Are you looking for long-term investment opportunities? We offer a range of investment options designed to help you build wealth over time. Our long-term gains investments are carefully curated to provide stable returns and are suitable for investors who are willing to commit to a longer-term strategy. Whether you're a seasoned investor or just starting, we can help you find the right investment to meet your financial goals. Contact us today to learn more about our long-term gains investments and how we can help you achieve your financial objectives.

What You'll Learn

- Tax Implications: Understand long-term capital gains tax rates and deductions

- Investment Strategies: Explore methods for generating consistent long-term returns

- Risk Management: Diversify to mitigate risks associated with long-term investments

- Market Analysis: Study historical trends and forecasts for long-term investment opportunities

- Portfolio Optimization: Adjust asset allocation to maximize long-term gains and minimize volatility

Tax Implications: Understand long-term capital gains tax rates and deductions

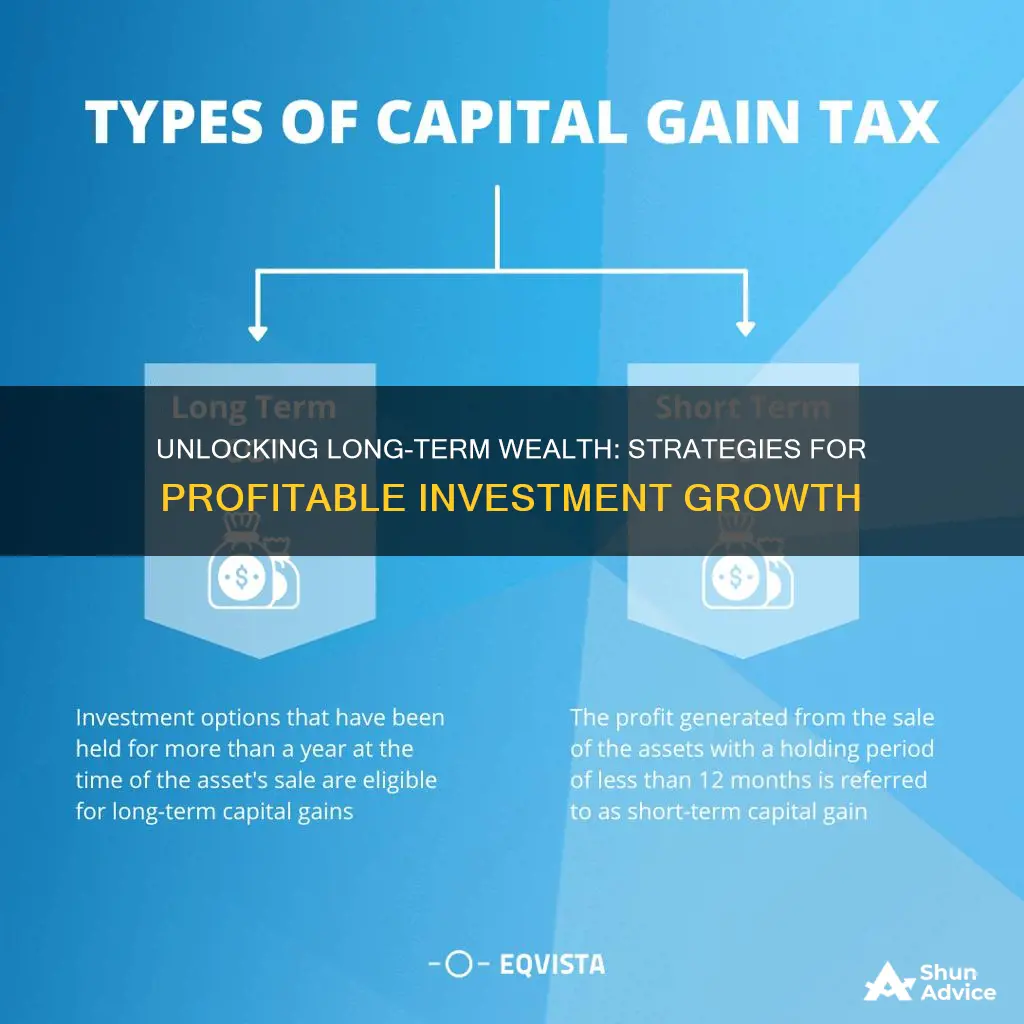

Understanding the tax implications of long-term capital gains is crucial for investors, as it can significantly impact their overall financial strategy. When you sell an investment held for more than a year, the tax treatment is different from short-term gains, which are typically taxed at ordinary income rates. Long-term capital gains are generally taxed at lower rates, which can result in substantial savings for investors.

The tax rates for long-term capital gains vary depending on the investor's income and filing status. For the tax year 2023, the long-term capital gains tax rates in the United States are as follows: 0%, 15%, or 20%. The 0% rate applies to single filers with a taxable income below $44,625 ($89,250 for married filing jointly), the 15% rate to those with income between $44,626 and $492,300 ($89,251 and $492,300 for married filing jointly), and the 20% rate to higher-income earners. These rates are subject to change, so it's essential to stay updated with the latest tax laws.

To calculate the tax on long-term capital gains, you need to determine the gain from the sale. The gain is calculated by subtracting the purchase price (basis) from the sale price. Any losses incurred on other investments can be used to offset the gains, reducing the taxable amount. It's important to keep detailed records of purchase and sale prices, as well as any costs associated with the investment, to ensure accurate tax calculations.

Deductions can also play a role in reducing the tax liability. Certain expenses related to the investment, such as brokerage fees, commissions, and investment-related travel expenses, may be deductible. Additionally, if you are self-employed, you can deduct a portion of your investment-related expenses, including a home office deduction if a significant part of your work is related to the investment. These deductions can help lower the taxable income and, consequently, the tax owed on long-term capital gains.

In summary, long-term capital gains investments offer tax advantages, with lower tax rates compared to short-term gains. Investors should be aware of their income level and filing status to determine the applicable tax rate. Proper record-keeping and understanding of allowable deductions can further optimize the tax strategy. Consulting with a tax professional or financial advisor is recommended to ensure compliance with tax laws and to make informed decisions regarding investment timing and tax planning.

Understanding Short-Term Investments: Current or Noncurrent Assets?

You may want to see also

Investment Strategies: Explore methods for generating consistent long-term returns

When it comes to investment strategies, the goal is often to generate consistent long-term returns. This requires a thoughtful approach, as the market can be volatile and unpredictable in the short term. Here are some methods to consider for achieving this objective:

- Value Investing: This strategy involves identifying undervalued assets or companies with strong fundamentals. The idea is to buy these assets at a price below their intrinsic value, allowing for potential long-term growth as the market recognizes their true worth. Value investors often look for companies with a history of strong performance, stable management, and a competitive advantage in their industry. By holding these investments for an extended period, you can benefit from the compounding effect of reinvesting dividends and the potential for significant capital appreciation.

- Dividend Reinvestment: Focusing on companies that consistently pay dividends is a popular approach for long-term wealth accumulation. Dividend-paying stocks provide a steady income stream, which can be reinvested to purchase additional shares. Over time, this strategy can lead to a substantial increase in the number of shares held, as the dividends are used to buy more of the same stock. It's important to research and select companies with a history of stable or increasing dividend payments, ensuring a reliable and growing income source.

- Index Funds and ETFs: Investing in index funds or Exchange-Traded Funds (ETFs) that track a specific market index is a passive investment strategy. These funds aim to replicate the performance of a particular market segment, such as the S&P 500 or a specific sector. By investing in an index fund, you gain instant diversification, as it holds a basket of securities representing the entire index. This approach is generally considered low-cost and efficient, providing long-term returns that closely follow the market's performance.

- Long-Term Buy-and-Hold: This strategy involves purchasing assets with the intention of holding them for an extended period, often years or even decades. The idea is to ignore short-term market fluctuations and focus on the long-term fundamentals of the investment. This approach requires patience and a long-term perspective, as it may involve weathering market downturns. However, history has shown that markets tend to recover and provide substantial returns over time, especially when combined with a disciplined investment approach.

- Sector-Specific Investing: Identifying and investing in specific sectors that have long-term growth potential can be a successful strategy. Sectors like technology, healthcare, or renewable energy often exhibit consistent growth over time. Researching and understanding the dynamics of these sectors can help investors make informed decisions. However, it's crucial to diversify within these sectors to manage risk, as individual stocks may vary in performance.

Remember, long-term investment strategies require a patient and disciplined approach. It's essential to educate yourself, diversify your portfolio, and regularly review and adjust your investments based on market conditions and your financial goals.

Long-Term Investments: Financing or Investing? Unlocking the Strategy

You may want to see also

Risk Management: Diversify to mitigate risks associated with long-term investments

In the realm of long-term investments, risk management is a critical aspect that investors must consider to safeguard their financial well-being. One of the most effective strategies to mitigate risks is through diversification, a principle that involves spreading your investments across various asset classes, sectors, and geographic regions. By doing so, investors can reduce the impact of any single investment's performance on their overall portfolio.

Diversification is a powerful tool to combat the inherent volatility of financial markets. When you diversify, you ensure that your portfolio is not overly exposed to any one particular asset or market segment. For instance, investing solely in stocks from a single country or industry can lead to significant losses if that specific market undergoes a downturn. By diversifying, you create a balanced portfolio that can weather such market fluctuations.

The key to successful diversification lies in understanding the correlation between different assets. Correlation refers to the tendency of certain investments to move in the same direction. For example, stocks and real estate often have a positive correlation, meaning they tend to rise and fall together. By investing in a mix of assets with low or negative correlations, investors can further reduce risk. This approach ensures that if one investment underperforms, others may compensate, thus maintaining the overall health of the portfolio.

To implement diversification, investors can consider the following strategies:

- Asset Allocation: Divide your portfolio into different asset classes such as stocks, bonds, real estate, and commodities. Each asset class has its own risk and return characteristics, allowing you to create a well-rounded investment mix.

- Geographic Diversification: Invest in companies and markets from various regions to reduce country-specific risks. Different countries experience economic cycles at different times, so this approach ensures that your portfolio is not overly reliant on a single region.

- Sector Allocation: Diversify across various sectors within the stock market. Sectors like technology, healthcare, and energy may perform differently based on market trends and economic conditions. By holding a portion of your portfolio in multiple sectors, you can reduce the impact of sector-specific downturns.

- Regular Review and Rebalancing: Periodically assess your portfolio's performance and adjust your asset allocation as needed. Over time, certain investments may outperform others, causing an imbalance. Rebalancing involves buying or selling assets to restore the original desired allocation, thus maintaining diversification.

In summary, diversification is a fundamental principle of risk management in long-term investments. By spreading your investments across different asset classes, regions, and sectors, you can significantly reduce the risks associated with market volatility and individual asset performance. This strategy empowers investors to stay committed to their long-term financial goals while minimizing potential losses.

Unlocking Liquidity: Navigating Long-Term Investments

You may want to see also

Market Analysis: Study historical trends and forecasts for long-term investment opportunities

When conducting a market analysis for long-term investment opportunities, it is crucial to delve into historical trends and forecasts to make informed decisions. This process involves a comprehensive study of past performance and future projections, allowing investors to identify patterns, understand market dynamics, and make strategic choices. Here's a breakdown of the key steps and considerations:

Historical Trend Analysis: Begin by examining the historical performance of various assets or markets you are interested in. Collect data over an extended period, typically spanning several years or even decades. Look for trends, cycles, and patterns in price movements. For example, if you are analyzing the stock market, study the historical behavior of different sectors or individual stocks. Identify whether they have been trending upwards, downwards, or showing periods of consolidation. Understanding these trends can provide insights into the market's overall behavior and potential future directions.

Identify Key Drivers: Market trends are often influenced by various factors such as economic indicators, geopolitical events, technological advancements, or industry-specific developments. Identify these key drivers that have historically impacted the markets or assets you are studying. For instance, interest rate changes, inflation rates, or major policy announcements can significantly affect investment returns. By recognizing these drivers, you can anticipate how the market might respond in the future and make more accurate long-term predictions.

Technical and Fundamental Analysis: Utilize both technical and fundamental analysis techniques to gain a comprehensive understanding of the market. Technical analysis involves studying price charts, identifying chart patterns, and using indicators to predict future price movements. On the other hand, fundamental analysis examines the underlying factors that drive a market or asset, such as financial ratios, revenue growth, industry trends, and competitive landscapes. Combining these approaches can provide a more robust framework for forecasting.

Market Forecasting: Based on your historical trend analysis and understanding of key drivers, develop forecasts for future market behavior. This may involve creating scenarios or using predictive models to estimate potential outcomes. Consider both short-term and long-term forecasts, as long-term investments often require a more extended outlook. Remember that forecasting is an art, and while it can provide valuable insights, market dynamics can be complex and unpredictable. Therefore, it's essential to regularly review and update your forecasts.

Risk Assessment: Long-term investments are not without risks, and a thorough market analysis should include risk assessment. Identify potential risks associated with your investment opportunities, such as market volatility, regulatory changes, or economic downturns. Develop strategies to mitigate these risks and ensure that your investment portfolio is well-diversified. Regularly monitoring and managing risks is an essential part of successful long-term investing.

By following these steps and conducting a thorough market analysis, investors can make more informed decisions about long-term investment opportunities. It empowers them to navigate the complexities of the financial markets, identify potential gains, and build a robust investment strategy. Remember, market analysis is an ongoing process, and staying updated with the latest trends and developments is crucial for long-term success.

Uncovering the Long-Term Value of Plant Assets

You may want to see also

Portfolio Optimization: Adjust asset allocation to maximize long-term gains and minimize volatility

In the realm of investing, the concept of portfolio optimization is a cornerstone strategy for those seeking to maximize long-term gains while effectively managing risk. This process involves a meticulous examination and adjustment of an investment portfolio's asset allocation, ensuring that it aligns with an investor's financial goals, risk tolerance, and time horizon. The primary objective is to create a balanced and robust portfolio that can weather market fluctuations and deliver consistent returns over the long term.

Asset allocation is a critical component of portfolio management, as it determines the distribution of investments across various asset classes such as stocks, bonds, real estate, and alternative investments. A well-diversified portfolio typically includes a mix of these assets, each contributing differently to the overall risk and return profile. For instance, stocks are generally associated with higher risk but also offer the potential for substantial long-term gains, while bonds provide a more stable, income-oriented approach.

To optimize your portfolio for long-term gains, consider the following strategies:

- Risk Assessment: Begin by evaluating your risk tolerance, which is your capacity to withstand market volatility. Younger investors might opt for a more aggressive approach, allocating a larger portion of their portfolio to stocks, as they have a longer time horizon to recover from potential downturns. In contrast, older investors may prefer a more conservative strategy, favoring bonds and fixed-income securities to preserve capital.

- Asset Allocation: Diversification is key. Allocate your investments across different asset classes to spread risk. For instance, a common strategy is to use a 60/40 model, where 60% of the portfolio is in stocks and 40% in bonds. This allocation provides a balance between growth potential and capital preservation. However, this ratio can be adjusted based on individual circumstances and market conditions.

- Regular Review and Rebalancing: Market dynamics change over time, and so should your portfolio. Regularly review your asset allocation to ensure it remains aligned with your investment goals. Rebalancing involves buying or selling assets to restore the original allocation percentages. For example, if stocks have outperformed bonds, selling a portion of the excess stock gains and reinvesting in underweight bond holdings can help maintain the desired risk-return profile.

- Consider Alternative Investments: Explore alternative asset classes like real estate investment trusts (REITs), commodities, or private equity. These can provide diversification benefits and potentially enhance long-term returns. However, they may also introduce new risks, so thorough research and understanding of these investments are essential.

- Tax Efficiency: Tax considerations are vital for long-term gains. Tax-efficient strategies, such as tax-loss harvesting (selling losing investments to offset capital gains), can help maximize after-tax returns. Additionally, understanding the tax implications of different asset classes can guide investment choices.

By implementing these portfolio optimization techniques, investors can navigate the complexities of the financial markets with greater confidence. It allows for a more strategic approach to investing, ensuring that the portfolio is not only optimized for long-term growth but also tailored to the individual's specific needs and risk preferences. Regular monitoring and adjustment of asset allocation are essential to adapt to changing market conditions and economic environments.

Understanding Short-Term Investments: Are They Cash Equivalents?

You may want to see also

Frequently asked questions

Yes, we specialize in providing long-term investment strategies and products tailored to meet your financial goals. Our team of experts can guide you through various investment vehicles designed to grow your wealth over an extended period.

Long-term investments are a powerful tool for wealth accumulation. By investing for the long haul, you can take advantage of compound interest, which allows your money to grow exponentially. This approach often involves a more conservative strategy, reducing the impact of short-term market fluctuations and providing a more stable financial future.

We offer a comprehensive range of investment options, including mutual funds, index funds, and retirement plans. Our financial advisors can help you assess your risk tolerance, understand your financial objectives, and create a personalized plan. They will guide you through the process, ensuring you make informed decisions and build a robust long-term investment strategy.