How long will it take to invest in something and see a return? This is a common question, and a common concern is that people don't have enough time in the day to invest or to learn how to invest. The answer depends on a multitude of factors, from what you're invested in, when you invested, the state of the market, and how much you invested. Returns can happen a lot sooner than you may think, and theoretically, it's possible to have an immediate return on investment. However, it's important to remember that investing is a commitment and that there is no guarantee of returns.

| Characteristics | Values |

|---|---|

| How to calculate ROI | ROI is calculated by subtracting the current price of your investment from the initial amount paid, dividing the new number by the cost of the investment, and then multiplying it by 100. |

| How soon can you expect a return on investment? | This depends on factors such as what you're invested in, when you invested, the market situation, and how much you invested. |

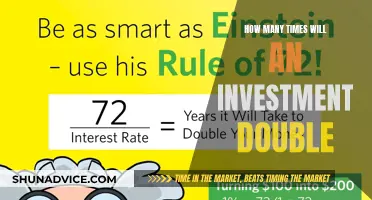

| The Rule of 72 | A simple way to determine how long an investment will take to double given a fixed annual rate of interest. Divide 72 by the annual rate of return to get a rough estimate. |

| Calculating growth rates | To calculate how long it takes an investment to grow, divide the target value by the initial investment, calculate the natural log of the result, add 1 to the annual rate of return, calculate the natural log of the new result, and finally, divide the previous results by each other. |

What You'll Learn

Returns can happen sooner than you think

When people hear that investing is for the long term, they may think that they don't have enough time to do it or that it takes years and years to generate a return. But that's not always the case. While investing does require some commitment, returns can happen a lot sooner than you may expect.

Return on investment (ROI) is a measurement used to see how efficiently an investment performs. You can use this measurement to compare different investments and find your best and worst performers. ROI can be shown as a percentage or a ratio, but it is always calculated by subtracting the current price of your investment from the initial amount you paid for it, then dividing this new number (your net return) by the cost of the investment, and finally multiplying it by 100.

For example, if you have investments currently worth £150 and you originally paid £80 for them, your net return is £70, making your ROI 87.50%.

How soon you can expect a return on your investment depends on a wide range of factors, including what you've invested in, when you invested, the state of the market, and how much you invested.

It's possible to have an immediate return on investment. If you buy when the price is low and then sell at a higher price, covering the initial price and any transaction fees, you can make a positive return within a single day. This type of fast-paced trading is known as Day Trading.

Another thing to consider is whether you have any investments that pay dividends or interest. Dividends are when a company pays its stockholders, either in cash or additional stock, out of their earnings. Interest is when you receive a payment as a percentage of the amount that you lent to a government or company in the form of bonds. If you have invested in a way that provides dividend or interest payments, you may have the opportunity to see a return on your investment within a quarter or even a month.

However, what you do with these payments could impact your long-term returns. If you take your payments as cash, you may have made some returns now, but if you reinvested that money, those additional investments could have returned their own profits. This amount could then snowball, and after investing for a few years, your returns could be even greater – this is called compounding.

If you're happy to wait while your investments mature and you're planning on reinvesting any profits to benefit from compounding, you can use the Rule of 72 to estimate how quickly your investment will double in size. The Rule of 72 gives an estimate of how long it may take to double your money by dividing 72 by your rate of return. For example, if you invest with a 10% return, you would double your money every 7.2 years.

While investing can take time, returns can happen sooner than you may expect, and there are strategies to help you maximise your returns.

Jesus Invested in People Through Love and Sacrifice

You may want to see also

How to calculate return on investment

Return on Investment (ROI) is a common metric used to evaluate the forecasted profitability of an investment. ROI can be applied to anything from stocks to real estate, and it is calculated by dividing the benefit (or return) of an investment by the cost of the investment. The result is then expressed as a percentage or a ratio.

ROI = (Net Profit / Cost of Investment) x 100

Alternatively, you can use the following formula:

ROI = (Final Value of Investment - Initial Value of Investment) / Initial Value of Investment

It is important to note that ROI does not take into account the holding period or passage of time, which can be a limitation when comparing investment alternatives. To address this, you can calculate the annualized ROI, which takes into account the length of time the investment is held.

Suppose you invest $10,000 in a venture with no fees or associated costs. The net profit from this investment is $15,000. To calculate the ROI, you would divide the net profit by the cost of the investment and then multiply by 100:

ROI = ($15,000 / $10,000) x 100 = 150%

This means that for every $100 invested, you would earn $150, making it a productive investment.

In conclusion, understanding how to calculate ROI is a valuable skill for evaluating the potential profitability of investments and making informed financial decisions.

Impact Investing: Social Enterprises

You may want to see also

Dividends and interest payments

Dividends

Dividends are payments made by companies to their shareholders, typically as a way to distribute profits. They can provide a source of income for investors and also impact the overall return on an investment. Dividends can be reinvested to benefit from the power of compounding, which can accelerate wealth accumulation over time. Compounding occurs when the dividends earned generate even more dividends, creating a snowball effect.

Interest Payments

Interest payments, on the other hand, are returns that investors receive for lending their money. This could be through bonds, savings accounts, or other interest-bearing instruments. The amount of interest earned depends on the interest rate, which varies depending on the type of investment. For example, high-yield savings accounts may offer more attractive interest rates compared to regular savings accounts.

Time to Double Your Money

The time it takes to double your money through investing depends on the annual returns generated by your investments. The "Rule of 72" provides a simple way to estimate this. By taking 72 and dividing it by the annual rate of return, you can determine how long it will take for your investment to double. For example, at a 7% annual return, it will take about 10 years to double your money.

However, it's important to note that this rule is a rough estimate, and the actual time may vary. A more precise method is to use a logarithmic equation, which takes into account the natural log of 2 and the rate of return.

Impact on Long-Term Wealth Accumulation

The impact of dividends and interest payments on your investments can be significant over the long term. For example, consider an investment in the S&P 500, which has historically averaged 11.5% returns between 1928 and 2022. With reinvested dividends, an initial investment of $100 would have grown to over $624,000 during this period.

In contrast, choosing a low-interest savings account with an average rate of 0.6% would result in a much slower growth of your money. Taking inflation into account, your money could even lose value over time in such an account.

In summary, dividends and interest payments play a crucial role in investing. They can provide a source of income, impact overall returns, and significantly contribute to long-term wealth accumulation when combined with the power of compounding.

S&P 500: Invest Now or Wait?

You may want to see also

Individual investment growth

Starting Early

Starting to invest early in one's career is crucial, as it allows more time for investments to grow and compound. Even if the amount invested is small, the power of compound interest over time can lead to significant returns. For example, investing during one's 20s can result in the most growth due to the advantage of time and the ability to absorb market changes.

Asset Allocation and Diversification

Investing in a variety of asset classes, such as stocks, bonds, cash, real estate, and commodities, provides diversification. Diversification is essential as it protects individuals from losing all their money if one asset class underperforms. The specific allocation across these asset classes will depend on the investor's age, risk tolerance, and financial goals. Younger investors are generally advised to allocate more to stocks, while older investors closer to retirement may shift towards more stable options like bonds.

Regular Contributions

Consistently contributing to investments over time is vital for individual investment growth. This can be done through regular contributions from income, such as monthly or biweekly deductions. The amount contributed will depend on the individual's budget and savings goals. Extreme savers may opt for more significant contributions, while casual savers may choose a lower amount.

Investment Choices

Individuals have several investment options to choose from, each with its own risks and potential returns. These include stocks, index funds, exchange-traded funds (ETFs), and mutual funds. Stocks, or individual shares of a company, offer potentially higher returns but come with higher risk. Index funds and ETFs track a market index and offer diversification and lower fees. Mutual funds pool money from multiple investors to buy a collection of stocks, bonds, and other securities and are suitable for long-term goals like retirement.

Maximizing Retirement Savings

Taking advantage of retirement accounts, such as 401(k)s and Individual Retirement Accounts (IRAs), is an essential aspect of individual investment growth. Contributing the maximum amount allowed, or at least enough to get any company match in a 401(k), is recommended. Additionally, individuals should consider utilizing tax-advantaged accounts, such as Roth IRAs, to maximize their after-tax returns.

Monitoring and Adjusting

Finally, individuals should regularly monitor their investments and adjust their strategies as needed. This includes rebalancing their portfolio to maintain the desired asset allocation and taking advantage of market opportunities. Seeking advice from financial professionals can help individuals make informed decisions and secure their financial future.

Overall, individual investment growth requires a long-term commitment, regular contributions, prudent investment choices, and a strategic allocation of assets. By starting early, diversifying their portfolios, and maximizing retirement savings, individuals can increase their chances of achieving their financial goals.

Young Investors: Why the Hesitation?

You may want to see also

The Rule of 72

Additionally, the Rule of 72 can be applied to anything that increases exponentially, such as GDP or inflation, to understand their long-term effects. For instance, if the GDP grows at 4% annually, the economy will be expected to double in 18 years (72 / 4 = 18).

Leveraging Investments to Eliminate Loan Debt

You may want to see also

Frequently asked questions

This depends on a range of factors, including what you've invested in, the market, and how much you've invested. It's possible to see returns within a day, but it could also take years.

You can use the Rule of 72, which involves dividing 72 by the annual rate of return. This will give you a rough estimate of how many years it will take for your initial investment to double.

The Rule of 72 is most accurate for rates of return between 5% and 10%. For greater precision, divide 69.3 by the rate of return.

You can use the formula for calculating the future value of a present amount. Divide your target value by the initial investment to find the increase rate, then follow the remaining steps outlined in the University of Oregon's growth rate calculation method.