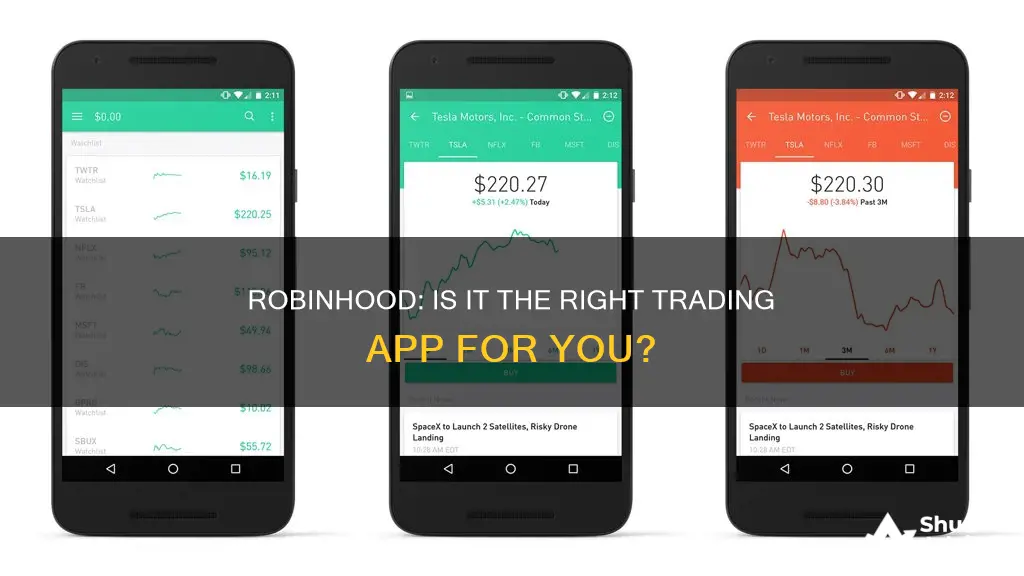

Robinhood is a popular brokerage app that has made investing in the stock market more accessible to the general public. It has a simple, user-friendly interface and offers commission-free trades on stocks, ETFs, options, and cryptocurrencies. However, it has faced criticism for gamifying investing, which may encourage users to make impulsive trades. It also lacks certain investment options, such as mutual funds and bonds, and has been criticised for its poor customer support and lack of transparency. Overall, Robinhood is a good option for beginner investors who want an easy-to-use platform with low fees, but more advanced investors may find the platform lacking in features and investment options.

| Characteristics | Values |

|---|---|

| Commission fees | $0 for stocks, ETFs, options and cryptocurrency trades |

| Account fees | No annual or inactivity fees. $100 ACAT outgoing transfer fee. Robinhood Gold costs $5 a month. |

| Interest rate on uninvested cash | 0.01% for free accounts, 4.5% for Gold accounts |

| Investment options | Stocks, ETFs, Options, Cryptocurrency, American Depositary Receipts for over 650 global companies, Fractional shares. Bonds only available in the form of bond ETFs |

| Number of no-transaction-fee mutual funds | N/A |

| Customer support | 24/7 chat support. Phone support available from 7:00 a.m. ET to 9:00 p.m. ET, Monday - Friday |

| IRA match | 1% for regular customers and 3% for gold-level subscribers |

| Margin rates | 5.7% to 6.75% |

| Data security incidents | In 2021, personal information for a portion of account holders was accessed by hackers |

What You'll Learn

Pros and cons of Robinhood

Robinhood is a user-friendly, commission-free trading app that has gained popularity due to its low fees and simple interface. However, it has received criticism for its lack of transparency and limited investment options. Here are some pros and cons to help you decide if Robinhood is the right platform for you:

Pros:

- No Account Minimum or Monthly Fee: Robinhood has no minimum balance requirements and does not charge a monthly fee for using the platform, making it accessible to new investors.

- Fractional Share Trading: Robinhood allows users to invest in fractional shares, meaning you can buy a portion of a share, even if you don't have enough money to purchase a full share. This makes it easier to invest in a diverse range of stocks and assets.

- Cryptocurrency Trading: Robinhood offers access to a wide range of cryptocurrencies, and trading is free, although there may be network fees for processing blockchain transactions.

- Instant Access to Deposited Cash: Users can instantly access and trade with deposited cash, making it convenient for those who want to act quickly on investment decisions.

- IRA with Match: Robinhood offers an Individual Retirement Account (IRA) with a 1% contribution match, which is a rare feature among non-employer-sponsored retirement accounts. Gold members get a 3% match.

- High Interest on Uninvested Cash: Robinhood offers a relatively high interest rate on uninvested cash, especially for Gold members, which can be beneficial for those with large cash balances.

Cons:

- Limited Investment Options: Robinhood does not offer mutual funds, bonds, or foreign exchange trading. This limits investment strategies and makes it difficult to build a truly diversified portfolio.

- Delayed Price Quotes: Robinhood has been criticised for delayed price quotes, which can impact an investor's ability to make timely and well-informed trading decisions.

- Limited Research and Education Tools: Robinhood has a limited selection of third-party research and data offerings. While it does provide educational resources for beginners, more advanced investors may find the platform lacking in this regard.

- Payment for Order Flow: Robinhood accepts payment for order flow, which means they may route your order to a market maker that provides them with the best financial benefit, rather than the one that will get you the best price.

- Security Concerns: Robinhood has faced data security issues and hacking incidents in the past, raising concerns about the safety of users' personal and financial information.

- Controversies and Lawsuits: Robinhood has been involved in several controversies, including restricting trading during the GameStop short squeeze, which led to class-action lawsuits and criticism from Congress. The company has also been fined by the SEC and FINRA for misleading customers and providing false information.

- Encouraging Active Trading: The app's design and features may encourage active trading, which involves buying and selling stocks rapidly and is not a suitable strategy for most investors due to the high level of risk involved.

Overall, Robinhood is a good choice for beginners who want a simple, low-cost platform to start investing. However, more advanced investors may find the lack of investment options and research tools limiting, and there are concerns about the platform's security and transparency.

Calculating Net Cash Flow: Investing Activities Explained

You may want to see also

Robinhood's target audience

Robinhood targets mobile users who are new to investing and are looking for an easy-to-use, low-cost broker. Its simple, intuitive platform is designed to make trading simple and straightforward, particularly for those who want to trade from their phones.

- New investors: The platform is designed to lower market barriers, with a barebones interface and low fees.

- Mobile users: Robinhood's competitors have imitated its app, which offers a smooth and easy trading experience.

- IRA investors: Robinhood offers a 1% match on IRA contributions, which is a feature that sets it apart from other providers.

- Margin traders: Robinhood offers low margin rates, making it attractive to those who trade on margin.

Robinhood's audience also includes those who want to trade stocks, ETFs, options, and cryptocurrencies on a user-friendly platform without paying commissions. The platform appeals to those who want to trade fractional shares and access direct cryptocurrency trading.

However, Robinhood is not suitable for more advanced or sophisticated traders and investors who require more sophisticated tools, research capabilities, and a wider range of asset classes. The platform lacks mutual funds, fixed income, foreign exchange, and futures trading options, which may drive more experienced traders to alternative brokers.

Cash Investment Strategies: Your Guide to Profitable Opportunities

You may want to see also

Robinhood's investment selection

Robinhood offers a range of investment options to its users, including stocks, ETFs, options, and cryptocurrencies. The platform also provides access to fractional shares, allowing users to invest in a wider range of assets.

One of Robinhood's key features is its no-commission and no-minimum trading, which makes it easier for beginners to get started with investing. The platform also offers a premium subscription called Robinhood Gold, which provides users with higher interest rates on uninvested cash, higher instant deposit limits, and access to Morningstar research reports.

In addition to its investment options, Robinhood also offers a cash management feature, including a debit card that allows users to earn rewards on their purchases. The platform also has a dividend reinvestment program that automatically reinvests dividends from stocks or ETFs.

However, it is important to note that Robinhood does not offer mutual funds, fixed income, or foreign exchange trading. This limits the ability of investors to diversify their portfolios and employ certain trading strategies. Overall, Robinhood's investment selection is geared towards beginners and casual investors rather than advanced traders.

Cash Flow Statement: Understanding Investment Changes

You may want to see also

Robinhood's security and reliability

Security and reliability are key considerations when choosing a trading platform. Here's an overview of Robinhood's security and reliability features:

Security Features

Robinhood has implemented several security measures to protect its users' accounts and investments. These include:

- Two-factor authentication: Users can enable two-factor authentication to add an extra layer of security when logging in.

- Face or fingerprint scan: The mobile app allows users to log in using facial or fingerprint recognition, providing quick and secure access.

- Password protection: Passwords are hashed using the industry-standard BCrypt hashing algorithm and are never stored in plaintext.

- Secure data transmission: Robinhood uses encryption protocols to ensure that data transmitted between its platform and users' devices is secure.

- SIPC membership: Robinhood is a member of the Securities Investor Protection Corporation (SIPC), which provides protection for its customers' securities and cash holdings. The SIPC covers up to $500,000 per account, including $250,000 for cash.

- Additional insurance: Robinhood has purchased additional insurance, providing coverage of up to $1 billion aggregate limit for securities and cash. The per-customer limit is $50 million for securities and $1.9 million for cash.

- Data breach response: In 2021, Robinhood experienced a data breach where hackers accessed personal information of around seven million customers. However, no financial loss or compromise of financial information occurred, and Robinhood took steps to enhance its security measures after the incident.

Reliability Features

Robinhood has also implemented features to ensure the reliability of its platform:

- System enhancements: Robinhood has invested in improving its technology infrastructure to handle increased trading volumes and prevent system outages during periods of high market volatility.

- Trade execution quality: While Robinhood's trade execution quality is slightly below average, at 95.62%, it still ensures that the majority of trades (95.18%) are executed at the National Best Bid and Offer (NBBO) or better.

- Trade restrictions: During the GameStop short squeeze in January 2021, Robinhood faced criticism for restricting trades on certain securities. However, the company has since improved its capital holdings, compliance, and risk management procedures to prevent similar incidents from occurring.

- Customer support: Robinhood offers 24/7 live chat support and extended-hours phone support from 7 a.m. to 9 p.m. ET, Monday through Friday. While there have been mixed reviews about the responsiveness and effectiveness of their customer support, they continue to expand their customer support team.

Understanding Investment Revenue in the Cash Flow Statement

You may want to see also

Robinhood's customer service

Robinhood's customer support features include 24/7 in-app chat and extended-hours phone support, available from 7 a.m. to 9 p.m. ET, Monday to Friday. To speak with a support agent, you must give your phone number to request a call back through the app. Alternatively, you can send a chat message and wait for a representative to respond, which can take up to 24 hours. Robinhood's customer service ratings are mixed, scoring 4.2 on the App Store, 4.1 on Google Play, and 1.2 on Trustpilot.

Robinhood has been the subject of several controversies and lawsuits over the years, including a fine from the SEC in 2020 for misleading consumers and executing trades at inferior prices. In 2021, Robinhood restricted trading of GameStop and several other stocks, angering customers. The company has since improved its customer support team and capital holdings to prevent similar issues in the future.

Investing Excess Cash: Strategies for Smart Financial Planning

You may want to see also

Frequently asked questions

Robinhood has been the subject of serious complaints and lawsuits over the years, which potential users shouldn’t ignore. However, Robinhood has made efforts to reassure investors about the safety of its platform — including a guarantee that it will reimburse 100% of direct losses due to unauthorized account activity that isn't the fault of the customer.

The main downside of Robinhood is that the investment selection is limited for hands-off, passive investors: The broker offers no mutual funds or index funds, which financial advisors typically suggest using as the basis of a diversified portfolio. Customer service availability and support also aren't as robust at Robinhood as they are at other, more mainstream brokers.

Robinhood is a good fit for beginner investors, and the company made our list of the best brokers for beginners. The app offers a streamlined, approachable and easy-to-navigate trading platform, plus extremely low costs, which beginner investors tend to prioritize. Robinhood is designed to provide easy access to the stock and crypto markets.

Robinhood is an affordable discount broker at its core. It's easy to pick up and get started, even if you're totally new to investing. A few features set it apart from your vanilla trading app.

Robinhood receives payment for order flow, directing orders to third-party market makers in exchange for a fee. Robinhood also makes money from margin interest from margin lending, income generated from uninvested cash, and rebates from market makers and trading venues from volume rebates on cryptocurrency trades.

After selling stock or options in your Robinhood brokerage or retirement account, the transaction usually needs to settle before you can withdraw the proceeds and move them to your bank account. The settlement period for equities is the trade date plus two trading days. That’s sometimes called a regular-way settlement. On the third day, you’ll be allowed to withdraw those proceeds.