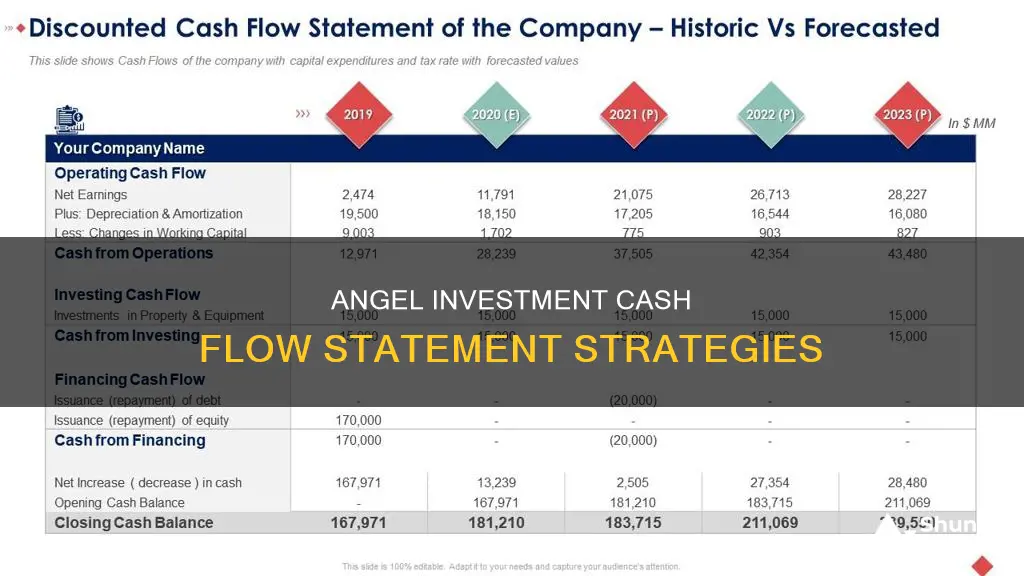

Angel investors are individuals who provide seed money to startups in exchange for an equity stake in the company if the idea is successful. They are often wealthy individuals looking for a higher rate of return than more traditional investments can offer. Angel investments are typically made during the early stages of a company's life cycle, and while this can lead to big returns, it is also very risky. Understanding how angel investments are reflected in a company's cash flow statement is crucial for investors to monitor the performance of their investments and make informed decisions. A cash flow statement provides insights into a company's financial health and operational efficiency by summarizing the inflow and outflow of cash and cash equivalents.

What You'll Learn

Cash flow from operating activities

A cash flow statement is a financial statement that tracks the inflow and outflow of cash, providing insights into a company's financial health and operational efficiency. It is one of the three main financial statements, alongside the balance sheet and the income statement.

The first section of a cash flow statement is the cash flow from operating activities, which indicates the amount of money a company brings in from its ongoing, regular business activities, such as selling goods or providing services to customers. It does not include long-term capital expenditures or investment revenue and expenses.

The cash flow from operating activities is an important benchmark for determining the financial success of a company's core business activities. It provides insight into the company's cash-generating abilities and can indicate whether the core business activities are thriving.

This section of the cash flow statement includes:

- Cash received from the sale of goods and services

- Salary and wages paid

- Payments to suppliers for inventory or goods needed for production

- Cash paid to vendors and suppliers

- Cash collected from customers

- Interest income and dividends received

- Income tax paid and interest paid

There are two methods for depicting the cash flow from operating activities: the indirect method and the direct method. The indirect method starts with net income from the income statement and adds back non-cash items to arrive at a cash basis figure. The direct method tracks all transactions in a period on a cash basis and uses actual cash inflows and outflows.

The operating cash flow margin is a tool used to assess the cash from operating activities as a percentage of total sales revenues for a specific period. It helps to evaluate a company's profitability, efficiency, and earnings quality.

Cash App Investing: Are There Any Fees Involved?

You may want to see also

Cash flow from investing activities

Investing activities are an important aspect of growth and capital. They can include:

- Capital expenditures (CapEx)

- Lending money

- Sale of investment securities

- Expenditures in property, plant, and equipment (PPE)

- Acquisitions of other businesses

- Proceeds from the sale of property and equipment

- Proceeds from the sale of marketable securities

A negative cash flow from investing activities is not necessarily a bad sign. It can indicate that a company is investing in long-term growth and health. For example, a company may invest in fixed assets such as property, plant, and equipment to grow the business. This will show as a negative cash flow from investing activities in the short term, but it may generate cash flow in the longer term.

Positive cash flow from investing activities indicates that a company's disposals or sales of assets are generating more cash than its investments. This could be a cause for concern if it indicates that a company is not investing enough in its long-term health.

The total cash flow from investing activities in an accounting period is found by adding together both the positive and negative investing activities listed on the cash flow statement.

Investments, Cash Flows, and the Impact of Gains

You may want to see also

Cash flow from financing activities

CFF shows how a company raises and spends money through various activities, such as issuing stocks, borrowing funds, repaying debt, and paying dividends. It is an essential indicator of a company's liquidity and cash position, providing valuable insights into its operational efficiency and financial stability.

The formula for calculating CFF is:

> CFF = CED − (CD + RP)

Where:

- CED = Cash inflows from issuing equity or debt

- CD = Cash paid as dividends

- RP = Repurchase of debt and equity

In this formula, cash inflows are added, and cash outflows, such as stock repurchases, dividend payments, and debt repayment, are subtracted.

Positive CFF indicates that more money is flowing into the company, increasing its assets. On the other hand, negative CFF shows that the company is servicing or retiring debt or making dividend payments and stock repurchases.

It is important for investors to analyse CFF in conjunction with other sections of the cash flow statement to gain a comprehensive understanding of the company's financial performance and make well-informed decisions.

Temporary Investments: Are They Really Cash?

You may want to see also

How to calculate net cash flow

A cash flow statement provides an overview of a company's financial health and operational efficiency. It is one of the three main financial statements, alongside the balance sheet and the income statement.

The cash flow statement is divided into three sections:

- Cash flow from operating activities: This includes any sources and uses of cash from business activities, such as receipts from sales of goods and services, payments to suppliers, salary and wage payments, and other operating expenses.

- Cash flow from investing activities: This covers any sources and uses of cash from a company's investments, including purchases or sales of assets, loans made or received, and payments related to mergers and acquisitions.

- Cash flow from financing activities: This includes sources of cash from investors and banks, as well as cash paid to shareholders in the form of dividends, stock repurchases, and debt repayments.

The net cash flow is a key indicator of a company's financial health and can be calculated using the following formula:

Net Cash Flow Formula

Net Cash Flow = Net Cash Flow from Operating Activities + Net Cash Flow from Financial Activities + Net Cash Flow from Investing Activities

This can also be simplified as follows:

Net Cash Flow = Total Cash Inflows – Total Cash Outflows

Let's assume Company XYZ has the following financial data for a given period:

- Net cash flow from operating activities: $150,000

- Net cash flow from financial activities: $40,000

- Net cash flow from investing activities: -$60,000 (negative due to losses from investments)

To calculate the net cash flow for Company XYZ, we use the formula:

$150,000 + $40,000 – $60,000 = $130,000

So, the net cash flow for Company XYZ over the given period is $130,000, indicating a relatively strong financial position.

It is important to note that net cash flow is just one aspect of evaluating a company's financial health, and it should be considered alongside other financial metrics and indicators.

Invest Cash Safely: Strategies for Secure Financial Growth

You may want to see also

How to prepare a cash flow statement

A cash flow statement is a financial report that details the inflow and outflow of cash in a business during a reporting period. It is one of the three fundamental financial statements used by financial leaders, along with income statements and balance sheets. This statement is important for understanding a company's value, health, and liquidity, and it guides financial decision-making.

- Gather Financial Statements: Collect the necessary financial statements, including the income statement and balance sheet, which provide information on revenues, expenses, and net income, assets, liabilities, and equity.

- Determine the Reporting Period: Identify the period for which you are preparing the cash flow statement (monthly, quarterly, or annually).

- Choose the Method: Decide whether to use the direct method or the indirect method. The direct method involves listing all cash receipts and payments during the reporting period. The indirect method starts with net income and adjusts for changes in non-cash transactions.

- Prepare the Statement:

- Cash Flow from Operating Activities: List cash receipts from customers and cash payments to suppliers, employees, interest, and taxes. Calculate the net cash flow by subtracting total cash payments from total cash receipts.

- Cash Flow from Investing Activities: Identify cash transactions related to the buying and selling of long-term assets, such as property, facilities, and equipment. Calculate the net cash flow by subtracting cash payments from cash receipts.

- Cash Flow from Financing Activity: Examine cash inflows and outflows related to financing activities, including debt and equity financing. Calculate the net cash flow by subtracting cash payments from cash receipts.

- Combine All Sections: Add the net cash flows from operating, investing, and financing activities to determine the overall change in cash for the period.

- Reconcile with Beginning Cash: Add the change in cash to the beginning cash balance to arrive at the ending cash balance, ensuring it matches the balance reported on the balance sheet.

The direct and indirect methods will yield the same results for the three types of activities (operating, investing, and financing). The choice of method depends on the specific needs and preferences of the business.

Understanding E-Trade Cash Calls: What Investors Need to Know

You may want to see also