When it comes to investing, understanding the concept of a long-term investment horizon is crucial. This term refers to the period an investor is willing to commit their money to a particular investment strategy, often spanning several years or even decades. The length of this horizon can vary significantly depending on an individual's financial goals, risk tolerance, and personal circumstances. In this article, we will explore how the duration of a long-term investment horizon influences investment decisions, strategies, and outcomes, providing insights into why it is a key factor in successful investing.

What You'll Learn

- Age and Life Stage: Younger investors can afford longer timeframes

- Risk Tolerance: Higher risk tolerance allows for longer investment periods

- Financial Goals: Long-term goals like retirement require extended investment horizons

- Market Volatility: Understanding market cycles is key to long-term investing

- Economic Cycles: Investing through economic cycles can be beneficial over time

Age and Life Stage: Younger investors can afford longer timeframes

Younger investors often have a distinct advantage when it comes to long-term investing. This demographic typically possesses a longer investment horizon, which is a crucial factor in financial planning. The concept of a long-term investment horizon refers to the period an investor is willing to commit their funds to a particular asset or strategy, often spanning several years or even decades. For younger individuals, this horizon can be significantly extended due to various life factors.

One of the primary reasons is their age. Younger investors are typically in their prime earning years, which means they have a higher capacity for risk and can afford to wait out short-term market fluctuations. This is because they have a larger portion of their wealth in the form of assets that can grow over time, such as stocks and mutual funds. As such, they can take advantage of the power of compounding, where their investments grow exponentially over extended periods.

Additionally, younger investors often have a more flexible financial situation. They might be saving for long-term goals like retirement, home ownership, or even starting a business. This flexibility allows them to rebalance their portfolios when necessary without being as concerned about short-term market volatility. Over time, they can gradually shift their investments towards more conservative assets as they approach retirement, ensuring a well-diversified and balanced portfolio.

Another advantage is the ability to recover from potential losses. Younger investors have more time to recover from any downturns in the market. They can ride out the ups and downs of the economy, knowing that their investments will likely grow over the long term. This mindset encourages a buy-and-hold strategy, where they focus on long-term gains rather than short-term market movements.

In summary, younger investors can embrace a longer investment horizon due to their age, earning potential, flexibility, and capacity for risk. This approach allows them to take advantage of compounding growth, rebalance portfolios effectively, and recover from market fluctuations. By understanding and utilizing this advantage, younger investors can set themselves up for financial success in the long run.

Navigating Short-Term Investments: Asset or Liability?

You may want to see also

Risk Tolerance: Higher risk tolerance allows for longer investment periods

When it comes to investing, risk tolerance plays a crucial role in determining the length of one's investment horizon. Higher risk tolerance refers to an investor's ability to withstand market volatility and potential losses over an extended period. This concept is closely tied to the idea of a long-term investment strategy, where investors aim to benefit from the potential growth of their investments over many years.

Individuals with a higher risk tolerance often have a more aggressive investment approach, which enables them to take on greater risks in pursuit of potentially higher returns. This tolerance allows investors to focus on long-term goals, such as retirement planning or wealth accumulation, without being overly concerned about short-term market fluctuations. By embracing a longer investment horizon, these investors can ride out the market's natural ups and downs, allowing their investments to grow and compound over time.

The relationship between risk tolerance and investment period is a fundamental aspect of financial planning. Higher risk tolerance encourages investors to consider a longer-term perspective, as they are more willing to accept short-term losses in exchange for potential long-term gains. This mindset enables investors to make strategic decisions, such as investing in growth-oriented assets, international markets, or alternative investments, which may offer higher returns but also carry greater risks.

For instance, a high-risk tolerance investor might choose to allocate a significant portion of their portfolio to stocks, which historically have provided substantial long-term returns. They understand that stocks may experience temporary declines, but over an extended period, their value tends to appreciate. This investor's willingness to endure short-term volatility is a key factor in their ability to maintain a long-term investment focus.

In summary, higher risk tolerance empowers investors to adopt a longer-term investment approach, enabling them to navigate market challenges and capitalize on growth opportunities. It is a critical aspect of financial strategy, allowing investors to make informed decisions that align with their risk preferences and long-term financial goals. Understanding and embracing risk tolerance can lead to more effective investment choices and a more successful long-term investment journey.

Unveiling the Tricks: How Short-Term Investments Are Manipulated

You may want to see also

Financial Goals: Long-term goals like retirement require extended investment horizons

When it comes to financial planning, understanding the concept of a long-term investment horizon is crucial, especially for those with retirement goals in mind. This concept refers to the extended period during which an investor is willing to commit their money to a particular investment strategy, often spanning decades. For long-term goals, such as securing a comfortable retirement, this investment approach is essential.

Retirement planning is a significant financial endeavor that requires a patient and strategic mindset. It involves setting aside funds over a prolonged period to ensure a steady income stream during one's golden years. The traditional rule of thumb often suggests that retirement savings should be invested for at least 30 years or more to allow for the power of compounding returns. This means that the longer the investment horizon, the more time the invested funds have to grow and accumulate value.

A long-term investment horizon allows investors to ride out short-term market fluctuations and economic cycles. Markets tend to be volatile in the short term, with prices rising and falling rapidly. However, over an extended period, the market has historically shown a positive trend, rewarding those who stay invested. For instance, a study of the S&P 500 index over the past century revealed that annualized returns averaged around 10%, demonstrating the potential for significant growth over time.

To illustrate, consider an investor planning for retirement who starts saving at age 30. If they invest in a well-diversified portfolio of stocks and bonds, the long-term growth potential is substantial. With a 40-year investment horizon, they can afford to be more aggressive in their asset allocation, potentially benefiting from higher returns. As they near retirement, they can gradually shift their portfolio to more conservative investments to preserve capital and ensure a steady income stream.

In summary, long-term investment horizons are vital for financial goals, particularly retirement planning. It enables investors to benefit from compound growth, weather market volatility, and make strategic decisions that align with their long-term objectives. By embracing this approach, individuals can build a robust financial foundation for their future, ensuring financial security and peace of mind.

Unlocking Investment Strategies: A Guide to Understanding Investment Terms

You may want to see also

Market Volatility: Understanding market cycles is key to long-term investing

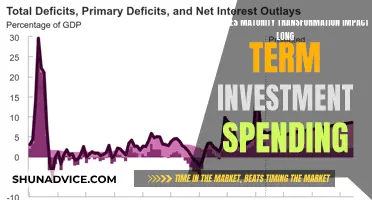

Understanding market volatility and the concept of market cycles is fundamental for long-term investors. Market cycles, often referred to as economic or business cycles, are recurring patterns of expansion and contraction in the economy. These cycles are characterized by fluctuations in various economic indicators such as GDP, employment, and inflation over time. While these cycles are natural and inevitable, they can significantly impact investment strategies, especially for those with a long-term investment horizon.

Long-term investors typically aim to ride out the market's short-term volatility and focus on the underlying trends and growth potential. This approach is based on the idea that markets tend to follow a cyclical pattern, with periods of growth and decline. By understanding these cycles, investors can make more informed decisions and potentially benefit from the market's long-term upward trajectory. For instance, during the expansion phase of a cycle, when the economy is growing, investors might consider investing in stocks or growth-oriented assets. Conversely, during the contraction or recession phase, investors may opt for more defensive strategies, such as bonds or dividend-paying stocks, to weather the market's downturn.

The key to navigating market volatility is to maintain a disciplined and patient approach. Long-term investors should avoid the temptation to make impulsive decisions based on short-term market fluctuations. Instead, they should stick to their investment plan, which is tailored to their financial goals and risk tolerance. This strategy involves diversifying investments across different asset classes and sectors to mitigate risk. By diversifying, investors can reduce the impact of any single market event or sector-specific downturn.

Additionally, understanding the market cycle can help investors time their investments more effectively. For example, during the early stages of an economic expansion, when interest rates are typically low, investors might consider investing in real estate or certain sectors that benefit from low borrowing costs. As the cycle progresses and interest rates rise, investors could shift their focus to more defensive investments. This tactical approach, combined with a long-term perspective, can help investors make the most of market cycles and potentially enhance their investment returns.

In summary, market volatility and the understanding of market cycles are essential concepts for long-term investors. By recognizing the cyclical nature of the market, investors can make strategic decisions, diversify their portfolios, and potentially benefit from the market's long-term growth. It is crucial to remember that short-term market fluctuations are often temporary, and a patient, disciplined approach is key to achieving investment success over the long haul.

Uncovering the Long-Term Value of Plant Assets

You may want to see also

Economic Cycles: Investing through economic cycles can be beneficial over time

Investing through economic cycles is a strategy that can significantly benefit long-term investors, as it allows them to capitalize on the natural ebb and flow of market trends. Economic cycles, which typically involve periods of expansion, peak, contraction, and recovery, present unique opportunities for those who understand and navigate them effectively. Here's how this approach can be advantageous:

Diversification and Risk Management: Economic cycles often bring about significant shifts in various sectors and industries. By investing across different sectors, investors can diversify their portfolios, reducing the impact of any single economic downturn. For instance, during a recession, sectors like healthcare, utilities, and consumer staples tend to be more resilient, while cyclical sectors like manufacturing and construction may suffer. A well-diversified portfolio can weather these cycles, ensuring that investors don't experience substantial losses during economic downturns.

Long-Term Growth Potential: Economic cycles are often associated with long-term growth opportunities. After a recession, governments and central banks usually implement stimulative measures, such as lowering interest rates or increasing fiscal spending, which can boost economic activity. This can lead to a period of expansion, creating a favorable environment for businesses to thrive and for investors to benefit from capital appreciation and dividend growth. Over time, this cyclical pattern can result in substantial gains for investors who remain committed to their long-term investment strategy.

Identifying Undervalued Assets: Economic cycles can cause certain assets to become undervalued during downturns. When the market overreacts to negative news or events, it can create opportunities for investors to purchase high-quality assets at discounted prices. This strategy, known as buying the dip, can be particularly effective for long-term investors who have a strong conviction in their chosen investments. By identifying and investing in such undervalued assets, investors can potentially benefit from significant upside gains when the economy recovers.

Strategic Timing and Rebalancing: Understanding economic cycles enables investors to time their investments strategically. For example, during a period of economic growth, investors might consider rebalancing their portfolios towards more aggressive, growth-oriented assets. Conversely, during a recession, they may shift towards more defensive, income-generating securities. This tactical approach can help investors optimize their returns while managing risk effectively.

Historical Perspective: Throughout history, economies have demonstrated a cyclical pattern of growth and contraction. By studying these cycles, investors can develop a deeper understanding of market behavior and make more informed decisions. Historical data can provide valuable insights into the duration and severity of economic downturns, as well as the subsequent recovery periods. This knowledge can guide investors in making strategic choices, ensuring they are well-prepared for various economic scenarios.

In summary, investing through economic cycles is a powerful strategy for long-term wealth creation. It involves a proactive approach to portfolio management, diversification, and strategic timing. By understanding the natural economic cycle, investors can make informed decisions, capitalize on undervalued assets, and benefit from the long-term growth potential that typically follows economic downturns. This approach requires discipline, research, and a commitment to a well-defined investment strategy.

Unraveling the Misconception: Treasury Bills as Long-Term Investments

You may want to see also

Frequently asked questions

A long-term investment horizon typically refers to a time period of at least 10 years or more. It is a strategy that involves investing in assets with the expectation of holding them for an extended duration, allowing for the potential to weather short-term market fluctuations and benefit from long-term growth trends.

Long-term investors often aim to ride out market volatility and focus on the overall upward trend of the financial markets. By maintaining a long-term perspective, investors can avoid making impulsive decisions based on short-term price movements. This approach encourages a buy-and-hold strategy, which can lead to higher returns over time as investments mature and compound.

Several factors influence the length of an investment horizon, including an individual's financial goals, risk tolerance, and time commitment. Younger investors often have a longer time horizon, allowing them to take on more risk and potentially benefit from long-term growth. As investors age, they may adjust their strategy to a shorter horizon, focusing on capital preservation and income generation.

Absolutely! While a long-term horizon provides a strategic framework, it can be adapted based on changing circumstances. Investors may adjust their time frame by rebalancing their portfolio, reallocating assets, or making strategic adjustments to align with their evolving financial goals and market conditions. Flexibility within a long-term strategy allows investors to stay on track while managing risk effectively.