Maturity transformation is a key concept in finance that refers to the process of managing the timing of cash flows to align with an investor's financial goals. It involves adjusting the maturity of assets and liabilities to ensure that the cash flows from investments match the cash flow requirements of the investor. This strategy is particularly important for long-term investment spending, as it helps investors manage the risk of interest rate changes and market volatility. By understanding how maturity transformation impacts long-term investment spending, investors can make more informed decisions about their financial strategies and better prepare for the future.

What You'll Learn

- Maturity Structure: Longer-term investments benefit from a balanced maturity mix to ensure consistent cash flow

- Risk Management: Maturity transformation can mitigate interest rate risk by diversifying investment horizons

- Liquidity Needs: Short-term investments provide liquidity, while long-term investments offer higher returns

- Market Volatility: Maturity transformation strategies can reduce the impact of market fluctuations on investment portfolios

- Regulatory Compliance: Financial institutions must adhere to regulations regarding maturity matching and investment strategies

Maturity Structure: Longer-term investments benefit from a balanced maturity mix to ensure consistent cash flow

Maturity transformation is a critical concept in financial management, especially for long-term investments. It refers to the practice of adjusting the maturity of assets and liabilities to ensure a consistent cash flow and optimize the use of funds. This strategy is particularly important for investors seeking to maintain a steady and reliable income stream over an extended period. By carefully managing the maturity structure, investors can navigate the challenges of market volatility and economic cycles, ensuring their investments remain robust and resilient.

The core principle behind a balanced maturity mix is to match the timing of cash inflows and outflows. Longer-term investments often provide higher returns but may be subject to market fluctuations and interest rate changes. By diversifying the maturity of these investments, investors can create a more stable and predictable cash flow. For instance, a well-structured portfolio might include a mix of short-term, medium-term, and long-term assets, ensuring that there is always a steady stream of cash available to meet obligations and take advantage of opportunities.

In practice, this could mean holding a portion of investments in highly liquid, short-term assets to provide immediate access to cash. Simultaneously, longer-term investments, such as bonds or equity stakes in companies with strong growth prospects, can be held to generate higher returns over time. The key is to find a balance that aligns with the investor's risk tolerance, financial goals, and the overall market conditions.

A balanced maturity structure also allows investors to take advantage of tax efficiency. By strategically managing the timing of cash flows, investors can optimize their tax liabilities. For instance, holding investments with shorter maturities can help defer taxes, as the income is realized and taxed at a lower rate in the current period. This approach can be particularly beneficial for investors in higher tax brackets or those seeking to minimize their tax exposure.

Additionally, a well-managed maturity structure can enhance an investor's ability to weather economic downturns. During periods of economic instability, short-term investments can provide a safety net, ensuring that the investor has the necessary liquidity to meet short-term obligations. Longer-term investments, once the economic situation stabilizes, can then be used to capitalize on emerging opportunities. This strategic approach to maturity transformation is a powerful tool for investors, enabling them to navigate the complexities of the financial markets and achieve their long-term financial objectives.

Unlocking the Long-Term Potential: Savings vs. Investments

You may want to see also

Risk Management: Maturity transformation can mitigate interest rate risk by diversifying investment horizons

Maturity transformation is a financial strategy that involves managing the timing of cash flows to align with an organization's investment goals and risk appetite. It is particularly relevant in the context of long-term investment spending, where the objective is to optimize returns while managing potential risks. One of the key benefits of maturity transformation is its ability to mitigate interest rate risk through a process known as diversification of investment horizons.

Interest rate risk refers to the potential loss or gain that an investment may experience due to changes in interest rates. When an organization has a significant portion of its investments in fixed-income securities, it becomes vulnerable to interest rate fluctuations. As interest rates rise, the value of existing fixed-income investments can decrease, impacting the overall portfolio value. Conversely, falling interest rates can lead to capital losses for bondholders.

Maturity transformation addresses this risk by strategically adjusting the maturity of investments. By diversifying the investment portfolio across different maturity dates, organizations can reduce the impact of interest rate changes on their overall holdings. For example, an organization might hold a mix of short-term and long-term bonds, where short-term bonds mature more quickly, providing a buffer against potential interest rate increases. This strategy ensures that even if interest rates rise, the organization's short-term investments can be quickly liquidated to minimize losses.

The process of maturity transformation involves actively managing the duration of investments. Duration is a measure of the sensitivity of a security's price to changes in interest rates. By adjusting the duration of investments, organizations can control the potential impact of interest rate movements. Longer-duration investments are more sensitive to interest rate changes, while shorter-duration investments provide a more stable return. Through careful selection and allocation of securities with varying durations, maturity transformation enables organizations to create a balanced portfolio that is less susceptible to interest rate risk.

In summary, maturity transformation is a powerful risk management technique for long-term investment spending. By diversifying investment horizons and strategically managing the duration of securities, organizations can mitigate the impact of interest rate fluctuations. This approach allows investors to maintain their investment strategies while reducing the potential losses associated with interest rate risk, ultimately contributing to more stable and sustainable long-term financial performance.

Unlocking Liquidity: Navigating Long-Term Investments

You may want to see also

Liquidity Needs: Short-term investments provide liquidity, while long-term investments offer higher returns

Understanding the liquidity needs of investors is crucial when examining the impact of maturity transformation on long-term investment spending. Short-term investments play a vital role in meeting these liquidity requirements, offering investors a means to access their funds quickly without compromising their financial goals. These investments are typically low-risk and highly liquid, allowing investors to convert their assets into cash relatively easily. For instance, money market funds and short-term government bonds are excellent examples of short-term investments that provide immediate liquidity while maintaining a low level of risk.

On the other hand, long-term investments are designed to generate higher returns over an extended period. These investments often involve a higher degree of risk but offer the potential for substantial gains. Examples of long-term investments include stocks, real estate, and long-term corporate bonds. While these assets may take longer to mature, they provide investors with the opportunity to build wealth over time, making them attractive for those seeking to grow their capital. However, it's important to note that long-term investments may not be as liquid as short-term options, meaning investors might need to hold them for a more extended period to realize their full potential.

The trade-off between liquidity and return is a critical consideration for investors. Short-term investments offer the advantage of quick access to funds, ensuring that investors can meet their short-term financial obligations or take advantage of immediate opportunities. This liquidity is especially important for investors with frequent cash flow needs or those who prefer a more conservative investment strategy. In contrast, long-term investments are geared towards those who can afford to commit their capital for an extended period, as they offer the potential for higher returns but may require a longer time horizon to unlock their full benefits.

In the context of maturity transformation, understanding the liquidity needs of investors is essential. Maturity transformation refers to the practice of matching the maturity of assets with the maturity of liabilities. For investors, this means ensuring that their investments can meet their short-term liquidity requirements while also providing the potential for long-term growth. By carefully selecting a mix of short-term and long-term investments, investors can achieve a balance between liquidity and return, thereby managing their risk exposure and financial goals effectively.

In summary, short-term investments are crucial for meeting liquidity needs, providing investors with quick access to their funds. In contrast, long-term investments offer higher returns but may require a longer commitment. Investors should carefully consider their financial goals, risk tolerance, and time horizon when deciding on a suitable investment strategy. By understanding the impact of maturity transformation and the liquidity needs of investors, financial institutions can better advise clients on how to optimize their investment portfolios for both short-term and long-term financial success.

Long-Term Investments: Separating Fact from Fiction

You may want to see also

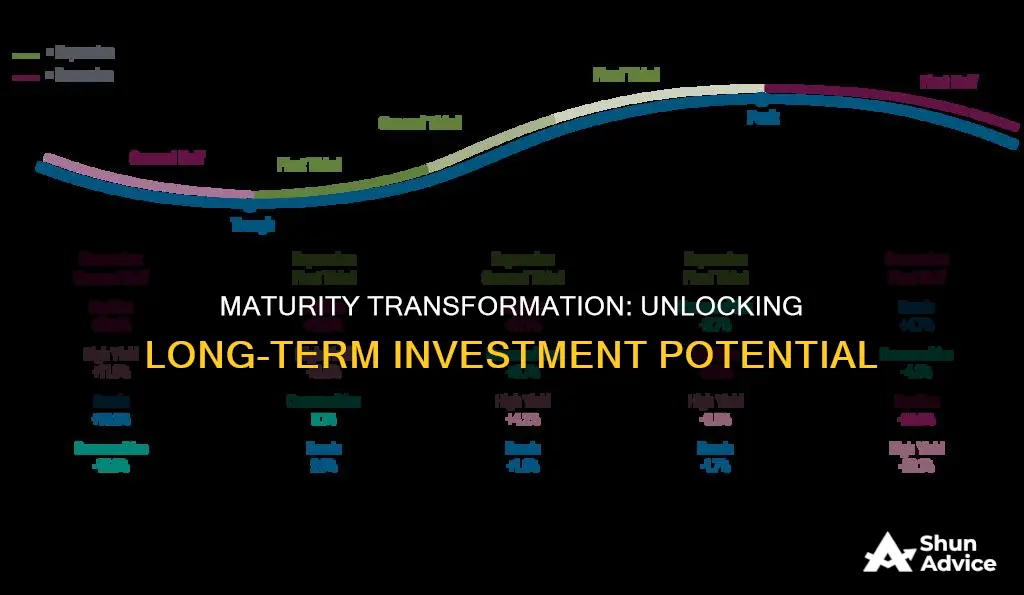

Market Volatility: Maturity transformation strategies can reduce the impact of market fluctuations on investment portfolios

Market volatility poses significant challenges for investors, especially those with long-term investment goals. The inherent unpredictability of financial markets can lead to substantial fluctuations in asset values, potentially eroding the capital of investors and undermining their financial objectives. One effective strategy to mitigate these risks is maturity transformation, which involves adjusting the timing of cash flows to align with investment maturities. This approach can significantly reduce the impact of market volatility on investment portfolios.

Maturity transformation is a technique used by investors to manage the risk associated with interest rate changes and market fluctuations. It involves the strategic adjustment of the maturity structure of assets and liabilities to ensure that cash inflows and outflows are matched over time. By doing so, investors can reduce the sensitivity of their portfolios to market volatility, thereby minimizing potential losses. For instance, an investor with a long-term investment horizon might choose to hold a mix of short-term and long-term assets. This strategy allows them to take advantage of potential short-term gains while also providing a safety net in case of market downturns, as short-term assets are generally less volatile.

The core idea behind maturity transformation is to create a balanced portfolio that can withstand market volatility. This is achieved by carefully selecting investments with varying maturity dates, ensuring that the portfolio's overall risk exposure is managed effectively. For example, a maturity-transformed portfolio might include a combination of government bonds with short-term maturities, corporate bonds with medium-term maturities, and long-term investments in stocks or real estate. This diversification helps to smooth out the impact of market fluctuations, as different asset classes react differently to economic changes.

In practice, maturity transformation strategies can be implemented through various financial instruments and techniques. One common approach is to use derivative products, such as forward contracts or options, to hedge against potential losses. These derivatives allow investors to lock in specific interest rates or prices, providing a level of protection against market volatility. Additionally, investors can employ dynamic asset allocation strategies, where the proportion of different asset classes in the portfolio is adjusted over time based on market conditions. This proactive approach enables investors to maintain a balanced portfolio even during periods of high market uncertainty.

By employing maturity transformation strategies, investors can significantly reduce the impact of market volatility on their long-term investment spending. This approach provides a sense of security and stability, allowing investors to focus on their financial goals without being overly concerned about short-term market fluctuations. It is a powerful tool for managing risk and ensuring that investment portfolios remain on track, even in the face of economic uncertainty.

Maximizing Returns: Understanding Investment Percentage Strategies

You may want to see also

Regulatory Compliance: Financial institutions must adhere to regulations regarding maturity matching and investment strategies

Financial institutions operate within a highly regulated environment, and one of the critical aspects they must navigate is the concept of maturity transformation and its impact on long-term investment spending. This is a complex topic that directly influences the stability and risk management of these institutions. Regulatory compliance in this area is essential to ensure that financial institutions maintain a balanced and sustainable approach to their operations.

The primary regulation that governs maturity matching and investment strategies is often derived from central bank guidelines and financial stability frameworks. These regulations aim to prevent financial institutions from engaging in practices that could lead to liquidity crises or systemic risks. One key principle is the requirement to match the maturity of assets with the maturity of liabilities. This means that banks and other financial entities should ensure that the funds they have available to meet short-term obligations are not invested in long-term instruments that could mature at an inopportune time. By adhering to this rule, institutions can avoid the potential pitfalls of a run on the bank or sudden liquidity shortages.

For instance, a bank's liquidity position could be severely impacted if it invests heavily in long-term government bonds but faces a surge in customer withdrawals or a need to fund short-term loans. To comply with regulations, financial institutions must carefully assess their investment portfolios and ensure that they have sufficient liquid assets to meet their obligations. This may involve diversifying investments across different maturity buckets or implementing stress testing to identify potential risks.

In addition to maturity matching, regulations often dictate specific investment strategies that financial institutions must follow. These strategies are designed to promote stability and risk mitigation. For example, regulations might encourage banks to invest in a mix of short-term, medium-term, and long-term assets to ensure a steady income stream and maintain financial flexibility. Institutions must also consider the creditworthiness of their investments and the potential impact of credit rating changes on their own financial health.

Non-compliance with these regulations can result in severe consequences, including fines, regulatory interventions, and reputational damage. Financial institutions must, therefore, stay abreast of the latest regulatory developments and adapt their investment strategies accordingly. This includes regular reviews of investment policies, stress testing, and ensuring that internal controls are in place to monitor and manage risks effectively. By adhering to these regulations, financial institutions can contribute to a more stable and resilient financial system, which is crucial for long-term economic growth and investor confidence.

Understanding the Difference: Long-Term Assets vs. PPE

You may want to see also

Frequently asked questions

Maturity transformation refers to the practice of managing financial assets by matching the duration of assets with the duration of liabilities. In the context of long-term investments, it involves holding assets with longer maturity dates to meet future financial obligations or spending needs. This strategy allows investors to maintain a consistent cash flow and ensure that funds are available when needed.

Maturity transformation can have a significant impact on long-term investment strategies. By matching the maturity of assets with the desired investment horizon, investors can optimize their spending and ensure financial stability. This approach helps in avoiding liquidity issues, especially during economic downturns or unexpected cash flow needs. It enables investors to make more informed decisions about asset allocation and risk management, ultimately supporting sustainable long-term investment spending.

While maturity transformation offers benefits, it also carries certain risks. One of the main risks is the possibility of interest rate risk, where changes in market interest rates can affect the value of long-term investments. If interest rates rise, the value of existing assets may decrease, impacting the overall investment portfolio. Additionally, there is a risk of prepayment risk, where borrowers might repay loans earlier than expected, potentially disrupting the investor's planned cash flow. Effective risk management and diversification strategies are essential to mitigate these risks.