Index investing is a long-term investment strategy that aims to mirror the performance of a specific market index, such as the S&P 500 or the FTSE 100. This approach involves investing in a diversified portfolio of assets that closely follows the composition of the chosen index. While it may seem counterintuitive to invest in a passive strategy, index investing has proven to be a highly effective and efficient way to build wealth over time. The concept is based on the idea that actively picking individual stocks is often more challenging and less profitable than simply investing in a broad market index, which provides exposure to a wide range of companies and industries. This strategy works by leveraging the power of compounding returns and the historical tendency of markets to trend upwards over the long term.

What You'll Learn

- Long-Term Performance: Index funds consistently outperform active funds over decades

- Low Costs: Fees and expenses are minimized, leading to higher returns

- Diversification: Holding a wide range of assets reduces risk

- Market-Beating Potential: Indexing can beat the market in the long run

- Compounding Growth: Reinvesting dividends leads to exponential wealth accumulation

Long-Term Performance: Index funds consistently outperform active funds over decades

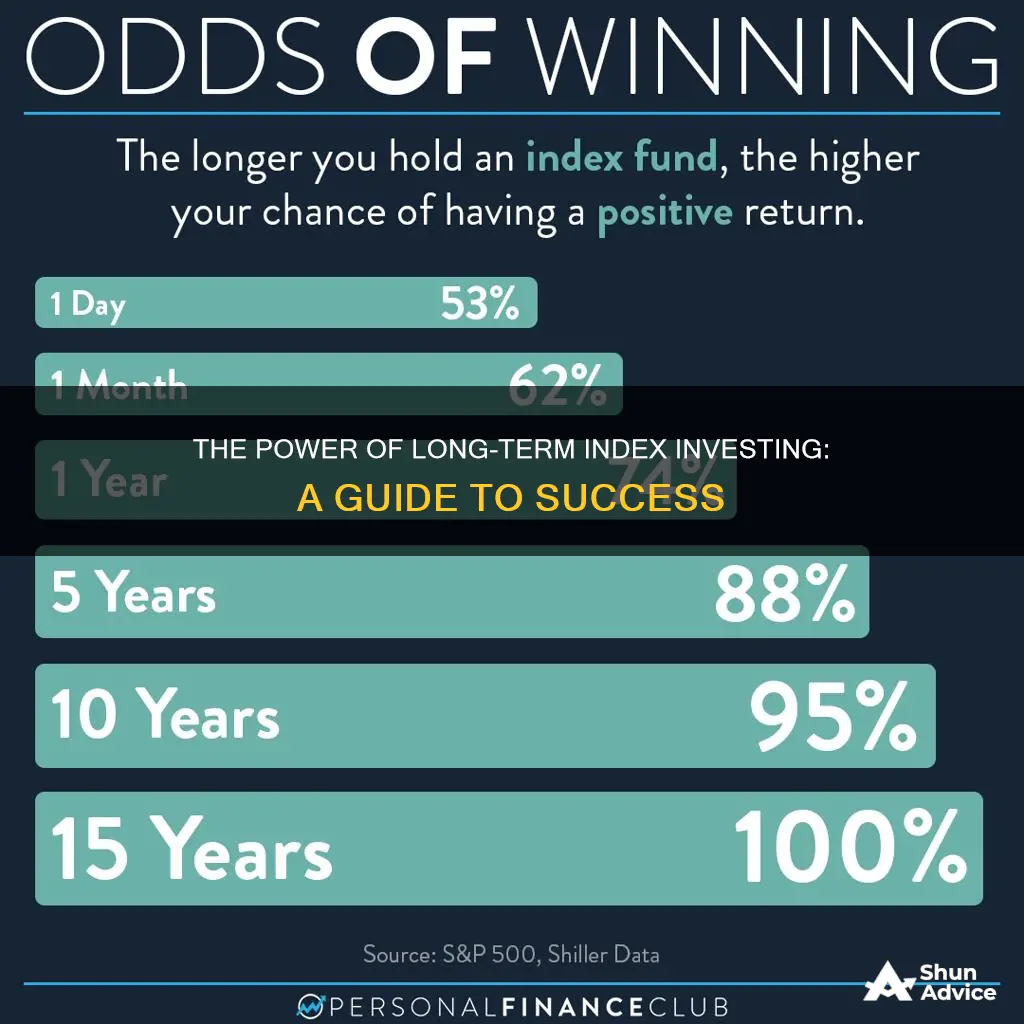

The concept of index investing is rooted in the idea that attempting to consistently outperform the market through active management is a challenging and often futile endeavor. This is supported by extensive historical data and research, which consistently demonstrates that index funds, which aim to mirror the performance of a specific market index, have a proven track record of outperforming actively managed funds over the long term.

One of the key advantages of index funds is their ability to provide broad market exposure at a low cost. By tracking a market index, such as the S&P 500 or the FTSE 100, these funds offer investors a diversified portfolio that mirrors the overall market performance. This approach eliminates the need for active stock selection and the associated risks and costs. Over time, the consistent and disciplined approach of index investing has led to superior long-term returns compared to actively managed funds.

Numerous studies have analyzed the performance of index funds versus actively managed funds over extended periods. These studies consistently reveal that index funds have a higher probability of outperforming their actively managed counterparts, especially when considering the cumulative effect of fees and transaction costs. The concept of 'market beating' is often associated with active management, but the data suggests that this is a rare and fleeting achievement.

The long-term performance of index funds can be attributed to several factors. Firstly, the low expense ratios of index funds mean that investors retain a higher proportion of their returns. Secondly, the passive nature of index funds reduces trading activity, thereby minimizing the impact of market timing and transaction costs. Additionally, the broad diversification offered by index funds reduces the risk associated with individual stock selection.

In conclusion, the consistent outperformance of index funds over active funds over decades is a well-documented phenomenon. This success is underpinned by the low costs, broad diversification, and disciplined approach inherent in index investing. For investors seeking long-term wealth creation, index funds provide a reliable and efficient strategy that has proven its mettle over time.

Unleash Your Trading Power: Understanding Margin Investing

You may want to see also

Low Costs: Fees and expenses are minimized, leading to higher returns

Index investing is a strategy that aims to replicate the performance of a specific market index, such as the S&P 500 or the FTSE 100. One of the key advantages of this approach is its low-cost structure, which can significantly impact long-term returns. By minimizing fees and expenses, index investors can maximize their overall gains.

The concept of low costs in index investing revolves around the idea that traditional active management strategies often incur higher expenses. These expenses include management fees, transaction costs, and other operational charges. In contrast, index funds and ETFs (Exchange-Traded Funds) typically have lower expense ratios because they aim to mirror the index rather than actively select individual securities. This passive approach reduces the need for frequent trading and management, resulting in lower costs for investors.

When it comes to fees, index investors benefit from lower expense ratios, which are the annual charges deducted from the fund's assets. These ratios are usually expressed as a percentage and represent the cost of managing the fund. For example, an index fund with a 0.05% expense ratio will charge 0.05% of its assets annually to cover management and operational costs. Over time, these savings can accumulate and contribute to higher overall returns.

Additionally, index investing minimizes transaction costs, which are associated with buying and selling securities. Active managers often engage in frequent trading to beat the market, incurring higher transaction fees. In contrast, index investors hold a diversified portfolio of securities and rarely buy or sell, resulting in lower transaction costs. This reduction in trading activity further contributes to the overall cost-effectiveness of index investing.

By minimizing fees and expenses, index investing provides investors with a more efficient way to participate in the market. Lower costs mean that a larger portion of the returns goes directly to the investors, potentially leading to higher long-term gains. This strategy is particularly appealing to long-term investors who aim to build wealth over an extended period, as the cumulative effect of low costs can significantly impact final returns.

Makeup Investment: Who's Spending?

You may want to see also

Diversification: Holding a wide range of assets reduces risk

Diversification is a fundamental principle in investing, and it plays a crucial role in managing risk. The concept is simple: instead of putting all your eggs in one basket, you spread your investments across various assets, sectors, and industries. This strategy is particularly relevant in index investing, where the goal is to replicate the performance of a specific market index.

In index investing, the focus is on mirroring the returns of a broad market index, such as the S&P 500 or the FTSE 100. These indices represent a diverse range of companies and industries, providing a comprehensive view of the market. By investing in an index fund or ETF (Exchange-Traded Fund), you gain instant diversification, as these funds hold a basket of securities that closely follow the index. This approach is designed to provide long-term capital appreciation and is often considered a more passive investment strategy.

The primary advantage of diversification in index investing is risk reduction. When you hold a wide variety of assets, the impact of any single investment's underperformance is minimized. For example, if one stock in the index experiences a decline, it won't significantly affect the overall performance of the index fund, as the fund's value is tied to the entire index. This diversification effect helps smooth out the volatility of returns, making the investment journey less bumpy.

Additionally, diversification allows investors to benefit from the growth potential of various sectors and industries. Different sectors and asset classes have distinct growth rates and risk profiles. By holding a diverse portfolio, investors can capture the upside potential of multiple sectors, ensuring that their investments are not overly exposed to any single market or economic event. This approach is particularly useful in navigating through economic cycles and market downturns.

In summary, diversification is a powerful tool for investors, especially in the context of index investing. It enables investors to manage risk effectively by spreading their investments across a broad spectrum of assets. This strategy provides a more stable and balanced investment experience, allowing investors to stay invested for the long term and potentially benefit from the overall growth of the market. As the old adage goes, "Don't put all your eggs in one basket," and diversification is a practical way to follow this wise advice in the world of investing.

Unlocking the Power of Investment Trusts: A Comprehensive Guide

You may want to see also

Market-Beating Potential: Indexing can beat the market in the long run

Indexing is a powerful investment strategy that has gained significant traction in recent years, and its market-beating potential is a topic of much interest among investors. While it may not guarantee outperformance in the short term, the long-term prospects of indexing are compelling. This approach involves investing in a broad range of assets, such as stocks, bonds, or commodities, that are represented by a specific market index. By mirroring the index, investors can achieve diversification and potentially outperform the market over an extended period.

The core idea behind indexing is to capitalize on the historical trend of active management underperforming the market. Numerous studies have shown that actively managed funds often fail to beat the market's performance, and this is where indexing shines. Index funds and exchange-traded funds (ETFs) aim to replicate the returns of a particular index, ensuring that investors benefit from the overall market growth. Over time, this strategy can lead to superior returns, especially when compared to actively managed funds.

One of the key advantages of indexing is its ability to provide diversification. By investing in a wide range of securities, index funds reduce the risk associated with individual stock selection. This diversification effect can lead to more consistent returns and potentially lower volatility. As a result, investors can benefit from the overall market's growth while minimizing the impact of individual stock performance.

Additionally, indexing offers a cost-effective approach to investing. These funds typically have lower expense ratios compared to actively managed funds, as they require less research and trading activity. Lower costs can contribute to higher net returns for investors over the long term. The efficiency of indexing allows investors to benefit from market trends without incurring excessive fees, making it an attractive strategy for those seeking market-beating potential.

In summary, indexing presents a compelling strategy for investors seeking market-beating potential. By investing in a broad range of assets and mirroring market indices, investors can benefit from diversification and potentially outperform actively managed funds. The long-term prospects of indexing are promising, offering a cost-effective and efficient way to participate in the overall market growth. As investors continue to explore various investment approaches, indexing remains a powerful tool to navigate the complexities of the financial markets.

Financial Literacy: Powering Personal Finance

You may want to see also

Compounding Growth: Reinvesting dividends leads to exponential wealth accumulation

Compounding growth is a powerful concept in investing, and it becomes even more significant when you reinvest dividends in your portfolio. This strategy, often associated with index investing, can lead to exponential wealth accumulation over time. Here's how it works and why it's a game-changer for long-term investors.

When you invest in a company through a mutual fund or an exchange-traded fund (ETF), you typically receive dividends as a portion of the company's profits. Reinvesting these dividends means instead of taking the cash and potentially spending it or saving it elsewhere, you use it to purchase additional shares of the same fund or ETF. This practice has a profound impact on your investment journey. As you reinvest, the number of shares in your portfolio grows, and with each new purchase, you acquire a larger stake in the underlying companies. This process is the essence of compounding growth.

The beauty of this strategy lies in its ability to create a snowball effect. Initially, the impact might seem small, but as time passes, the effect becomes more substantial. Here's why: with each reinvestment, you earn dividends on the new shares, and these dividends, in turn, generate additional dividends. This creates a cycle of growth, where the reinvested dividends contribute to the purchase of more shares, leading to even more dividend income. Over the years, this process compounds, resulting in a substantial increase in the value of your portfolio.

Index investing, a popular approach that tracks a specific market index, often involves reinvesting dividends. By investing in an index fund or ETF, you gain exposure to a diverse range of companies, and the dividends are automatically reinvested, allowing your wealth to grow exponentially. This strategy is particularly effective for long-term investors, as it provides a consistent and steady growth trajectory.

The key to success with this approach is patience and a long-term perspective. While the initial returns might not be spectacular, the power of compounding becomes evident over time. It's a strategy that aligns well with the principles of index investing, which aims to mirror the performance of a particular market or sector. By consistently reinvesting dividends, you're essentially participating in the success of the companies you invest in, allowing your wealth to grow in a sustainable and exponential manner.

In summary, reinvesting dividends is a powerful tool for wealth accumulation, especially in the context of index investing. It allows investors to harness the power of compounding, turning modest initial investments into substantial fortunes over time. This strategy is a testament to the idea that consistent, long-term investing can lead to remarkable financial success.

Wyndham's Annual Investor Count

You may want to see also

Frequently asked questions

Index investing is a long-term strategy, and results may take time to materialize. While individual stocks can fluctuate daily, index funds aim to mirror the performance of a specific market index, such as the S&P 500. Historically, these indices have shown steady growth over the long term, often outpacing the average annual return of actively managed mutual funds. The power of index investing lies in its ability to provide broad market exposure and minimize costs, allowing investors to benefit from the overall market's performance over extended periods.

No, index investing is not a get-rich-quick scheme. It is a long-term investment strategy that requires patience and a commitment to a well-diversified portfolio. While it can provide solid returns over time, the process of building wealth through index investing is gradual. The strategy focuses on capturing the market's overall growth, which may not result in rapid wealth accumulation but can lead to substantial long-term gains.

No, immediate returns are not guaranteed with index funds. Index investing is designed to provide long-term capital appreciation and income through regular dividends. The performance of index funds is tied to the overall market, and short-term market fluctuations can impact the fund's value. However, historically, well-managed index funds have demonstrated resilience and have the potential to recover from temporary losses, making them a reliable long-term investment choice.

Successful index investing typically requires a long-term investment horizon, often recommended to be at least 10-15 years or more. This is because index funds aim to provide stable, long-term returns, and short-term market volatility can be smoothed out over an extended period. While there may be short-term fluctuations, a longer investment timeframe allows for the compounding effect of returns, potentially leading to significant growth.