In the UK, investment banking is a demanding profession, often requiring long hours and a high level of dedication. The typical workweek for investment bankers can vary significantly, but it is commonly known that they often put in more than 60 hours per week. This demanding nature of the job is a reflection of the fast-paced, high-pressure environment in which investment bankers operate, where they are expected to deliver results and maintain a competitive edge in a global market. Understanding the work-life balance and the potential impact on health and well-being is crucial for both employees and employers in this industry.

What You'll Learn

- Average Workweek: Investment bankers in the UK work 40-50 hours weekly

- Overtime: Long hours are common, with some working 60+ hours weekly

- Industry Comparison: Compare UK hours to global investment banking norms

- Impact on Health: Excessive hours may affect mental and physical health

- Regulations: UK regulations limit working hours to protect employees

Average Workweek: Investment bankers in the UK work 40-50 hours weekly

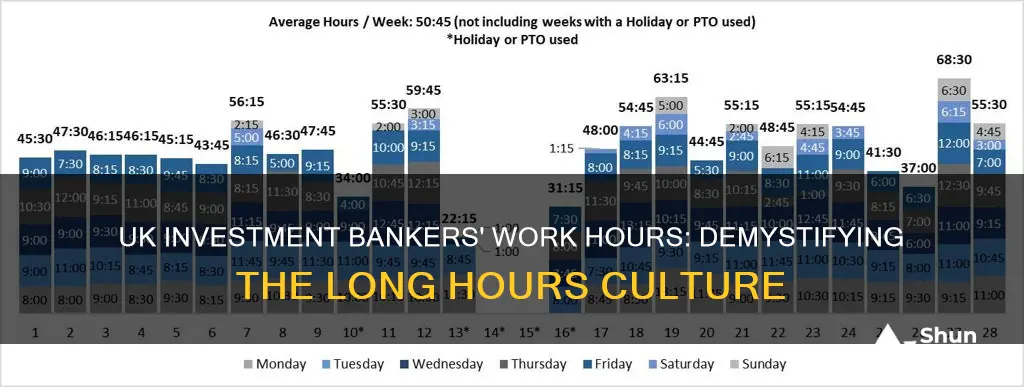

The typical workweek for investment bankers in the UK is demanding, often requiring long hours and a significant commitment to the job. On average, investment bankers can expect to work between 40 and 50 hours per week, with some individuals even pushing beyond this range. This demanding schedule is a reflection of the high-pressure nature of the job, where deadlines, client demands, and the fast-paced, competitive environment can lead to extended work hours.

The 40-50 hour workweek is a standard in the industry and is often a requirement for success and career advancement. Investment banking is a highly competitive field, and professionals are expected to dedicate substantial time and effort to their work. This includes not only the time spent in the office but also the additional hours spent on research, client meetings, preparing reports, and staying updated on market trends.

Long hours are often a result of the fast-paced, deadline-driven nature of investment banking. Deals and transactions require quick decision-making and execution, which can lead to extended work sessions. Additionally, the industry's global reach means that bankers may need to work outside regular hours to accommodate different time zones and meet with clients or colleagues worldwide.

Despite the demanding workweek, many investment bankers find the job rewarding and are willing to make the sacrifice. The high earning potential, intellectual challenges, and the opportunity to work with influential clients can make the long hours worthwhile. However, it's important to note that this demanding schedule can also lead to burnout and work-life balance issues if not managed properly.

For those considering a career in investment banking, it's essential to understand the commitment required. Prospective employees should be prepared for a challenging and often time-intensive role. Effective time management and a healthy work-life balance are crucial to navigating this demanding profession successfully.

Ally Invest Drip: A Comprehensive Guide to Automated Investing

You may want to see also

Overtime: Long hours are common, with some working 60+ hours weekly

The investment banking industry in the UK is renowned for its demanding work culture, often requiring long hours and a significant commitment from its employees. It is not uncommon for investment bankers to work well beyond the standard 40-hour workweek, with many regularly putting in 60 hours or more each week. This demanding schedule is a defining feature of the profession and is often a factor that attracts ambitious individuals seeking challenging and high-stakes careers.

The long hours are a result of the fast-paced and dynamic nature of investment banking. Deals and transactions can be time-sensitive, requiring quick decision-making and constant communication. Investment bankers often need to be available outside of regular working hours to meet clients, attend meetings, and respond to urgent requests. This can include evenings, weekends, and even public holidays, especially during busy periods or when a deal is in its final stages.

For many, the extended workweeks are seen as a necessary trade-off for the high earning potential and the opportunity to work on exciting, high-profile projects. The industry is known for its competitive compensation packages, which can include base salaries, bonuses, and performance-based incentives. However, this comes at a cost, as the long hours can lead to increased stress, fatigue, and a potential work-life balance imbalance.

Despite the challenges, some individuals thrive in this environment, driven by their passion for the industry and the desire to excel. They find satisfaction in the fast-paced nature of the job, the intellectual challenges it presents, and the opportunity to make a significant impact on their clients' financial goals. However, it is essential for those considering a career in investment banking to be aware of the potential drawbacks and to carefully consider their work-life priorities.

In recent years, there has been a growing awareness of the importance of work-life balance and the potential health risks associated with long working hours. Some firms are now implementing policies to encourage a healthier approach to work, such as flexible working hours, remote work options, and regular reviews of workload and schedules. These initiatives aim to support the well-being of employees while still meeting the demands of the industry.

Bullion Buying Basics: Navigating the Best Investment Options

You may want to see also

Industry Comparison: Compare UK hours to global investment banking norms

The working hours in the UK investment banking sector have been a subject of interest and concern for both employees and employers. According to a survey conducted by the Investment Banking Association (IBA) in 2022, the average weekly working hours for investment bankers in the UK were reported to be around 45-50 hours, with some individuals working even longer hours. This is a significant increase from the traditional 35-40 hour workweek, which is the standard in many other industries.

When compared to global investment banking norms, the UK's working hours stand out. In the United States, for instance, investment bankers are known to work extremely long hours, often exceeding 60 hours per week. This is a well-documented phenomenon, with many US investment banks having a culture of "working hard" and "long hours" as a badge of honor. However, this has also led to concerns about employee burnout and well-being.

In contrast, European investment banks, including those in the UK, have traditionally maintained a more balanced approach. The European Banking Authority (EBA) guidelines suggest a maximum of 48 hours per week, including overtime, to protect employees' health and safety. This norm is in line with the UK's Working Time Regulations, which limit the working week to 48 hours on average, including overtime.

However, the recent trend in the UK investment banking industry has been moving towards longer hours, similar to the US model. This shift is partly due to increased competition, the pressure to meet client demands, and the desire to stay ahead in a fast-paced market. As a result, the industry is witnessing a gradual increase in the number of employees working beyond the recommended 48-hour limit.

Despite the challenges, it is essential to note that the UK investment banking industry is taking steps to address the issue of long working hours. Many firms are implementing initiatives to promote work-life balance, such as flexible working arrangements, well-being programs, and regular reviews of workload and schedules. These efforts aim to ensure that employees can maintain a healthy lifestyle while contributing to the industry's success.

Old Tool, New Tricks: The Surprising Tech Investing Disruptor

You may want to see also

Impact on Health: Excessive hours may affect mental and physical health

The demanding nature of investment banking often leads to long working hours, which can significantly impact the mental and physical health of professionals in this field. The UK, known for its competitive financial sector, often expects investment bankers to put in extended hours, sometimes exceeding 60 hours per week. While dedication and hard work are admirable, the potential consequences on health should not be overlooked.

Mentally, the pressure to meet deadlines, secure deals, and maintain a high performance level can lead to chronic stress. Investment bankers often face high-stakes situations, where the consequences of a single decision can be substantial. This pressure can contribute to anxiety, burnout, and even depression. The constant need to be 'on' and the fear of missing out on opportunities can create a toxic work environment, affecting an individual's overall well-being.

Physically, the impact of long working hours is equally concerning. Research suggests that extended work hours are associated with increased risks of cardiovascular diseases, sleep disorders, and metabolic issues. The sedentary nature of many banking tasks, combined with long periods of concentration, can lead to musculoskeletal problems such as back pain and eye strain. Additionally, the lack of time for proper rest and recovery can weaken the immune system, making individuals more susceptible to illnesses.

To mitigate these health risks, it is crucial for investment bankers to prioritize self-care. This includes maintaining a healthy work-life balance, ensuring adequate sleep, and engaging in regular physical activity. Taking short breaks during long workdays to stretch, hydrate, and relax can help reduce physical strain. Moreover, seeking support from colleagues, friends, or professionals can provide an outlet for stress and help manage the mental demands of the job.

Employers also play a vital role in promoting a healthier work environment. Implementing policies that encourage reasonable working hours, providing access to wellness programs, and fostering a culture that values work-life balance can significantly improve the health and well-being of investment bankers. By addressing the potential health impacts of excessive work hours, the industry can strive for a more sustainable and healthier future for its professionals.

Where Investment Bankers Tailor Their Success

You may want to see also

Regulations: UK regulations limit working hours to protect employees

The UK has implemented various regulations to ensure the well-being of its employees, including those in the financial sector. One of the key areas of focus is the limitation of working hours, which is crucial in preventing burnout and promoting a healthy work-life balance. These regulations are particularly important for investment bankers, who often face high-pressure environments and demanding careers.

The Working Time Regulations 1998 is a significant piece of legislation that sets out the rights of employees regarding their working hours. It mandates that workers should not exceed an average of 48 hours per week, including overtime. This regulation applies to all employees, including investment bankers, and is designed to protect their health and safety. By setting a maximum limit, it encourages employers to manage workloads effectively and ensure that employees have adequate time for rest and personal activities.

In the UK, investment banking is a highly competitive and demanding profession, often requiring long hours and intense dedication. However, the regulations provide a necessary framework to safeguard employees' rights. These rules ensure that investment bankers do not consistently work excessive hours, which can lead to fatigue, decreased productivity, and potential health risks. The regulations also promote a more sustainable work environment, allowing bankers to maintain a better work-life balance.

Employers in the investment banking industry must adhere to these regulations and ensure that their employees' working hours are monitored and managed accordingly. This may involve implementing policies such as regular breaks, flexible working arrangements, and clear guidelines on overtime. By doing so, companies can demonstrate their commitment to employee welfare while also maintaining a productive and efficient workforce.

It is worth noting that while these regulations provide a protective framework, they also encourage employers to foster a culture that values productivity and efficiency rather than solely relying on long working hours. Investment banks can thrive by promoting a healthy work environment, where employees are motivated and engaged, and their well-being is a priority. This approach can lead to better performance and a more satisfied workforce.

Retirement Investments: Strategies for a Secure Future

You may want to see also

Frequently asked questions

Investment banking hours in the UK can vary significantly depending on the role, the firm, and the individual's experience. However, it is generally known that investment bankers often work long hours, with a culture that can be demanding and fast-paced. On average, investment bankers in the UK might work anywhere between 50 to 60 hours per week, and some may even work up to 80 hours or more during busy periods or when dealing with critical deals.

Yes, investment bankers often experience higher workloads during certain times of the year. For instance, the end of the financial year, tax seasons, and major corporate events like mergers and acquisitions (M&A) activity tend to be busier periods. Additionally, the lead-up to important deadlines, such as initial public offerings (IPOs) or regulatory filings, can also result in extended working hours.

Many investment banking firms offer various incentives and benefits to compensate for the demanding work culture. These may include competitive salaries, performance-based bonuses, and additional perks such as health and wellness programs, financial planning services, and generous vacation packages. Some firms also provide flexible working arrangements, allowing bankers to manage their time and workload to some extent.

Achieving a healthy work-life balance in investment banking can be challenging but not impossible. Here are some strategies: Prioritize self-care and set personal boundaries to ensure you take regular breaks and maintain a healthy lifestyle. Learn to delegate tasks and manage your time effectively. Develop strong time management skills and learn to say no when necessary. Build a strong support network both inside and outside the industry to help you stay grounded and maintain perspective.