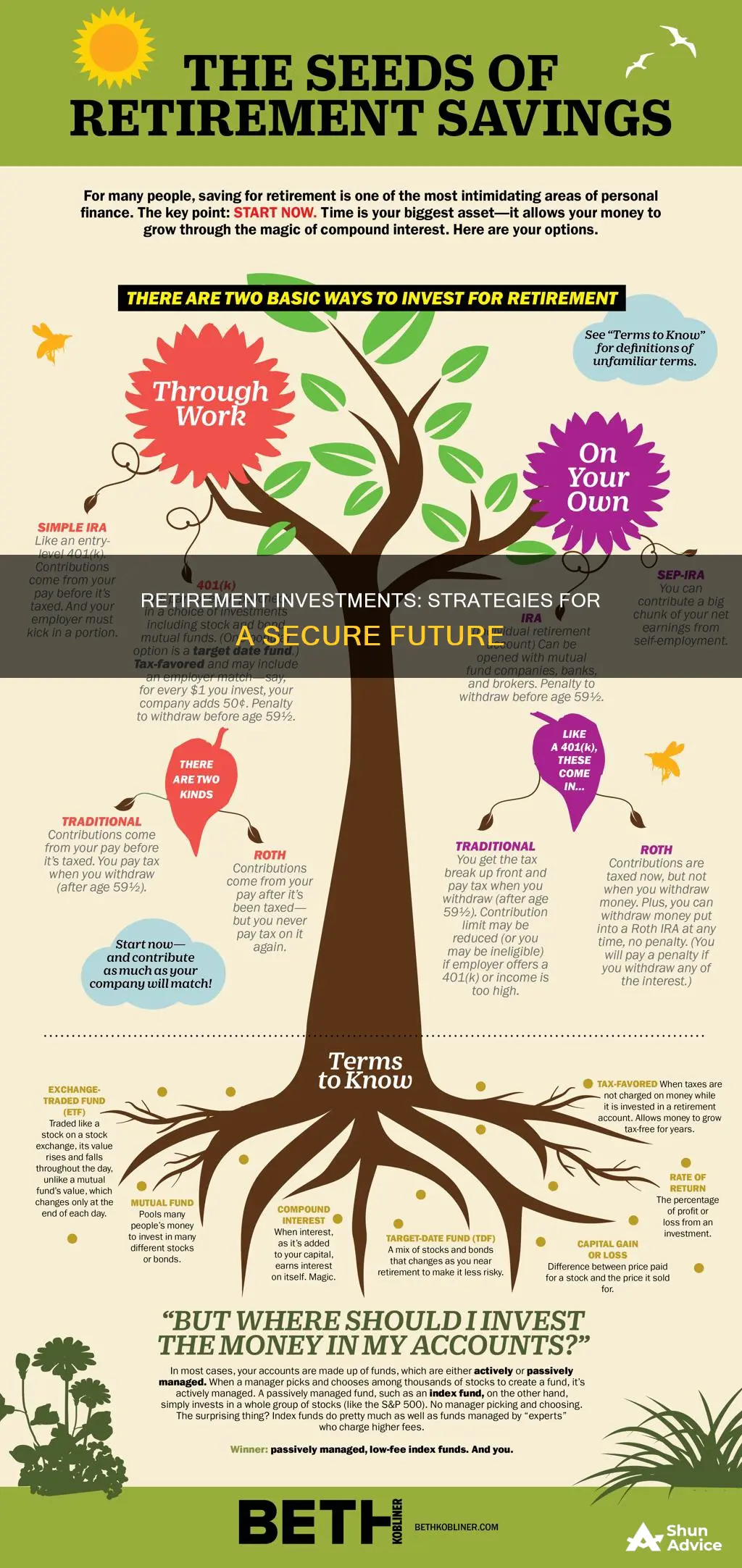

When it comes to retirement, there are many factors to consider when planning how to manage your investments. Firstly, it is important to understand the different options available to you, such as tax-advantaged accounts like 401(k)s and IRAs, or taxable accounts like brokerage and bank accounts. Starting to save early and regularly is crucial, as it allows your money to grow over time. It is also essential to calculate your net worth and keep track of it to ensure you are on the right path. Paying attention to investment fees is vital, as they can significantly impact your retirement funds. Seeking advice from a financial professional can be beneficial if you need guidance.

Another critical aspect is diversifying your investments to minimise risks. This can be achieved through mutual funds, index funds, and ETFs, which pool investor money into various securities. Additionally, maintaining an appropriate asset allocation is essential, balancing stocks, bonds, and cash investments based on your age and risk tolerance. As you approach retirement, gradually adjusting your asset allocation towards more conservative investments can be a prudent strategy.

There are also specific investment options to consider in retirement, such as annuities, which provide a steady income stream, and income-producing equities like dividend-paying stocks. Bonds are another option, offering fixed income with varying yields and risk characteristics. A total return investment approach combines interest, dividends, and capital gains to meet both immediate cash flow needs and future expenses.

Ultimately, consulting a financial professional can help you navigate the complexities of retirement investing and develop a strategy tailored to your needs and goals.

| Characteristics | Values |

|---|---|

| Retirement Account Options | 401(k)s, IRAs, brokerage accounts, defined-benefit plans, pension plans, SEP, SIMPLE, solo 401(k), profit-sharing plans |

| Investment Options | Mutual funds, index funds, ETFs, individual stocks and bonds, annuities, dividend-paying stocks, rental property, REITs, QLACs |

| Investment Strategies | Asset allocation, robo-advisors, target date funds, diversification, total return approach |

| Other Considerations | Calculate net worth, understand fees, seek professional advice |

What You'll Learn

Understand your retirement account options

Understanding your retirement account options is a crucial step in planning for your retirement. Here are some detailed insights to help you make informed decisions:

Tax-Advantaged vs. Taxable Accounts

You can choose from various tax-advantaged and taxable accounts to save for retirement. Tax-advantaged accounts, such as 401(k) plans and Individual Retirement Accounts (IRAs), offer tax-deferred growth, meaning you don't pay taxes on contributions or earnings until withdrawal during retirement. Traditional IRAs and 401(k)s are funded with pre-tax dollars, while Roth 401(k)s and Roth IRAs are funded with after-tax dollars, offering tax-free withdrawals in retirement. Taxable accounts, on the other hand, are funded with after-tax dollars and don't offer any tax breaks.

Employer-Sponsored Plans

Your employer may offer retirement plans such as 401(k)s, 403(b)s, or pension plans. These are defined-contribution plans funded by employees, often with tax incentives and employer-matching contributions. It's important to understand the specifics of your employer's plan, including contribution limits and any matching programs.

IRAs (Individual Retirement Accounts)

IRAs are tax-advantaged accounts that can be opened at financial institutions like banks or brokerage firms. They offer tax-deferred investing, and there are two main types: Traditional IRAs and Roth IRAs. Traditional IRAs may allow you to deduct contributions from your taxes, while Roth IRAs offer tax-free withdrawals in retirement but don't allow tax deductions on contributions.

Self-Employed or Small-Business Plans

If you're self-employed or own a small business, you have additional retirement account options. These include SEP IRAs, SIMPLE IRAs, solo 401(k)s, and profit-sharing plans. These plans offer tax advantages and flexibility for those who are self-employed.

Understanding Investments

Retirement accounts are not investments themselves; instead, they hold various investments. It's essential to understand the different types of investments available, such as mutual funds, index funds, exchange-traded funds (ETFs), stocks, bonds, and annuities. Each investment type has its own characteristics, risks, and potential rewards. Diversification across different asset classes is crucial to balance risk and maximize returns.

Robo-Advisors and Target Date Funds

If you want a more hands-off approach to managing your retirement investments, consider using robo-advisors or target-date funds. Robo-advisors use algorithms to customize investments for your portfolio, while target-date funds automatically adjust your asset allocation over time based on your chosen "target date" for retirement. While these options charge extra fees, they can simplify the process of maintaining your retirement portfolio.

ESG Investing: Who's On Board?

You may want to see also

Calculate your net worth

Net worth is a quantitative concept that measures the value of an entity and can be applied to individuals, corporations, sectors, and even countries. It is the value of assets minus the liabilities one owes. Liabilities include loans, accounts payable, and mortgages.

Identify your assets:

Assets are valuable possessions that you own. This includes things like cash, retirement and investment accounts, vehicles, and your house. It also includes certain investments, such as stocks and bonds, that you could sell for cash. These are often referred to as liquid assets.

Some fixed assets can also be included, such as the value of your home, if you're willing to sell it or use it for a home equity line of credit.

Identify your liabilities:

Liabilities are any financial debts you owe. This includes credit card debt, student loans, mortgages, auto loans, and any other money you owe. If you're including your home as an asset, its mortgage should also be included as a liability.

Calculate your net worth:

Once you have identified your assets and liabilities, calculate the value of everything you own and subtract the value of everything you owe (your liabilities). This will give you your net worth.

Interpret your net worth:

If your net worth is positive, it means your assets exceed your liabilities, indicating good financial health. A negative net worth indicates that your liabilities exceed your assets, which is a cause for concern as it might signal a decrease in assets relative to liabilities. If your net worth is zero, it means your liabilities perfectly cancel out your assets, and you are on your way to having a positive net worth.

Work on improving your net worth:

You can improve your net worth by either reducing liabilities while maintaining or increasing assets, or by increasing assets while maintaining or reducing liabilities. This can be done by saving more, paying off debt, and investing.

Apple: Invest Now or Miss Out?

You may want to see also

Keep your emotions in check

It's normal to feel emotional about your investments, especially during times of heightened volatility. However, letting emotions drive your investment decisions can lead to poor outcomes. Here are some tips to keep your emotions in check when investing for retirement:

Understand Emotional Investing

Recognize that emotional investing occurs when you let emotions such as fear, greed, or envy drive your investment decisions instead of logic or sound reasoning. It's essential to understand the motivations behind emotional investing to avoid making suboptimal choices.

Automate Decisions

One effective way to remove emotions from the equation is to automate your investment decisions. Set up regular contributions to your retirement plans or automatic withdrawals if you're already retired. This approach, known as dollar-cost averaging, has been proven successful over time. It ensures that you buy or sell at regular intervals, sometimes when prices are low and sometimes when they're high, taking the emotion out of the process.

Avoid Financial Media During Crises

During financial or economic crises, it's best to steer clear of the financial media. Listening to market commentators who may be feeling emotional about their investments can trigger your own emotional responses. Remember, the media doesn't exist to make you feel comfortable about your portfolio; instead, it often fuels the urge to follow the crowd, which can lead to selling at the wrong time.

Know Your "Why"

Understanding your investment goals and keeping them in mind during market stress can help you stay calm. Placing your assets into different "buckets" based on your goals and risk tolerance can also help. For example, knowing that money for emergencies and the near future is in safe investments can prevent panic selling when stocks fall.

Avoid Market Timing

Market timing is a common emotional reaction, especially in response to a deteriorating economy. However, it's extremely difficult to time the market accurately. Instead, think about various scenarios and position your portfolio based on the most likely ones. Selling for emotional reasons often leads to missing out on potential gains when the market recovers.

Consult Experts

Consulting a financial expert can help you evaluate the accuracy of your thinking and give you time to make more rational decisions. A financial advisor can provide well-reasoned advice and help you stay on track when you feel uneasy about investing. They can also assist with budgeting, retirement planning, taxes, and other financial tasks.

Life Annuities: Retirement Investment or Security Blanket?

You may want to see also

Pay attention to fees

Investment fees can have a huge impact on your wealth. Even a 1% fee can significantly reduce the value of your portfolio over time.

Fees are an important aspect of investing to keep in mind because they are a great indicator of returns. In most cases, the lower the fees, the higher your returns. This is why index funds are such a popular choice for long-term investing.

There are two types of fees associated with 401(k) plans: those charged by the plan provider and those charged by the individual funds within the plan. While you can't do much about plan provider fees, you can choose funds within the plan with lower expense ratios.

- Loads (sales commissions)

- Management fees

- Distribution and service (12b-1) fees

- Administrative fees and operating costs

- Transaction fees/trading fees

When deciding which investment fees are worth paying, consider the long-term value of the investment, the overall cost of the fees, and your expected return. While a 1% difference in fees may not seem like much, it can make a significant difference in the long run.

To determine whether you are paying high fees, calculate your expense ratio by adding up all the fees you pay for a fund and dividing it by the amount you have invested.

- Choose funds with lower expense ratios.

- Opt for index funds, which tend to trade less frequently than actively managed funds, keeping transaction fees lower.

- Understand the fees charged by your financial advisor.

- Use a free tool like Personal Capital's Retirement Fee Analyzer to evaluate your investment fees.

Investments: Paying with Potential

You may want to see also

Start saving early

The earlier you start saving for retirement, the less you'll need to put away each year. Here are some reasons why starting early is beneficial:

Compound Interest

The longer your money has to work for you, the better the outcome. Compound interest is interest that accumulates on both your initial investment and the interest it generates. The longer you leave your money invested, the more compound interest you will earn. This means that starting early will allow you to save less each month while still achieving the same financial goal.

More Disposable Income

Starting your savings journey earlier means you will have more disposable income. This is because you will likely have greater disposable income between the ages of 20 and 40. After 40, financial responsibilities tend to increase, with commitments such as paying for a child's education and servicing a home mortgage loan.

Save Less to Reach Your Goals

By starting early, your investments will do a lot of the hard work for you. You will have more disposable income to spend on other things, such as buying property, investing, travelling, donating to charity, or starting a business.

A More Relaxed Transition into Retirement

Starting early means you can create a comprehensive retirement wealth management plan, allowing you to look forward to a comfortable life after retirement. You will have more time to save, which means you will have more money by the time you retire, giving you peace of mind.

Gain Expertise

The more time you have, the more experience you will gain and the more expertise you will develop in a wider variety of investment options. This will help you make better decisions and improve your chances of a comfortable retirement.

Amazon: A Worthy Investment

You may want to see also

Frequently asked questions

There are a few ways to create income in retirement. You can use annuities, which can generate a guaranteed stream of income for a period of years or until your death. You can also use a diversified bond portfolio, a total return approach, or income-producing equities.

Given that your retirement may last 20 years or longer, it's important to protect yourself from the impact of inflation. With an average inflation rate of 3%, your living costs will double in less than 25 years. Therefore, it's recommended to include stocks in your retirement portfolio to generate a growing stream of income and keep pace with rising living costs.

It's recommended to have a diversified portfolio that includes income-generating bonds and stocks. Annuities may also be a good option, but they shouldn't be your only source of income as they may not include inflation protection.

Many advisors recommend saving 10% to 15% of your income. However, this may vary depending on your individual circumstances and retirement goals. It's important to consult with a financial advisor to determine the right savings plan for you.