CDs, or certificates of deposit, are a type of investment vehicle that offers a fixed rate of return over a specified period of time. They are a low-risk investment option, making them an attractive choice for those seeking a safe and secure way to grow their money. When you invest in a CD, you essentially lend your money to a financial institution, such as a bank or credit union, and in return, you receive a guaranteed interest rate. This interest is typically paid out at maturity, providing a predictable and stable return on your investment. Understanding how CDs work can be a valuable step for anyone looking to diversify their investment portfolio and potentially earn a steady income stream.

What You'll Learn

- Understanding CDs: Fixed-term deposits offering higher yields than savings accounts

- Interest Calculation: APY, compounding, and how interest accrues over time

- Maturity Dates: Fixed end dates, penalties for early withdrawal, and maturity rewards

- Tax Implications: Tax treatment of CD interest, potential capital gains, and tax-free savings

- Risks and Benefits: Lower risk, higher yields, and potential penalties for early access

Understanding CDs: Fixed-term deposits offering higher yields than savings accounts

A Certificate of Deposit (CD) is a type of investment vehicle that offers a fixed rate of interest for a predetermined period, providing a more secure and potentially higher return compared to traditional savings accounts. CDs are essentially time deposits, meaning they are a form of savings account with a fixed term and a guaranteed rate of interest. This makes them an attractive option for investors seeking a stable and predictable return on their investments.

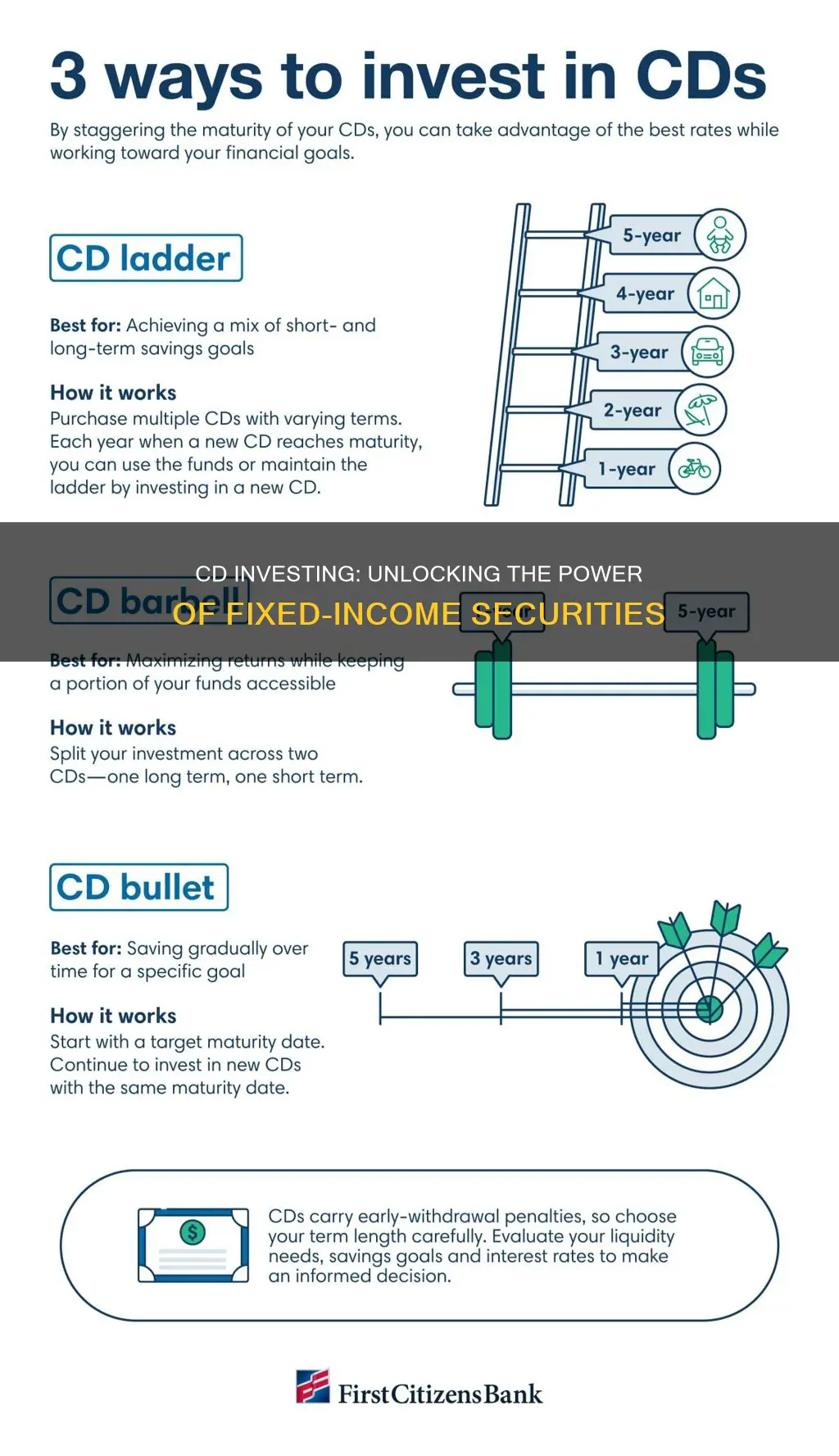

When you invest in a CD, you agree to keep your money in the account for a specified period, known as the term or maturity date. During this time, the funds are typically locked in, and you cannot withdraw them without incurring penalties. The interest earned on a CD is usually calculated and paid out at maturity, or it can be added to the principal amount, allowing your investment to grow even further. This fixed-term nature of CDs provides a level of security and predictability that is often lacking in other investment options.

One of the key advantages of CDs is the potential for higher yields compared to regular savings accounts. Banks and financial institutions offer CDs to attract investors who are willing to tie up their funds for a fixed period. In return, these investors receive a higher interest rate, which can be significantly more competitive than what is typically offered on savings accounts. This higher yield is a result of the bank's ability to lend out the deposited funds at a higher rate, thus generating more revenue.

Understanding the mechanics of CDs is essential for investors looking to maximize their returns. When opening a CD, you need to decide on the term length, which can vary from a few months to several years. Longer-term CDs generally offer higher interest rates but come with the risk of losing access to your funds for an extended period. It's crucial to assess your financial goals and risk tolerance before committing to a specific term. Additionally, be mindful of any early withdrawal penalties, as these can significantly impact your overall returns if you need to access your funds before the maturity date.

In summary, CDs are a valuable investment tool for those seeking a secure and potentially lucrative return. By understanding the fixed-term nature of CDs and the associated risks and rewards, investors can make informed decisions to align their financial goals with the right investment strategy. Remember, while CDs offer higher yields, they also require a commitment to a fixed term, so careful consideration is essential.

REITs: A Smart Real Estate Investment?

You may want to see also

Interest Calculation: APY, compounding, and how interest accrues over time

Understanding how interest is calculated and compounds over time is crucial when investing in certificates of deposit (CDs). This knowledge empowers you to make informed decisions about your savings and maximize your returns. Here's a breakdown of the key concepts:

APY (Annual Percentage Yield): This is the most important metric to understand when comparing CDs. APY represents the total interest earned on your investment over the course of a year, taking into account the effects of compounding. It's expressed as a percentage and provides a clear picture of the true growth potential of your CD. For example, a CD with an APY of 5% will earn 5% interest annually, with the interest compounded according to the terms of the CD.

Compounding: This is the process by which interest earned on your initial deposit is added to the principal, and then interest is calculated on the new, higher balance. This creates a snowball effect, where your money grows exponentially over time. The more frequently interest is compounded, the faster your savings will grow. CDs typically offer compounding options, such as daily, monthly, quarterly, or annually. The more frequent the compounding, the higher the potential return.

Interest Accrual: This refers to the process of earning interest on your CD. Interest accrual can be calculated in two main ways: simple interest or compound interest. Simple interest is calculated as a percentage of the principal amount, without considering the effects of compounding. Compound interest, on the other hand, takes into account the accumulated interest from previous periods, leading to exponential growth. When you invest in a CD, you'll typically choose a compounding frequency, and interest will accrue accordingly.

Example: Let's say you invest $1,000 in a CD with a 5% APY, compounded annually. After one year, your balance will be $1,050. In the second year, interest will be calculated on the new balance of $1,050, resulting in $52.50 in interest earned. This process repeats for the duration of the CD term. The key takeaway is that the more compounding periods you have, the larger the final amount will be.

Understanding APY, compounding, and interest accrual allows you to compare different CD offerings and choose the one that best aligns with your financial goals. By selecting a CD with a competitive APY and a compounding frequency that suits your needs, you can maximize your returns and watch your savings grow.

Wealth in the 16th Century: Investing in Land and Trade

You may want to see also

Maturity Dates: Fixed end dates, penalties for early withdrawal, and maturity rewards

When you invest in a Certificate of Deposit (CD), you're essentially lending your money to a financial institution, typically a bank or credit union, for a fixed period. This investment vehicle is known for its predictability and security, making it an attractive option for those seeking a stable return on their savings. One of the key aspects of CDs is the concept of maturity dates, which are crucial to understanding how they work.

A maturity date is a fixed end date specified in the CD agreement. This date is the agreed-upon time when the CD will mature, meaning the investment will come to an end. At this point, the bank or credit union is required to return the principal amount (your initial deposit) plus any accrued interest back to you. The maturity date is set when you open the CD and is an essential part of the investment's structure. It provides investors with a clear timeline, allowing them to plan their financial decisions accordingly.

Early withdrawal from a CD can be penalized, which is another critical aspect of maturity dates. If you need access to your funds before the maturity date, you may be charged a penalty. This penalty is designed to compensate the financial institution for the loss of potential interest they would have earned had you kept the funds in the CD until maturity. The penalty amount can vary depending on the terms of the CD and the institution's policies. It's important to consider this potential cost when deciding whether to withdraw early, as it can significantly impact your overall return on investment.

On the positive side, reaching the maturity date brings maturity rewards. When the CD matures, you receive the full amount you initially deposited, along with the accumulated interest. This interest is calculated based on the interest rate agreed upon at the time of opening the CD. The higher the interest rate and the longer the term, the more substantial the maturity reward. This aspect of CDs makes them an appealing choice for those seeking a guaranteed return on their investment, especially for long-term savings goals.

In summary, maturity dates are a fundamental feature of CDs, providing investors with a clear and predictable investment horizon. While early withdrawals may result in penalties, the maturity date ensures that investors can expect to receive their principal and interest at a specified time. Understanding these maturity dates and the associated penalties and rewards is essential for anyone considering CD investments as a part of their financial strategy.

Two Harbors Investment: Dividend Sustainability in Question

You may want to see also

Tax Implications: Tax treatment of CD interest, potential capital gains, and tax-free savings

When it comes to Certificate of Deposit (CD) investments, understanding the tax implications is crucial for investors to make informed decisions. CDs are a type of time deposit account offered by banks, offering a fixed rate of interest for a specified period. While CDs provide a safe and relatively stable investment option, the tax treatment of CD interest and potential capital gains can vary, and investors should be aware of these nuances.

Tax Treatment of CD Interest:

CD interest is generally taxable income for the account holder. When you open a CD, the interest earned is typically reported on your tax return, and you will be taxed on the interest accrued during the term of the CD. The tax rate applied to this interest income depends on your overall income and tax bracket. It's important to note that the interest earned from CDs is usually subject to federal income tax, and in some cases, state taxes as well. The interest may be compounded, meaning it earns additional interest over time, which also becomes taxable.

Potential Capital Gains:

CDs are typically considered a low-risk investment, and the primary attraction is the fixed interest rate. However, there is a potential for capital gains if the CD is held until maturity and then sold at a higher price. In this scenario, the investor may realize a capital gain, which is the difference between the purchase price and the selling price of the CD. Capital gains are generally taxed at different rates depending on the holding period and the investor's tax bracket. Short-term capital gains (held for less than a year) are often taxed as ordinary income, while long-term capital gains (held for more than a year) may qualify for a lower tax rate.

Tax-Free Savings:

One of the advantages of CDs is that they can be a tax-efficient way to save for certain goals. If you are investing in a CD for a specific purpose, such as a child's education or a down payment on a house, you may want to consider tax-free savings options. Some jurisdictions offer tax-free savings accounts or programs that allow investors to earn interest without paying taxes on the earnings. These accounts can be an attractive alternative to traditional CDs, especially for those seeking tax-efficient growth. However, it's essential to research and understand the specific tax laws and regulations in your region to take full advantage of these tax-free savings opportunities.

In summary, while CDs provide a secure investment with fixed returns, investors should be mindful of the tax implications. Understanding how CD interest is taxed and being aware of potential capital gains can help investors make strategic decisions. Additionally, exploring tax-free savings options can be a beneficial strategy for those looking to maximize their savings while minimizing tax liabilities. It is always advisable to consult with a tax professional or financial advisor to ensure compliance with tax laws and to tailor investment strategies to individual circumstances.

Moon Pay's Magnetic Pull: Strategies for Investing in the Crypto Platform

You may want to see also

Risks and Benefits: Lower risk, higher yields, and potential penalties for early access

When considering Certificate of Deposit (CD) investments, it's important to understand the risks and benefits associated with this type of investment vehicle. CDs are time deposits offered by banks, typically with higher interest rates than regular savings accounts, but they come with certain trade-offs.

One of the key advantages of CDs is the lower risk they offer compared to other investment options. CDs are insured by the Federal Deposit Insurance Corporation (FDIC) in the United States, up to $250,000 per depositor, per insured bank. This insurance provides a safety net for your principal investment, ensuring that your money is protected even if the bank fails. This makes CDs an attractive option for risk-averse investors who prioritize capital preservation.

In terms of benefits, CDs offer a fixed interest rate for a predetermined period, known as the term. This means you know exactly how much interest you will earn over the term, providing a stable and predictable return. The longer the term, the higher the interest rate, but also the greater the risk if you need to access your funds early. CDs are ideal for investors who can commit their money for a fixed period, allowing them to benefit from the higher yields.

However, there are potential risks and penalties to consider. One of the main risks is the penalty for early withdrawal. If you need to access your funds before the CD maturity date, you may incur a penalty, which can significantly reduce your potential earnings. The penalty is typically a percentage of the principal, and it varies depending on the bank and the term length. It's crucial to carefully consider your financial needs and ensure that you won't require early access to your funds.

Additionally, while CDs offer lower risk, they may not provide the highest returns compared to other investment options. The interest rates on CDs are generally lower than those of stocks or bonds, especially for shorter-term investments. Therefore, investors seeking higher yields might need to consider other investment vehicles. It's essential to evaluate your investment goals and risk tolerance to determine if CDs align with your financial strategy.

In summary, CDs provide a safe and predictable investment option with lower risk and potential higher yields, but they come with penalties for early access. Understanding these risks and benefits is crucial for making informed investment decisions and ensuring that your financial goals are met.

Investing During Depressions: Strategies for Success

You may want to see also

Frequently asked questions

A CD is a time-bound deposit account offered by banks or credit unions. When you invest in a CD, you essentially lend your money to the financial institution for a specified period, known as the term or maturity. In return, the bank pays you a fixed interest rate, which is agreed upon at the time of purchase. CDs are considered low-risk investments, making them attractive to risk-averse investors.

Selecting the appropriate CD involves considering several factors. Firstly, determine your investment horizon; CDs typically have fixed terms ranging from a few months to several years. Longer-term CDs often offer higher interest rates but may not be suitable if you need immediate access to your funds. Secondly, compare the interest rates offered by different financial institutions. Online banks often provide competitive rates. Lastly, review the early withdrawal penalties; some CDs charge a fee if you withdraw before the maturity date, so ensure you understand the terms to avoid any surprises.

While CDs are generally considered safe, there are a few risks to be aware of. One risk is inflation, as the interest earned on CDs might not keep up with the rising inflation rate, eroding the purchasing power of your investment over time. Additionally, if you need to access your funds before the maturity date and the CD has an early withdrawal penalty, you could incur a financial loss. It's essential to have a clear understanding of the terms and conditions to manage these risks effectively.

Yes, CDs are known for offering higher interest rates compared to traditional savings accounts. When comparing CDs, look for those with competitive rates, especially if you're considering longer-term investments. However, it's important to remember that higher interest rates often come with longer lock-up periods, and you should evaluate the trade-off between interest earnings and flexibility.

To avoid early withdrawal penalties, it's crucial to understand the CD's terms and conditions. Some CDs allow penalty-free withdrawals if you provide notice before a specific date. Others might offer grace periods, allowing you to withdraw funds without penalties during the first few months. Always review the maturity date and any associated withdrawal rules to ensure you can access your funds when needed without incurring unnecessary fees.