In the realm of business partnerships, understanding the dynamics of salary and investment is crucial for long-term success. When a working partner's salary is linked to the firm's investment, it creates a unique financial relationship that can significantly impact the venture's growth. This arrangement often involves a performance-based compensation structure, where the partner's earnings are directly proportional to the firm's financial achievements. Such a model incentivizes partners to actively contribute to the company's success, aligning their interests with the investors' goals. This approach fosters a collaborative environment, where the working partner's expertise and dedication are rewarded, while also ensuring that the firm's financial health is a shared responsibility.

What You'll Learn

- Salary Structure: Define compensation based on equity ownership and performance

- Profit-Sharing: Align partner earnings with company profitability and growth

- Carried Interest: Reward partners with a percentage of profits after returns

- Management Fees: Compensate partners for operational and strategic responsibilities

- Performance Metrics: Establish clear criteria to evaluate partner and company success

Salary Structure: Define compensation based on equity ownership and performance

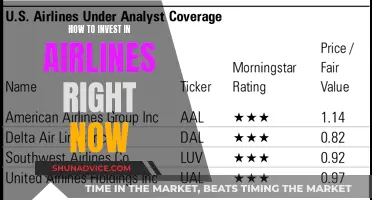

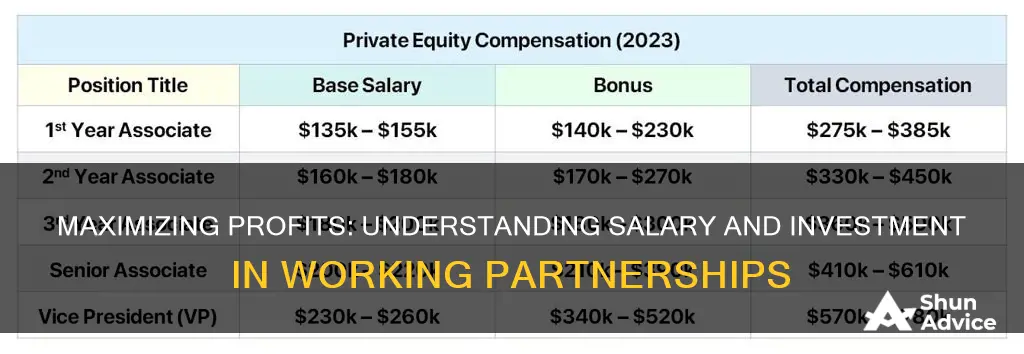

The salary structure for working partners in a business context, especially when tied to investments, is a strategic approach to incentivize and reward partners based on their equity ownership and performance. This model is particularly prevalent in venture capital firms, private equity firms, and startups, where partners' compensation is directly linked to the success of their investments. Here's a detailed breakdown of this compensation structure:

Equity-Based Compensation: In this model, a partner's salary is not solely determined by a fixed annual amount but is instead tied to the ownership of the firm or specific investment vehicles. Partners are often granted equity in the form of shares, options, or units in the company or the funds they manage. This equity ownership provides a direct financial stake in the firm's success and aligns the partners' interests with those of the business. The salary structure might include a base salary, which could be a fixed amount or a percentage of the partner's total compensation, and performance-based bonuses or distributions.

Performance-Linked Rewards: The performance of the investments is a critical factor in determining the salary and overall compensation package. Partners' salaries can be structured as a function of the returns generated by their investment strategies. For instance, a partner might receive a base salary plus a percentage of the profits or a fixed fee for managing a particular fund. In some cases, the salary structure may also include a carry or carry-over provision, where partners receive a share of the profits beyond a certain threshold, further incentivizing successful investments.

Tiered Compensation: Some firms implement a tiered salary structure, where partners' compensation increases as their equity ownership and performance improve. This approach encourages partners to focus on long-term value creation and can lead to significant financial gains if the investments perform well. For example, a partner might start with a lower base salary but have the potential to earn higher compensation through performance bonuses and profit-sharing as the firm's value grows.

Alignment with Business Goals: The salary structure for working partners should be designed to align with the firm's strategic goals and investment objectives. Compensation packages can be tailored to attract and retain top talent by considering factors such as the partner's role, experience, and the specific investment strategies employed. This personalized approach ensures that partners are motivated by both financial rewards and the success of their investments.

In summary, defining compensation based on equity ownership and performance is a powerful strategy to motivate working partners. This structure not only provides financial incentives but also fosters a sense of ownership and accountability, driving partners to actively contribute to the firm's success and the growth of their investments. It is a complex and nuanced process, requiring careful consideration of various factors to create a sustainable and rewarding compensation framework.

Amazon: A Worthy Investment

You may want to see also

Profit-Sharing: Align partner earnings with company profitability and growth

Profit-sharing is a strategic approach to incentivize and align the interests of partners with the company's financial performance and long-term growth. This method involves distributing a portion of the company's profits to partners, creating a direct link between their earnings and the company's success. By implementing profit-sharing, businesses can foster a culture of shared responsibility and motivate partners to actively contribute to the company's growth.

The concept is straightforward: as the company's profitability increases, so do the partners' earnings. This alignment of interests encourages partners to focus on strategies that drive revenue, reduce costs, and enhance overall efficiency. For instance, a software development firm could allocate a percentage of its annual profit to its partners, with the amount based on individual contributions and the company's financial performance. This not only rewards partners for their efforts but also encourages them to actively participate in decision-making processes that impact the company's bottom line.

To implement profit-sharing effectively, companies should consider the following:

- Performance Metrics: Clearly define key performance indicators (KPIs) that will determine the profit-sharing distribution. These metrics could include revenue growth, market share, customer satisfaction, or cost-saving initiatives.

- Transparency: Ensure that partners understand how their contributions are measured and how the company's profitability is calculated. Transparency builds trust and encourages open communication.

- Flexibility: Adapt the profit-sharing structure to accommodate different partner roles and responsibilities. For instance, sales partners might receive a higher percentage of profits during peak sales periods, while technical partners could be rewarded for innovative solutions.

- Regular Review: Periodically assess the effectiveness of the profit-sharing program. Adjust the structure as needed to ensure it remains fair and motivating for all partners.

Profit-sharing provides a powerful incentive for partners to actively engage with the company's goals. It encourages a collaborative environment where partners are invested in the company's success, leading to increased productivity, innovation, and overall business growth. This approach is particularly valuable for startups and small businesses, as it can attract top talent and create a strong foundation for long-term success.

In summary, profit-sharing is a strategic tool to align partner earnings with company profitability, fostering a culture of shared success. By implementing this approach, businesses can create a motivated and engaged partner network, driving the company towards its financial and operational goals.

Contrarian Investing: Unveiling the Power of Dissent in Markets

You may want to see also

Carried Interest: Reward partners with a percentage of profits after returns

Carried interest is a unique and powerful incentive structure used in private equity, venture capital, and other investment firms to compensate partners and attract top talent. This compensation model is a direct reflection of the 'partnership' aspect of these businesses, where the success of the firm is intrinsically tied to the efforts and investments of its partners. The concept is simple yet highly effective: partners are rewarded with a percentage of the profits generated from their investments, after all other returns and expenses have been accounted for. This approach ensures that the partners' interests are deeply aligned with the firm's goals and the success of the investments they make.

In the context of private equity, for example, a typical carried interest agreement might allocate a certain percentage of the fund's profits to the general partners (GPs) after a specific return threshold has been met. This threshold is often set at a multiple of the investors' capital, such as a 2x or 3x return on their investment. Once this threshold is achieved, the GPs receive a predetermined percentage of the profits, often ranging from 20% to 30%, depending on the fund's performance and the specific terms of the partnership agreement. This structure incentivizes GPs to focus on making successful investments and managing the fund effectively to maximize returns.

The beauty of carried interest lies in its ability to motivate partners by directly linking their compensation to the firm's success. It encourages partners to take calculated risks, make strategic decisions, and work diligently to ensure the fund's growth. This model also fosters a sense of ownership and commitment among partners, as they are not just employees but also part-owners of the business. As such, they are more likely to invest their time, energy, and expertise into the firm's success, knowing that their compensation is directly tied to the firm's performance.

This compensation structure is particularly attractive to top talent in the investment industry, as it offers a significant financial upside potential. Unlike traditional salary structures, carried interest provides a clear and tangible reward for exceptional performance and successful investment strategies. It also aligns the interests of partners with those of the firm, creating a more cohesive and motivated team.

In summary, carried interest is a powerful tool for rewarding partners and attracting top talent in the investment industry. By offering a percentage of the profits after a specific return threshold, this compensation model incentivizes partners to work diligently, take calculated risks, and make strategic decisions that drive the firm's success. It is a key component of the partnership structure in private equity, venture capital, and other investment firms, ensuring that the interests of the firm and its partners are deeply intertwined.

Unleash Your Investment Potential: Crowdfunding's Power Explained

You may want to see also

Management Fees: Compensate partners for operational and strategic responsibilities

Management fees are a crucial component of the compensation structure for working partners in investment firms, serving as a means to recognize and reward their operational and strategic leadership. These fees are designed to reflect the value partners bring to the firm through their oversight, decision-making, and overall management of the investment process. The primary purpose is to ensure that partners are adequately compensated for the time, effort, and expertise they invest in the firm's operations and strategic direction.

In the context of investment partnerships, management fees typically cover a range of responsibilities. Firstly, they provide compensation for the day-to-day operational tasks, including portfolio management, research, and trading activities. This ensures that partners are rewarded for their active involvement in the firm's core business functions, which are essential for generating returns and managing risks. Secondly, management fees also account for the strategic responsibilities that partners undertake. This includes long-term planning, market analysis, and the development of investment strategies that align with the firm's goals and the interests of its investors.

The structure of management fees can vary depending on the specific agreement between the partners and the firm. Often, these fees are calculated as a percentage of the firm's assets under management (AUM). This percentage rate is negotiated and agreed upon, taking into account the partners' experience, the scale of the firm's operations, and the potential risks and rewards associated with the investment strategy. For instance, a senior partner with extensive experience might receive a higher management fee percentage compared to a junior partner, reflecting their greater expertise and the associated responsibilities.

In addition to the percentage-based structure, management fees can also include performance-based incentives. These incentives are designed to align the partners' interests with the firm's performance and the success of the investment strategies. For example, a partner might receive a bonus or additional fees if the firm's returns exceed certain targets or if specific investment milestones are achieved. Such performance-based compensation encourages partners to actively contribute to the firm's success and fosters a culture of excellence.

It is important to note that the transparency and fairness of management fee structures are essential for maintaining trust and long-term relationships between partners and investors. Firms should provide clear and detailed explanations of how management fees are calculated and allocated, ensuring that all stakeholders understand the rationale behind the compensation. This transparency helps in building confidence and reinforces the partnership's commitment to ethical and responsible investment practices.

JPMorgan's Robo-Advisor: When Will It Arrive and What to Expect

You may want to see also

Performance Metrics: Establish clear criteria to evaluate partner and company success

When it comes to evaluating the success of working partners and the company as a whole, establishing clear performance metrics is essential. These metrics provide a structured framework to assess progress, identify areas for improvement, and ensure that everyone is aligned with the shared goals. Here's a detailed approach to defining these criteria:

Define Key Performance Indicators (KPIs): Start by identifying the specific areas that are critical to the partnership's success and the company's objectives. These could include financial targets, such as revenue growth, profit margins, or return on investment (ROI). For example, if the partnership is focused on a joint venture, KPIs might include market share gains, customer acquisition rates, or product development milestones. Additionally, consider non-financial metrics like customer satisfaction, employee productivity, or brand awareness. Tailor these KPIs to the unique nature of the partnership and the industry.

Set Clear Targets: Once the KPIs are identified, set measurable and achievable targets for each. These targets should be specific and time-bound. For instance, if the partnership aims to increase market share by 15% in the next fiscal year, this becomes a clear metric to evaluate. Break down larger goals into smaller, manageable milestones to track progress effectively. Regularly review and update these targets to reflect changing market conditions or evolving partnership strategies.

Establish Performance Evaluation Process: Develop a comprehensive process to collect and analyze data related to these KPIs. This process should involve regular reporting, data analysis, and performance reviews. Set up a system where partners and company representatives can input relevant data, ensuring accuracy and consistency. Schedule periodic meetings to discuss performance, compare actual results against targets, and identify any deviations or areas requiring attention. This process should be transparent and involve all relevant stakeholders to ensure buy-in and accountability.

Quantify and Qualify Performance: Performance metrics should be both quantitative and qualitative. Quantitative metrics provide numerical data, such as sales figures, website traffic, or customer feedback scores. Qualitative assessments involve subjective evaluations, like partner satisfaction surveys, customer testimonials, or internal team feedback. A balanced approach ensures a comprehensive understanding of success and allows for a nuanced evaluation of the partnership's overall health.

Regular Feedback and Adjustment: Performance evaluation should be an ongoing process. Regular feedback sessions between partners and the company can help identify challenges, celebrate successes, and make necessary adjustments. This iterative approach ensures that the partnership remains dynamic and responsive to market changes. By continuously refining performance metrics and strategies, the partnership can adapt and thrive in a rapidly evolving business landscape.

Your Money, Your Adviser: A Match?

You may want to see also

Frequently asked questions

The salary for a working partner is typically based on a percentage of the partnership's profits or a fixed amount. It is agreed upon by the partners and can be structured in various ways. This arrangement ensures that the working partner's efforts and contributions are compensated while also aligning their interests with the partnership's success.

Yes, it is common for a working partner's salary to be tied to the amount of investment they bring to the partnership. This linkage ensures that the partner's financial commitment is recognized and encourages them to actively participate in decision-making. The specific percentage or ratio can be negotiated and may vary depending on the partnership's nature and goals.

Tax considerations are essential when structuring a working partner's salary and investment. The tax treatment may vary based on the jurisdiction and the specific terms of the partnership agreement. Typically, a working partner's salary is considered a business expense and can be tax-deductible for the partnership. Investment returns may be subject to different tax rules, and partners should consult tax professionals to ensure compliance with tax regulations.

The partnership agreement should clearly define the profit-sharing and investment distribution criteria. It should specify how profits are allocated among partners, including the working partner's salary and potential bonuses. Additionally, the agreement should detail how investment returns are distributed, considering factors like the initial investment, returns generated, and any agreed-upon incentives or penalties.

Yes, there are a few challenges to consider. Firstly, ensuring a fair and balanced compensation structure that motivates all partners. Secondly, maintaining transparency and clear communication to avoid potential conflicts. Additionally, the partnership should regularly review and adjust the salary and investment structures as the business evolves to ensure continued alignment with the partnership's goals and the working partner's contributions.