The Florida Retirement System (FRS) Investment Plan is a defined-contribution plan, where the ultimate benefit depends on the performance of the individual's investment funds. The plan has been offered to FRS employees since 2002 and is designed for shorter-service and mobile employees, as well as older employees who don't expect to work for at least six to eight years. Under the Investment Plan, retirement benefits are based on the account balance at the time of distribution, which includes employer and employee contributions, dividends, interest, and investment gains or losses. There is no fixed benefit level at retirement, but individuals can purchase a guaranteed lifetime cost-of-living payment option with annual 3% increases.

| Characteristics | Values |

|---|---|

| Type of Plan | Defined-contribution plan |

| Who's Eligible | All FRS employees except: Deferred Retirement Option Program (DROP) participants; Mandatory State University System Optional Retirement Program (SUSORP) members; Teachers' Retirement System members |

| How Your Benefit Accumulates | Benefits are earned more or less evenly over your career (subject to fluctuations in the financial markets and your investment strategy) |

| Vesting | After one year of service in the FRS Investment Plan |

| Benefit Paid at Retirement | Based on your account balance at the time you request a distribution, consisting of any cumulative employer and employee contributions, dividends and interest, and investment gains or losses, less expenses |

| Retirement Income Options | Lump sum or periodic withdrawals on demand or by a pre-determined payout schedule; Survivor benefits and 3% annual benefit increase option are available |

| Pre-Retirement Benefits | Vested account balance will be paid to your beneficiary or estate if you die |

| DROP Rollover | DROP participants can roll over their DROP benefit into the Investment Plan following termination from DROP |

| Rollovers | Former FRS Investment Plan members (retirees) who terminated FRS employment and took a distribution from their Investment Plan account are permitted to roll eligible funds into the FRS Investment Plan |

What You'll Learn

The plan is a defined-contribution plan

The Florida Retirement System (FRS) Investment Plan is a defined-contribution plan. This means that employer and employee contributions are defined by law, but the ultimate benefit depends on the performance of the investment funds. The plan has been offered to FRS employees since 2002 and is designed for shorter-service and mobile employees, as well as older employees who don't expect to work for at least six to eight years.

The FRS Investment Plan is funded by employer and employee contributions that are based on the employee's salary and FRS membership class (e.g. Regular Class, Special Risk Class). Contributions are directed to individual member accounts, and employees can allocate their contributions and account balance across various investment funds. The retirement benefit is the value of the account at termination, and there is no fixed benefit level at retirement. However, a guaranteed lifetime cost-of-living payment option with annual 3% increases can be purchased.

In the FRS Investment Plan, benefits are earned more or less evenly over an employee's career, subject to fluctuations in the financial markets and their investment strategy. This is in contrast to the FRS Pension Plan, where benefits are accumulated slowly at first and then at a faster rate the longer the employee stays. Therefore, the Investment Plan may be more advantageous for those who do not plan to stay with FRS employers for most of their career or the final years of their career.

Under the Investment Plan, employees will be vested (i.e. own the assets in their account) after completing one year of service. If they transfer from the FRS Pension Plan to the FRS Investment Plan, their Pension Plan service will count toward the one-year vesting requirement. However, if they transfer the present value of their FRS Pension Plan benefit to their FRS Investment Plan account, they will need to complete six to eight years of service (depending on their enrolment date) before they "own" this money. Employee contributions are immediately vested, so if employment is terminated before meeting the vesting requirements, the employee will still be entitled to a distribution of their contributions. Nonetheless, taking such a distribution may not be financially prudent as it will result in the forfeiture of any unvested employer contributions and service credit.

If an employee leaves FRS-covered employment after vesting, they can choose to leave their account invested in the Plan, where it will continue to earn market returns until retirement. Alternatively, they can "roll it over" to an Individual Retirement Account (IRA) or another plan, but this will result in being considered retired from the FRS. If they leave prior to vesting, their account balance will be placed in a suspense account for up to five years, and they will regain control over their account if they return to FRS-covered employment within this period.

GME Investors: Who's In?

You may want to see also

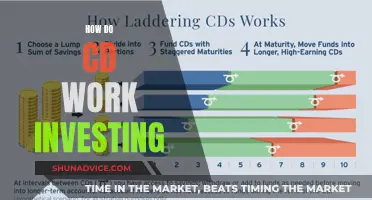

Benefits are based on contributions and growth over time

The Florida Retirement System (FRS) Investment Plan is a defined contribution retirement plan, which means that the benefits you receive in retirement are based on the amount you and, if applicable, your employer contribute to your account during your working years, as well as the growth of those contributions over time. This is in contrast to a defined benefit plan, where retirement benefits are based on a set formula, often tied to years of service and salary.

With the FRS Investment Plan, your retirement benefit is directly linked to the performance of your investments. The longer your contributions have to grow and compound, the larger your balance is likely to be when you retire. This means that the earlier you start saving and the more you contribute, the better your chances of accumulating a substantial retirement nest egg.

The growth of your account balance over time is a key factor in determining your future benefits. The FRS Investment Plan offers a range of investment options, including stock and bond funds, with varying levels of risk and potential return. Over time, these investments should grow, increasing the value of your account. The compound interest effect, where your earnings generate further earnings, can significantly boost your balance, especially over longer periods.

The contributions made to your account, combined with the growth of those contributions over your working life, will determine the size of your retirement benefit. This benefit can be taken as a lump sum or used to provide regular income in retirement, or a combination of both. The flexibility of the Investment Plan allows participants to tailor their retirement income to their individual needs and preferences. It is important to remember that market fluctuations will also play a part in the growth of your account, and these cannot be predicted or controlled.

Here's an example to illustrate how contributions and growth over time can impact your retirement benefit:

Let's say you start contributing to the FRS Investment Plan at age 30. You contribute $300 per month ($3,600 annually) to your account, and your employer matches that contribution. Assuming a 7% annual rate of return, by the time you reach age 65, you would have contributed a total of $162,000 (not including any potential increases in your contribution amount over time). With the power of compound interest, your account balance at retirement could be approximately $455,000. This example demonstrates how time and consistent contributions can lead to a substantial retirement benefit.

Unraveling the Mystery of Fidelity Investments' Payer Federal ID Number

You may want to see also

There are 20 funds to choose from

The Florida Retirement System (FRS) Investment Plan is a defined-contribution plan, allowing participants to choose how to invest their money. The benefit is based on the amount contributed and its growth over time.

The FRS Investment Plan has been offered to employees since 2002 and is designed for shorter-service and mobile employees, as well as older employees who do not expect to work for at least six to eight years.

The plan is funded by employer and employee contributions, which are based on salary and FRS membership class. The contributions are directed to individual member accounts, and you can allocate your contributions and account balance across the various investment funds.

Your benefit accumulates differently in the Investment Plan compared to the Pension Plan. In the Investment Plan, benefits are earned more or less evenly over your career, whereas in the Pension Plan, you accumulate benefits slowly at first and then at a faster rate the longer you stay.

If you leave FRS-covered employment after vesting and go to a non-FRS employer, you can choose to leave your account in the Plan, where it will continue to earn market returns until retirement. Alternatively, you can roll it over to an Individual Retirement Account (IRA) or to your new employer's plan, if allowed.

The FRS Investment Plan offers flexibility and control over your retirement savings, allowing you to choose from a range of investment funds to align with your financial goals and risk tolerance.

Investor's Losing Bet: Why Double Down?

You may want to see also

You can leave your account in the plan if you change employers

If you change employers, you can choose to leave your account in the Florida Retirement System Investment Plan. Your money will continue to grow until you retire or elect to have it paid to you. You will continue to have access to the MyFRS Financial Guidance Line services (online and telephone) at a modest charge to you. You will be able to monitor and change your investment elections, just as before. Generally, the investment fund fees you pay in the Investment Plan are lower than those you would pay in the retail market for mutual funds.

If you leave FRS-covered employment after vesting and go to a non-FRS employer, you can also "roll over" your account to an Individual Retirement Account (IRA) or to the plan of your new employer (if allowed by that plan). However, if you roll your money out of the Investment Plan, you will be considered retired from the FRS.

Pay Off Loans or Invest: Navigating the Pros and Cons for Your Financial Future

You may want to see also

You can choose to receive your account balance as a lump sum

The Florida Retirement System offers a lump sum option called The Investment Plan. This plan gives you a lump sum payout from the FRS instead of a monthly pension amount.

The Investment Plan gives you and your beneficiaries control over when and how you take distributions. For example, if you have little to no bills or another source of income and don't need a high pension amount, you can choose to receive your account balance as a lump sum. This is because higher distributions may simply mean a higher tax bracket for some.

Additionally, if you have high bills now that you won't have in the future, you can elect the investment plan to help pay that bill, and then drop the amount of distributions at a later date. You can also choose to receive a lump sum if you want higher income during the prime of your life.

You can also choose to receive your account balance as a lump sum if you want access to additional funds. With the FRS Investment Plan, you have full authority over when and how much you take. For example, you may wish to take a lump sum distribution for travelling and leisure or to help out family members.

Please note that distributions from the investment plan or rollover investments are taxable. Please consult a tax professional before taking any lump-sum distributions.

Student Debt Strategies: Investing to Reduce the Burden

You may want to see also

Frequently asked questions

The Florida Retirement System Investment Plan is a defined-contribution plan that allows participants to choose how to invest the money in their account. There is no fixed benefit level at retirement.

The benefit of the plan is based on the amount contributed and its growth over time.

All FRS employees are eligible for the Investment Plan except for participants in the Deferred Retirement Option Program (except as a distribution option), Mandatory State University System Optional Retirement Program (SUSORP) members, and Teachers' Retirement System members.

Exempt/salaried employees need to opt out of the SUSORP by faxing an ORP Enroll Form to UFHR Benefits. All employees must then complete an FRS Online Enrollment Form (ELE-1 Online).