Understanding how gains on investments affect cash flow is crucial for evaluating a company's financial health and stability. Cash flow from investing activities (CFI) is a section of a company's cash flow statement, reflecting the cash inflows and outflows from various investment initiatives. This includes purchases and sales of long-term assets, acquisitions, and investments in marketable securities. While negative cash flow is often associated with poor performance, it's important to note that investments in long-term health can lead to short-term losses but potentially significant long-term gains if managed effectively.

What You'll Learn

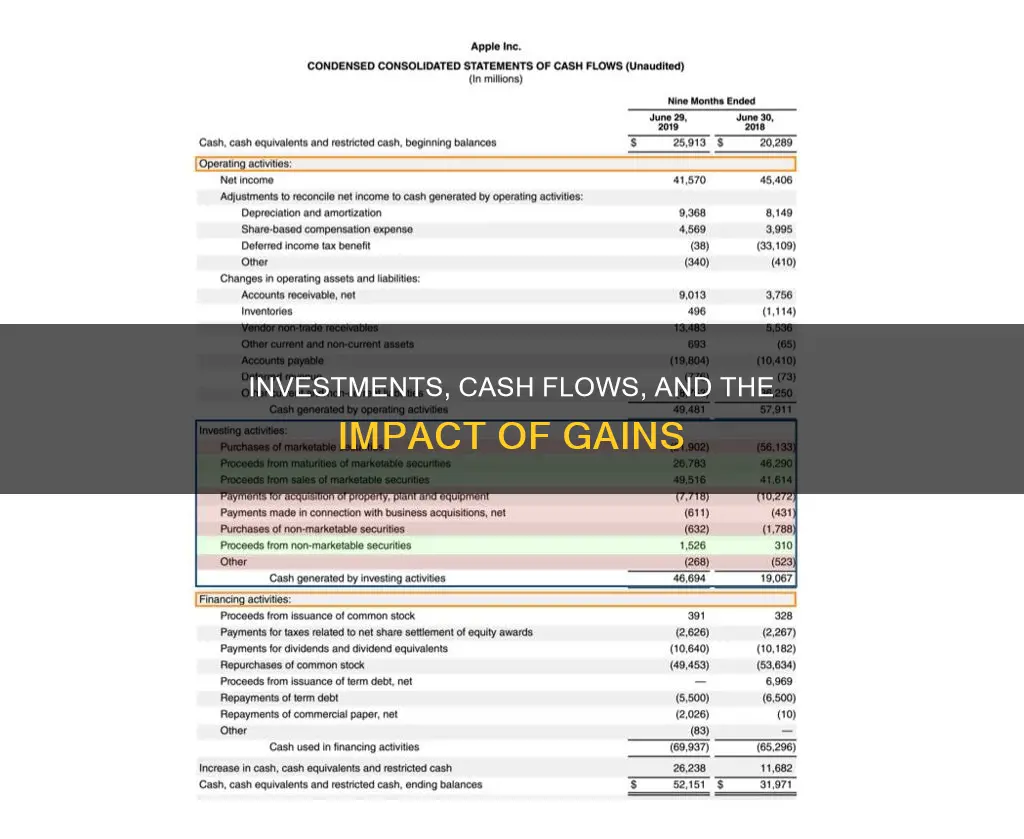

Cash flow from investing activities

Investing activities include purchases of physical assets, investments in securities, or the sale of securities or assets. Investments can be made to generate income on their own, or they may be long-term investments in the health or performance of the company.

- Purchase of property, plant, and equipment (PP&E), also known as capital expenditures

- Proceeds from the sale of PP&E

- Acquisitions of other businesses or companies

- Proceeds from the sale of other businesses (divestitures)

- Purchases of marketable securities (i.e. stocks, bonds, etc.)

- Proceeds from the sale of marketable securities

- Lending money

- Collecting loans

It's important to note that negative cash flow from investing activities does not always indicate poor financial health. It often means that the company is investing in assets, research, or other long-term development activities that are important for the health and continued operations of the company.

CDs: Cash or Investment?

You may want to see also

Cash flow from operating activities

The operating activities section also includes any other types of operating expenses, and in the case of a trading portfolio or investment company, it will also include receipts from the sale of loans, debt, or equity instruments. Changes in cash, accounts receivable, depreciation, inventory, and accounts payable are generally reflected in this section.

The cash flow statement as a whole provides an account of the cash used in operations, including working capital, financing, and investing. It bridges the gap between the income statement and the balance sheet by showing how much cash is generated or spent on these three types of activities.

The cash flow statement is an important tool for creditors and investors to assess a company's financial health and make informed decisions. While negative cash flow can sometimes indicate poor performance, this is not always the case. In the context of cash flow from investing activities, it can be a sign that a company is investing in its long-term health and future growth.

Extra Cash: Smart Investment Strategies for Beginners

You may want to see also

Cash flow from financing activities

CFF includes transactions related to debt, equity, and dividends. When a company raises funds through debt, it typically issues bonds or takes out loans, and must make interest payments to creditors and bondholders. When a company raises funds through equity, it issues stock to investors who become shareholders and may receive dividends, representing a cost to the company.

The formula for CFF is:

> CFF = CED − (CD + RP)

Where:

- CED = Cash inflows from issuing equity or debt

- CD = Cash paid as dividends

- RP = Repurchase of debt and equity

Positive CFF indicates more money flowing into the company, increasing its assets. However, if a company frequently relies on new debt or equity for cash, it may be a warning sign of insufficient earnings.

Negative CFF indicates more money flowing out of the company. This could be due to debt servicing, retirement of debt, dividend payments, or stock repurchases. While these may be positive signs to investors, they could also indicate that management is attempting to prop up the stock price.

Overall, CFF is an important metric for investors and analysts to assess a company's financial health and capital structure management.

Cash App Investing: Are There Any Fees Involved?

You may want to see also

Realized gains on cash flow statements

Realized gains, also known as recognized gains, occur when a company sells an asset for more than its original purchase price. This can be the result of selling securities or other assets, such as property. The cash flow statement is a financial statement used to track the flow of cash in and out of a company during a specific period. It includes four categories of activities: operating, financing, investing, and supplemental. The investing category includes entries for the purchase and sale of assets.

The method used to report realized gains on a cash flow statement depends on how long the asset was owned before its sale. If the asset was owned for longer than one year, it is considered a long-term asset and is taxed at the capital gains tax rate. On the other hand, if the asset was owned for less than one year, it is considered a short-term asset and is taxed at the higher income tax rate.

Realized gains are recorded separately from operating activities and are included in the investment activities section of the cash flow statement. This section includes lines for the purchase and acquisition of investments and other assets, as well as cash received from the sale of investments and assets, including any realized gains.

Including realized gains on the cash flow statement provides valuable information about a company's use of investments to support its stability and expansion. It also helps with estimating the company's potential tax burden, as the IRS taxes gains on long-term assets differently from short-term assets.

Capital Investment Project: Cash Flows Strategy

You may want to see also

Calculating cash flow from investing activities

The cash flow statement is one of the three main financial statements used by a business, alongside the balance sheet and income statement. The cash flow statement is divided into three sections: cash flow from operating activities, cash flow from financing activities, and cash flow from investing activities.

The cash flow from investing activities section details the amount of cash generated by or spent on investment activities over a specific period. This includes purchases of physical assets, investments in securities, or the sale of securities or assets.

To calculate the net cash flow from investing activities, you must first add up all the investing activities that were cash flow positive, and then calculate those that were cash flow negative. You then subtract the negative cash flow from the positive cash flow to get your net cash flow figure.

For example, imagine a company engages in the following investment-related activities in a given month:

- Purchase of marketable securities: $5,000

- Sale of marketable securities: $23,000

- Purchase of capital equipment: $20,000

- Sale of capital equipment: $34,000

The cash inflows are $23,000 + $34,000 = $57,000. The cash outflows are $5,000 + $20,000 = $25,000. The net cash flow from investing activities is therefore $57,000 - $25,000 = $32,000.

It's important to note that negative cash flow from investing activities does not always indicate poor financial health. It may be a sign that a company is investing in assets, research, or other long-term development activities that are important for the health and continued operations of the company.

Depreciation's Impact on Cash Flow: Investing Activities

You may want to see also