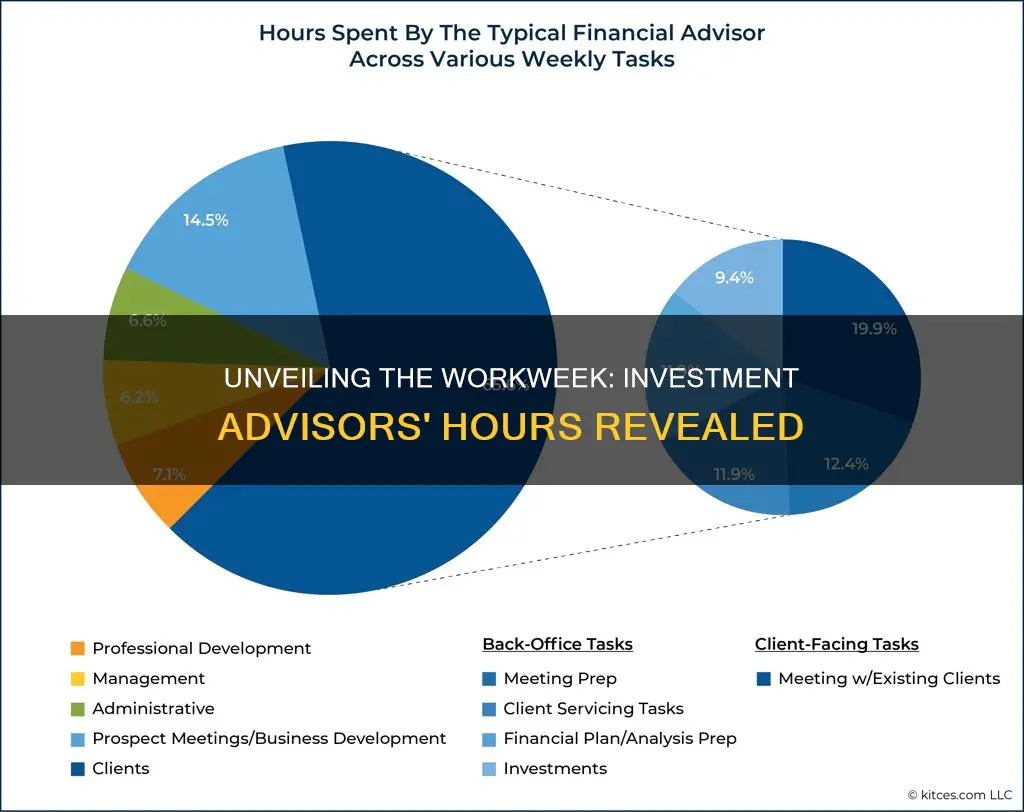

Investment advisors play a crucial role in guiding clients' financial decisions, but their work hours can vary significantly. Understanding the typical workweek for these professionals is essential for both advisors and clients. This paragraph will explore the diverse work patterns of investment advisors, shedding light on the factors that influence their weekly hours and the potential impact on their clients' financial journeys.

| Characteristics | Values |

|---|---|

| Typical Workweek | 40-50 hours |

| Overtime | Common, especially during market volatility or client meetings |

| Flexibility | Some firms offer flexible hours or remote work options |

| Seasonal Variations | Busier during tax seasons or when markets are active |

| Client Demands | May require extended hours to meet client needs and expectations |

| Industry Standards | Varies by region and company, but generally aligns with professional standards |

| Personal Preferences | Individual advisors may choose to work different hours based on their lifestyle and goals |

What You'll Learn

- Work-Life Balance: Investment advisors' typical work hours and days

- Industry Norms: Standard workweek hours in the financial sector

- Client Demands: How client needs impact advisor work hours

- Job Type: Full-time vs. part-time advisors and their hours

- Flexibility: Remote work and flexible hours in the investment field

Work-Life Balance: Investment advisors' typical work hours and days

The workweek for investment advisors can vary significantly depending on factors such as experience, specialization, and the specific firm or company they work for. However, it is generally accepted that investment advisors often work long hours, often exceeding the standard 40-hour workweek. Here's an overview of the typical work hours and days for investment advisors:

Work Hours: Investment advisors typically have demanding work schedules. They often start their days early, sometimes as early as 7 or 8 am, to review market trends, analyze financial data, and prepare for client meetings. These meetings can vary in duration but often extend for hours, especially for advisors with a large client base or those managing complex portfolios. During these meetings, advisors provide financial advice, discuss investment strategies, and offer solutions tailored to their clients' needs. After meetings, advisors might spend additional time on administrative tasks, such as updating client records, preparing reports, and responding to emails. The workload can be particularly heavy during market volatility or when significant financial events occur, requiring advisors to work late into the evening or even over the weekend to meet client demands.

Work Days: Investment advisors usually work full-time, 5 days a week, with some firms offering flexible work arrangements. However, the nature of the job often leads to a blurring of boundaries between work and personal life. Advisors might find themselves working on weekends, especially when dealing with time-sensitive market opportunities or client emergencies. This can be a significant challenge for maintaining a healthy work-life balance. Additionally, advisors often attend industry conferences, networking events, and training sessions, which can further extend their work hours and contribute to a busy lifestyle.

Impact on Work-Life Balance: Achieving a healthy work-life balance is essential for investment advisors to prevent burnout and maintain their well-being. The long hours and demanding nature of the job can lead to high-stress levels and a sense of isolation. To manage this, advisors should set clear boundaries, prioritize self-care, and ensure they take regular breaks during the workday. Many firms now offer flexible work arrangements, allowing advisors to work remotely or adjust their schedules to some extent, which can help improve work-life balance.

In summary, investment advisors often face a demanding work environment with long hours and a potential lack of clear boundaries. While the job offers opportunities for success and financial rewards, it is crucial for advisors to be mindful of their well-being and take proactive steps to maintain a healthy work-life balance. This might include setting personal boundaries, utilizing flexible work options, and ensuring they take time for relaxation and personal pursuits outside of work.

Investment Demand Curve: Factors for Rightward Shift

You may want to see also

Industry Norms: Standard workweek hours in the financial sector

The financial sector, particularly the investment advisory field, operates within a demanding and often high-pressure environment, which influences the workweek hours of professionals in this domain. While the exact number of hours can vary depending on factors such as experience, specialization, and the specific firm or company, there are certain industry norms and trends that provide a general framework for the workweek in this sector.

In the United States, for instance, investment advisors typically work a standard 40-hour workweek, similar to many other professional roles. This standard workweek is a legal requirement and is often used as a benchmark for employment contracts and industry standards. However, it's important to note that this is a general guideline, and many investment advisors may work longer hours, especially those in senior positions or with a high volume of clients. The nature of the job often requires long hours, as advisors need to stay updated with market trends, conduct research, meet with clients, and manage various administrative tasks.

Industry norms suggest that investment advisors often work extended hours, especially during market-moving events or when client demands are high. For example, during the trading day, advisors might work closely with clients, providing real-time advice and monitoring market conditions. This can lead to longer workdays, sometimes extending beyond the standard 40-hour mark. Additionally, advisors may need to dedicate extra time to client meetings, portfolio reviews, and preparing reports, which can further increase the weekly work hours.

Furthermore, the financial industry is known for its competitive and fast-paced nature, where advisors are expected to be responsive and available to clients at various times. This often results in a culture of long workweeks, with advisors voluntarily putting in extra hours to ensure they meet client needs and maintain a high level of service. However, it's essential to maintain a healthy work-life balance, and many firms are now promoting initiatives to support employee well-being, including flexible work arrangements and time management strategies.

In summary, while the standard workweek for investment advisors is often around 40 hours, the reality is that the job demands can lead to longer hours, especially during critical market periods or when client demands are high. The industry norms reflect a culture of dedication and responsiveness, but also emphasize the importance of maintaining a healthy work-life balance. Understanding these industry standards can help advisors and employers alike in managing expectations and promoting a sustainable work environment.

Leaving a Lasting Legacy: Directing Your Investments to Charity

You may want to see also

Client Demands: How client needs impact advisor work hours

The demands of clients can significantly influence the work hours of investment advisors, often requiring them to go beyond the standard 40-hour workweek. Investment advisors play a crucial role in managing clients' financial portfolios, offering advice on investments, and providing financial planning services. As such, their work hours are often dictated by the needs and expectations of their clients.

One of the primary factors affecting advisor work hours is the level of client interaction and service required. High-net-worth individuals or clients with complex financial situations may demand more frequent and detailed advice. This can lead to extended work hours, including evenings and weekends, to accommodate these clients' needs. For instance, an advisor might need to conduct in-depth research, analyze market trends, or create personalized financial plans, which can take several hours daily.

Additionally, the nature of the advice provided can impact work hours. Investment advisors may need to stay updated on market news, regulatory changes, and economic trends to offer relevant and timely advice. This requires continuous learning and research, which can extend beyond regular working hours. For example, advisors might need to spend time reading industry publications, attending webinars, or participating in professional development programs, all of which contribute to their overall work hours.

Client demands for prompt responses and quick decision-making can also lead to longer work hours. Investment advisors often need to provide immediate feedback on market movements, investment opportunities, or risk assessments. This real-time response requirement can result in advisors working beyond their scheduled hours, especially during volatile market conditions or when clients have urgent financial matters to address.

Furthermore, the administrative tasks associated with client management can also impact advisor work hours. Documenting client interactions, updating client records, and ensuring compliance with regulatory requirements are essential but time-consuming tasks. These administrative duties often need to be completed during the advisor's regular work hours, leaving less time for client-facing activities.

In summary, investment advisors' work hours are influenced by the diverse needs and demands of their clients. Balancing client expectations with the advisor's own workload and well-being is essential for maintaining a healthy and productive work environment. Effective time management, efficient client communication, and a structured approach to work can help advisors manage their time effectively while meeting client demands.

The Workforce Investment Act: Funding Education for America's Future

You may want to see also

Job Type: Full-time vs. part-time advisors and their hours

The working hours of investment advisors can vary significantly depending on their job type, whether they are full-time or part-time. Full-time advisors typically work a standard 40-hour workweek, which is the norm in many industries. This means they dedicate a substantial portion of their week to client meetings, research, portfolio management, and administrative tasks. During these hours, they are expected to be fully engaged and available to provide their professional services. Full-time advisors often have a more structured schedule, allowing them to plan their days and weeks efficiently to meet client needs and maintain a healthy work-life balance.

Part-time advisors, on the other hand, may work fewer hours, usually ranging from 20 to 30 hours per week. This flexibility can be advantageous for advisors who prefer a more varied schedule or those who have other commitments. Part-time advisors might choose to work in the evenings or weekends to accommodate clients with different time zones or schedules. While this arrangement provides flexibility, it may also require a higher level of organization and time management skills to ensure that clients receive the attention and service they deserve.

The number of hours worked can also influence the type of services an advisor offers. Full-time advisors often have the capacity to provide comprehensive services, including in-depth research, personalized portfolio management, and regular client communication. They can dedicate time to staying updated on market trends and financial news, ensuring that their clients' investments are well-informed and aligned with their financial goals. Part-time advisors might focus on specific areas, such as retirement planning or tax-efficient strategies, and may offer more limited services due to their reduced availability.

It's important to note that the job type and hours worked can also impact the advisor's earning potential. Full-time advisors often have the opportunity to build a larger client base and generate more revenue due to their extended working hours. Part-time advisors might need to carefully manage their time to ensure they can still provide high-quality services and maintain a steady income. Additionally, some firms may offer different compensation structures, such as a base salary plus commissions, which can further vary based on the advisor's role and the firm's policies.

In summary, the job type of an investment advisor significantly influences their working hours. Full-time advisors typically work a standard 40-hour week, offering comprehensive services, while part-time advisors may work fewer hours, providing more flexible schedules and potentially focusing on specific areas of expertise. Understanding these differences is essential for both advisors and clients to manage expectations and ensure a successful working relationship.

Savings Strategies: Where to Invest Right Now

You may want to see also

Flexibility: Remote work and flexible hours in the investment field

The investment field offers a unique opportunity for flexibility in terms of work arrangements, particularly in the context of remote work and flexible hours. This flexibility is a significant advantage for investment advisors, allowing them to manage their time more efficiently and adapt to their personal needs and preferences.

One of the key benefits of remote work in the investment industry is the ability to eliminate commute time. Investment advisors can save hours each day by working from home or a co-working space, which can be especially valuable for those in urban areas with heavy traffic. This increased flexibility enables advisors to start their day earlier or finish later, accommodating personal commitments or family responsibilities without compromising their work schedule. For example, an advisor might choose to work early in the morning to avoid rush-hour traffic and then take a longer lunch break to spend time with family, ensuring a better work-life balance.

Remote work also opens up opportunities for advisors to collaborate with clients and colleagues across different time zones. This is particularly advantageous for global investment firms or those with clients worldwide. Advisors can schedule meetings and calls at times that suit their clients' needs, ensuring efficient and effective communication without the constraints of a traditional office environment. This flexibility can lead to improved client satisfaction and retention, as advisors can provide more personalized and accommodating services.

Flexible hours are another aspect of this flexibility that investment advisors can utilize. The nature of the job often involves working with various clients and markets, which may require quick responses during specific time frames. Advisors can set their schedules to accommodate these needs, ensuring they are available when required without being tied to a strict 9-to-5 office routine. For instance, an advisor might choose to work in shorter bursts during market hours, taking longer breaks to recharge and maintain productivity throughout the day.

Additionally, flexible hours can enable advisors to attend to personal matters or pursue further education and professional development opportunities. Many investment firms offer online training programs or workshops that can be accessed remotely, allowing advisors to enhance their skills without leaving their homes. This flexibility can contribute to the overall growth and development of the investment advisor, ultimately benefiting both the individual and the firm.

In summary, the investment field's flexibility in terms of remote work and flexible hours provides investment advisors with a unique advantage. It allows them to manage their time efficiently, adapt to various client needs, and maintain a healthy work-life balance. By embracing these flexible work arrangements, investment advisors can excel in their careers while enjoying the benefits of a more personalized and accommodating work environment.

Your Guide to Buying Strategies: Unlocking the Power of Investing

You may want to see also

Frequently asked questions

Investment advisors' work hours can vary significantly depending on their specific role, location, and the nature of their clients. On average, full-time investment advisors often work around 40 hours per week, similar to many other professional roles. However, this can range from 30 to 60 hours or more, especially for those in senior positions or with a high volume of clients. Some advisors may also work flexible hours to accommodate client meetings or research needs.

While the standard 40-hour workweek is common, investment advisors, particularly those in wealth management or with a high-net-worth client base, may often work longer hours. This can include evenings and weekends to provide personalized service and stay updated with market trends. Additionally, advisors might work extra hours during tax seasons or when preparing comprehensive financial plans for clients.

Investment advisors often have a mix of client-facing and administrative tasks. They may work in a structured environment with set hours, but flexibility is essential. Some advisors might have a more traditional 9-to-5 schedule, while others may work remotely or have a more fluid work pattern. The nature of the job allows for some autonomy, but it also demands a certain level of availability to address client needs promptly.